Amoveo ♥🧿

Previous messages

Next messages

27 November 2018

Z

02:13

Zack

The 50 thousandth veo is about to be mined.

MF

02:13

Mr Flintstone

yup, should be in a few hours

AK

02:25

A K

at $0.1/kW*h it costs $65-70 to mine one VEO currently

02:25

assuming 1080Ti at 4.5 GH/s at 250 Watts

Z

02:26

Zack

If the price is significantly higher than the cost of production, that is a sign the block reward is too big, right?

OK

02:28

O K

In reply to this message

Maybe, but I think you're misinterpreting the data. Relative to the history of mining veo, it's very expensive to mine right now

[

02:49

[Riki]

+ add asset depreciation

AK

02:51

A K

i’d say at every moment in time it should be in equilibrium, right?

02:51

more mining power “knows” about veo, just recently there was 120 th/s

02:51

but they’re not coming back, so

Z

02:53

Zack

you are misreading the data. the highest it got was 89.4

02:54

120 was just the upper bound on the range being measured

AK

02:55

A K

EWAH was at 120 no?

Z

02:56

Zack

That number jumps around a lot due to randomness.

OK

Aries invited Angel Freeman

[

03:25

[Riki]

its misleading to compare current cost of mining with spot price of veo. it has to do a lot with expectations about future price of veo. otherwise, miners would sell at spot price, which is not the case because daily trading volume is below what is being mined daily. or, miners would not mine at loss if they would not expect price in future to rise. there is a time difference between cost and realised revenues from mining in most cases.

OK

03:26

O K

In reply to this message

We should examine mining qua mining and speculation qua speculation, IMO

03:26

Not all miners speculate

[

03:27

[Riki]

In reply to this message

i think most veo miners do. those who dont, they mine eth 😛. this is not just a guess but an opinion from at least 10 other miners that i know and who mine veo, even at loss, because they speculate to gain more in future.

007 007 invited 007 007

OK

03:29

O K

Perhaps most, but I've been asked many times, exchange owners can also attest, can they mine to exch addr

00

03:32

007 007

Please share the baht file and miner for Nvideo maps.

MF

05:22

Mr Flintstone

50k at next block

AK

05:23

A K

I hope it unlocks some Easter egg

M⛏

V

05:34

Victor

What is the most actual miner for nVidia and AMD?

Z

05:35

Zack

Maybe ask in the mining channel on discord

V

05:38

Victor

FYI, there is a current FPGA that works on expanding to different algos.

I am sure that Amoveo hasn't attracted that manufacturer yet, due to low liquidity, but their devices can appear suddenly.

I am sure that Amoveo hasn't attracted that manufacturer yet, due to low liquidity, but their devices can appear suddenly.

05:39

If you are looking for info, I can share it.

05:47

it is real

Z

05:49

Zack

Amoveo's mining algorithm is designed to be as easy to implement as possible.

I wouldn't be surprised if someone has been using fpga for months already.

Fpga cost a lot more than gpu, so they have been a worse investment so far.

That is why gpu have been more popular.

Eventually when the profit margins are tighter, then fpga will be the better investment.

The only reason people would use fpga for mining now is if they already have fpga.

I wouldn't be surprised if someone has been using fpga for months already.

Fpga cost a lot more than gpu, so they have been a worse investment so far.

That is why gpu have been more popular.

Eventually when the profit margins are tighter, then fpga will be the better investment.

The only reason people would use fpga for mining now is if they already have fpga.

V

05:55

Victor

Zack: Yeah, I know it's SHA with some modifications and I have read your motives about commoditisation of mining hardware.

I though miners would not bother having some additional info.

I though miners would not bother having some additional info.

05:57

That FPGA I pointed to is RAM-less.

M

07:23

Mike

In reply to this message

Many may believe an exchange address is easier and safer. If one of the two exchanges were hacked right now, would we let the hacker keep his VEO?

Deleted invited Deleted Account

Deleted invited Deleted Account

10:31

Deleted Account

Can those trading bots really make money? I heard that a platform called fmz quant could write trading strategies by users. I don't know how that works.

BS

10:38

Bo Smubo

What's the name of rent amazon GPu?

10:38

P100 large?

Deleted invited Deleted Account

Heath invited Heath

H

17:16

Heath

In reply to this message

It was off that manufacturer’s discord that I learnt about Amoveo. Users are requesting a bitsteam to mine veo.

M

S

M

18:26

Marek

Perhaps it would have been nice if there was bet channel on Insight landing success /failure

18:26

:)

MF

20:21

Mr Flintstone

someone posted this on twitter

M

20:44

Minieep21

You got the tweet? I'll retweet

Alex C invited Alex C

S

21:03

Shaun

Looks like a pretty well compiled and overall objective post. Props to whoever wrote it

AK

21:06

A K

judging from the website, the content might be a copy-paste from somewhere

Deleted invited Deleted Account

S

22:26

Shaun

Btw this is the original tweet link I think https://twitter.com/fx_c_com/status/1067112309208756224

MF

22:31

Mr Flintstone

ya

V

23:16

Victor

$bagholder "journalist" detected.

MF

23:59

Mr Flintstone

while they did basically just copy and paste the wp and excerpts from the GitHub docs , I think it does do a pretty good job of communicating the different ideas behind amoveo

28 November 2018

Z

00:03

Zack

The Amoveo part is longest. I am guessing that they are an Amoveo whale who is trying to get people from the other projects on the list to notice Amoveo.

[

00:04

[Riki]

so maybe zack you wrote it yourself

Z

00:05

Zack

I didn't

LB

Deleted invited Deleted Account

Deleted invited Deleted Account

Я

15:05

Ярослав

block reward raised ? )))

SS

16:58

Can light node be ported to ESP32? :)

Z

16:59

Zack

The light node is javascript

17:00

The full node could probably be made compatible with atom VM. It might already work.

SS

20:11

Spike Spiegel

Which card is best for veo?

20:12

Is there a table with hashpower per card/

AK

20:12

roughly 4.5 gh/s for 1080Ti

SS

20:14

Spike Spiegel

Nobody tried RTX 2080 yet?

AK

20:14

A K

from other ccys it makes no sense

20:14

at current prices

[

20:14

[Riki]

aint no one got money for 2080

20:14

its comparable to 1080ti

S

20:29

Sy

and i heared they like living on the edge ^^

Cicero invited Cicero

29 November 2018

Josh invited Josh

04:33

Deleted Account

Amoveos shot for a minute of fame. Wikileaks latest tweet: Question: What's the best "define your own bet" market where WikiLeaks can let the general public bet on who will be proved trustworthy and accurate, WikiLeaks or the Guardian?

MF

04:35

Mr Flintstone

they would both need to make a prediction about something publicly known that is quantifiable

Deleted invited Deleted Account

Deleted invited Deleted Account

. invited .

Deleted invited Deleted Account

Deleted invited Deleted Account

OK

08:48

O K

You can find more info on the github

a p invited a p

Deleted invited Deleted Account

Z

11:00

Zack

nothing is official

MF

11:03

Mr Flintstone

except this telegram group name

А

Deleted invited Deleted Account

AK

14:08

A K

Damn was supposed to be a nice smile

Aleksandr Khomutov invited Aleksandr Khomutov

Deleted invited Deleted Account

16:58

Deleted Account

Does anyone familiar with “fmz quant” platform? Does they support arbitrage strategy? In the bear market now, arbitrage trading it he only choice we left right? Small range of volatility, trend strategy seems not doing so good.

Ritvars invited Ritvars

SS

19:42

Spike Spiegel

Any "platform" which provides arb trading is scam

19:43

Arbitrage is usually very limited in both time and money - arbitrageurs don't need outside capital

AK

19:43

A K

It's a bot

Tim invited Tim

S

20:44

Sy

arbitrage isnt that complicated automated, you just have to be able to lock enough funds

20:44

and your coin mustnt go to hell xD

SS

21:33

Spike Spiegel

And exchange can default

21:34

Usually persistent arb oportunities have a reason - for example some exchange may have high withdrawal fees or temporary disable

MF

21:44

Mr Flintstone

the amount of money to be made via an arbitrage strategy is measured in number of dollars and not %. so if someone is selling you an arbitrage strategy it is likely either a scam or won’t work.

🤠Anton invited 🤠Anton

Deleted invited Deleted Account

30 November 2018

AK

00:02

They have no oracle design yet, but state channels are declared to be working

00:07

5 Our Solution: Fate Channels

We have invented a provably fair system using state channels

containing pre-committed partial RNG seeds provided sepa-

rately by the player and the operator. These partial seeds are

comitted to the blockchain at the start of the gaming session.

State channels work by allowing participants to engage in a

rapid back-and-forth countersigning of updated “claims” on

an escrowed amount of funds. The Bitcoin Lightning protocol

was the first to popularize the idea. On EthereumVM-capable

blockchains, State channels are very simple to create and im-

plement – a smart contract holds escrowed funds, and then

releases when the state channel participants request it.

During gaming, we create instead a “Fate Channel”; a State

channel with the added ability to verify a progressive reveal

scheme by both parties, advancing a deterministic (“fated”) but

unpredictable sequence of random numbers.

Details of our Fate Channel implementation will follow our to-

ken sale; for now we feel it gives us and our token holders a

competitive advantage to keep implementation details private

a little bit longer.

We have invented a provably fair system using state channels

containing pre-committed partial RNG seeds provided sepa-

rately by the player and the operator. These partial seeds are

comitted to the blockchain at the start of the gaming session.

State channels work by allowing participants to engage in a

rapid back-and-forth countersigning of updated “claims” on

an escrowed amount of funds. The Bitcoin Lightning protocol

was the first to popularize the idea. On EthereumVM-capable

blockchains, State channels are very simple to create and im-

plement – a smart contract holds escrowed funds, and then

releases when the state channel participants request it.

During gaming, we create instead a “Fate Channel”; a State

channel with the added ability to verify a progressive reveal

scheme by both parties, advancing a deterministic (“fated”) but

unpredictable sequence of random numbers.

Details of our Fate Channel implementation will follow our to-

ken sale; for now we feel it gives us and our token holders a

competitive advantage to keep implementation details private

a little bit longer.

MF

00:32

Mr Flintstone

The last sentence is a little sus

Deleted invited Deleted Account

AK

00:51

A K

yeah (

Al invited Al

Simak off invited Simak off

Tv

04:31

Tarrence van As

Zack the github mentions that if two participants take opposide sides of a bet, initially the market maker is the coutner party and needs to lock collateral to cover each bet. However, it suggests that it is possible to match the two betters directly and free up the market makers collatoral. Could you provide more info on how this is done? Do the two participants need to interact with each other to transition to a peer-to-peer bet or is it possible for the market maker to do so without any interaction from them?

s

04:58

sanket

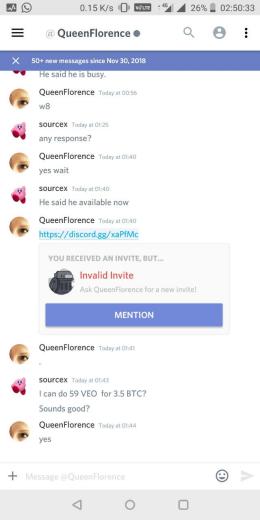

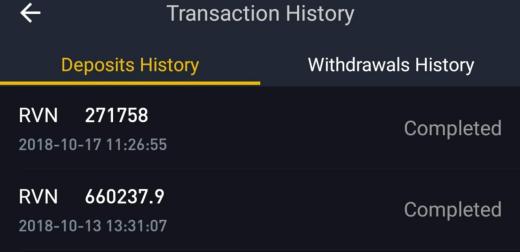

Anybody here can help?

I made a big mistake. Just got scammed of 59 VEO because of greed and carelessness.

QueenFlorence (discord user) message me with a deal and I accepted it. He asked to contact sONk for escrow. He made a server with 3 of us. The timing was such I did not remember to see the discord id. I wasn't thinking right.

I sent him a small txn and he confirmed. Then I sent him all of it.

He deleted everything at that time and that's when I realise I got scammed.

Just lost all of my VEO holding.

This was the address to which it was sent.

https://veoscan.io/account/BMoSc%252B5TgNEOLD4TNadjxwoJQBEz1K549Ge44pLQOOelb5xwCJX5ols%252BG47Febn75lAXJf3tEAqeDxYgn6IUaqo%253D

I know I should have cross check multiple times and it was too good a deal to accept it(0.06 btc for 1 Veo)

But I forgot all the basic hygiene. Accumulated for 8 months and then lost it all in 8 seconds.

I made a big mistake. Just got scammed of 59 VEO because of greed and carelessness.

QueenFlorence (discord user) message me with a deal and I accepted it. He asked to contact sONk for escrow. He made a server with 3 of us. The timing was such I did not remember to see the discord id. I wasn't thinking right.

I sent him a small txn and he confirmed. Then I sent him all of it.

He deleted everything at that time and that's when I realise I got scammed.

Just lost all of my VEO holding.

This was the address to which it was sent.

https://veoscan.io/account/BMoSc%252B5TgNEOLD4TNadjxwoJQBEz1K549Ge44pLQOOelb5xwCJX5ols%252BG47Febn75lAXJf3tEAqeDxYgn6IUaqo%253D

I know I should have cross check multiple times and it was too good a deal to accept it(0.06 btc for 1 Veo)

But I forgot all the basic hygiene. Accumulated for 8 months and then lost it all in 8 seconds.

OK

05:16

I'm not sure what can be done. Maybe contacting exchanges is a start.

05:16

I'm sorry that happened to you

AK

05:16

A K

So sorry, I've seen his/her offers, seemed shady as fuck.

05:22

In reply to this message

How can it be done?

The address which I sent to has a long history of transaction.

The address which I sent to has a long history of transaction.

OK

05:23

I am away from my desk or I would do it for you

s

05:24

sanket

I mentioned in the channel.

AK

s

05:34

sanket

Yeah but they sell too.

p

OK

05:59

O K

Haven't seen any reason not to trust either exchange

p

06:00

private_pr0perty

Thank you

Z

07:37

Zack

In reply to this message

The benefit of using a market is that the contract can be matched at the market price.

There is a plan for moving bets from indirect paths to direct paths. It is a simple application of hash locking.

No one programmed a tool for that yet.

The smart contracts are turing complete, so we can program many things.

A more short term goal is for making customized bets between pairs of people without any market.

This way there is no extra colateral locked up. It is nice for cfd contracts, which are often customized and traded otc.

There is a plan for moving bets from indirect paths to direct paths. It is a simple application of hash locking.

No one programmed a tool for that yet.

The smart contracts are turing complete, so we can program many things.

A more short term goal is for making customized bets between pairs of people without any market.

This way there is no extra colateral locked up. It is nice for cfd contracts, which are often customized and traded otc.

Deleted invited Deleted Account

11:35

Deleted Account

hey guys, just wonder what is the easiest way to send veo?

11:38

is this safe to use http://amoveo.exan.tech/ ?

m

11:56

mm

By lack of https I can already tell it’s unsafe

11:57

(They support https, but it should be enforced)

11:59

And even when you connect via https it communicates with node via http

S

12:03

is that something that could be implemented?

m

12:04

mm

What not using zack lighting wallet?

OK

m

12:12

mm

But usually you run it locally? I hope!

OK

12:12

O K

And I agree, it would be preferable

S

12:41

Sebsebzen

desktop wallet would be cool too

DV

14:57

Denis Voskvitsov

In reply to this message

as Zack said, using https doesn't add much to safety here, since all the data used by web wallet are stored as merkle proofs or sent to the full node signed.

anyway, I think we'll force https on amoveo.exan.tech eventually

anyway, I think we'll force https on amoveo.exan.tech eventually

S

16:18

You’re like redhat

16:18

Kinda like this setup

16:19

Keeps things clean and compartmentalized

AK

S

16:20

Sebsebzen

Maybe there will be several service providers for VEO in the future and they can received development funds via futarchy mechanism

16:20

Which makes the project more antifragile and efficient

16:20

Than ICO which received millions of USD upfront and has little incentive to deliver anything afterwards

H

m

16:52

mm

In reply to this message

Doesn’t matter, because I can inject arbitrary JavaScript if it’s served via http. And steal your keys. Or subvert pseudo random number generator to predict generated keys if I want to be stealthy .

AK

16:56

A K

The full node doesn't have HTTPS afair, that was the show stopper

DV

16:58

Denis Voskvitsov

yes, that's good reason to secure channel. you're right.

16:59

In reply to this message

it shouldn't. we can wrap requests with https-supporting web server. it's not that straightforward due to some default node settings, but possible ofc

m

17:48

mm

I think things like that should be included in technical comparison with other projects.

m

18:04

mm

Aeternity for example uses noise protocol for communication between nodes.

18:05

Amoveo needs solids foundations like that to compete with others.

AK

18:16

is it solid, or is it the case of "roll your own crypto"

m

18:36

mm

Very solid. They really did good job with it

18:37

But... I don’t know about Erlang implementation. maybe it’s not so solid

G

18:45

Gregor

Hi all, I’m pretty new to Amoveo. I’d like to start playing with mining. Have an Intel NUC i5 with 16gb RAM. Would that work? Or would I need a gpu miner?

AK

18:48

A K

only GPU at this point

18:49

Hi )

[

19:09

[Riki]

Only fpga at this point 😆

m

19:56

mm

Still on fpga, lol? Only asic at this point

[

19:57

[Riki]

Animation

Not included, change data exporting settings to download.

122.8 KB

AK

19:59

A K

yeah, canaan selling all models at $200, should do double hashrate on veo, amirite?

[

20:00

[Riki]

3x

20:02

Its like a gtx 4080ti

22:21

Ok guys who is keeping the price down?

22:21

Who is the mega whale?

MF

22:30

Mr Flintstone

looks like an early miner exiting

22:30

at least one of their pubkeys I mean

T

22:36

Tromp

O okk makes sense

N

22:37

NM$L

HODL

T

22:42

Tromp

Hodl till 5 billion mkt cap 🍺

22:43

There is no hurry my friend 👍🏻

N

22:56

NM$L

why pump today

А

22:58

Андрюхин

why not ?

T

23:24

Tromp

Hahaha

1 December 2018

J

00:06

Jurko | Bermuda capital 📈

Ath was like 0.1 btc?

M

00:33

Minieep21

ATH in USD was around $1k

00:34

Crypto was going through another dump then so BTC/ETH pair ath is not concrete

MF

00:40

Mr Flintstone

back in the day veo traded basically only in USD

00:40

I think like 0.1-0.13 or so was ATH

Deleted invited Deleted Account

J

00:46

I was there 😊

T

00:49

Tromp

Damn

S

00:52

Sebsebzen

Whats now in USD, i've been out of the loop

00:52

and before we get scolded to discuss this on discord :)

J

S

01:15

Sebsebzen

not to bad

01:21

Deleted Account

mainly the exchange coin was ETH in discord. Best prices was ~0.8 eth ... so the price for veo is better now ... dont think in usd :)

Le Anh tuan invited Le Anh tuan

01:22

Deleted Account

so if you kept the eth u are now in a worse situation then with veo

Pete | Tankwars.zone | Fiberblock.io invited Pete | Tankwars.zone | Fiberblock.io

P

06:25

Pete | Tankwars.zone | Fiberblock.io

How to mine??

06:28

What gpu specs on this ?

OK

P

06:31

Pete | Tankwars.zone | Fiberblock.io

How do i see specs of the coin ??

M⛏

DV

A

06:45

Aries

this is great

Deleted invited Deleted Account

H

09:36

Harmony is lifer • $ONE 🦄

Bro Zack you have plans listing veo on binance or bittrex?

G

09:59

Gregory

And coinbase please))$

11:03

Deleted Account

Does anyone know the backtesting mechanism of the fmz quant platform?

11:06

Deleted Account

zack plz veo etf

Oke Pearson invited Oke Pearson

18:33

in amoveo

AK

18:34

A K

you mean in principle or whether there are any open govt oracles?

18:37

Deleted Account

i mean in the future when futarchy is being used, where can i see it

p

19:09

private_pr0perty

Hello, where I can to check balance, if I have only private key. Is it possible?

Z

20:05

Zack

In reply to this message

Use the private key to generate your public key. Then use the public key to look up your balance.

p

20:06

private_pr0perty

Thanks. Could you share a link for doing this?

Z

20:07

Zack

In reply to this message

https://github.com/zack-bitcoin/amoveo/tree/master/docs/design

There are a couple documents called futarchy in the design folder in the docs.

There are a couple documents called futarchy in the design folder in the docs.

20:07

In reply to this message

Depends if you have a full node formated private key, or if it is light node formatted.

007 007 invited 007 007

2 December 2018

Deleted invited Deleted Account

Z

06:51

Zack

Does anyone use the oracle_bets endpoint on the external api?

It seems like a security vulnerability, and it is so poorly named, I really want to get rid of it, or at least rename it.

It seems like a security vulnerability, and it is so poorly named, I really want to get rid of it, or at least rename it.

06:56

The tree-fix hard update is pretty big.

I think the cleanest way to do this is to have everyone stop using the oracles for a period of time.

We give people some time to close any leftover orders in the oracles.

The update deletes the old merkel trees of orders entirely, and we start fresh.

This way we can focus on optimizing the sync speed.

I think the cleanest way to do this is to have everyone stop using the oracles for a period of time.

We give people some time to close any leftover orders in the oracles.

The update deletes the old merkel trees of orders entirely, and we start fresh.

This way we can focus on optimizing the sync speed.

07:19

Deleted Account

Is there a particular type of user that benefits most from optimizations in the sync speed?

Z

07:20

Zack

more decentralized == cheaper to run a full node.

Sharding is an important goal for anyone holding VEO tokens, we don't want unnecessary complications to slow this goal down.

Sharding is an important goal for anyone holding VEO tokens, we don't want unnecessary complications to slow this goal down.

Deleted joined group by link from Group

Deleted invited Deleted Account

N

19:15

NM$L

welcome

AK

Z

19:31

Zack

We could plan the hard update for after new years

19:31

It's only a month away.

And the software isn't written yet

And the software isn't written yet

AK

19:33

A K

If the oracle resolves to True, we will have at least two new exchanges , so it'll be necessary to coordinate with them, too

Z

19:38

Zack

Everyone running full nodes will get a big warning before the update. Just like the dozen or so hard updates we have done so far.

SS

23:46

Spike Spiegel

What's the current consensus on total supply?

23:46

or 2050 supply

M

3 December 2018

SS

00:39

Spike Spiegel

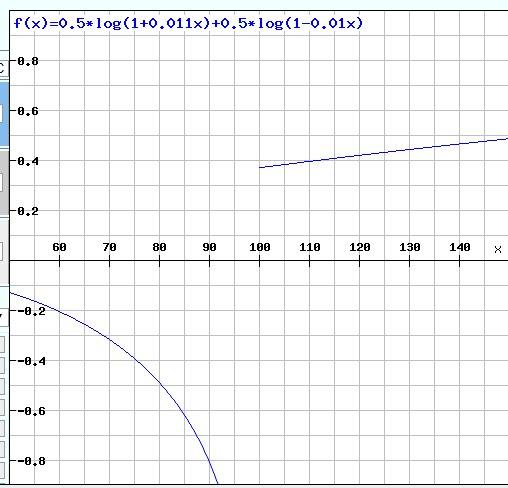

"It seems to me that you would only participate in a gambling game if the expected returns were positive."

http://r6.ca/blog/20070816T193609Z.html

http://r6.ca/blog/20070816T193609Z.html

00:39

One can get bankrupt flipping a coin biased in his favour

Z

Z

03:11

Zack

In reply to this message

The problem is that they only solved for the case where one asset is perfectly safe, and they other is risky.

Many cryptocurrency enthusiasts think that fiat currency has significant risk of hyperinflation.

It would be cool if there was a javascript tool where you could plug in your expectations of the risk profiles of different assets, and it would calculate the optimal hedged portfolio based on your beliefs.

Many cryptocurrency enthusiasts think that fiat currency has significant risk of hyperinflation.

It would be cool if there was a javascript tool where you could plug in your expectations of the risk profiles of different assets, and it would calculate the optimal hedged portfolio based on your beliefs.

03:13

I got the single node tests passing on the hard update branch, so hopefully it will be ready soon.

Another benefit of this hard update is that it will be much easier for the light node to read merkel proofs of information from the oracle, because oracle bets will be in the same format as all the other merkel proofs. we can reuse existing libraries.

Another benefit of this hard update is that it will be much easier for the light node to read merkel proofs of information from the oracle, because oracle bets will be in the same format as all the other merkel proofs. we can reuse existing libraries.

OK

03:27

O K

When real testnet

Z

03:27

Zack

ive got to get the integration tests passing first

MF

03:27

Mr Flintstone

In reply to this message

not sure it is easy to measure consensus about that. all we have is the block reward/block time to modify, not like we are using futarchy to define a halving schedule

03:29

seems cleaner than dealing with mining and diff

Z

03:41

Zack

how about an upper limit on block difficulty.

So you if you use a gpu, you get hundreds of blocks a minute.

So you if you use a gpu, you get hundreds of blocks a minute.

03:42

it looks like integration tests are passing

OK

03:48

O K

I think keeping as close to the main net is the spirit of testnets

03:48

Minus the changes trying to be made

Z

03:49

Zack

Amoveo is a lot more adaptive than most blockchains. Life finds a way.

03:49

It could mutate and escape our control

OK

03:50

O K

This doesn't happen lol

SS

03:52

Spike Spiegel

Is it only coin with governance for supply?

OK

03:52

O K

Just make the testnet dev reward 1000x the block reward and give some random admins addresses too

03:52

Then we can hyperinflate at will

03:53

And also give away some for people to play with channels

Z

03:53

Zack

We should call the testnet "Jurassic Park" to remind us of the risk

OK

03:53

O K

People like playing on testnets, see ethereums

Z

03:53

Zack

In reply to this message

Amoveo uses futarchy governance for many things besides the block reward and block time

03:54

the dev reward is controlled by governance

OK

03:54

O K via @gif

Animation

Not included, change data exporting settings to download.

62.2 KB

Z

03:54

Zack

adding some hyperinflation that is outside the control of governance sounds like a good strategy for neutering the dinosaurs.

SS

04:00

Spike Spiegel

But nobody is using the governance variables for anything else / futarchy markets aren't popular compared to directly investing in VEO as just coin

Z

04:00

Zack

We used futarchy to make some decisions about hard updates and governance updates.

04:01

Futarchy isn't a big deal the way an election is.

Only a small handful of insiders actually participate in the futarchy or even talk about it.

Only a small handful of insiders actually participate in the futarchy or even talk about it.

04:01

If futarchy is effective, then good decisions will be made for Amoveo

T

04:02

Tromp

How do you plan for the amount of users vs the amount of speculators in a futarchy system? Simply the people that dont pay dont care?

Z

04:03

Zack

In reply to this message

If you speculate in futarchy, either you guess right and it doesn't matter, or you guess wrong, in which case your bet is a prize for someone else to come and report the truth.

Robin Hanson wrote a paper about how people betting wrong increases the accuracy of prediction markets.

Robin Hanson wrote a paper about how people betting wrong increases the accuracy of prediction markets.

04:04

I am expecting most recreational gamblers to participate in the user friendly smart contracts on top of the lightning network.

I expect almost no one to make oracle transactions on the blockchain.

I expect almost no one to make oracle transactions on the blockchain.

T

04:05

Tromp

Can a miner with a lot of money come in at these prices and vote for the block reward to increase by x percent messing with the holders?

Z

04:06

Zack

In reply to this message

An attempt to manipulate the result of a prediction market like this is the same as throwing money away. You can't influence the outcome.

04:06

Bad bets are a prize for others to take from you by making good bets.

T

04:07

Tromp

Ok thanks 🍺

04:08

By the way, does anyone know why the hashrate keeps increasing so much?

04:08

Some chinese miner or something?

Z

04:09

Zack

The price of other blockchains has gone down lately, it makes Amoveo more profitable to mine relatively.

04:10

the hashrate was 50% higher a couple weeks ago

SS

04:10

Spike Spiegel

I thought that "non-speculative" value of veo should reflect amount locked in markets / channels

Z

04:12

Zack

In reply to this message

"speculative" often means that people are gambling recreationally. I don't know what you are saying

SS

04:21

Spike Spiegel

That people are buying due to expectation of price increase & possible supply reduction and not that organic usage of markets would force higher price

Z

04:22

Zack

right, people use "speculative" to describe that sort of an investment

04:22

but I think in this case, Tromp was asking about people who gamble in a futarchy market without knowing anything about which decision is better.

04:24

It is a little complicated, because VEO is something you can invest in, and it allows for all these other contracts that you can invest in.

So we use similar language to describe VEO and to describe the different smart contracts.

So we use similar language to describe VEO and to describe the different smart contracts.

SS

04:36

Spike Spiegel

Right now price = supply & demand play. Meanwhile Ethereum is "backed" by ERC20 tokens, since they need ETH for liquidity and apparently ETH marketcap > sum of erc20 marketcap

04:36

Marketcap of veo needs to be higher than the dollar sum locked inside - IHMO getting more people to use it that way would yield higher returns than anything else

OK

04:36

O K

I'd rather be backed by supply and demand than backed by shitcoins, if that's what you're saying

Z

04:38

Zack

Erc20s could sum to something bigger than eth. Why not?

04:39

All amoveo contracts are priced in Veo.

T

04:42

Tromp

Have you though of a way of valuing Amoveo from a fundamental perspective in usd terms? Must be extremely hard in this stage i guess

Z

04:45

Zack

we made a contract for difference CFD smart contract.

So now you can make synthetic USD on Amoveo.

So now you can make synthetic USD on Amoveo.

T

04:49

Tromp

I mean in terms of market cap hahaha i read the other day that you wish to surpass augurs market cap

Z

05:06

Zack

I want to build the new world reserve currency.

Financial derivatives are the most popular application of currency.

Financial derivatives are the most popular application of currency.

G

05:11

Gregory

Sticker

Not included, change data exporting settings to download.

💫, 46.9 KB

M

10:42

Props to whoever structured the sell book, assuming that 20 different people aren’t floating sell orders 20-50% above market price

OK

10:59

O K

People have been market buying

H

11:23

Harmony is lifer • $ONE 🦄

Guys i think its better to use qt wallet for veo

B

14:20

Ben

then start adopting it

14:20

have fun

S

Deleted invited Deleted Account

SS

17:42

Spike Spiegel

erc20 ICO's created massive demand for ETH itself

E

17:48

Eloi

no ICO no Eth

17:48

infinite Eth being sold, dep eth

17:50

just imagine for a second the amount of Eth dropped in icos, most of them scam icos

18:23

Deleted Account

In reply to this message

good link, thanks. And if you draw the line along x axis further towards 100, you will find that after 100, your growth rate is more than 40%, which means you need to invest all your money each round...someone please correct if i am wrong.

[

18:30

[Riki]

In reply to this message

isn't your expected loss maximized if you bet 100% every round? after infinite rounds, your chance of surviving is 0?

18:32

Deleted Account

In reply to this message

i believe you are right. just want to know what the positive return means after 100, does that mean you need to borrow?

[

18:40

[Riki]

In reply to this message

if you can borrow additional funds each time after an unsuccessful round, then it would make sense that you bet 100% each round since you can never lose (you can always borrow again and again). in other words you dont have a financial leverage limit. i dont know how to interpret the "40%" growth rate in that context. how does the profit distribution look like, is it normal?

18:50

Deleted Account

not sure, that is out of my knowledge.

4 December 2018

SS

04:04

Spike Spiegel

Instead of buying $1000 worth of S&P500 you can borrow $2000 for $1000 to buy $2000 worth of shares = so your upside and downside risk is 2x (and you need to pay interest + risk liquidation)

Deleted invited Deleted Account

Tv

05:34

Tarrence van As

Hi Zack, in the orders record, there is a member

https://github.com/zack-bitcoin/amoveo/blob/8d21fde027dea09ac851022f5ed93c644f3ef909/apps/amoveo_core/src/consensus/trees/orders.erl#L20

pointer. What does it point to? https://github.com/zack-bitcoin/amoveo/blob/8d21fde027dea09ac851022f5ed93c644f3ef909/apps/amoveo_core/src/consensus/trees/orders.erl#L20

05:35

I’m trying to understand how to find who an order in an oracles order book belongs to

Z

05:42

Zack

It's a linked list. It points to the next order.

Tv

05:53

Tarrence van As

Ok, so it should correspond to the next orders

aid?

05:56

When querying some orders for an oracle I’m getting data that looks like this:

Where the pointer doesn’t match the next orders id perfectly, but a large substring does. For example in the case above, ss

{

"amount": "14702787",

"id": "BMjV7rAAssU+DGd8w+6XsyDSdgoichddlSipZT3U+jehHSD68UwPdF9TO3HQ0g4hCh2rgUQyqPnP7vP0i/l8Ijw=",

"pointer": "AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA=",

"root_hash": "fj8c2jiAO9WT9kAhdZ0bAWF4xQI4BQrsPw1BKQDq0OQ="

},

{

"amount": "5260629159936",

"id": "AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAE=",

"pointer": "ssU+DGd8w+6XsyDSdgoichddlSipZT3U+jehHSD68UwPdF9TO3HQ0g4hCh2rgUQyqPnP7vP0i/l8IjwAAAAAAAA=",

"root_hash": "fj8c2jiAO9WT9kAhdZ0bAWF4xQI4BQrsPw1BKQDq0OQ="

}Where the pointer doesn’t match the next orders id perfectly, but a large substring does. For example in the case above, ss

U+DGd8w+6XsyDSdgoichddlSipZT3U+jehHSD68UwPdF9TO3HQ0g4hCh2rgUQyqPnP7vP0i/l8Ijw matches. I wonder what I am doing incorrectly

05:57

This is for oracle

tgGxIve5FdNsAB0t4diP5p3cJjeax05KpWX7ltfJjyI=

Andrey invited Andrey

Z

08:54

Maybe the order is not being decoded correctly.

Z

12:34

Zack

The bunch of AAAA at the end is zero bytes. So it isn't decoding correctly.

Tv

12:36

Tarrence van As

Thanks. I’m debugging the deserialization function now but haven’t been able to figure it out yet.

12:37

12:37

I get this

12:37

Input Data: <<"BE/xUgDuGzJMqZl6xZpP74v+z5ACl6I5Radeh3Jyn0BJeWUWGtgtEuODCE1/iojRUvgGxho3kqkMFjLZimM10lMAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAQ==">>

Amount: 4741397610734

AID: <<"AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAE=">>

P: <<"GzJMqZl6xZpP74v+z5ACl6I5Radeh3Jyn0BJeWUWGtgtEuODCE1/iojRUvgGxho3kqkMFjLZimM10lMAAAAAAAA=">>

Z

12:37

Zack

great.

I am guessing you are using some javascript library to decode?

I am guessing you are using some javascript library to decode?

Tv

12:38

Tarrence van As

No, I’m using the erlang client

Z

12:38

Zack

what command are you using to decode the order?

Tv

12:38

Tarrence van As

I’m calling it internally

12:38

orders:get

Z

12:38

Zack

orders:deserialize/1 ??

Tv

12:39

Tarrence van As

orders:get/2

12:40

In theory this should exhibit the same issue but I haven’t tested yet

Z

12:41

Zack

I notice that it is 65 bytes with the AAAA at the end

12:42

oh, this is the head of the list.

12:42

I made the head of the linked list a little different. It stores some meta data about the entire list, like how long it is.

12:43

that is why it says such a big number for Amount. that isn't an amount of veo, that is just decoding junk binary as if it was an amount.

Tv

12:47

Tarrence van As

Gotcha, so the deserialization function needs to be updated?

Z

12:48

Zack

no.

12:48

there is this other function already to deserialize order-headers.

Chris 🍞 invited Chris 🍞

C

18:02

Chris 🍞

g'day =)

18:04

What a mess at AE, think i'm going back to Amoveo mining

M

19:06

Minieep21

Hello

19:07

What's going on with them?

19:07

C

19:07

Chris 🍞

poor mining tools from dev team, since launch someone with private software been mining 90%+ of all blocks

AK

19:09

A K

100% expected lol

19:10

But it's capitalism

19:10

Anyone had like a year to develop custom mining software

S

19:10

Sy

whats their algo? cuckoo cycle?

AK

19:11

A K

Yep

S

19:11

Sy

isnt that used in other coins before? thats always dangerous because there might be an asic already in the making and they sweep by your coin as a side effect

AK

19:11

A K

i’m not sure

19:11

it will be used in Grin

19:12

but AE might be the first one to market actually

19:12

and the algo is supposed to be ASIC resistant *cough* *cough*

19:14

cant find which coins are using it tho but as someone explained earlier, there is nothing you cant build an asic for, an asic is just specialised for one task, doesnt matter what task it is - usually asics have not that much memory but thats just one parameter you have to change and its working again as prooven by bitmain

19:15

this one

AK

19:17

A K

all true

S

19:21

Sy

so zacks approach is a good one, choose an asic friendly algo because its going to happen either way, this way more ppl can get a shot at it vs a complex algo but dont take an existing one

AK

21:02

A K

absolutely

21:03

how to make sense of it? :-/

G

21:05

Gregory

софт конечно очень сырой

21:59

this

21:59

seems similar to predition market

22:00

but are used to verify truth

Alex invited Alex

SS

22:33

Spike Spiegel

TBH trustory seems like another Theranos

Z

22:41

Zack

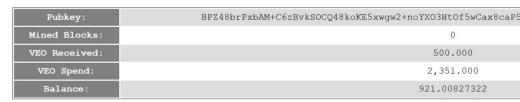

In reply to this message

I think it is because of the delete-account txs that this person used.

They received money from the other accounts that got deleted.

They received money from the other accounts that got deleted.

AK

22:42

A K

is there a way to fix it somehow?

22:42

so that explorer shows correctly

DV

22:43

Denis Voskvitsov

AFAIR veoscan did smth to handle these tx's (they're special because tx amount isn't stored in blockchain)

AK

22:43

A K

i assume it's just the explorer bug(?) and that the node "knows" the correct balance

Z

22:43

Zack

In reply to this message

Haha

Looks like someone is trying to sell prediction market oracles, but they don't understand how a prediction market works.

Looks like someone is trying to sell prediction market oracles, but they don't understand how a prediction market works.

SS

Z

22:51

Zack

In reply to this message

The amoveo lie detector is for assessing the accuracy of people's promises about the future. It uses a combinatorial prediction market.

Truthy looks like it is for knowing facts about the world as it exists now.

Truthy looks like it is for knowing facts about the world as it exists now.

SS

23:03

S S

In reply to this message

Well even if I'm able to detect if the news published last week was true/false, it can be useful for assessing reputation of the publisher, no?

Z

23:06

Zack

In reply to this message

A prediction market allows us to bet on anything that will eventually become common knowledge.

We can bet on a sporting event, because after the event ends it is easy for us all to know who won, so it is easy to report the result to the blockchain.

But if something is not common knowledge, then we could not bet on it.

If the community can't easily agree on the outcome, then they would not know what to report to the Oracle.

We can bet on a sporting event, because after the event ends it is easy for us all to know who won, so it is easy to report the result to the blockchain.

But if something is not common knowledge, then we could not bet on it.

If the community can't easily agree on the outcome, then they would not know what to report to the Oracle.

23:08

A prediction market can be used to know if someone is lying when they make a promise about doing something public in the future.

A prediction market can't be used to know the accuracy of a person's story about the past.

A prediction market can't be used to know the accuracy of a person's story about the past.

SS

23:18

S S

Doesn't a story's validity eventually become evident as more facts open up. I agree the timeline is not well defined but at some point of time you're going to Know whether it was factually right or wrong, I think or maybe my understanding of prediction market is wrong.

Z

23:20

Zack

I just flipped a coin.

I tell you it landed heads.

I could be lying.

How long until you can tell me if I was lying or honest about the coin flip?

It doesn't matter how long you wait, you will never know the result of the coin flip.

I tell you it landed heads.

I could be lying.

How long until you can tell me if I was lying or honest about the coin flip?

It doesn't matter how long you wait, you will never know the result of the coin flip.

23:22

Oracles can't be used for secret coin flips by anonymous people online.

Oracles can only be used to record information that is common knowledge. Information that is cheap for anyone to look up.

Oracles can only be used to record information that is common knowledge. Information that is cheap for anyone to look up.

SS

23:23

S S

Just to understand better, what would an oracle for amoveo lie detector have?

Z

23:26

Zack

For example, Bob is running for president.

He promises that if he gets elected, the price of beans will go down by at least 50%.

So we would make 2 oracles. One asks if Bob gets elected.

The other asks if the price of beans fell by at least 50%.

Then we make a market to ask about the correlation of these variables.

If they are correlated, that means Bob's promise is honest. If he is elected, the price of beans will probably go down at least 50%.

If they are uncorrilated, then Bob is a liar.

He promises that if he gets elected, the price of beans will go down by at least 50%.

So we would make 2 oracles. One asks if Bob gets elected.

The other asks if the price of beans fell by at least 50%.

Then we make a market to ask about the correlation of these variables.

If they are correlated, that means Bob's promise is honest. If he is elected, the price of beans will probably go down at least 50%.

If they are uncorrilated, then Bob is a liar.

N

23:28

NM$L

A guy found ae is 51 attacked

SS

Z

23:30

Zack

Ico is so difficult.

All 100% of coins are at risk on day one.

In amoveo, we had very few tokens at risk on day 1, because they hadn't been mined yet.

All 100% of coins are at risk on day one.

In amoveo, we had very few tokens at risk on day 1, because they hadn't been mined yet.

AK

OK

AK

23:30

A K

afaik nobody uses mainnet tokens yet, no exchanges accept them, so what's the point of the attack?

N

23:31

NM$L

hh

harold harold 04.12.2018 23:25:16

you can update block explorer every 3 second

23:31

Wait new block come out

23:31

Other wise ae is not using mesh network

23:31

Its several mintes ago when it updared

23:31

So its been attacked

23:31

Not like btc

N

23:31

NM$L

n

nassim|DefiPulse 04.12.2018 23:29:59

I can see last blocks are by different miners.

23:31

Why should a 51% attacker give blocks to someone else

OK

23:32

O K

Orphaned blocks?

23:33

If they have enough hash rate, and depending on how well their network syncs, it may not even be deliberate

23:33

Have there been double spends?

Z

23:33

Zack

They have a block Explorer?

AK

23:33

A K

😂

SS

5 December 2018

Adel invited Adel

A

01:28

Adel

is amoveo an ERC20 token?

Z

01:28

Zack

In reply to this message

No.

On March 2 2018 we launched main net starting with zero tokens

On March 2 2018 we launched main net starting with zero tokens

Evgeny Vlasov invited Evgeny Vlasov

OK

Z

04:23

Zack

I am planning out making a testnet to try out the new hard update before we do it on mainnet.

P

Z

04:26

Zack

I was thinking of forking at a recent height, so we all have the same balances. but I am a little concerned about transactions being replayed on both sides.

Even if I build great software to prevent txs from being replayed, I am worried that the user interfaces wont be clear enough.

For example, you could use any light node to make a valid signature, so generating the signature from a testnet light node isn't a guarantee that it can't be broadcast on main net.

Even if I build great software to prevent txs from being replayed, I am worried that the user interfaces wont be clear enough.

For example, you could use any light node to make a valid signature, so generating the signature from a testnet light node isn't a guarantee that it can't be broadcast on main net.

04:40

This update replaces a lot of code with other much shorter code.

So now something like 10% of Amoveo's code is dead. It is only used for verifying historical blocks.

I am hoping to find a way to add a checkpoint, so that we can stop doing some aspects of verification for these old blocks.

That would make syncing faster, and allow us to delete a bunch of confusing unused code.

So now something like 10% of Amoveo's code is dead. It is only used for verifying historical blocks.

I am hoping to find a way to add a checkpoint, so that we can stop doing some aspects of verification for these old blocks.

That would make syncing faster, and allow us to delete a bunch of confusing unused code.

Артём invited Артём

Z

04:51

Zack

maybe I should just append every dead line with the comment symbol, and add a line to the documentation explaining how to tell when code is dead.

Z

05:44

Zack

I think there is a daily pattern in the VEO price.

I guess some time zones are mostly selling, and others are mostly buying.

I guess some time zones are mostly selling, and others are mostly buying.

05:48

I see cup and handle and liftoff

Z

05:49

Zack

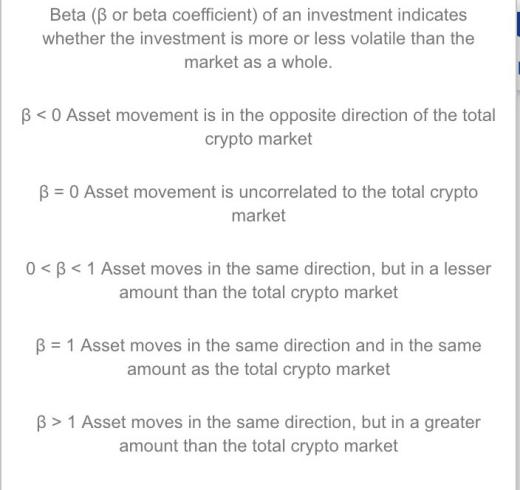

Veo is doing pretty well considering how this is a bear market.

It seems like we aren't very correlated to other cryptocurrencies, so that means VEO is probably a good hedge for most cryptocurrency investors.

It seems like we aren't very correlated to other cryptocurrencies, so that means VEO is probably a good hedge for most cryptocurrency investors.

OK

05:50

O K

I think it's being made into that hedge

SS

05:51

Spike Spiegel

It has 1.8 beta - one should short BTC and long veo for hedge

Z

05:53

Zack

I think a reason that cryptocurrencies are so correlated is that a lot of projects have a lot of cryptocurrency from their ICO. So a large fraction of the value of an altcoin is in the bitcoin/eth reserves of the business who did the ico.

Amoveo doesn't have any crypto reserves.

Amoveo doesn't have any crypto reserves.

OK

05:54

O K

In reply to this message

This is less simple than just the fact they are priced in BTC/ETH on exchanges

MF

05:56

Mr Flintstone

doesn’t coinpaprika do the beta calc?

05:57

I would take beta calcs with a large grain of salt driven by the fact that there can be meaningful dislocations in the volatility of veo vs bitcoin

05:57

plus, are they doing beta of veousd vs btcusd or veobtc vs btcusd

05:59

In reply to this message

beta of veo vs bitcoin = correlation of veo to bitcoin * volatility of veo / volatility of bitcoin

SS

06:13

Spike Spiegel

Amoveo is moving in the same direction as market - mostly - but with 1.8 movement = if you hold bitcoin already you cannot hedge buy buying veo, you need to short bitcoin to get market neutral exposure

06:13

Say I bought some veo when bitcoin was 6400 and now it's ATH in both BTC and ETH but I'm underwater on dollar terms

OK

Z

06:20

Zack

you would get a different beta depending on what part of the history you measured.

Things change fast in the cryptocurrency world.

Things change fast in the cryptocurrency world.

SS

06:23

Spike Spiegel

you need some recent correlation for that - option pricing and general trading is very interesting - seems like Amoveo would benefit from having somebody experienced in futures markets to write quality explainers & how_to guides

06:24

One thing is technical feasibility of implementing something, another is getting people to understand and use it

MF

06:28

Mr Flintstone

you can use baskets of options to create what are effectively correlation swaps: long an option on a 50/50 veo/btc portfolio and sell options on standalone btc and standalone veo portfolios

Z

06:28

Zack

or we could use the power of amoveo oracles to ask exactly that question

MF

06:29

Mr Flintstone

that too :)

06:29

much simpler

SS

06:29

Spike Spiegel

Would portfolio X outperform beta?

xD

xD

Z

06:30

Zack

that is a powerful abstraction.

I think in practice these super specific questions wont be so useful.

The benefit of a basket of options is that hopefully each option in the basket is useful to other people who make different baskets.

You get more liquidity with more participants.

I think in practice these super specific questions wont be so useful.

The benefit of a basket of options is that hopefully each option in the basket is useful to other people who make different baskets.

You get more liquidity with more participants.

MF

06:33

Mr Flintstone

I wonder if we can blend our scalar markets and the XNOR oracle question we use in futarchy to create a correlation market

Z

07:32

Zack

What is the current state of mining hardware research?

Is it better to have computation be the bottleneck, or memory accesses?

I feel like memory is more reusable. It would be easy to make efficient hardware that could be used on many different memory hard pow algorithms.

Maybe they can specialize in the size of memory they read in one go, or the total amount of memory that needs to be available while mining.

I wonder if computation is getting cheaper faster, or if memory is getting cheaper faster.

Is it better to have computation be the bottleneck, or memory accesses?

I feel like memory is more reusable. It would be easy to make efficient hardware that could be used on many different memory hard pow algorithms.

Maybe they can specialize in the size of memory they read in one go, or the total amount of memory that needs to be available while mining.

I wonder if computation is getting cheaper faster, or if memory is getting cheaper faster.

08:06

Deleted Account

In reply to this message

trustory verify truth from past , predition market predict future. i think they said that in their forum

Z

08:07

Zack

Are they like, archeologists?

08:08

Deleted Account

im not sure whether it's a blockchain projects tho , i just found the site yesterday

OK

Deleted invited Deleted Account

SS

08:53

Spike Spiegel

I would argue against memory bound algo because it may create unfavourable ripple effects: ETH made gaming cards more expensive due to increased demand - supply was constrained so price skyrocketed

Z

08:54

Zack

I wonder if there are any favorable side effects.

Maybe all the intense research into mining hardware will lead to the discovery of better ways to do computation.

Maybe all the intense research into mining hardware will lead to the discovery of better ways to do computation.

Deleted invited Deleted Account

Aqua Chiang invited Aqua Chiang

SS

18:26

Spike Spiegel

Electricity network shedding & frequency mgmt

18:27

You can put some % of output from electric plant to miners, and turn them off immediately if you need more power - so your plant will always work at 100% capacity generating more stable revenue

AK

18:28

A K

yeah, but miners might be disappointed with idle periods, kills the ROI

18:29

only work in times like now if the regular kWh price makes mining a loss

18:29

or maybe current times are the new norm )

19:48

Deleted Account

Been there done that. Mining investment costs are so high that if you dont mine 24/7 you will not profit. Add to this the very large risk of mining profitability in the future

19:49

If one day mining hardware that is cheap in purchase and competitive power wise comes to existence, it will be a boost for renewable energy. So we can hope that happens

19:49

Reason: renewable will have a market for energy when there is no grid need

19:50

My favorite product if this happens is to make an electric heater that mines for crypto

AK

19:52

Deleted Account

That would mean that they are only part time profitable? Not exactly a good model for future investments in mining hardware I would think

AK

19:53

A K

dunno the business model, but I saw that exact business pitch somewhere

19:53

mine+heat

P

19:55

Prizrak

cominopool.com uses FPGA for the mining of this coin. FPGA is much more economical in terms of consumption of electricity.

K

AK

P

AK

19:56

A K

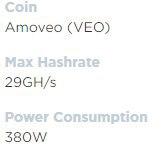

where?

P

19:58

Deleted Account

Wow... is this really an amoveo fpga? What you get exactly? Remote License?

Vitaly Fralenko invited Vitaly Fralenko

Z

20:00

Zack

It seems like the FPGA they use runs encrypted software.

So you pay them $100, and they send you software to make your FPGA mine for Amoveo.

You can't re-use the mining software on other FPGA, because it needs to be custom encrypted for each board.

So you pay them $100, and they send you software to make your FPGA mine for Amoveo.

You can't re-use the mining software on other FPGA, because it needs to be custom encrypted for each board.

20:00

I am excited for the first person to buy one of these boards to tell us how well they work

P

20:01

Prizrak

And at the same time, all FPGA clients mined a VEO in their pool - cominopool

Z

20:03

Zack

so if you use their FPGA, you can only join cominopool?

That sounds like a bad thing.

If FPGA can only join their pool, then they will have >50% hashrate soon.

We need to program an open source bitstream for FPGA, that way you can use FPGA with any mining pool.

Maybe we can use a dominant assurance contract for this.

That sounds like a bad thing.

If FPGA can only join their pool, then they will have >50% hashrate soon.

We need to program an open source bitstream for FPGA, that way you can use FPGA with any mining pool.

Maybe we can use a dominant assurance contract for this.

20:06

Deleted Account

That would be bad.

Z

20:06

Zack

Well, we don't really know anything until someone buys their bitstream and gives us a review of how it works

20:07

Deleted Account

The interesting thing here would be the numbers for hashrate vs power. It could trigger others to make the FPGA software

Z

20:07

Zack

yes

P

20:08

Prizrak

In reply to this message

Why no one can mine on cominopool? address cominopool.com redirects to https://comino.com/en/

It turns out that the largest pool in the network is private?

It turns out that the largest pool in the network is private?

Z

20:12

Zack

I think cominopool is currently private, they are testing out fpgas and getting ready to sell their bitstream

P

20:15

Prizrak

In reply to this message

And at the same time, they use it to advertise their services and products.

SS

20:21

Spike Spiegel

What about fundraising for a software to run single SHA256 on commodity hardware?

Z

20:21

Zack

we have that already. There are CPU and GPU open source miners.

20:31

I am talking to Evgeny Vlasov of Comino.

He says:

"there are many FPGA chips and for each specific model it should be createed specific bitstream

we created two bitstream for VEO

for Stratix 10 (Altera Intell)

for CV13P Xilinks Ultrascale +

we are selling right now bitsstream from CVP13

CVP13 - model of board (cv13p is FPGA chip)

CVP13 is the most powerful solution on the market coming from Bittware near month

we as a legal company are supplier of Bittware and manufacturing liquid cooling systems (complite solution with fpga, liquid cooling, soft etc )

FPGA board consumes 380W and can be run only with liquid cooling

with air flow I guess it can be ~200 with no problems

we are selling bitstream separately as well with fix price 99 EUR per one Board with no fee

Any advices or comments or other chips FGPA - very velcome well We are open for any Idea you have to help Amoveo.

I can create video in Youtube as well to show how does it work"

He says:

"there are many FPGA chips and for each specific model it should be createed specific bitstream

we created two bitstream for VEO

for Stratix 10 (Altera Intell)

for CV13P Xilinks Ultrascale +

we are selling right now bitsstream from CVP13

CVP13 - model of board (cv13p is FPGA chip)

CVP13 is the most powerful solution on the market coming from Bittware near month

we as a legal company are supplier of Bittware and manufacturing liquid cooling systems (complite solution with fpga, liquid cooling, soft etc )

FPGA board consumes 380W and can be run only with liquid cooling

with air flow I guess it can be ~200 with no problems

we are selling bitstream separately as well with fix price 99 EUR per one Board with no fee

Any advices or comments or other chips FGPA - very velcome well We are open for any Idea you have to help Amoveo.

I can create video in Youtube as well to show how does it work"

Mr.Bogus invited Mr.Bogus

Mr.Bogus invited Alexey Chistov

SS

20:37

Spike Spiegel

What will happen if they would own 51%

20:38

Monero changed algo at least once AFAIK - I'm not sure if single SHA256 is secure at all

AK

20:38

A K

wait

20:38

Monero changed because if ASICs

20:39

Amoveo welcomes ASICs, so no need to change at all

SS

20:41

Spike Spiegel

Even if they mine 51% ?

Z

20:41

Zack

Sounds like you can use comino pool bitstream to mine for any mining pool

AK

20:43

A K

yeah that would be like shooting themselves in the leg. i think the only reason to host one own's pool is to save on pool fees

Raccoonov invited Raccoonov

T

20:52

Tromp

It would be great if you did some youtube videos explaining how amoveo works and its future developments 🍺 Zack

SS

20:54

Spike Spiegel

FPGA != ASIC

R

20:54

Raccoonov

FPGA is much more flexible than ASIC

20:55

FPGA is adaptable to changes, and ASIC is not

AK

R

20:57

Raccoonov

That’s why noone sees FPGAs sellouts such as of ASICs, as one just can adapt FPGAs and continue running them

Coinman ศิษย์ปลาวาฬ invited Coinman ศิษย์ปลาวาฬ

H

21:01

Harmony is lifer • $ONE 🦄

Difficulty mooning 😭

Z

21:03

Zack

difficulty was higher a couple weeks ago

SS

AK

22:19

A K

all true, I'm very happy Amoveo and Zack shared it all from the very beginning

Z

22:25

Zack

It looks like Amoveo's original design was lucky. Back in March almost everyone thought ASIC-resistance was best, since then the average beliefs of the blockchain community seems to have shifted a lot.

M⛏

22:33

Moe ⛏

In reply to this message

Also comino isn't the only bitstream available for VEO.. there are others

Z

22:35

Zack

if someone is selling a bitstream, they should tell us so I can write about it on twitter and they will get more customers

S

22:57

Shaun

I feel like now it's more believed that ASICS are an indispensible part of security in blockchains

22:58

A lot of people ranted about it after the Vertcoin attack

22:58

including Emin Gün Sirer

Deleted invited Deleted Account

MF

S

23:42

Sy

the downside of asics is that sooner or later someone builds a private one and concentrates hashrate

23:42

i mean face it, you only sell your asic if you think you make more (or enough?) money this way than just using them yourself

AK

23:44

Alex K

In reply to this message

you sell it because you can make instant profit instead of taking crypto volaitility risk

OK

23:45

O K

And asic companies are evolving and there is more competition than ever

23:46

With a coin like veo, an asic dev would be better off being at least somewhat open about development

23:46

They wouldn't want us changing algos

23:47

And especially since we are pro-asic, it would be safer to be upfront

MF

23:47

Mr Flintstone

right

23:47

if someone doesn’t want to sell the community ASICs we can always change the algo as leverage

23:48

but I don’t really see a situation where someone puts millions into making veo ASICS so as to attack the network

23:48

would be a waste of money

Z

23:48

Zack

Asics are expensive, but as cryptocurrencies get bigger, and more money gets involved, it makes asics less expensive relatively.

In the limiting case, there are massive companies competing to produce asics with razor thin profit margins.

They maximize profits by immediately selling hardware, so they have more cash on hand to produce more hardware.

Mining recovers their investment too slowly, and it comes with significant risks.

In the limiting case, there are massive companies competing to produce asics with razor thin profit margins.

They maximize profits by immediately selling hardware, so they have more cash on hand to produce more hardware.

Mining recovers their investment too slowly, and it comes with significant risks.

6 December 2018

Z

00:21

Zack

I think the difference between miners and asics manufacturers is similar to the difference between coin investors and and miners.

In the beginning all the big coin holders are also miners, but as the project grows, vertical integrations starts being less efficient. people specialize and optimize.

Similarly, in the beginning all the big asics miners will also be manufacturers, but as the project grows, vertical integrations will start being less efficient. people will specialize and optimize.

In the beginning all the big coin holders are also miners, but as the project grows, vertical integrations starts being less efficient. people specialize and optimize.

Similarly, in the beginning all the big asics miners will also be manufacturers, but as the project grows, vertical integrations will start being less efficient. people will specialize and optimize.

I

01:31

Iridescence

In reply to this message

funny, because the vertcoin team specifically blames ASICS for the recent ongoing 51% attacks

S

01:32

Shaun

I doubt you'd need an ASIC to attack Vertcoin

I

01:32

Iridescence

true

J

01:32

Jurko | Bermuda capital 📈

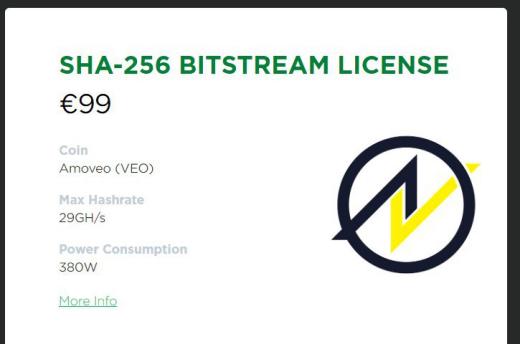

almost 0.1 btc per veo on qtrade 😊 gg

I

01:33

Iridescence

wow

AK

01:33

A K

someone liked the FPGA news

I

01:34

Iridescence

I guess FPGa development lends more credibility to VEO?

AK

01:34

A K

doesn't hurt! shows someone with resources is willing to spend time and money

Deleted invited Deleted Account

I

01:35

Iridescence

also BTC dumping again

OK

02:26

O K

When should we raise the block reward?

Я

MF

02:31

Mr Flintstone

good luck raising it lol. can’t imagine that will be popular

OK

ILYA VELLER invited ILYA VELLER

M⛏

03:03

Moe ⛏

In reply to this message

not if you're a dictator trying to take down the next world reserve currency 😜

V

03:39

Vampyr

I was right

Rustam invited Rustam

Z

03:45

Zack

In reply to this message

It seems like 2 things we could optimize for are Veo price and market cap.

I figure we should make a futarchy market that optimizes for a linear combination of those 2 values.

I wonder what ratio would be best.

I figure we should make a futarchy market that optimizes for a linear combination of those 2 values.

I wonder what ratio would be best.

AK

03:46

A K

market cap is all that matters

Z

03:46

Zack

yes maybe 100% market cap is better to optimize for.

M⛏

03:46

Moe ⛏

whats the current inflation rate?

Z

03:47

I think it is about 1 Veo per block

MF

03:47

Mr Flintstone

closer to 0.75

03:47

well, about equal to 0.75 lol

OK

MF

03:48

Mr Flintstone

0.2% inflation per day

03:49

EMH rekt. down the drain. rejected.

03:49

someone can write a nobel thesis on that ))

MF

03:50

Mr Flintstone

lol, there aren’t any arb opps cuz u have to take liquidity

03:50

highest bid on qtrade is low

M⛏

Z

03:51

Zack

It's less than a year old. So wouldn't it be >100% annual?

MF

03:51

Mr Flintstone

you would expect a pow chain with unchanged block reward to have inflation of 100% from end of year 1 to end of year 2

AK

03:52

A K

36500 veo per year currently vs 50K+ supply

Z

03:52

Zack

Oh right, we lowered it like 30 %

MF

03:52

Mr Flintstone

we lowered the block reward

03:52

and lots of veo was mined early when diff was low

Z

03:53

Zack

I wonder what the average block time was. I think the slow and fast times most canceled out

MF

03:54

Mr Flintstone

plus our blocks are 11 minutes, so about 10% less inflation than you think

03:55

In reply to this message

true, though I think I remember it still being very quick to like block 30k(faster than a half year?)

AK

03:56

A K

past inflation is not indicative of future inflation )

Tv

09:29

Tarrence van As

The oracles datastructure has a

result field that seems to be set to either 0, 1, 2, or 3. What do those values correspond to?

Z

10:37

Zack

0 is still open. 1 is true. 2 is false. 3 is bad question.

10:37

I think

Tv

10:41

Tarrence van As

Should the

type always be in sync with result if result is non-zero?

10:43

I’m seeing this being returned from the client

10:43

{

"__typename": "Oracle",

"ends": 28394,

"governance": "DEVELOPER_REWARD",

"id": "firE+J0/yBeBKiZ96oy66r662rvOcP9TwXSxfHAGoSQ=",

"result": "3",

"type": "TRUE"

}

Z

10:46

Zack

Type tells what kind of oracle bets are sitting in the Oracle order book.

Once the Oracle is closed, then the type does not matter.

Once the Oracle is closed, then the type does not matter.

10:47

If the total volume of bets in the Oracle is very small, then the outcome will be bad-question, regardless of the type of bets in the order book.

Tv

10:47

Tarrence van As

I see thank you

10:48

Another question, what does

cs and ex stand for in the governance params?

10:48

Oh channel slash for cs

Z

10:49

Zack

I think thst those are fees for all the tx types. Ex is for a proof of existence tx.

Tv

10:52

Tarrence van As

Gotcha thanks

N

13:58

NM$L

when coinmarketcap

J

14:19

Lately they list only trash projects

S

14:34

Sebsebzen

KuCoin could be Potential exchange

14:34

They list most custom blockchains

14:35

And if on KuCoin likely that will be on CMC via their api

N

14:35

NM$L

veo should list on a chinese exchange

D

S

14:36

Sebsebzen

How?

14:36

Community vote?

AS

14:36

Aizen Sou

In reply to this message

Wrong. They have their policy of listing. U can't be added without being listed on proper exchanges, at least 2

J

14:36

Jurko | Bermuda capital 📈

oh then my bad

AK

D

14:41

Danil

In reply to this message

No, it was listed without fees. Because it had no ico, but had community and mainnet. But Zack should fill the application for the listing.

H

15:57

Harmony is lifer • $ONE 🦄

Nope

15:58

We had a legal documents from attorney

15:58

Saying raven is not security

15:58

Wr submit it to bittrex

15:59

Binance just list it for free

15:59

Actually raven did not pay anything on exchanges

S

16:00

Sebsebzen

Raven is ERC20? Easy to add to exchange

H

16:00

Harmony is lifer • $ONE 🦄

But before cryptopia and bittex. Raven had a community vote on binance but didnt win

16:00

Nope

16:00

X16r

16:02

After 3 mos listing on bittrex and then binance came before the mainnet

16:03

Sold at 1020 sats

16:03

😂

S

16:09

Sebsebzen

What’s x16r

N

M