Amoveo ♥🧿

Previous messages

Next messages

21 March 2019

Z

06:03

Zack

haha, I think people have asked me if HiveOS works with Amoveo, and I said "no".

AK

06:04

A K

Or can be a different sha256 algo, but since it's in the GPU-only must be veo

Z

06:06

Zack

sha256 probably means bitcoin or bitcoin forks.

No other blockchain has miners compatible with Amoveo.

No other blockchain has miners compatible with Amoveo.

AK

06:07

A K

It's in GPU stats so not Bitcoin

Z

06:07

Zack

GPU can mine bitcoin too, they are just slow.

06:08

it could be a altcoin fork of bitcoin.

AK

SS

08:12

Spike Spiegel

Rainbow protocol seems like obvious rip-off from Amoveo original ideals but at least they managed to produce concise pdf / latex format whitepaper

Z

08:12

Zack

In reply to this message

so lets take their pdf, white out some stuff, write VEO in a few places, and re-publish?

MF

08:13

Mr Flintstone

lol

Z

08:13

Zack

if they want to do free technical writing for Amoveo, that is great

SS

08:16

Spike Spiegel

yes, i want to ( mostly in order to learn the stuff )

Bitcoin whitepaper is very short and doesn't require advanced math / economy knowledge at all.

I think that with nice graphics one can even create 1 pager explaining Veo oracle concept.

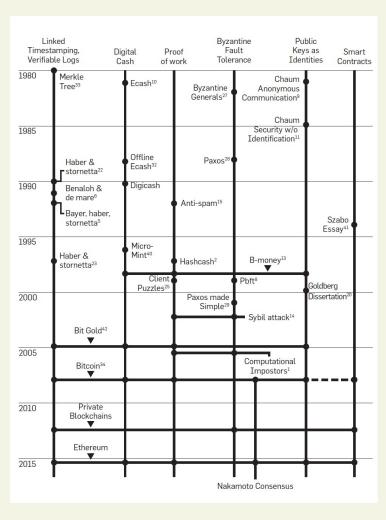

http://www.truthcoin.info/blog/contracts-oracles-sidechains/ redpilled me on idea that oracles are key feature for blockchain: most popular ETH projects ( MKR / Compound ) are using centralised oracles in order to work - it's fake decentralisation

Bitcoin whitepaper is very short and doesn't require advanced math / economy knowledge at all.

I think that with nice graphics one can even create 1 pager explaining Veo oracle concept.

http://www.truthcoin.info/blog/contracts-oracles-sidechains/ redpilled me on idea that oracles are key feature for blockchain: most popular ETH projects ( MKR / Compound ) are using centralised oracles in order to work - it's fake decentralisation

Z

08:18

Zack

It's great you figured this out spike, and it sounds like you are on track to help others realize

SS

08:20

Spike Spiegel

But there is one problem - people are willing to do lot of work in order to implement such things on Ethereum while they don't want to invest in new blockchain that's objectively better. It's like VHS vs Betamax

Z

08:21

Zack

https://www.orchid.com/assets/whitepaper/whitepaper.pdf

This paper talks about probabilistic payments to do some very cool stuff.

In some cases, they are better for micropayments instead of channels.

I am thinking of doing a hard update for a new kind of spend transaction that has this probabilistic feature.

This paper talks about probabilistic payments to do some very cool stuff.

In some cases, they are better for micropayments instead of channels.

I am thinking of doing a hard update for a new kind of spend transaction that has this probabilistic feature.

MF

08:22

Mr Flintstone

where do you get the randomness

Z

08:23

Zack

In reply to this message

I think it isn't possible to rebuild an oracle as cheap as ours onto Ethereum.

We combine the consensus mechanism with the oracle mechanism in a way that isn't possible with ethereum smart contracts

We combine the consensus mechanism with the oracle mechanism in a way that isn't possible with ethereum smart contracts

08:23

like the game where we both hold out fingers, and if the total sum is odd, you win, and if it is even, I win.

SS

08:24

Spike Spiegel

The design of difficult-to-manipulate price oracles is an area

of ongoing research, which is far too deep to explore in this paper

of ongoing research, which is far too deep to explore in this paper

Z

08:24

Zack

In reply to this message

I only linked that paper for the probabilistic payments section.

08:25

not related to what you are talking about.

SS

08:25

Spike Spiegel

I'm talking about rainbow protocol

Z

08:25

Zack

oh, right

08:26

so they aren't copying all of Amoveo.

Just a handful of features from our channel system.

Just a handful of features from our channel system.

08:28

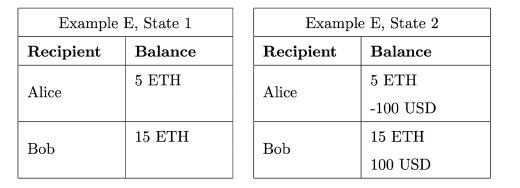

I love the simplicity of this - total sum of USD in the system is always 0

Z

08:28

Zack

yes, that is how financial derivatives work. We can only trade risk, we can't create or destroy it.

08:30

Probabilistic payments seem ideal for a lot of website sybil defense applications.

Because you don't have to wait for a tx to confirm to buy credits, and you don't have to make a channel.

Because you don't have to wait for a tx to confirm to buy credits, and you don't have to make a channel.

08:30

it would be a great upgrade to the encrypted messenger system.

08:31

This could be the solution to the sharing blocks altruism problem.

If we use probabilistic payments to pay the servers who send us blocks, this will make the full nodes completely resistant to sybil spam.

If we use probabilistic payments to pay the servers who send us blocks, this will make the full nodes completely resistant to sybil spam.

SS

08:32

Spike Spiegel

But here is the question: obviously stable-coins are 90% use case for crypto ( except money transfer )

Then it would be nice to have UX that can abstract away Amoveo features so I can just own some virtual USD in VEO Wallet while other "speculator / market maker" is sophisticated enough to take the risk / hedge and provide useful product to end user which may be even clueless grandma

Then it would be nice to have UX that can abstract away Amoveo features so I can just own some virtual USD in VEO Wallet while other "speculator / market maker" is sophisticated enough to take the risk / hedge and provide useful product to end user which may be even clueless grandma

08:33

I cannot wrap my mind - I can understand how to hold DAI in Metmask wallet but I don't understand what I have to do in order to own and keep stablecoin on veo ( and how much it will cost me )

Z

08:33

Zack

In reply to this message

yes, I agree. I tried to design the full node with a simple api, and provide a modular javascript light node to make it as easy as possible for web developers to build exactly these kinds of tools.

08:34

We will get there, incrementally. The derivatives tool is improving quickly.

SS

08:35

Spike Spiegel

Disclaimer: I'm probably not Mensa level bright - it was hard for me to understand how Ethereum works before I've seen actual example ( Mist wallet + Metamask )

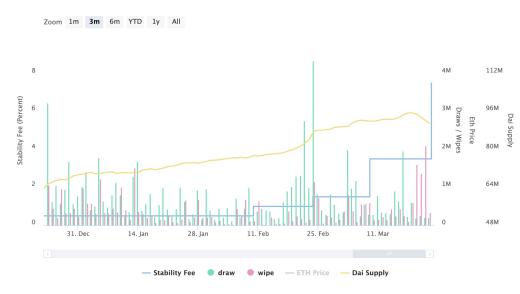

Currently holding DAI via CDP cost 3.5% and maybe cost will increase to 7%. But it's possible to have stablecoin with effective negative cost in veo right?

Currently holding DAI via CDP cost 3.5% and maybe cost will increase to 7%. But it's possible to have stablecoin with effective negative cost in veo right?

Z

08:36

Zack

Why would you pay 3.5% to own something that stays the same value as USD?

Wouldn't it make more sense to just buy USD?

Wouldn't it make more sense to just buy USD?

SS

08:37

Spike Spiegel

Many people are using CDP to get more ETH exposure without using exchanges with margin. There are no exchanges with VEO margin so only way to get such thing is on derivative market by offering people stablecoins

Z

08:37

Zack

In Amoveo, the price for USD stablecoin contracts has been 5% to the person holding the USD side.

Because the person wants to pay a premium to go long-veo.

Because the person wants to pay a premium to go long-veo.

SS

08:37

Spike Spiegel

5% per annum?

Z

08:37

Zack

per month

08:38

I sold 10 veo worth of USD stablecoins to sourcex

08:38

and payed him 0.5 veo

SS

08:38

Spike Spiegel

I actually believe that USD is so good that people may be willing to pay up to 10% per year for being able to have something with stable value accepted globally

Z

08:39

Zack

why wouldn't they just buy normal paper dollars?

SS

08:40

Spike Spiegel

Transaction costs + storage costs + liquidity costs + just not having USD bank account or being afraid of KYC

Z

08:40

Zack

That would be amazing. if people would pay me, for me to have even more veo exposure.

SS

08:40

Spike Spiegel

10% per annum in order to avoid tax / laundry money from drug sales is nothing

Z

08:40

Zack

Lets get this happening

SS

08:42

Spike Spiegel

That's hypothetical - I seriously recommend reading this with fresh eyes as it may be very useful for veo https://www.interfluidity.com/uploads/2017/10/Fiat-Is-Effective-Minitalk-light-edit-to-share.pdf

If there would be no USD people would be using something other - but USD holders aren't complaining about inflation or risk of country disappearing

If there would be no USD people would be using something other - but USD holders aren't complaining about inflation or risk of country disappearing

08:43

If DAI will pay more interest then dollar ( via Compound ) people may move USD -> DAI pushing underlying collateral price up

08:44

"Current iterations of crypto are just ridiculously poor candidates for a dominant money, except maybe in countries that lack the capacity to

issue credible fiat."

And similarly Amoveo is bad product compared to CBOE but good if you cannot use CBOE

issue credible fiat."

And similarly Amoveo is bad product compared to CBOE but good if you cannot use CBOE

Z

08:46

Zack

You can also use Amoveo to make markets that are legally restricted from existing in the CBOE or whatever central markets.

SS

08:46

Spike Spiegel

"We want a unit of account and store of value that hedges our risk, inherent in the fact that our contractual obligations and the prices of goods and services we require may fluctuate over time and leave us unable to meet our obligations."

Z

09:38

Zack

There has been debate in Amoveo about whether our futarchy markets for updates to Amoveo should optimize for the market cap or for the price of a VEO.

Spike offers up a third option of what we should optimize for. We should try to keep the volatility as low as possible.

The cost of making derivatives is proportional to how wide the margins are on those derivatives. The width of margins priced in VEO is mostly determined by how volatile VEO is.

So, if we want Amoveo to be a useful platform for derivatives, we should try to keep the volatility low.

We should come up with some ways of estimating the volatility, and make some graphs of it changing over time so we can visualize the situation.

Spike offers up a third option of what we should optimize for. We should try to keep the volatility as low as possible.

The cost of making derivatives is proportional to how wide the margins are on those derivatives. The width of margins priced in VEO is mostly determined by how volatile VEO is.

So, if we want Amoveo to be a useful platform for derivatives, we should try to keep the volatility low.

We should come up with some ways of estimating the volatility, and make some graphs of it changing over time so we can visualize the situation.

EA

SS

09:48

Spike Spiegel

Or even more savage: Amoveo - improved implementation of Rainbow protocol

Z

09:51

Zack

Maybe instead of gambling on the short term volatility, we should have a couple layers.

First there are people gambling on the long-term volatility.

Then we make futarchy markets comparing the price of that asset in the short term vs our governance decision.

First there are people gambling on the long-term volatility.

Then we make futarchy markets comparing the price of that asset in the short term vs our governance decision.

09:54

that way the governance decision can be correlated with something measurable in the short term.

MF

09:57

Mr Flintstone

upside volatility doesn’t break contracts like downside vol does

Z

09:58

Zack

true

09:59

https://github.com/zack-bitcoin/amoveo/issues/237

I made this page where we can discuss this issue

I made this page where we can discuss this issue

09:59

or, I will copy paste relevant info from here into there.

SS

09:59

Spike Spiegel

Yup - that's my point.

The best currency for derivatives:

- stable

- not decreasing

There is some amount of tolerable upside volatility but the network would be unusable with price swinging after small trade orders

The best currency for derivatives:

- stable

- not decreasing

There is some amount of tolerable upside volatility but the network would be unusable with price swinging after small trade orders

10:05

Section 3.4 of RainbowNetwork whitepaper - channels without oracles - I wonder if it's secure

Z

10:06

Zack

I was working on that with mr flinstone, i'll collect some notes on our conclusions

SS

10:07

Spike Spiegel

It may work like this: use price feed from participants and if they disagree then fallback to oracle or close the position at T-1 price

10:08

It would provide small free option for one party...

Say if bitcoin price is increasing too much one can provide fake data to push counterparty to close the position with price before the price increased

Say if bitcoin price is increasing too much one can provide fake data to push counterparty to close the position with price before the price increased

Z

10:09

Zack

It seems like for this to work, both participants in the channel need to have some shared reference price.

So either this reference price is not cryptoeconomically secure, it is centrally hosted, or a team of people. or it is cryptoeconomically secure, in which case it needs to be a secure oracle mechanism.

The only continuous price feed oracle that I can think of is an on-chain market for the same asset.

So the limitation is that for any market existing on-chain on ethereum, some much smaller continuous market over the same asset could exist on bitcoin.

So either this reference price is not cryptoeconomically secure, it is centrally hosted, or a team of people. or it is cryptoeconomically secure, in which case it needs to be a secure oracle mechanism.

The only continuous price feed oracle that I can think of is an on-chain market for the same asset.

So the limitation is that for any market existing on-chain on ethereum, some much smaller continuous market over the same asset could exist on bitcoin.

SS

10:11

You say the price and I say the price and you can buy for min(my_price, your_price) and sell for max(my_price, your_price)

Z

10:12

Zack

oh, kind of like a I-cut-you-choose protocol

SS

10:13

If you fake the price I will use shotgun clause somehow

Z

10:13

Zack

That is how I would divide cake with my siblings as a child.

10:14

im having troubling understanding this.

10:14

is this still part of a continuous process re-occurring every few seconds?

10:17

I think this does not work as an alternative to an oracle.

Imagine that you put $60 into a channel, and I put $40 so we could make our bet.

Eventually it comes time to do the shotgun protocol.

In reality, you won the bet, so you should get 100%.

You choose the price $100, and I choose the price $50.

So what happens next? Do we each get $50 out of the channel?

Imagine that you put $60 into a channel, and I put $40 so we could make our bet.

Eventually it comes time to do the shotgun protocol.

In reality, you won the bet, so you should get 100%.

You choose the price $100, and I choose the price $50.

So what happens next? Do we each get $50 out of the channel?

SS

10:18

Spike Spiegel

No, to settle the previous bet we are doing another bet with shotgun clause

10:19

It's secure if next bet with shotgun clause is significantly higher in value then previous one

Z

10:19

Zack

it works with the house because there is an actual house that has real value.

You can use this mechanism to incentivize the players to reveal how much they want the house. it is like a second price auction.

If our bet is just over how we will divide a pile of money. We already know how much we each value the money. We can't do a 2nd price auction of a pile of cash to reveal anything.

You can use this mechanism to incentivize the players to reveal how much they want the house. it is like a second price auction.

If our bet is just over how we will divide a pile of money. We already know how much we each value the money. We can't do a 2nd price auction of a pile of cash to reveal anything.

SS

10:21

Spike Spiegel

Say you are giving me BTC price and I have freedom to trade with you X worth of BTC and I can decide If I want to buy or sell

10:21

Then any price different then current price will be X * (price difference) penalty

Z

10:23

Zack

how can you do that on-chain on bitcoin?

The only coins are bitcoins.

The only coins are bitcoins.

10:23

there are no dollars to do a bitcoin-usd trade.

10:23

it only makes sense to use the continuous derivative mechanism on bitcoin, because it is always inferior to the normal derivatives mechanism, and normal derivatives aren't possible on bitcoin because there is no oracle.

10:24

but it looks like continuous derivatives don't work as an alternative to an oracle after all.

SS

10:26

Spike Spiegel

w8, assuming the ping will be each 10 seconds then worst case is getting rate from 10 back in time

Z

10:26

Zack

There is no way they would write a ethereum light node into bitcoin core to allow bitcoin to use ethereum as a continuous price feed oracle.

SS

10:27

Spike Spiegel

You don't need price feed oracles at all

10:27

You sign channel every few seconds

Z

10:27

Zack

the blockchain probably can't enforce anything faster than 3 blocks

SS

10:27

Spike Spiegel

It's all off-chain

Z

10:28

Zack

if your partner is not cooperating, your only recourse it to take it on-chain.

10:28

there will be at least a 3 block delay after you post it on-chain. 30 minutes of free-option time.

SS

10:28

Spike Spiegel

yes, with last price that's ok for me

10:29

he cannot do anything as I've decided to close the channel

Z

10:29

Zack

So lets say you are taking turns updating the channel data

10:29

that means you are taking turns having short free options with each other.

10:30

if you wait slightly longer until you respond, then your free option is longer, so you are more likely to profit from a sudden price swing.

SS

10:30

Spike Spiegel

Only for few seconds

Z

10:30

Zack

it would cause them both to go as slow as possible without breaking the rules of the contract.

SS

10:30

Spike Spiegel

And it can be solved with reputation network - just don't trade with people that abuse it

Z

10:31

Zack

reputation doesn't work very well. retirement attacks are so common.

10:31

it is questionable if it reduces the loss due to theft at all

SS

10:32

Spike Spiegel

Well, for me it's pretty elegant thing with not that much of a downside

Z

10:32

Zack

kyc is no good.

10:33

anyway, the derivatives we already support are always superior to this hacked version they might build on bitcoin. So it is not very important for us to understand.

SS

10:36

Spike Spiegel

If you deal that way with an exchange you may trust them a little

10:37

As reputation value may be higher then one-off small free option cheat

Z

10:40

Zack

We need decentralized alternatives to exchanges.

We can atomic swap BTC - synthetic bitcoin on Amoveo.

Then sell the synthetic bitcoin for VEO.

We can atomic swap BTC - synthetic bitcoin on Amoveo.

Then sell the synthetic bitcoin for VEO.

10:43

having derivatives on bitcoin would be nice. but it is inconvenient needing to leave a computer turned on. What if the power goes out?

Normal derivatives in Amoveo have big advantages.

Normal derivatives in Amoveo have big advantages.

10:43

leaving a computer on with your private key 24/7 is the opposite of cold storage.

SS

10:43

Spike Spiegel

Even if you can create something on bitcoin or veo people will be using ETH based solution due to the ecosystem moat: almost nobody is using LN or doing any smart contracts on bitcoin except multisig - if you create something interesting outside ETH ecosystem then ETH devs will copy and implement it ( even if it's insecure )

10:44

I have vested interest in making VEO succeed but I'm seeing that people are indifferent to non-ETH stuff

Z

10:44

Zack

An insecure copy on Eth is a competitor the same way a centralized market for derivatives is a competitor.

10:45

If you aren't going to be cryptoeconomically secure, then why use a blockchain at all? blockchain tech is expensive to maintain.

SS

10:45

Spike Spiegel

If something cannot be quickly used with beautiful colorful interface with Metamask only then it won't be used even if it can cure cancer

Z

10:46

Zack

a beautiful interface on metamask wont be as comfortable as a centralized app made by facebook.

And if they both allow theft in the same way, then facebook will win.

And if they both allow theft in the same way, then facebook will win.

SS

10:46

Spike Spiegel

Maybe using blockchain is a marketing play after all - company may use fake blockchain solutions and get good PR and hype for being innovative

10:47

Sure:

FB > another website with FB login > website without FB login > metamask eth stuff > bitcoin > veo

FB > another website with FB login > website without FB login > metamask eth stuff > bitcoin > veo

Z

10:47

Zack

If centralized derivatives apps can legally service everyone's needs, then Amoveo does not need to exist.

In my experience, most people's desires for derivatives are outlawed.

In my experience, most people's desires for derivatives are outlawed.

10:49

Decentralized tech wont be as comfortable to use. If you are betting on us, it is because you think that the centralized tech will fail for some other reason.

I think that financial restrictions on derivatives are strict and are only getting stricter in the near future. That there is a lot of pressure for an outlet.

I think that financial restrictions on derivatives are strict and are only getting stricter in the near future. That there is a lot of pressure for an outlet.

10:51

With centralized solutions there is a natural trade-off between the cost of using the service and the probability that all the money will get stolen.

The cheaper it is, the more likely it will all get stolen.

The is because the central operators are weighing the trade-offs between whether they should take fees for a long time, or steal the money for a quick payout now.

The cheaper it is, the more likely it will all get stolen.

The is because the central operators are weighing the trade-offs between whether they should take fees for a long time, or steal the money for a quick payout now.

SS

10:51

Spike Spiegel

It's like saying that people need to trade stocks 24/7 - not only Mon-Friday. I was wondering why markets cannot work 24/7 and the answer is that there is very low demand for such thing.

Z

10:51

Zack

With decentralized technology we can have the fees go much lower, without sacrificing security.

SS

10:51

Spike Spiegel

CBOE isn't stealing customer money AFAIK

Z

10:52

Zack

and how high are their fees?

SS

10:57

The fact that you can charge high fees and people are still using your service is a proof that what you are doing is useful

10:57

Assuming they aren't forced to use it

Z

10:57

Zack

do you have to be rich to participate?

SS

11:01

Spike Spiegel

Dunno, I think that poor people should avoid speculating and trading

Z

11:02

Zack

derivatives can be for insurance

SS

11:02

Spike Spiegel

If you have $1000 then making 100% return isn't going to change anything but losing your capital may ruin you

Z

11:02

Zack

yeah, exactly. that is why insurance is so important.

SS

11:02

Spike Spiegel

Most useful insurance is claim based

11:03

There is no way to use VEO for health insurance or car insurance or fire insurance etc

11:04

Also I've realised that claim "help poor people" is bad as all people are getting positive utility from life and if they aren't happy they are free to commit suicide

11:04

Egoism is ethical, while altruism is bad

11:04

Most ethical people are actually slightly evil

Z

11:05

Zack

farmers like to be able to lock in their profits when the price is good, instead of taking the gamble to sell at harvest.

SS

11:05

Spike Spiegel

Pls stop using this example unless you will get an actual farmer to use such trade

11:06

No amount of code creating will give you the same as meeting with farmer and asking what he needs

11:07

Again - seriously contact farmer and get 1 farmer to use VEO and document proof of concept with him

Z

11:07

Zack

We can start by serving people who have no alternative besides Amoveo.

SS

11:07

Spike Spiegel

I doubt that such people exist at all

11:09

But I don't want to baseless FUD - I believe that catering to rich early crypto adopters willing to try new tech is better then saying that we are creating tech to help farms

Z

11:09

Zack

In reply to this message

that isn't an option until the hard update activates.

Historically, this is the 4th major iteration on how derivatives work on Amoveo.

Every time I work with potential users to realize how to make the next iteration better.

Historically, this is the 4th major iteration on how derivatives work on Amoveo.

Every time I work with potential users to realize how to make the next iteration better.

11:11

Our first version used hub-and-spoke to trade binary options. then we made the same for scalar options.

These didn't get popular because of the legal risk, and because of the cost of locking up so much veo into the contracts

These didn't get popular because of the legal risk, and because of the cost of locking up so much veo into the contracts

11:12

the third generation was P2P, and it worked well, but you had to wait confirmations, and both participants had to be online at the same time.

Which made it unusable to most people.

So this 4th generation that will come out in 3 days, with it you don't have to be online at the same time. You can post an offer, and anyone can accept it and make a channel with you while you are offline.

Which made it unusable to most people.

So this 4th generation that will come out in 3 days, with it you don't have to be online at the same time. You can post an offer, and anyone can accept it and make a channel with you while you are offline.

11:14

The 1st and 2nd generation would not have worked for farmers at all, because the cost of liquidity means it doesn't work on the time scales they need.

Deleted invited Deleted Account

EA

13:49

Eric Arsenault

Keep on sniffin’...the market is somewhere

Deleted invited Deleted Account

👻 invited 👻

M

20:54

Minieep21

I gave some much needed praise to @denis_voskvitsov and the exan.tech team here

https://twitter.com/Malk_Trade/status/1108646825895084032

Get them known on Twitter.

Thank you for all the hard work on making Amoveo better!

https://twitter.com/Malk_Trade/status/1108646825895084032

Get them known on Twitter.

Thank you for all the hard work on making Amoveo better!

aoi | KudasaiJP🇯🇵 invited aoi | KudasaiJP🇯🇵

JM

22 March 2019

Z

00:01

Zack

They are copying a lot of stuff from Amoveo

JM

00:01

J M

yeah

Nvl invited Nvl

Deleted invited Deleted Account

01:04

❤️

01:04

let's run a DAC for Paul to review Veo? or smth )

01:07

have to admit, I thought hivemind is dead when I found veo, that's why I got into initially. then I found out hivemind was not dead )) now torn!

Z

01:08

Zack

hivemind is a great project. There is nothing wrong with being involved with both.

01:12

A lot of the most poweful ideas I have had didn't come from my own creativity. They happened because I stepped back and forth between different cryptocurrency silos, mixing and matching the best ideas from each subculture.

AK

01:13

A K

indeed that applies even to holy Satoshi )

EA

01:13

Eric Arsenault

That is usually how the best ideas come to life

01:14

I find the more I am exposed to, the more effective I can mix siloed thinking and be creative

01:14

It is where the magic happens 🦹♂️

Deleted invited Deleted Account

SS

03:29

So the problem is that Augur lacks "invalid question" option?

AK

03:53

A K

that’s the easy fix for this particular problem, it seems, yep

Z

04:17

Zack

In reply to this message

I think Augur has an invalid option.

Their problem is that when invalid occurs, all the money gets split 50-50.

So if you bought at a price below 50, you still profit.

In Amoveo all the bets get un-done. you get the same money out that you put in.

Their problem is that when invalid occurs, all the money gets split 50-50.

So if you bought at a price below 50, you still profit.

In Amoveo all the bets get un-done. you get the same money out that you put in.

04:17

I think it isn't so easy to fix on Augur, because there is no good way to keep track of the prices that everyone originally bought their shares at in order to undo all those trades.

Z

05:04

Zack

Amoveo smart contracts are in channels, so if a bug is ever found, it doesn't cost us anything to fix the contract. Nothing on-chain is getting changed. A fix is as easy as refreshing your light node in the browser.

AK

05:54

A K

In Augur I think "invalid question" price will go to 1, rest to 0

05:55

Those who bet invalid win

Z

05:56

Zack

Are you talking about Augur trading, or the rebalancing of rep due to the voting process in the oracle?

Z

06:14

Zack

https://github.com/zack-bitcoin/amoveo/issues/238

looks like probabilistic payments don't actually work.

looks like probabilistic payments don't actually work.

Z

06:56

Zack

How about we use hashlocking to connect a tx for a probabilistic payment with a tx to make a channel? Is that something people would want?

06:56

or we could connect a probabilistic payment to the updating of a channel smart contract

06:57

Maybe this is how we can re-fill channels, to start accepting more payments.

That way we don't have to close and open new channels so often.

That way we don't have to close and open new channels so often.

EA

07:02

Eric Arsenault

TBH, for me to understand if I want it, I would need to understand how it is experienced from a UX perspective... What does it mean to a user of the platform?

07:03

(we don't need to get into that, but that is the first thing that comes to mind)

Z

07:04

Zack

In reply to this message

people like the idea of micropayments.

These are very tiny payments with no tx fee, they are instantaneous, they don't involve writing anything on-chain.

People don't like thinking about channel relationships, or having to log on periodically to make sure no one is closing the channel at the wrong state.

probabilistic payments is a way to achieve the goal of micropayments without burdening the user with channels.

These are very tiny payments with no tx fee, they are instantaneous, they don't involve writing anything on-chain.

People don't like thinking about channel relationships, or having to log on periodically to make sure no one is closing the channel at the wrong state.

probabilistic payments is a way to achieve the goal of micropayments without burdening the user with channels.

EA

07:05

Eric Arsenault

That clears things up!

Z

07:06

Zack

micropayments could mean that the server is able to direct more resources per user, because the user can efficiently pay for those resources.

Sybil defense, like DOS attacks, are a big headache for maintaining servers.

Sybil defense, like DOS attacks, are a big headache for maintaining servers.

EA

07:06

Eric Arsenault

this seems like it would be useful

07:07

I assume you can use the same probabilistic payments for larger payments too?

07:07

or is it really custom for micro?

Z

07:07

Zack

I am trying to imagine someone buying a $3 cup of coffee, by giving starbucks a 0.3% chance to win $1000.

07:07

Deleted Account

Hi gents

07:08

Today my question will be simple

Z

07:08

Zack

if you can save enough money on tx fees, it might make sense.

If the tx fee is $1, and coffee is only $3. a 33% tx fee isn't reasonable.

probabilistic payments is a way to avoid these fees.

If the tx fee is $1, and coffee is only $3. a 33% tx fee isn't reasonable.

probabilistic payments is a way to avoid these fees.

07:08

Deleted Account

In order to use question oracle, one still needs a full node?

EA

07:08

Eric Arsenault

ah

07:08

Deleted Account

or light node is enough

Z

07:09

Deleted Account

in the command line it should look like this: “api:new_question_oracle(Start, Question)”

Z

07:09

Zack

but you need a full node to be a reporter. we haven't added reporting tools to the light node yet.

07:09

Deleted Account

ok thanks

Z

EA

07:09

Eric Arsenault

yeah, I would agree on those fees. For mass adoption you can't have fees higher than 0-4%

07:10

Deleted Account

but you plan to built the same functions in light node too?

Z

07:11

Deleted Account

both questions and reporters?

Z

07:11

Zack

eventually we will have both in the light node.

EA

Z

07:12

Zack

and someone out there will end up spending $1000 on coffee 2 days in a row.

imagine being that guy.

imagine being that guy.

EA

07:12

Eric Arsenault

people would stop buying coffee

Z

07:13

Zack

well, you could lock only $100 into your probabilistic payment account. Then starbucks would have a 3% chance of getting $100 for your $3 coffee. maybe that would be more reasonable

07:13

you need to pay tx fees 10x more often, but you are putting 10x less at risk.

EA

07:14

Eric Arsenault

I'm not sure how you could make people use such a system

Z

07:14

Zack

I want to build this feature, even though it isn't very directly related to financial derivatives

EA

07:14

Eric Arsenault

I see

07:14

I just see big challenges in terms of usability

Z

07:15

Zack

It could also be useful for making the full nodes more hardened.

Right now we depend on altruism for downloading blocks for example.

Right now we depend on altruism for downloading blocks for example.

07:15

if it was profitable to run a full node, the system would be a lot more secure.

EA

07:16

Eric Arsenault

this makes sense

Z

07:16

Zack

If you were paid 0.001$ ever time a light node downloaded a merkel proof from your full node, then it would be expensive to spam your full node

EA

07:16

Eric Arsenault

and is not really usability related (ie, you would know much more about the benefits of that part)

07:17

ah - hence micropayments

07:17

yes, this makes sense

Z

07:18

Zack

It is hard to guess how people could end up using an economic tool like this. Once it is available, they might surprise us.

EA

07:18

Eric Arsenault

I agree

SS

07:19

Spike Spiegel

probabilistic payments - love the idea - it's like microgambling

EA

07:20

Eric Arsenault

I like it in theory

Z

07:21

Zack

I can't see any way it could harm Amoveo to try it out.

And if we don't like it, we can always get rid of it later.

And if we don't like it, we can always get rid of it later.

EA

07:21

Eric Arsenault

but people accepting payments want assurance they are going to get payments. people giving payments don't want to pay $100 for coffee... it's a stretch for me to see real work use cases

07:21

yeah I agree

Z

07:22

Zack

they would have cryptographic proof that they had a 3% chance of receiving $100.

EA

07:22

Eric Arsenault

yeah I get it in theory, but try selling that to Starbucks

Z

07:23

Zack

try and calculate how much Starbucks is paying VISA every year to accept debit card payments.

EA

07:23

Eric Arsenault

ah - now we are talking

07:23

what would fees be for these micropayments?

Z

07:25

Zack

if you have a 3% chance of making a payment, then on average you are paying 3% of a tx fee per payment.

EA

07:25

Eric Arsenault

it isn't much better than visa

Z

07:25

Zack

but it looks like a probabilistic account requires 3 on-chain txs in total.

So 3% * 3 = 9%

So 3% * 3 = 9%

EA

07:26

Eric Arsenault

that is higher than visa

SS

07:26

Spike Spiegel

Hmm... but what if you pay and never use the same vendor again?

EA

07:26

Eric Arsenault

exacltly - it sucks!

SS

07:26

Spike Spiegel

Is this gambler fallacy?

Z

07:26

Zack

a tx fee on amoveo is 0.00152000 veo, which is like $0.10

9% of that is $0.01

That is a lot less than VISA.

9% of that is $0.01

That is a lot less than VISA.

EA

07:27

Eric Arsenault

oh, that makes more sense

[

Z

07:28

Zack

if you lock $1000 instead of $100 into the account, then the fee is 10x lower. $0.001 per payment.

07:30

it looks like a debit card payment is almost always at least $0.20

SS

07:44

Spike Spiegel

Isn't making blocksize drastically bigger better solution?

07:45

But keeping it manageable so it would be always possible to have a node in 4U rack server

07:49

What's exactly strongest Amoveo innovation?

- governance via futarchy?

- cryptoeconomically secure oracles?

- state channels?

- governance via futarchy?

- cryptoeconomically secure oracles?

- state channels?

07:51

What's exactly novel and what is state of the art?

Z

07:59

Zack

Amoveo combines lots of different technology to make an ideal platform for financial derivatives.

08:04

innovations aren't so important in cryptocurrency, since we all just copy each other's features.

This isn't the kind of business where we can use patents to maintain a monopoly.

What matters more is bringing together the right technology to build a useful product.

This isn't the kind of business where we can use patents to maintain a monopoly.

What matters more is bringing together the right technology to build a useful product.

SS

08:07

Spike Spiegel

But it's important in academy word - to say where you got the idea from where

08:15

To pay homage / give credit

EA

08:16

Eric Arsenault

AWESOME

SS

08:29

Spike Spiegel

Can we create similar list for VEO? Obviously you didn't invented all building blocks for blockchain - explicitly naming projects / people that were inspiration increases street cred of the project itself

Z

08:34

Zack

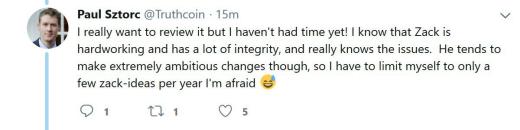

Jae Kwon from Cosmos showed me how to do secure encryption, and he taught me about how to take full advantage of merkelized data structures to save on bandwidth.

But he didn't invent either of those things.

But he didn't invent either of those things.

08:35

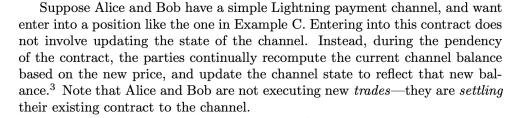

Robin Hanson came up with the name "futarchy", and wrote papers about using prediction markets to make decisions for communities.

08:35

Paul Sztorc came up with the idea of putting a prediction market onto a blockchain, and he discovered a lot of consequences of doing this, and came up with a lot of ideas about how to build this.

08:36

Nakamoto consensus comes from Bitcoin.

08:36

The accounts system in Amoveo and our patricia merkel tree is from ethereum.

The idea of blockchain smart contracts as an alternative to updating the consensus mechanism is from ethereum.

The idea of blockchain smart contracts as an alternative to updating the consensus mechanism is from ethereum.

08:38

https://bitcointalk.org/index.php?topic=193281.msg2224949#msg2224949

Tier Nolan came up with the idea of atomic swaps, which is when people started realizing about hashlocking, an essential technology that enables generalized smart contracts in channels.

Tier Nolan came up with the idea of atomic swaps, which is when people started realizing about hashlocking, an essential technology that enables generalized smart contracts in channels.

08:40

Satoshi knew about payment channels when designing bitcoin. I am not sure who came up with that idea.

08:45

I invented the specific kind of oracle used in Amoveo, which is based on nakamoto consensus instead of voting, making is orders of magnitude cheaper than other existing design at that time.

I invented the idea of putting smart contracts inside of channels, and built all the first implementations of this.

I invented the idea of putting smart contracts inside of channels, and built all the first implementations of this.

SS

08:47

Spike Spiegel

It's not about people but rather specific published papers / articles - usually the point of thesis / article is to show how exactly you advanced state of the art.

Bitcoin innovation was online value transfer without trusted intermediary ( it was not possible before )

Bitcoin innovation was online value transfer without trusted intermediary ( it was not possible before )

08:48

What's the key most important feature of VEO?

// So even if you remove other features the project would be still interesting from scientifical point of view

// So even if you remove other features the project would be still interesting from scientifical point of view

Z

08:49

Zack

I invented limit-orders in channels which are secure against front-running. It was thought impossible until I built it.

08:51

In reply to this message

this is less of a scientific project, and more of an engineering project.

Users care about how much it costs for them to buy a service.

That cost is determined by the interaction of many different features.

Users care about how much it costs for them to buy a service.

That cost is determined by the interaction of many different features.

WL

09:33

Wilson Lau

In reply to this message

If a group of ppl set up a probabilistic payment network, will it helps?

Z

09:58

Zack

In reply to this message

so, like, I would send 0.1% chance to get $1000 to you, and you would send a 4.9% chance to get $20 to the coffee shop,

And you keep the extra 0.1% chance of $20 as a fee.

And you keep the extra 0.1% chance of $20 as a fee.

09:59

since the probabilistic payment is based on hashlocking, it is easy to connect them together like this.

It is a good idea.

It is a good idea.

10:01

Maybe it makes more sense to make a probabilistic payment to someone who has a channel with the coffee shop already. And they can use the channel to pay the coffee shop immediately.

10:01

connecting a channel payment to a probabilistic payment should be easy. since they are both based on the same hashlocking protocol.

10:02

it is like a lightning payment.

10:03

What if there are 2 tiny lightning networks, and we use probabilistic payments to settle things between the channel networks.

10:04

Say I want to buy a coffee.

I would make a lightning payment to my channel operator, who uses a probabilistic payment to forward the lightning to the coffee shop's channel operator. where it turns back into a normal channel payment to pay the coffee shop.

I would make a lightning payment to my channel operator, who uses a probabilistic payment to forward the lightning to the coffee shop's channel operator. where it turns back into a normal channel payment to pay the coffee shop.

WL

10:04

Wilson Lau

In reply to this message

yes, that's the idea. but it will involve setting up channel. I am not sure is this the best way to avoid Tx fee. Cause I think originally probabilistic payment happen on the chain not on addtional channel, maybe i get something wrong.

Z

10:05

Zack

the probabilistic payment happens on-chain, but only if money actually gets transfered.

So if I have $100 in my pp-account, any payment of $1 only has a 1% chance of costing a fee.

So if I have $100 in my pp-account, any payment of $1 only has a 1% chance of costing a fee.

WL

10:09

Wilson Lau

In reply to this message

That's mean it is a lighting network happened on chain with a probability to settle

Z

10:12

Zack

a lightning payment can start on bitcoin, pass through ethereum, and then end up on bitcoin again.

10:12

the probabilistic payment has some expected value, just like btc or eth. so it can be a step of the lightning path.

10:15

I think this is a huge improvement over the hub and spoke version of the lightning network. We would almost never have to settle a channel on-chain.

WL

Z

Deleted invited Deleted Account

15:20

Deleted Account

Hello, everyone. I like to make friends.

15:20

Sticker

Not included, change data exporting settings to download.

👋, 51.0 KB

T

S

18:08

Sy

In reply to this message

its pretty much unchanged over the last weeks, even decreased a bit

Z

18:09

Zack

In reply to this message

Yeah, the message is old now.

There was a bitcoin ready to be sold at 0.02 when I wrote that.

There was a bitcoin ready to be sold at 0.02 when I wrote that.

Deleted invited Deleted Account

Deleted invited Deleted Account

23 March 2019

Deleted invited Deleted Account

Deleted invited Deleted Account

👉 Ben invited 👉 Ben

Z

09:35

Zack

Thinking about P+epsilon attacks against PoW.

oh, here is a potential solution. We could lock up the block reward for like 1 week until it becomes spendable. Then if a mining pool commits this attack, we can burn 1 week of their block rewards as a punishment.

oh, here is a potential solution. We could lock up the block reward for like 1 week until it becomes spendable. Then if a mining pool commits this attack, we can burn 1 week of their block rewards as a punishment.

MF

09:57

Mr Flintstone

do we find out about the attack by asking an oracle?

09:57

or do we just do the burning with a fork

09:58

I guess you can’t use the oracle cuz pools can censor tx

Z

10:01

Zack

the attacker needs to get his alternative software to the mining pools, or convince the mining pools to forward their PoW to him.

MF

10:01

Mr Flintstone

what is the procedure to identify the address, identify that there was an attack and then burn the coins

Z

10:02

Zack

Hopefully one of the mining pool operators will alert the rest of us, and then we will be ready to do hard updates to delete any block rewards the attacker finds

OK

10:02

O K

We should take a vote of course

MF

10:02

Mr Flintstone

lol

10:02

won’t we have enough time to realize something was going on

Z

10:02

Zack

if the attacker is sending a modified full node to the mining pools, they could show us the modified code

MF

10:03

Mr Flintstone

1 week is a while

Z

10:03

Zack

if the mining pools are forwarding work to the attacker, then we wont see his code

OK

10:03

O K

We could choose a random bitcoin block in the future and whether it's odd or even do one thing or the other

MF

10:03

Mr Flintstone

users will try to use the chain and it won’t work as expected

Z

10:04

Zack

if the attacker can get 50% hashrate before we realize what he is doing, then it could be a disaster

MF

10:05

Mr Flintstone

what attack can they do that will net them 50% of not-attacked veo blocks for a week

Z

10:06

Zack

If the mining pool operators warn us about what is happening, I think we will survive.

And I am pretty sure it is always in their interest to warn us.

And I am pretty sure it is always in their interest to warn us.

MF

Z

10:06

Zack

if they have >50% control, they can rewrite all the rules, and confiscate any coins.

MF

10:07

Mr Flintstone

they can only confiscate coins through the spend limit trick we talked about? they don’t have private keys

Z

10:07

Zack

I think it is kind of important to do an update in Amoveo so that block rewards are locked for at least a week.

But I think miners might hate this.

But I think miners might hate this.

10:07

yeah, they can do the spend limit trick.

Soft forks, which means censorship, can change any aspect of the consensus mechanism.

Soft forks, which means censorship, can change any aspect of the consensus mechanism.

MF

10:08

Mr Flintstone

but that can be reverted easily. I don’t think the new coins would be valued highly

Z

10:08

Zack

what can be reverted?

10:08

what new coins?

MF

10:09

Mr Flintstone

reversing the spend limit trick is also a sf?

Z

10:09

Zack

sure. a soft fork can undo any other soft fork, or do any other change to consensus.

MF

10:09

Mr Flintstone

my node won’t accept anyone’s tx spending more than x% if I choose

10:09

so even if miner is limiting me, I limit the miner

Z

10:10

Zack

if you have weird extra rules like that, then your node will just get frozen at a height and stop downloading new blocks

MF

10:10

Mr Flintstone

it depends if people want to defend against this type of attack or not

10:10

not a chance anyone is spending more than the amount I can out of my pubkey

Z

10:11

Zack

I think instead of locking up more money, it is best to unlock everything and revert to the normal software.

I very much am not interested in maintaining some hacked up soft fork version of Amoveo.

I very much am not interested in maintaining some hacked up soft fork version of Amoveo.

10:13

@potat_o

What do you think of a hard update so that block rewards from mining will be unspendable for like 7 days?

How bad would an update like that be for miners?

What do you think of a hard update so that block rewards from mining will be unspendable for like 7 days?

How bad would an update like that be for miners?

OK

10:14

O K

Bitcoin is like that, but I think it's more about protecting orphan spends. We've already integrated that into the pool software, yours too.

Z

10:15

Zack

I think you aren't currently waiting 7 days though, right?

OK

10:15

O K

Right

Z

10:15

Zack

so how about a 7 day limit enforced on-chain?

MF

10:16

Mr Flintstone

I thought bitcoin was 100 blocks?

OK

10:16

O K

🤷♀ why?

Z

10:16

Zack

yes, maybe less time is enough. I will do some more math, and get back with a more detailed proposal at a later date.

$FX invited $FX

S

16:52

Sy

There are coins out there with high mature time of block rewards...does it really help with anything or is it just a gimmick? I dont know

16:52

You basicly just invest a week longer in your attack, nothing more

16:52

If at all

16:54

If you do any 50% stuff you already have the coins, do the spends, revert them, do them again quickly on another Exchange or more ppl and be gone...

16:54

You dont really care about block reward at this point, mining wont be the source of your coins anyway

Z

19:03

Zack

We just want to make it so that participating in the attack is not a Nash equilibrium.

As long as less than 50% hashpower participates in the attack, then the attack fails.

As long as less than 50% hashpower participates in the attack, then the attack fails.

19:04

If we can confiscate a weeks worth of rewards from any pool that participates, that makes this attack expensive

Z

19:49

Zack

How big does amoveo have to get until we can have an amoveo conference?

[

19:50

[Riki]

At least 3 active women in the community

Z

19:50

Zack

Hahaha

19:50

I can switch genders for the conference, if it helps

S

19:50

Sy

In reply to this message

how do you confiscate a weeks worth of coins if someone sets up a pool, puts 50% on it, does his attack and leaves within 24h?

[

19:50

[Riki]

I guess 50 would be very meaningful already. Geography is an issue though.

S

19:50

Sy

a 50% attack wont go on for a week+

19:51

if you do this it will probably be done in 2h tops

Z

19:51

Zack

In reply to this message

It takes a week to receive any block rewards from malicious mining. So we have time to delete those rewards before they are distributed.

19:51

This reduces the incentive to mine maliciously

S

19:52

Sy

is there any single 50% attack that cared about mining rewards?

19:52

you buy 2k on an exchangen, you sell them at different places using 50%, you leave

Z

19:52

Zack

This is for P+epsilon attacks against POW.

19:53

https://blog.ethereum.org/2015/01/28/p-epsilon-attack/

Near the bottom he talks about doing p +epsilon to pow

Near the bottom he talks about doing p +epsilon to pow

19:54

Maybe a week is too long. Maybe we can get by with a shorter time. We should do some math and find out.

19:55

It is generally considered an unsolved problem. It would be cool if we solved it in amoveo while everyone thinks it is unsolvable

S

20:06

Sy

it would call this more a workaround than a solution

20:06

but it discourages miner hopping aswell, you cant just switch to veo when it is lucrative if the reward isnt instant

Z

20:07

Zack

If the Nash equilibrium switches to not running the attackers version of consensus, then it is a solution.

20:07

The mining pool could take on risk and pay early.

20:08

The odds of a 5+block reorganization is practically zero

SS

20:13

Spike Spiegel

FYI people are paying now 7.5% pa. for stablecoins in MKRDAI

Z

20:14

Zack

So people are willing to lose 7.5% annually to hold something that stays the same value as bitcoin on ethereum?

20:15

I can't see how mkrdao could compete with normal leveraged derivatives.

It seems to me that the premium for different stablecoins should be different, and it should change based on the margins of that particular contract.

It should change based on the interest rate of the native currency

It seems to me that the premium for different stablecoins should be different, and it should change based on the margins of that particular contract.

It should change based on the interest rate of the native currency

SS

20:18

Spike Spiegel

The problem with multiple stablecoins with different margins is that it's fragmenting the market preventing it from reaching scale

Z

20:20

Zack

So you think if everyone in USA holding a financial derivative of a foreign currency, if they are all charged exactly the same fees for these derivatives, that would unify the market for derivatives and allow it to reach higher scale?

20:20

So you would be charged the same fees to hold euro or argentine peso

SS

20:21

Spike Spiegel

Crypto isn't the same as financial markets - it's skewed because there is lot of "dumb money" and people aren't perfectly rational

20:21

And such irrationalities may stay much longer then anybody can remain solvent ( so shorting bad ideas is hard )

Z

20:21

Zack

Forcing obviously different goods to have the same price is a mistake.

Either some are underpriced, or others are too expensive, or both.

Either some are underpriced, or others are too expensive, or both.

20:23

The interest rate to hold usd is determined by a market.

The interest rate to hold btc is determined by a market.

Pretending that both these interest rates are the same, that is clearly not true.

The interest rate to hold btc is determined by a market.

Pretending that both these interest rates are the same, that is clearly not true.

SS

20:23

Spike Spiegel

Who cares? I've realised that winning is more important than being right and logically consistent.

T

20:23

It seems that optimal rate is maybe between 3.5% and 7.5%

Z

20:24

Zack

In reply to this message

If you sell a good at below cost of production, you will have many customers and lose money on each sale.

If you sell above the cost of production you have few customers and earn money on every sale.

If you sell above the cost of production you have few customers and earn money on every sale.

20:25

Imagine going to a restaurant, and everything on the menu is the same price.

Water costs the same as wine. Steak is the same as bread sticks.

Water costs the same as wine. Steak is the same as bread sticks.

SS

20:26

Spike Spiegel

What is the cost to create stablecoin in MKR system? If you have lots people willing to get 2x exposure to eth you may get stablecoin as byproduct for negative price

Z

20:26

Zack

A restaurant like that will quickly be out competed against a restaurant that has accurate prices

SS

20:26

Spike Spiegel

Disclaimer: I still don't understand fully the concept of interest rates for cryptocurrencies

20:27

Have you ever run a biz?

20:27

If you have customers that aren't price sensitive you may increase or decrease prices without much changes in demand

20:28

How to understand concept of interest rate for bitcoin for example?

20:29

Both banks and centrals bank of US pays interest on deposits - so so called "risk free return rate" exists

But what's the meaning of this concept for cryptos? There is no central bank of bitcoin

But what's the meaning of this concept for cryptos? There is no central bank of bitcoin

Z

20:29

Zack

If you are abandoning the position that rationality matters, if you really think logic doesn't matter, then it doesn't make sense to waste time writing reasoned messages to me on this forum.

20:30

In reply to this message

Many banks offer interest bearing accounts denominated in different currency.

The interest for different currencies is different.

The interest for different currencies is different.

SS

20:31

Spike Spiegel

I think that rationality is systematised winning - if something works then it's rational. If something works in theory yet doesn't work in practice then it isn't rational

Z

20:31

Zack

The interest rate of bitcoin is how muh you would need to pay someone to lock the bitcoin in a bond for a period of time.

SS

20:32

Spike Spiegel

Current rates are ~5% range

Z

20:32

Zack

So you would adjust your practice to achieve your goals? That sounds like a rational strategy to me.

I guess you aren't abandoning rationality and logic.

I guess you aren't abandoning rationality and logic.

SS

20:32

Spike Spiegel

What's the current rate for VEO?

Z

20:32

Zack

How would I know?

20:35

I know that the profit margin for a restaurant tend to be a lot less than 5%.

So if I was losing more than 5% of each trade due to bad prices, it would completely wipe out my profit.

So if I was losing more than 5% of each trade due to bad prices, it would completely wipe out my profit.

SS

20:36

Spike Spiegel

By observing how much does it cost to create stablecoin on veo - for example interest rate for ETH is currently 1% ( rational people should not lock ETH for lower reward )

Z

20:36

Zack

the profit margins for financial derivatives are even tighter, they are practically zero

20:37

In reply to this message

Interest rate is determined by the market price.

Not whatever "rational" means to you in this context.

Not whatever "rational" means to you in this context.

SS

20:37

Spike Spiegel

irrational - below market price

Z

20:38

Zack

It's very rational to pay below market price, given the opportunity

SS

20:39

Spike Spiegel

Ok so my point is that people are willing to pay currently 7.5% APR to create DAI and get more ETH exposure - maybe Amoveo can undercut MKRDAO offering similar financial product with lower cost

Z

20:40

Zack

I think we can sell usd stablecoin at negative cost, because of the demand for long-veo

SS

20:41

Spike Spiegel

There is strong evidence that demand for both stablecoins and ETH leverage is strong. Almost $89M worth of stablecoins - if it would be backed by VEO then MCAP of veo would be at least $89M

Z

20:41

Zack

You should be paid a premium to hold stable usd

SS

20:42

Spike Spiegel

My point is that making stablecoins yielding premium accessible to public and advertising such thing would drive people to buy more VEO for nonspeculative purpose ( real utility )

Z

20:42

Zack

The market for financial derivatives is measured in trillions

20:42

Ethereum is a tiny fraction of this market

20:42

Yeah, we should try and target people who want stablecoins

20:43

It is clear that there is enough demand so that Amoveo's market cap would be fully utilized for this service

SS

20:44

Spike Spiegel

People who use ETH based financial products are easy to convert to other system - friction is low because people may easily convert ETH to VEO without KYC...

And they already own crypto and are using competing product that's significantly overpriced

And they already own crypto and are using competing product that's significantly overpriced

Z

20:44

Zack

Yes, these are probably the easiest kinds of users to acquire

20:47

I think tomorrow the hard update activates. Then it will be far easier to trade stablecoins on amoveo

20:48

We should start with some small scale testing of people in the network, then make the UX better, then we can start to really push into taking users from ethereum

SS

20:52

Spike Spiegel

From what I know: "Financial innovation is always and in all ways one of two things — a new way of securitising something or a new way of leveraging something."

So this would be equivalent of securitising a product that pays you two digit interest for holding VEO based USD

So this would be equivalent of securitising a product that pays you two digit interest for holding VEO based USD

Z

20:53

Zack

Cash settled synthetic assets aren't an innovation. That is a very old kind of contract.

20:53

It might be older than written history

20:54

And we supported these contracts over a year ago.

20:55

The p2p tool is new though. I think it will make it a more useful way to trade stablecoins

SS

20:55

Spike Spiegel

The future of VEO is bright.

- Amoveo desktop wallet is dope

- stablecoins in wallet with nice UX - even better

- Amoveo desktop wallet is dope

- stablecoins in wallet with nice UX - even better

Z

20:56

Zack

I didn't try the desktop yet. Which version did you try?

20:56

It only does spend and receive, right?

20:56

Do you have to think about syncing headers? Or is it automated?

SS

20:57

Spike Spiegel

Automated, slick UI and syncing is blazingly fast

Z

20:57

Zack

That's great :)

₿ooker invited ₿ooker

Z

21:04

Zack

I think Amoveo, financially speaking, is more of an exnovation than innovation.

We are returning to the tried and true financial contracts that humans have used for all of written history.

We are abandoning the wild subcurrency type innovations of ethereum, which have all turned out worse than the contracts we inherited from our ancestors.

Amoveo is technologically innovative. As far as blockchain tech and software development.

We are returning to the tried and true financial contracts that humans have used for all of written history.

We are abandoning the wild subcurrency type innovations of ethereum, which have all turned out worse than the contracts we inherited from our ancestors.

Amoveo is technologically innovative. As far as blockchain tech and software development.

21:06

In a sense, the blockchain innovations have allowed for financial exnovations.

AK

22:07

A K

main benefits of DAI vs VEO-stable-USD: fungibility and ERC20 network effects

22:08

you can’t use stable VEO to bet in PMs, but you will be able to use DAI on Augur

22:08

you can send DAI to any Ethereum compatible counterpart, exchange, wallet, API etc

22:08

Maker is aware that one-size-fits-all APR isn’t optimal, I think they’re working on smth to make rate marketable

22:09

and allowing collateral other than ETH, too

22:09

so e.g. stable coin on EOS, NEO or VEO, even if cheaper, doesn’t have same utility, nowhere near as ERC20

MF

22:24

Mr Flintstone

I feel like synthetic financial assets with scalar markets will be more popular than binary options in prediction markets

22:25

in that case, you can trivially get rid of your veo price risk by just accounting for it in the oracle question

22:26

but I can see the utility argument around dai for binary options. but when you interlock these systems you assume the failure mode of all of them right

22:28

also, augur needs to fork every time makerdao does right? Because maker is going to upgrade their system, and I don’t think there is an elegant way to include the upgraded system in augur automatically

22:28

and makerdao has been much more open to political risk and voting than augur with their risk committees and trusted feeds, so idk. I’m not sure augur would be completely trust free for years

22:29

funnily enough it’s probably more trust free right now than it’s about to be when they force users to use dai

A invited A

Deleted invited Deleted Account

24 March 2019

Deleted invited Deleted Account

Z

00:15

Zack

https://github.com/zack-bitcoin/amoveo/blob/master/docs/basics/trust_theory.md

I wrote this paper about the different flavors of trust that exist.

I wrote this paper about the different flavors of trust that exist.

00:19

it proposes some open problems

Z

00:35

Zack

I hope "sincere trust" become a widely used term.

Z

01:05

Zack

According to this trust theory, it looks like Amoveo is a lot more secure than Bitcoin Hivemind or Augur

1.1 vs 3.1

1.1 vs 3.1

AK

01:38

A K

In reply to this message

Augur hasn't integrated Dai yet, maybe waiting for new Dai indeed

EA

02:34

Eric Arsenault

In reply to this message

Zack, DM me for testing. We can work on second DAC...🤘🤘🤘

Deleted invited Deleted Account

Z

03:53

Zack

27 blocks until the hard update activates

Paul Sztorc invited Paul Sztorc

PS

05:56

Paul Sztorc

So, how do I learn how Amoveo works, anyway?

Z

05:57

Welcome Paul, thank you for joining us

PS

05:57

Paul Sztorc

This is like in alphabetical order https://github.com/zack-bitcoin/amoveo/tree/master/docs/design

Z

05:57

Zack

Paul invented the idea of blockchain prediction markets, Amoveo is trying to achieve the goals he spelled out for us.

05:58

https://github.com/zack-bitcoin/amoveo/blob/master/docs/design/oracle.md

I think you would be interested in the oracle

I think you would be interested in the oracle

05:58

we are trying to re-use nakamoto consensus to power the oracle

PS

05:58

Paul Sztorc

In reply to this message

I also gave a talk about the blockchain oracle problem and why it is so hard https://www.infoq.com/presentations/blockchain-oracle-problems

Z

06:00

Zack

that might not be the best way to share your video, it isn't working in firefox with ubuntu

PS

06:00

Paul Sztorc

miners do not want to have to look into any outcomes, especially difficult-to-resolve ones (especially ambiguously-worded ones)

Z

06:00

Zack

yes, I agree

06:01

we have some escalation mechanisms in place, and the nash equilibrium is that the miners will never actually have to care about any oracle

PS

06:01

Paul Sztorc

Ah, but then why would you say that you are using nakamoto consensus for the oracle?

Z

06:02

Zack

By using nakamoto consensus as a final source of truth, it is possible to make a much cheaper design, in comparison to trying to rebuild an entire consensus mechanism

06:02

because that is what a trustless oracle is. it is a way for a community to come to consensus about some data.

PS

06:03

Paul Sztorc

Ok so can you explain the outcome-resolution process

06:03

?

06:03

give me everything that happens in order

Z

06:03

Zack

https://github.com/zack-bitcoin/amoveo/blob/master/docs/design/transaction_types.md

there are 3 tx types for oracles

there are 3 tx types for oracles

06:04

one for asking a question. it has to be a true/false question.

one for making a bet in the oracle. which is a way to move your money to the side of the fork that you think will have higher valued tokens.

and finally, a tx to close the oracle, if it has stayed in the same state for along enough period of time.

one for making a bet in the oracle. which is a way to move your money to the side of the fork that you think will have higher valued tokens.

and finally, a tx to close the oracle, if it has stayed in the same state for along enough period of time.

06:05

we combine the results of multiple oracles to encode binary data.

The turing complete smart contracts make it possible to write stuff like this.

The turing complete smart contracts make it possible to write stuff like this.

PS

06:05

Paul Sztorc

No, I just want everything that happens, in order

06:05

1. "ask question" message

2. "bet" message

3. "close oracle" message

2. "bet" message

3. "close oracle" message

Z

06:06

Zack

1) someone makes a new_oracle_tx, asking "did trump win the election?"

2) trump wins.

3) someone makes a bet in the oracle saying they would prefer owning veo on the version of the chain where trump wins.

4) after enough time passes, someone does an oracle_close_tx to close the oracle.

2) trump wins.

3) someone makes a bet in the oracle saying they would prefer owning veo on the version of the chain where trump wins.

4) after enough time passes, someone does an oracle_close_tx to close the oracle.

06:07

chronologically

06:07

that is the typical order of events.

06:07

the nash equilibrium is that only one person makes one bet in the oracle.

PS

06:07

Paul Sztorc

You can't bet on the outcome until after it happens?

Z

06:08

Zack

when you ask the oracle the question, you can choose the block height when the oracle activates, and it becomes possible to bet in it.

PS

06:08

Paul Sztorc

So, yes? or no?]

Z

06:08

Zack

being able to ask the question ahead of time means we can start making smart contracts that reference that oracle's id

06:08

you can't bet on the outcome until after it happens.

06:09

in the oracle

PS

06:09

Paul Sztorc

?? Then what is the point

06:09

of having an oracle at all

Z

06:09

Zack

the oracle isn't for betting. only one person makes a bet per oracle question. and their bet isn't 'even matched

06:09

the oracle provides data, our smart contracts can access the data

PS

06:09

Paul Sztorc

Ah, so what you mean to say is that your list is incomplete

Z

06:09

Zack

we have markets in the smart contracts that match trades in single price batches

PS

Z

06:10

Zack

I thought you wanted to just know about the oracle first

06:10

14 blocks until the hard update activates

06:10

ok, ill make a longer chronological list

PS

06:11

Paul Sztorc

Ok so it is

1. Question asked ; appears in list

2. Users bet

3. There is a meta-market about the oracle itself; people bet on just one outcome

4. After a contest period, it is decided that whatever was bet on in 3 is what happened

1. Question asked ; appears in list

2. Users bet

3. There is a meta-market about the oracle itself; people bet on just one outcome

4. After a contest period, it is decided that whatever was bet on in 3 is what happened

06:13

Of course, there will be many people who are going to lose a ton of money. And they want to manipulate outcome-resolution

Z

06:14

Zack

1) someone makes a new_oracle_tx, asking "did trump win the election?" using this page: http://139.59.144.76:8070/new_oracle.html