Amoveo ♥🧿

Previous messages

someone made a trade, then mostly undid the trade. now the market has slightly more value, because of the 0.2% trading fee

Next messages

5 September 2020

z

23:37

zhaxzhax

Yeah, your opinion is brilliant which just rebuild my realize of blockchain. I have been a POS supporter because POS cost less resource than POW. But you point out that POS can not be trusted. Maybe I need more time to digest it.

K

23:40

Kxxxed

main difference being that there is direct financial incentive to keep the PoS network healthy. There is no direct financial incentive in a real world democracy structure. Not fair to compare the two. Given the financial incentive, PoS is less likely to be abused by the investor vs a PoW investor. When you invest in PoS you are "stuck" with that investment, when you invest in PoW, you can take your hardware and go support another project. Or just do drive by 51% attacks. More PoWs have been attacked then PoS,,, I dont even remember last time were PoS network was attacked.

z

23:48

zhaxzhax

In reply to this message

Your point make sense either. Zack think validator in POS network will be easily corrupted because they want to keep their coins rather than that the miner may hold no coin. But I suggest that if miner hold no coins, it maybe easy to bribe the miner to attack pow network maybe in some perspect.

23:50

If miner hold nothing. Why they are still willing to secure the network if a attack will send they more coins?

Z

23:50

Zack

When you bribe a PoS validator, they can lock up more money in another contract to enforce that they will participate in the attack.

With pow this is not possible, because you can't necessarily know which pool made which block.

With pow this is not possible, because you can't necessarily know which pool made which block.

23:51

So it is not possible to do soft fork bribery attacks against pow

z

23:52

zhaxzhax

But I can bribe miner, cause miner hold no coin, start a attack will not damage miner's benefit.

K

23:53

Kxxxed

If a validator has decent amount of collateral locked up,,, he is not going to risk fucking with the network over a measly bribe,, if the risk is him losing his collateral or the value of it. A validator will do everything to promote his investment, not hurt it.

23:55

I have played this delegation game on several high profile projects, and still hold delegate spot on some of them, including LISK. Game of Delegates is crazy,, and I have been in private groups where delegates meet to discuss stuff. I have never seen a delegate trying to compromise the network for a quick profit vs holding on to their precious delegate spot

z

23:56

zhaxzhax

If a attack in POS network happen, the validator's coin will become nothing rather than piece of shit. The network lose it credit. The validtor will not take this risk to destory the network.

I mean he can keep his token away from punish, but after this attack his token will have no value.

I mean he can keep his token away from punish, but after this attack his token will have no value.

K

23:56

Kxxxed

^^

23:57

Both PoW and PoS have the same theoretical "bribe" attack vector... but the likely hood of it happening on a PoS is much less likely vs PoW.

23:58

If a PoW attack fails, only electricity bill was the financial hit,,, (or renting rigs).. If PoS attack fails,,, the financial damage is much greater.

Z

23:58

Zack

In reply to this message

I agree. If the attack succeeds, the pos coins will be worth nothing.

It is still more profitable for the validator to participate in the attack.

Because of tragedy of the Commons.

It is still more profitable for the validator to participate in the attack.

Because of tragedy of the Commons.

23:59

In reply to this message

if you pay me to stop mining. How can you know if I actually stopped mining?

I can just mine to a different pubkey.

So bribing pow miners just does not work.

I can just mine to a different pubkey.

So bribing pow miners just does not work.

6 September 2020

K

00:00

Kxxxed

bribing miners= buying hash power

00:00

ie: ETC

Z

00:01

Zack

You can fill the blocks with spam if you pay enough fees, yes. That is the case with all blockchains though.

00:02

Filling a pow blockchain with spam is expensive, but not destructive. Eventually you can't afford to pay fees.

00:02

A bribery attack against PoS completely destroys the network, and is cheap.

K

Z

00:04

Zack

This is a place to talk about Amoveo.

K

00:04

Kxxxed

sorry.. was just comparing. Anywho.

00:07

anyways,, so far the record shows that there has been countless of PoW attacks,, but few if any PoS have been. And that has been primarly due to financial incentive. Matter of fact,, even getting hold of enough PoS delegates to collude is almost impossible vs bribing a single mining farm.

Z

00:10

Zack

Pow gets stronger as the network gets bigger and more decentralized.

The cost to attack is proportional to the rate of economic activity.

PoS gets weaker. The cost of attacking is: the average amount of stake owned by a validator who is a member of the poorer half of validators.

The cost to attack is proportional to the rate of economic activity.

PoS gets weaker. The cost of attacking is: the average amount of stake owned by a validator who is a member of the poorer half of validators.

K

00:14

Kxxxed

how much bigger do you need to get? look at ETC market cap, .. its getting raped left and right.. You cant attack PoS unless you buy a huge stake,, and at that point you have to be a retard to want to hurt your investment by attacking the network. good luck trying to bribe enough stakers to attack PoS specially if the value is dropping, and by the time you finish your attack and try to dump your come up, you might get less then your initial bribe investment due to the fact that you crushed the value with your attack.

Z

00:15

Zack

In reply to this message

When 2 blockchains share the same kind of mining hardware, that makes it insecure.

Etc is attacked because the mining is compatible with eth.

Etc is attacked because the mining is compatible with eth.

K

00:17

Kxxxed

every pow should use BTC chain for marking checkpoints. dont think there is any PoW algo right now that cant be abused. anyways... good chatting. gtg

z

00:19

zhaxzhax

That's why most blockchain network choose to turn into POS. To attack POS, you need to hold a lot of tokens which are pretty expensive. Zack's soft-fork bribe attack may not be thoughtful, the validator will never choose to under the risk of their token becoming no value meaningless nothing.

Z

00:20

Zack

the cost to bribe a validator is (how much they stand to lose if the attack succeeds ) * (how much more likely the attack is to succeed, if they join the attack)

00:21

(How much more likely the attack is to succeed if they join) this is approximately the same as (the part of the stake they own)/(all the stake owned by validators)

K

00:22

Kxxxed

your theoretical PoS attack does not play out in the real world, i dont think you fully understand the power of financial incentive.

z

00:23

zhaxzhax

In reply to this message

nope. If the attack is going to be succeed. The validtor will get nothing because their token will become meaningless.

Z

00:23

Zack

So the cost to bribe a validator is (the value of the stake they own) * (the proportion of stake they own out of the total)

So if you are a validator with $1000 of stake, and the total pool is $1000000, then the cost to bribe you is approximately $1.

So if you are a validator with $1000 of stake, and the total pool is $1000000, then the cost to bribe you is approximately $1.

z

00:24

zhaxzhax

In reply to this message

Yeah, if the bribe be paid on a different blockchain, why i can be bribed by $1 that I will lose $1000.

K

00:24

Kxxxed

lol,, validator with $1000 stake? and he is holding a meaningful validator spot? as in this single validator can pose a threat with his $1000 stash? who the fuck would want to even attack that cheap ass worthless coin?

00:25

btw, you need to bribe 51% of validators

00:25

vs 1 mining farm

Z

00:25

Zack

If there are 1000 validators with $1000 of stake each, the bribe per validator is $1.

So bribing 51% costs $510.

So bribing 51% costs $510.

z

K

00:26

Kxxxed

ok, try to get a hold of 51% validator to bribe without causing a panic or doing it on a downlow

00:26

IMPOSSIBLE

ŽM

00:26

Živojin Mirić

In reply to this message

The point that you're missing from the beginning of talking about bribe attacks is that humans are not robots that comply to your bribing equation. You still did not prove a PoS attack, even a cheap one.

Z

00:26

Zack

In reply to this message

Causing a panic that destroys the value of the PoS coin was the point of the attack in the first place.

K

00:27

Kxxxed

so your shorting?

00:27

hehe

Z

00:27

Zack

In reply to this message

The humans that use the more profitable strategy will take the money from those who don't. Eventually the majority of money will be controlled by those who are using the profitable strategy.

K

00:27

Kxxxed

i guess. but still., its almost impossible to get that kind of consensus on PoS via bribing,, vs bring 1 mining farm.

ŽM

00:27

People are irrational

00:28

You could maybe abuse PoS with bribery if validators were ML algorithms

Z

00:28

Zack

In reply to this message

Release an alternative version of the full node software that pays stakers 1% more.

Call it an update.

Call it an update.

ŽM

00:28

Živojin Mirić

But not in real life

z

00:29

zhaxzhax

In reply to this message

The Byzantium Consensus only need 33% validator to be bribed, so you need cost $334

00:30

There will be some reason that most new blockchain network choose POS rather than POW.

ŽM

00:30

Živojin Mirić

It all sounds perfect in game theory...

Z

z

00:32

zhaxzhax

You havn't answered about Byzantium Consensus

00:34

I think may be there are some misunderstand in POS network of Zack.

00:35

Zack may have misunderstood POS network.

00:36

But I love your brilliant coding talent and impressive opinion

Z

00:37

Zack

I probably do misunderstand.

I'm not asking anyone to trust me.

I give you the reasons for why I think PoS is not secure.

If you want to change my mind, you would probably need to find a flaw in my reasoning and point it out to me.

I'm not asking anyone to trust me.

I give you the reasons for why I think PoS is not secure.

If you want to change my mind, you would probably need to find a flaw in my reasoning and point it out to me.

z

00:50

zhaxzhax

Byzantine Fault Tolerance (BFT) will allow at least 33% Malicious node. You can not use 1$ to bribe the validator who stake 1000$.

If there are 1000 validator who stake 1000$. You need to bribe 34%validator which cost 1000$*1000*34%

If there are 1000 validator who stake 1000$. You need to bribe 34%validator which cost 1000$*1000*34%

Z

00:50

Zack

https://github.com/zack-bitcoin/amoveo-docs/blob/master/other_blockchains/the_defence_of_pos.md

I think it is very revealing to see the supposed PoS professionals explain how PoS can possibly survive this kind of attack.

You would think that if PoS existed as a thing that could be understood, that we would be able to agree on why it can survive certain attacks.

Each person seems to have an independent concept of how PoS works.

I think it is very revealing to see the supposed PoS professionals explain how PoS can possibly survive this kind of attack.

You would think that if PoS existed as a thing that could be understood, that we would be able to agree on why it can survive certain attacks.

Each person seems to have an independent concept of how PoS works.

00:50

In reply to this message

in this situation the cost to bribe one validator is $1. so 34% is $340.

z

00:53

zhaxzhax

Why $1? If the attack happened, my staking 1000$ token will become nothing unless no one knows this attack ever happened.

00:53

If I am the validator, I will ask for 1001$

Z

00:53

Zack

the cost of the bribe is (how much you can lose) * (how much more likely the attack is to succeed, if you participate)

z

00:54

zhaxzhax

Ok I get it

00:54

ture, 1$

Z

00:54

Zack

In reply to this message

the bribery stuff can be done using other keys, on other blockchains. so you are cryptographically anonymized

00:54

it can be an off-chain smart contract enforced by Amoveo :)

I

00:56

Instinct

In reply to this message

Lol u reminded me of this https://m.youtube.com/watch?v=Ok9kXOsWeQM

Z

00:56

Zack

hahahaha

z

00:57

zhaxzhax

Nice talk to you. Although maybe I was convinced by you, I will still thinking about this question.

Z

01:31

Zack

about 4 days left until the AMM update.

about 12 hours until subcurrencies.

about 12 hours until subcurrencies.

x

10:08

x

i don't know where is proof of stake better than current fiat system

10:10

probably worst than

mx

11:08

mr x

i have account with 0.3 tveo but it gives me "load a key with funds." on uniswap.html hmm?

z

12:53

zhaxzhax

Yeah, it make sense. If I am not into the attack, I will lose my wealth. So there are more likelihood for me to be forced into this attack.

Cresus invited Cresus

C

16:04

Cresus

Hello

16:06

I red that POS was not enough secure but two questions :

Why ethereum with best blockchain experts don't know that ? And why ethereum has billions of $$$

If i should buy a rrue secure crypto which one do I need to choose ?

Why ethereum with best blockchain experts don't know that ? And why ethereum has billions of $$$

If i should buy a rrue secure crypto which one do I need to choose ?

Z

16:10

Zack

In reply to this message

the hard update didn't activate yet, or are you talking about the testnet?

16:10

I set up that page on the full node, because it will be active in like 3 days.

but it isn't ready yet.

but it isn't ready yet.

Z

16:39

Zack

In reply to this message

The ethereum community thinks they have found a flaw in our narrative, and they are working with an alternative narrative.

In the ethereum narrative, PoS is better because the network has more capability to punish validators who behave incorrectly.

They feel that our narrative is flawed, because they think that this kind of soft fork bribery attack can be done against PoW as well. Vitalik explains on the bottom of this page https://blog.ethereum.org/2015/01/28/p-epsilon-attack/

The attack that Vitalik is describing, it is the same thing as paying all the tx fees + all the block rewards to completely fill up blocks and censor the network from continuing.

bitcoin txs reference a recent hash. if you try to rebuild history for a double-spend, you can't include the txs from the valid side of history. So you aren't just undoing the one tx you want to attack, you are undoing significant activity.

Even if your side of history technically has more work, that doesn't necessarily mean that it will have the most value.

PoW is useful for decreasing the total number of alternatives to be manageable for us to agree on which version is the valuable version. The community may decide to update their nodes and wallets to ignore the attack-fork.

If this attack is done against PoS, it can permanently destroy all the value in that blockchain, and the attack is cheap.

If it is done against PoW, it can temporarily prevent any txs from getting processed, and the attack is expensive.

I think at this point the ethereum community is already undergoing significant institutionalization.

Inside of Ethereum, if you want to succeed, you need to be loyal to the gatekeepers.

There are certain topics that are taboo for ethereum devs to talk about, because they will stop receiving funding and community support to develop on Ethereum.

Certain ideas are not worth the risk to think about.

If there is a powerful person who you depend on, and talking about flaws in PoS makes them look bad, then you would not think about flaws in PoS.

There are a few very rich people who have risked their entire reputation on the idea that PoS is possible and will succeed, and they raised lots of money on this idea.

If you want to receive any money from these people, then you need to avoid ever mentioning flaws about PoS in public.

In the ethereum narrative, PoS is better because the network has more capability to punish validators who behave incorrectly.

They feel that our narrative is flawed, because they think that this kind of soft fork bribery attack can be done against PoW as well. Vitalik explains on the bottom of this page https://blog.ethereum.org/2015/01/28/p-epsilon-attack/

The attack that Vitalik is describing, it is the same thing as paying all the tx fees + all the block rewards to completely fill up blocks and censor the network from continuing.

bitcoin txs reference a recent hash. if you try to rebuild history for a double-spend, you can't include the txs from the valid side of history. So you aren't just undoing the one tx you want to attack, you are undoing significant activity.

Even if your side of history technically has more work, that doesn't necessarily mean that it will have the most value.

PoW is useful for decreasing the total number of alternatives to be manageable for us to agree on which version is the valuable version. The community may decide to update their nodes and wallets to ignore the attack-fork.

If this attack is done against PoS, it can permanently destroy all the value in that blockchain, and the attack is cheap.

If it is done against PoW, it can temporarily prevent any txs from getting processed, and the attack is expensive.

I think at this point the ethereum community is already undergoing significant institutionalization.

Inside of Ethereum, if you want to succeed, you need to be loyal to the gatekeepers.

There are certain topics that are taboo for ethereum devs to talk about, because they will stop receiving funding and community support to develop on Ethereum.

Certain ideas are not worth the risk to think about.

If there is a powerful person who you depend on, and talking about flaws in PoS makes them look bad, then you would not think about flaws in PoS.

There are a few very rich people who have risked their entire reputation on the idea that PoS is possible and will succeed, and they raised lots of money on this idea.

If you want to receive any money from these people, then you need to avoid ever mentioning flaws about PoS in public.

C

16:45

So what is your solution ?

16:45

DAG ?

Z

16:45

Zack

Amoveo uses PoW for security. similar to Bitcoin.

C

16:46

😊

Z

16:48

Zack

bitcoin is only for payments.

amoveo is for financial derivatives.

amoveo is for financial derivatives.

C

16:49

The FAQ is dead

Z

16:50

Zack

veoscan was from catweed, a volunteer. he stopped doing it. there are other websites to get the same info.

16:50

idk what FAQ you are talking about

C

16:51

Cresus

On your website

Z

16:51

what faq?

C

16:52

Cresus

Ok I was on faq. Amoveo. Io

Z

C

16:53

Cresus

But what do you think about POW with an green era

Z

16:54

Zack

The economic and environmental cost to produce currency is minimized by PoW.

https://www.truthcoin.info/blog/pow-cheapest/

https://www.truthcoin.info/blog/pow-cheapest/

16:54

anything else is less-green.

16:58

@denis_voskvitsov looks like the FAQ page on amoveo.io is broken.

DV

17:00

Denis Voskvitsov

indeed it is. I think it used 3rd party service to publish FAQ, will ask to remove the link at least.

Z

17:02

Zack

thanks denis :)

C

17:03

Cresus

Where is the best plave to buy few ?

Z

DV

17:04

Denis Voskvitsov

you can also try @ExchangeAmoveo_bot for smaller amounts (that's exchange bot from Exantech)

C

17:06

Cresus

How many people in the team

Z

17:06

Zack

I don't employ anyone

17:08

There are various people involved in different ways.

It is less like a traditional business, and more like an open source software project.

It is less like a traditional business, and more like an open source software project.

17:16

2 blocks until the subcurrency update

17:16

this is probably the biggest hard update in Amoveo's history.

C

17:27

Cresus

Zack what is the best wallet

17:27

To store your coin ?

Z

17:28

Zack

https://github.com/zack-bitcoin/light-node-amoveo

This is the one I wrote.

You can use it for cold storage.

This is the one I wrote.

You can use it for cold storage.

17:35

one more block

Z

17:55

Zack

it is active :)

J

18:01

Jeans

🧿

Cedric invited Cedric

I

18:24

Instinct

🧿

mx

19:18

mr x

binary contract is just special case of scalar right?

A

19:52

Anger Trading

In reply to this message

Sorry im not too tech savy? Ive dled this and how to get it started?

Deleted invited Deleted Account

mx

20:00

mr x

go to src/js folder and open home.html

20:00

but it is not working for me at the moment

20:01

http://159.89.87.58:3010/home.html works but is not local

Z

21:01

Zack

I think the testnet isn't going to work with a local node.

Use a temporary private key

Use a temporary private key

mx

21:49

mr x

I don't think mainnet is working for me locally

cynthia invited cynthia

Z

22:44

Zack

there is no uniswap for mainnet for 3 more days

22:45

I updated this page http://159.89.87.58:3010/uniswap.html?mode=test

22:45

now it lists the 10 most popular contracts, and the oracle text that defines them

22:45

that way you don't have to copy paste the contract ID for your subcurrency.

22:45

you can just click the button, and it appears

22:46

I also made betting on true/false into a dropdown, so you don' have to type "true" or "false".

the only thing you need to type is the amount of currency that you want to send.

There is a dropdown to choose between the currencies you own for what to spend.

the only thing you need to type is the amount of currency that you want to send.

There is a dropdown to choose between the currencies you own for what to spend.

mx

22:59

mr x

nice

Z

23:00

Zack

Once there are more markets, I guess I'll show the top 10 filtered by a search phrase

mx

23:02

mr x

lookup price button gives Uncaught TypeError: Reduce of empty array with no initial value

Z

23:03

Zack

how about now?

23:04

I forgot to update the explorer that hosts the off chain oracle question text

C

mx

23:05

mr x

yeah works now

Z

23:06

In reply to this message

To be adaptable. To listen to what the users think. To deliver a product that is a pleasure to use.

C

23:07

Cresus

But without marketing your token will be never know. I mean you can have the better techno or stuff if nobody know....

K

23:08

K

Would be nice to give some block reward to Exante or other entities building user friendly UIs to keep them updated

Z

23:08

Zack

In reply to this message

Let's figure out who are the people that would benefit most from Amoveo. What they want. Then we can do targeted advertising for the initial users

C

23:16

Cresus

Where do you see Amoveo in 1 year ? 😂

Z

23:16

Zack

In reply to this message

I see that you change the price a little.

mr x is the first person other than me to make a bet

mr x is the first person other than me to make a bet

C

23:17

Cresus

😂

mx

23:17

mr x

yeahh!

C

I

23:20

Instinct

In reply to this message

I think Denis said they’ll probably do a dac for implementing subcurrency & amm stuff

K

Z

23:22

Zack

a DAC dominant assurance contract is when you use a financial derivative to incentivize the creation of a public good.

K

Z

23:23

Zack

it is a way to pay people to make software or digital value

23:23

that is trustless

x

23:45

x

In reply to this message

if it's prediction market, it seems that it will benefit traders and gamblers it seem similar to binary options

23:46

this s a binary option broker in the US

23:46

JS

23:48

Jon Snow

If people can do the arbitrage between those centralized platforms like NADEX and Amoveo, then Amoveo can have a pretty good market liquidity

x

23:52

x

there's also centralized prediction market too most likely, i don't remember the name

23:54

decentralized prediction market, is very important but probably will never have the scalability that centralized ones have.

JS

23:56

Jon Snow

Maybe Augur won’t have given the fees

23:56

Amoveo will be much cheaper

C

23:57

Cresus

Sorry but do you have a tutorial to store Amoveo in a wallet

23:57

I am not a blockchain expert 😢

23:58

Seems very not user friendly

I

7 September 2020

MF

C

00:02

But thank you

MF

00:03

Mr Flintstone

oh sorry

00:03

00:04

you can download it too

00:04

pretty user friendly

C

MF

00:04

Mr Flintstone

it has the same limitations as mew from a security perspective

00:04

if you use the website

00:05

i would download it and use it that way

C

AI 🏅 invited AI 🏅

A

05:01

AI 🏅

Hello! please tell me what's wrong with the amoveo project? the last news on the site was in 19

I

05:05

Instinct

In reply to this message

Exantech have taken a break from updating that. Zack is continuously working on development

JS

05:11

Jon Snow

In reply to this message

Best site to follow the progress is Zack’s github and this telegram chat. All other sites are built and maintained by community volunteers and they would stop volunteering at any moment if they want.

A

05:34

AI 🏅

Thx !

05:41

I wish the community and the project success

Ken Saxon invited Ken Saxon

K

06:05

Ken Saxon

anybody want to make a futarchy to bet whether a socially incapacitated person can ever create a cryptopcurrency with market capitalization greater than $20 million?

06:10

zack is a great programmer. the problem with this project is that Zack is a terrible executor ( 0 progress) , terrible at understanding what the market wants (0 listening to feedback) , and also a terrible theoretician (nick szabo has already proved futarchy is bullshit)

JS

K

06:11

Ken Saxon

yeah look at where the price has been the past year

JS

06:13

Jon Snow

Project progress ≠ Price

K

06:13

Ken Saxon

of course it does

06:13

first of all, nick szabo has long responses on why futarchy doesn’t work

06:14

second of all, even if futarchy does work (which it doesn’t), then it follows that the market would reflect the reality of the state of the project (complete failure)

06:15

so there’s a proof by contradiction. If futarchy is not bullshit (which it is), then it follows that project progress would be reflect by price. Since price has been shit while all other defi projects have been soaring, it’s a proof by contradiction that there is 0 project progress. QED.

A

mx

mx

OK

08:17

O K

In reply to this message

If futarchy doesn't work, maybe you should bet that it does work. That way when it doesn't work, you still win the bet.

EA

08:26

Eric Arsenault

😂

Z

10:46

Zack

I programmed the "pool" tab in the uniswap tool.

http://159.89.87.58:3010/uniswap.html?mode=test

http://159.89.87.58:3010/uniswap.html?mode=test

10:47

it displays the 10 markets with the most liquidity, so you can click on one of them instead of copy/pasting a market ID.

mx

12:34

mr x

hmm server rejected the tx

12:34

buying trump liquidity shares

Anish Dahiya invited Anish Dahiya

Deleted invited Deleted Account

C

17:52

Cresus

Can I run a node with a vps ?

Z

18:03

In reply to this message

Which part is confusing? You can ask questions here.

We will make improvements based on what parts don't make sense.

We will make improvements based on what parts don't make sense.

C

Z

18:07

Zack

Ok, I'm looking

C

18:07

Cresus

I can help you with design i have no time to code but i can create a design for you and generate some code but maybe it not necessary ?

Z

18:08

Zack

I can program. Just tell me what we need to change to make it easier, I'll change it.

18:09

You want rainbow colors or something?

C

18:10

Cresus

In reply to this message

😂 I can do for you suggestion but i dont want to work for nothing if you cannot implement my design

Z

19:01

Zack

In reply to this message

I can't reproduce this error. Can you give me more details or a screen shot or something?

Did you do 2 txs in a row fast? maybe it had something to do with a zeroth confirmation tx in the mempool.

Did you do 2 txs in a row fast? maybe it had something to do with a zeroth confirmation tx in the mempool.

19:06

2 days until the AMM hard update activates.

19:06

I think we have a minimum viable uniswap tool ready for it

19:06

I wonder what I should focus on next.

the hard update for perpetual subcurrencies?

the hard update for perpetual subcurrencies?

19:07

paying fees in currencies other than veo, and using a market to buy the veo to afford the fee?

19:07

combining the system of order books and market makers. So if a trade isn't possible at a good price, you can make a swap offer instead.

and when you buy in the AMM, it checks to see if you can atomically use any swap offers to get a better price.

and when you buy in the AMM, it checks to see if you can atomically use any swap offers to get a better price.

mx

19:19

mr x

In reply to this message

Okay I had to first do set buy and then buy liquidity shares. No multitx from veo to liquidity shares straight?

Z

19:20

Zack

In reply to this message

I was thinking of updating the swap tool so that if you try to swap from veo to liquidity shares it will automatically know to buy the kinds of subcurrencies you need and deposit them into the market to buy shares.

mx

19:21

mr x

transmute anything to anything with single click

Z

19:21

Zack

yeah

19:22

but I think it is also nice to have the pool tab.

I think some liquidity providers are putting in a fair amount of attention, and want more fine-grain control.

so maybe we can start with both and see what users think

I think some liquidity providers are putting in a fair amount of attention, and want more fine-grain control.

so maybe we can start with both and see what users think

mx

19:42

mr x

Nice MVP would be to: Show currencies you have. Show currencies you can buy. Allow sending those currencies (this would also be THE single page wallet we send new people to). Automatically update everything without refresh (balances, syncing, unconfirmed balances) so that user would have instant feedback that something is happening. Multitx support (0 veo accounts would be cool). Allow instant profit taking when outcome of event becomes known (guess this would happen automatically cause some people would specialize buying at 99%). Oh and then CSS magic lol.

Z

20:01

Zack

http://159.89.87.58:3010/uniswap.html?mode=test I updated the format of pool mode. now it shows the price, and embeds the oracle text for the subcurrencies.

20:05

In reply to this message

we can already do these things:

* showing currencies you have

* we can send any currency. there is a tool in the contracts.html page. maybe this could be easier.

* instant automatic profit taking when result of a swap is known.

things we need:

* auto sync headers

* update all balances when we find new headers.

* hard update for the 0 veo accounts.

* showing currencies you have

* we can send any currency. there is a tool in the contracts.html page. maybe this could be easier.

* instant automatic profit taking when result of a swap is known.

things we need:

* auto sync headers

* update all balances when we find new headers.

* hard update for the 0 veo accounts.

mx

20:15

mr x

If the oracle text isn't available don't show it?

Z

20:16

Zack

yeah. it shows the contract id instead

mx

20:16

mr x

Don't even show that :P?

Z

20:16

Zack

then you have no idea what the market is for

20:16

no reason to show it at all, right?

mx

20:16

mr x

Right

Z

20:17

Zack

ifyou only know the price and liquidity

mx

20:17

mr x

I mean don't show the market at all

20:17

:P

Z

20:17

Zack

ok

mx

20:21

mr x

Yeah the sending functionality is in contracts.html but would be nice if the MVP functionality is in ONE place without clicking around.

Z

20:21

Zack

In reply to this message

everything exists in the contract.html page. that is the one place.

20:22

oh, that is only for spending subcurrency

20:22

I could add a veo-spender to that page

mx

20:23

mr x

Contracts.html is for "power" user.

Z

20:23

Zack

I think the subcurrency spender could also be used for spending veo

mx

20:24

mr x

yes

Z

20:24

Zack

so, like a third tab on the uniswap page?

20:24

idk about calling it "uniswap" then

mx

20:24

mr x

right

Z

20:24

Zack

[swap] [pool] [spend]

three tabs?

three tabs?

mx

20:24

mr x

sounds reasonable

Z

20:25

Zack

is there anything else that needs to be made available to non-power-users?

mx

20:25

mr x

so first time veo user only needs that page

Z

20:25

Zack

creating new markets or contracts?

mx

20:26

mr x

hmm

Z

20:26

Zack

maybe ill call the easy page "amoveo.html"

mx

20:26

mr x

yes

20:26

exactly

Z

20:26

Zack

easy_wallet.html

20:26

power_wallet.html

20:27

novice-wallet/advanced-wallet

20:27

there are also other pages for oracle enforcement and oracle creation etc

20:28

so lets leave contract.html as contract.html since it is all smart contract tools

20:28

and make "uniswap.html" into "simple_wallet.html"

mx

20:28

mr x

right on

20:29

creating new markets would be kinda nice maybe hmm

Z

20:30

Zack

I think uniswap does support creating new markets between arbitrary pairs

mx

20:33

mr x

shattering currency into subcurrency and making markets out of them

Z

20:34

Zack

making the smart contract to shatter the currency is a different step from making the market to connect the parts together

mx

20:34

mr x

yes

C

Z

C

Z

20:39

Zack

if you tell us your pubkey, we can send you some test veo to try it out

C

20:39

Cresus

😂👍

mx

20:39

mr x

:P

Z

20:43

Zack

what part is confusing?

20:43

what part do you want documentation for?

20:44

https://github.com/zack-bitcoin/amoveo-docs this is the repository with all the documentation

C

20:45

Cresus

Thanks i will check that this week

Z

20:45

Zack

https://github.com/zack-bitcoin/amoveo-docs/blob/master/design/smart_contracts.md I wrote about some of the ideas behind this smart contract design here.

mx

20:48

mr x

Maybe combine newcontract,setbuy,teachcontract into single button in amoveo.html

20:48

or whatever the name

Z

20:51

Zack

a person would want to create a contract and start out owning value in both sides?

20:52

do they also want to put some of that value into a market?

20:52

and make a swap-offer to sell any excess value owned in one of the subcurrencies or the other?

mx

21:06

mr x

Hmm. Shattering currency is kinda fun and easy to understand? Make it one step?

21:07

learn derivatives with amoveo lol

Z

21:09

Zack

Another way to make the contract is by posting a swap offer to buy some subcurrency in it, and the derivative contract only gets created if someone matches your trade.

s invited s

EA

21:38

Eric Arsenault

In reply to this message

Yes to perpetuals, I feel like everything should just be perps

21:40

In reply to this message

Yeah, I would wait until we at least work out the kinks with the next couple updates

21:40

I’m sure there will be lots of feedback

Z

21:40

Zack

I rewrote a couple pages of docs, because a lot changed:

merkle trees now: https://github.com/zack-bitcoin/amoveo-docs/blob/master/design/trees.md

transaction types now: https://github.com/zack-bitcoin/amoveo-docs/blob/master/design/transaction_types.md

merkle trees now: https://github.com/zack-bitcoin/amoveo-docs/blob/master/design/trees.md

transaction types now: https://github.com/zack-bitcoin/amoveo-docs/blob/master/design/transaction_types.md

mx

21:51

mr x

Lot of people trading the same thing -> amm. One person offering lot of different things -> swap offers.

21:51

or something

Z

22:16

Zack

I'm thinking the amm liquidity tool should try to use existing subcurrency first.

And if you can't afford it, it should calculate a way to buy what you need, tell you the details, and ask for a confirmation.

And if you can't afford it, it should calculate a way to buy what you need, tell you the details, and ask for a confirmation.

JS

Z

23:07

Zack

http://159.89.87.58:3010/uniswap.html?mode=test

I set it up so you can view this page even if you don't have funds in the testnet.

I set it up so you can view this page even if you don't have funds in the testnet.

Z

23:24

Zack

227 blocks until it is possible to do yield farming on Amoveo.

ŽM

23:26

Živojin Mirić

can you tell me in layman terms how is amoveo superior to uniswap so I can shill it in the bar later?

Z

23:27

Zack

you can create an oracle on any question, and make a market to bet on that, without anyone's permission. and the oracle is more affordable than what is possible on ethereum.

ŽM

23:28

Živojin Mirić

with what do you farm?

Z

23:29

Zack

a market has 2 currencies. you buy those 2 and deposit them into the market to get liquidity shares.

you can exchange the liquidity shares for those 2 currencies again later

you can exchange the liquidity shares for those 2 currencies again later

23:30

while you are holding liquidity shares, they increase in value according to the trading fee of 0.2%

23:30

so markets with more trading and less liquidity are more profitable to hold liquidity shares in.

ŽM

23:30

Živojin Mirić

which currencies?

Z

23:33

Zack

we can make a smart contract. for example, betting on whether trump will be president again.

The smart contract has 2 kinds of subcurrency.

type 1 is valuable if he is president again.

type 2 is valuable if he is not president.

You can use the contract to transform 1 veo into (1 coin of trump-wins + 1 coin of trump-loses)

Then you can take those 2 coins, and deposit them into the market to get your liquidity shares.

So if people gamble on whether trump will be president, you can earn part of the trading fees.

The smart contract has 2 kinds of subcurrency.

type 1 is valuable if he is president again.

type 2 is valuable if he is not president.

You can use the contract to transform 1 veo into (1 coin of trump-wins + 1 coin of trump-loses)

Then you can take those 2 coins, and deposit them into the market to get your liquidity shares.

So if people gamble on whether trump will be president, you can earn part of the trading fees.

ŽM

23:36

Živojin Mirić

what happens to those currencies when elections pass?

23:36

they are automatically converted to VEO?

Z

23:37

Zack

we use the oracle process to teach the blockchain the outcome.

Then there is a way to make a tx so the smart contract finds out about the oracle result.

then it becomes possible to convert your winning shares into veo.

if that is too complicated, you can just sell your winning shares in the market, and someone else will go through the process of converting them to veo.

Then there is a way to make a tx so the smart contract finds out about the oracle result.

then it becomes possible to convert your winning shares into veo.

if that is too complicated, you can just sell your winning shares in the market, and someone else will go through the process of converting them to veo.

23:37

we can probably set up the light node so it realizes if any of your subcurrencies have resolved, and can be converted to veo, and do it automatically

x

23:54

x

why isn't atomic swap DEX popular? should amoveo be listed there?

23:54

on an atomic swap DEX

8 September 2020

DV

00:56

Denis Voskvitsov

we're working on VEO atomic swaps into corresponding wrapped token on ETH, and vice versa

s

Z

DV

00:57

Denis Voskvitsov

amoveo as is can't be listed on ethereum DEXes due to completely different blockchain.

Z

00:57

Zack

That could be huge

DV

00:57

Denis Voskvitsov

so wrapped token is the only solution.

00:57

In reply to this message

hope so. I think recent contract tx updates would help us to progress in this task.

I

s

C

EA

01:44

Eric Arsenault

😳

01:44

Could we wrap all of the sub currencies as well?

DV

01:45

Denis Voskvitsov

In theory, yes. but we need to start with base VEO at least.

JS

LH

02:11

Lettuce Hans

In reply to this message

Nice! I'm pretty sure CCX team have done the same recently too (similar marketcap to VEO). Definitely a plus

Deleted invited Deleted Account

C

Z

03:07

Zack

200 blocks until the AMM update activates

JS

03:33

Jon Snow

Is this the last major update in the near future?

Z

03:33

Zack

no

03:36

there are 4 near the top of the todo list:

the market swap dust update is coming.

That will allow people to specify that they want to sell all of a certain kind of subcurrency, so in flash loan trades they aren't left holding dust along the way.

we have a couple updates planned to make governance easier. we want to make a couple governance variables that can modify multiple things at once.

So the process of changing the block time can be more simple. it will automatically change the block reward proportionally to maintain the same inflation.

the zero veo accounts update.

changing multi-tx so a flash loan can pay the tx fee.

This way you don't need to own any veo to use amoveo. you can just hold subcurrencies.

the perpetual subcurrency update.

It will allow smart contracts to hold auctions to change their source currency.

So a stablecoin can change its margin to stay financially optimized.

the market swap dust update is coming.

That will allow people to specify that they want to sell all of a certain kind of subcurrency, so in flash loan trades they aren't left holding dust along the way.

we have a couple updates planned to make governance easier. we want to make a couple governance variables that can modify multiple things at once.

So the process of changing the block time can be more simple. it will automatically change the block reward proportionally to maintain the same inflation.

the zero veo accounts update.

changing multi-tx so a flash loan can pay the tx fee.

This way you don't need to own any veo to use amoveo. you can just hold subcurrencies.

the perpetual subcurrency update.

It will allow smart contracts to hold auctions to change their source currency.

So a stablecoin can change its margin to stay financially optimized.

JS

03:40

Jon Snow

Got it. What’s the timeframe you are thinking for those updates?

Z

03:42

Zack

idk on the order yet.

and it depends how much time I need to spend modifying the new AMM light node features in the coming days.

the zero veo accounts update is easiest. maybe like 2 days of work.

market swap is maybe 3 days.

the governance changes are probably 3 days.

the perpetual subcurrency update might be like 2 weeks.

if I just focused on these hard updates, we could do them all pretty quick. But there is a lot of other stuff going on right now.

and it depends how much time I need to spend modifying the new AMM light node features in the coming days.

the zero veo accounts update is easiest. maybe like 2 days of work.

market swap is maybe 3 days.

the governance changes are probably 3 days.

the perpetual subcurrency update might be like 2 weeks.

if I just focused on these hard updates, we could do them all pretty quick. But there is a lot of other stuff going on right now.

JS

03:44

Jon Snow

In reply to this message

Yeah, making sure the AMM running smoothly is definitely important as well

A

04:07

AI 🏅

🔥

13:33

Deleted Account

What is the incentive for people to use veo instead of the ETH based defi stuff?

E TS invited E TS

Z

16:31

Zack

In reply to this message

Our oracle is cheaper and more secure. You only need to use it for enforcement, not for creating bets. If participants agree on the outcome, you don't need to post it on chain at all.

Our smart contract system is more optimized for derivatives. You only need to create the contract on chain for enforcement. If participants agree on the outcome, you don't have to publish it on chain at all.

Since the on-chain aspects are only used for enforcement, it is free to make bet offers that aren't matched.

This means trading bots that are constantly adding and removing trade orders in an order book, these kinds of trading bots can be very cheap to operate . Giving us more liquidity.

We were designed for stateless full nodes since day 1, which over time is starting to seem like a more important part of scalability and usability.

Since amoveo blocks can sync in reverse, you can set up a new mining pool in minutes. Full nodes are immediately usable when you turn them on.

Compare this to ethereum, where if a mining pool has to resync, they can lose days.

Amoveo has a culture that makes decisions using futarchy. There is a clear path for the community to make decisions about the direction of the project, without wasting time on propaganda or arguments.

Our smart contract system is more optimized for derivatives. You only need to create the contract on chain for enforcement. If participants agree on the outcome, you don't have to publish it on chain at all.

Since the on-chain aspects are only used for enforcement, it is free to make bet offers that aren't matched.

This means trading bots that are constantly adding and removing trade orders in an order book, these kinds of trading bots can be very cheap to operate . Giving us more liquidity.

We were designed for stateless full nodes since day 1, which over time is starting to seem like a more important part of scalability and usability.

Since amoveo blocks can sync in reverse, you can set up a new mining pool in minutes. Full nodes are immediately usable when you turn them on.

Compare this to ethereum, where if a mining pool has to resync, they can lose days.

Amoveo has a culture that makes decisions using futarchy. There is a clear path for the community to make decisions about the direction of the project, without wasting time on propaganda or arguments.

J

17:10

Josh

Is it possible to make a derivative that's a 200 week moving average of something, like the bitcoin price? That would almost be like a stable coin.

Z

17:15

Zack

https://github.com/zack-bitcoin/amoveo-docs/blob/master/light_node/user_stories.md I wrote about the kinds of processes I imagine people going through when using the light node

17:15

the different kinds of users

C

J

17:44

Josh

In reply to this message

True, I guess the difference is this one historically always went up, pretty slowly and by quite a lot.

K

Z

18:30

Zack

In reply to this message

You can bet on any publicly available number. Including long term average bitcoin prices.

J

18:36

Josh

Could be interesting, I haven't really seen that offered on traditional markets

Z

19:56

Zack

I think the reason on-chain market makers are popular is because it is a way to profit by providing liquidity, without needing a hot wallet.

But this comes with the severe downside that you are giving up control of your investing to an on-chain tool.

How about if we create something with the benefits of both.

We could have smart contracts that are like trade generators.

You use your Veo private key to sign the trade generator, and then you have a different public/private key pair for signing the trades that come out of the generator.

In cold storage you could have some rule like "I want to sell as much of X as can, and the price needs to be better than 2% lower than a particular on-chain market maker"

So then you can use your other key to sign swap offers, but the offers are only valid if they obey the trading strategy that had been written off-chain.

And if there is ever evidence that someone compromised your hot private key, there can be an emergency escape transaction that sends the hot funds back to your cold wallet, and has a higher tx fee than is possible with any other set of txs that can come from the hot account.

But this comes with the severe downside that you are giving up control of your investing to an on-chain tool.

How about if we create something with the benefits of both.

We could have smart contracts that are like trade generators.

You use your Veo private key to sign the trade generator, and then you have a different public/private key pair for signing the trades that come out of the generator.

In cold storage you could have some rule like "I want to sell as much of X as can, and the price needs to be better than 2% lower than a particular on-chain market maker"

So then you can use your other key to sign swap offers, but the offers are only valid if they obey the trading strategy that had been written off-chain.

And if there is ever evidence that someone compromised your hot private key, there can be an emergency escape transaction that sends the hot funds back to your cold wallet, and has a higher tx fee than is possible with any other set of txs that can come from the hot account.

Deleted invited Deleted Account

J

20:55

Josh

Yeah that's like an on-chain HSM

20:55

Could be huge just for security in general.

20:57

You could also have velocity checks. A transaction is only valid if you haven't spent > x veo in the last hour.

Dereek69 invited Dereek69

Z

21:22

Zack

What is hsm?

21:26

The smart contract isn't actually on chain.

I publish a swap offer that can only exist if the contract gets created.

And if you accept a swap under invalid conditions, you lose your money. It is the same as creating a contract that gives me your money, and then depositing your money into it.

I publish a swap offer that can only exist if the contract gets created.

And if you accept a swap under invalid conditions, you lose your money. It is the same as creating a contract that gives me your money, and then depositing your money into it.

21:27

So this way I can have a warm-wallet. With restricted access for trading.

21:28

It's like, you pre-sign a bunch of swap offers from your cold storage.

And these swap offers reference off-chain contract code that specifies the rules under which the swap is valid.

And these swap offers reference off-chain contract code that specifies the rules under which the swap is valid.

21:29

Both my warm wallet, and the person I am trading with, they can both provide evidence to determine how the contract should resolve.

21:31

my contract could specify that I am allowed to sell for down to 3% below some on-chain markets price.

But before I give this offer to someone, I can sign more evidence onto it if I want. Like saying this particular offer is for 5% above the current market price.

It is a valid trade offer which meets the conditions for restricted trading.

But before I give this offer to someone, I can sign more evidence onto it if I want. Like saying this particular offer is for 5% above the current market price.

It is a valid trade offer which meets the conditions for restricted trading.

21:32

I think this is all possible now. It's just a matter of making the smart contracts.

J

21:51

Josh

HSM is hardware security module; it's what banks use to store their private keys. It can be programmed with a ruleset and then it uses the ruleset to sign transactions that are valid. They also have advanced tech so that it's hard to physically tamper with them. On-chain HSM functionality is better because we don't have to worry about anybody tampering with the hardware.

Z

21:51

Zack

Oh yeah, it is similar

J

21:54

Josh

this is really important because it means we don't have to worry so much about hot keys getting hacked

9 September 2020

Z

01:48

Zack

94 blocks until AMM

Alex Walium invited Alex Walium

Z

04:05

Zack

Is there a way to have 2 oracles reference each other, so at least one of them must result in a lying state?

I want to see the oracle mechanisms fight.

I want to see the oracle mechanisms fight.

J

04:07

Josh

but if B is saying A is false, wouldn't people already agree that A is false and not run it? In that case there would be no point in running B either.

Z

04:08

Zack

yeah, it is probably not possible

AW

04:14

Alex Walium

Just stumbled upon Amoveo. In a pile of shitcoins this actually looks really good, I'm intrigued for the first time in a while! Why is this project flying so under the radar?!? Is there anywhere to buy VEO other than HitBTC and qTrade? Just want to incentivize me into looking deeper into this coin.

Z

04:14

Zack

Qtrade seems to be the most popular place to trade

04:15

There is lots of info on the github. You can ask questions here

AW

04:17

Alex Walium

Thanks, I'm doing a dive into github right now. And this quick response made me even more intrigued! Much appreciated!

A

JS

04:49

Jon Snow

In reply to this message

My understanding (I’m just a regular community member full disclosure) is that it was not marketed like other coins, but soon it might be as some major updates are in place for a viable product market fit test.

AW

05:03

Alex Walium

In reply to this message

Thanks, I must say; this looks really promising (like once in a year discovery). I keep looking for the obvious hitch, but I can not find it as of yet. Will be buying a small stake and look into the github further. If the only thing that is missing is marketing this could be a true gem in the making. Not saying that the price is the important metric here, actually I would say that the fact that this has not been hyped or pumped makes it look more legit in my eyes..

JS

05:13

Jon Snow

In reply to this message

People here in the telegram channel are generally pretty helpful with questions that they know answers to and Zack is generally pretty responsive to questions as well. So feel free to ask questions and discuss issues here in this channel (no price discussion as a general rule though).

05:14

Discord has a dedicated price discussion channel

AW

J

05:20

Josh

Welcome, Alex

AW

05:21

Alex Walium

In reply to this message

I truly respect this.

I will not be talking about price here, and a strict practice about this is actually another pro in my opinion.. 😁 Keep up the good work!

I will not be talking about price here, and a strict practice about this is actually another pro in my opinion.. 😁 Keep up the good work!

J

05:28

Josh

Yep, it's small but dedicated

AW

𝑳𝒂𝒖𝒓𝒊𝒂𝒏𝒂 invited 𝑳𝒂𝒖𝒓𝒊𝒂𝒏𝒂

Z

15:14

Zack

In reply to this message

an interesting overview of what tools have been built for blockchain derivatives. it mostly focuses on ethereum stuff.

15:22

around 4 hours until the AMM hard update activates. I guess ill turn off the test node, and switch over the explorers to be connected to the mainnet node.

A

Z

18:57

Zack

4 more blocks

S

19:08

Sy

and ofc...no blocks xD

mx

19:47

mr x

!!?

Z

19:49

Zack

I fixed a bug that was preventing the light node in standalone mode from accessing the unisap.html page.

mx

19:49

mr x

🥳

D

19:53

Devender

Is it done?

Z

19:54

Zack

yes, the AMM update is live

D

Z

19:54

Zack

that is the link for the test node

D

19:55

Is it down?

19:55

Yes test node

Z

19:55

I took down the test node

D

19:55

Devender

Okay

Z

20:02

Zack

im making a market now

20:02

it is to bet on the block hash of block 131000

20:02

so 50-50 odds

20:03

im pretty sure if I sell all my liquidity shares right before 131000, that on average I will earn non-negative profit.

S

20:06

Sy

no new block since then...time to check the logs

x

20:08

x

so what i do there

20:08

so what can i do there

20:08

never tried uniswap before

20:09

no idea how uniswap works

20:10

what is this page for?

Z

20:10

Zack

the idea of on-chain market makers originally came from truthcoin

20:11

a market maker, it has the 2 assets locked up in it, and you can always use the market maker to swap one kind for the other.

20:11

so the market maker always shows a price between the 2 assets

20:11

what im setting up now is a market that is basically betting on a coin flip.

20:12

so you can buy shares of heads or tails, and sell them or trade them

x

20:13

x

ok

20:13

but amoveo don't have subcurrencies

20:13

or assets

Z

20:14

Zack

now it does

20:14

a smart contract defines 2 or more subcurrencies.

20:14

when the smart contract ends, it divides up it's value between it's subcurrencies

mx

20:16

mr x

130700... come on...

mx

20:35

mr x

so something went wrong?

Z

20:36

Zack

yeah, but I think sy an I will have a solution right away

mx

20:36

mr x

ok

x

20:42

x

can other types of assets be added?

20:43

what type of assets can be added

J

20:47

Josh

any bet that will have an easily verified public outcome

Z

20:49

Zack

In reply to this message

I think we already have a solution. it will take like 20 minutes to resync the node, and we will be good to continue.

20:53

sy seems offline haha

20:53

well, once he comes back we will get this sorted right away :)

EA

22:01

Eric Arsenault

it would be nice to see which pair you can trade against

Z

22:02

Zack

the uniswap tool lets you trade any pair

22:02

it finds the best set of market txs to get the best price for your swap

EA

22:02

Eric Arsenault

I know, but it would be nice to have a dropdown showing available pairs

22:03

or bets that people have created

Z

22:03

Zack

It creates a list of the top 10 most popular contracts, and if you click on one, it auto-fills the form

22:03

Give me some time. I'm trying to publish a contract and market

22:04

There are some small technical difficulties. We should be live shortly

22:04

Thank you for your patience.

S

22:11

Sy

My internet decided to take a break xD

Z

22:29

Zack

looks like everything is working normally again :)

22:30

some full nodes may need to be resynced.

22:37

oh, I am resyncing the node conneced to the market interface

22:37

so you can't use the markets until that is done

22:38

You can see in Sy's explorer that the market_new_tx and contract_new_tx got included into a block http://explorer.veopool.pw/index.php?input=130701

22:43

during these technical difficulties, no blocks are being re-wound, and no miners are wasting any of their effort.

22:58

http://159.89.87.58:8080/uniswap.html

ok, now it is ready to make bets

ok, now it is ready to make bets

22:58

I put 20 veo of liquidity into a market

x

22:58

x

can i watch other people's bets

Z

22:59

Zack

http://explorer.veopool.pw/index.php

you can look up txs in recent blocks here.

I am thinking of making a page where you can look up the history of a market. and it will show a graph of how the price of the market changed over time, and another graph of how much liquidity it had over time.

you can look up txs in recent blocks here.

I am thinking of making a page where you can look up the history of a market. and it will show a graph of how the price of the market changed over time, and another graph of how much liquidity it had over time.

23:01

the market I made, it should resolve in about 2 days

23:02

130 blocks per day. 290 blocks away.

s

Z

23:08

Zack

it is a market betting on the outcome of a coin flip

I

EA

23:09

Eric Arsenault

"publish the trade" does this confirm the trade?

Z

23:09

Zack

there is 50-50 odds that either subcurrency 1 or subcurrency 2 will have value

EA

23:09

Eric Arsenault

maybe we should have a more familiar name

s

23:09

sanket

In reply to this message

what are the currency? I still don't get what are we betting onm

EA

23:09

Eric Arsenault

like "SWAP"

23:09

or TRADE

Z

23:10

Zack

block 131000 will happen in a little over 2 days.

we are betting on the hash of that block

we are betting on the hash of that block

23:10

it is a 50-50 odds bet

EA

23:10

Eric Arsenault

In reply to this message

yeah, maybe we should do something more standard, like BTC price or something

Z

x

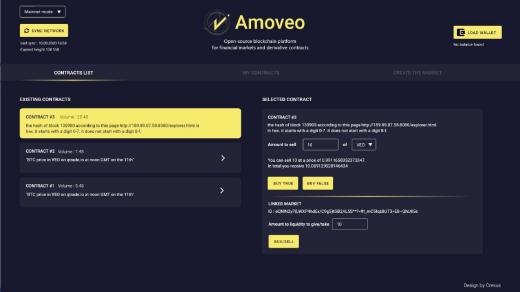

23:11

x

existing contracts

"the hash of block 131000 according to this page http://159.89.87.58:8080/explorer.html in hex. it starts with a digit 0-7. it does not start with a digit 8-f."~ buying truebuying false

"the hash of block 131000 according to this page http://159.89.87.58:8080/explorer.html in hex. it starts with a digit 0-7. it does not start with a digit 8-f."~ buying truebuying false

Z

23:12

Zack

I was also thinking the second button should appear only when it is ready, or be greyed out or something

EA

23:12

greyed out is good

Z

x

23:14

x

what does pool mode mean, indeed the design can be improved, for example adding definition of terms below a button

Z

23:15

Zack

In reply to this message

it is an interface for depositing the 2 kinds of currency into a market, so the market can be more liquid.

you receive liquidity shares.

You can use the liquidity shares to withdraw your portion of the pool later, or you can spend them like any other currency.

you receive liquidity shares.

You can use the liquidity shares to withdraw your portion of the pool later, or you can spend them like any other currency.

23:15

if the market is successful, then the trading fees will make your liquidity shares grow in value.

23:16

if either of the 2 currencies goes to zero value, then your liquidity shares will go to zero value as well.

23:16

it is like uniswap

23:17

this is sure a slow block

x

23:17

x

i havent tried uniswap yet, so i saw a lot of new terms

Z

23:18

Zack

the idea is that people want to profit from providing liquidity to markets, but they don't want to leave their private key on a computer that is connected tot he internet.

the on-chain market maker is a way to achieve this.

the on-chain market maker is a way to achieve this.

x

23:19

x

i see

23:21

i mean also "scalar/binary oracle , futarchy oracle" etc if some one new begin to use the light node, they can not understand it so they won't know how to use it

Z

23:21

Zack

yes, it is a work in progress

23:21

there is always room for improvment

x

23:21

x

i see ok

Z

23:22

Zack

but we want to start getting a few users now, so we can talk to them and get a better idea of what is the most important things to deliver.

EA

23:24

Eric Arsenault

We need markets people want to bet on

23:24

I want to be able to short ERC20s for example

Z

23:24

Zack

you can make markets too

EA

23:24

Eric Arsenault

Yeah, that is true

23:25

maybe we can create markets for gas prices on Ethereum, so you can hedge yourself

x

23:25

x

a market for bitcoin, eth, amoveo price seems good to me

23:25

bitcoin price

Z

23:25

Zack

like, a stablecoin?

23:26

a 50-50 bet market is the safest thing to be a market maker for, because the odds wont change.

So I think it is a good place to start.

So I think it is a good place to start.

x

23:26

x

what is max time before a market expire??

Z

23:26

Zack

hopefully someone will want to test it out

23:27

we need this market to get included into a block before anyone can make bets.

x

23:27

x

ok , so we can bet on bitcoin price next year

Z

23:27

Zack

anyway, markets don't expire. contracts do.

23:27

yes, we can bet on the bitcoin price next year.

23:28

but that is risky, the margins might stop making much sense in a few weeks. if veo's price changes a lot.

23:28

for now it is probably better to keep it more short term, until the perpetual stablecoin hard update is activated.

x

23:28

x

i see

23:29

what is the risk with perpetual stablecoin usually

Z

23:32

Zack

the design we are thinking of.

the perpetual stablecoin contract, it has a source currency it is denominated in, a different stablecoin with a fixed margin.

if the source currency's expiration gets near, or if the price moves too near or far from the margin, then the contract holds an auction.

It is currently denominated in stablecoin #1, and it asks for stablecoin #2 which has an expiration further in the future and/or has different margins.

There is an auction, anyone can offer an amount of stablecoin #2 to buy all the stablecoin #1 in the contract. Whoever offers the best price wins.

That is how the contract switches to being denominated in stablecoin #2.

the perpetual stablecoin contract, it has a source currency it is denominated in, a different stablecoin with a fixed margin.

if the source currency's expiration gets near, or if the price moves too near or far from the margin, then the contract holds an auction.

It is currently denominated in stablecoin #1, and it asks for stablecoin #2 which has an expiration further in the future and/or has different margins.

There is an auction, anyone can offer an amount of stablecoin #2 to buy all the stablecoin #1 in the contract. Whoever offers the best price wins.

That is how the contract switches to being denominated in stablecoin #2.

23:33

so each perpetual stablecoin contract could have a maximum rate at which it can react to price shocks, and it will be more expensive to use a stablecoin that can react to bigger price shocks.

23:34

there is a trade off. if the auction is too short, then we can't get the best price.

but if the auction is too long, then the price of stablecoin #1 could keep falling, as the price sinks deeper past the margin.

having a bigger margin means we can have longer auctions without worrying about the price moving so much.

but if the auction is too long, then the price of stablecoin #1 could keep falling, as the price sinks deeper past the margin.

having a bigger margin means we can have longer auctions without worrying about the price moving so much.

23:46

the market got included

23:51

someone made some txs in the market :)

23:53

they traded 0.4 veo.

the fee is 0.2%

so I already earned 0.0008 VEO.

That is well over $0.004 :)

the fee is 0.2%

so I already earned 0.0008 VEO.

That is well over $0.004 :)

KL

23:56

Karlis L

you mentioned some "arbitrage prevention", right? can i read somewhere what exactly is your plan? and is it supposed to solve the "impermanent loss" problem?

Z

23:57

Zack

In reply to this message

in the uniswap tool you choose which currency to spend, and which currency to receive.

If there are multiple ways to achieve this, it will automatically find the optimal mix of markets to participate in to get you the best trade it can.

So, it is avoiding creating arbitrage opportunities, it is avoiding waste by arbitrage.

If there are multiple ways to achieve this, it will automatically find the optimal mix of markets to participate in to get you the best trade it can.

So, it is avoiding creating arbitrage opportunities, it is avoiding waste by arbitrage.

x

Z

23:58

Zack

you can use the "pool" tab on the uniswap page

23:58

if you are going to use a private key with funds, it is safer to download the light node and run it on your own computer

23:59

In reply to this message

oh, you need to own both the subcurrencies in order to depost them into the pool

10 September 2020

Z

00:00

Zack

there is a tool on this page for creating both flavors of currency in the same market http://159.89.87.58:8080/contracts.html

it might be a cheaper way to buy them both, so you can get liquidity.

it might be a cheaper way to buy them both, so you can get liquidity.

00:01

or you can use the uniswap tool and let me collect fees :)

KL

00:01

Karlis L

In reply to this message

thanks!

and how about the impermanent loss? have you brainstormed about that? do you even recognize it as a problem?

and how about the impermanent loss? have you brainstormed about that? do you even recognize it as a problem?

Z

00:01

Zack

what is "impermanent loss"?

KL

00:02

Karlis L

ok, that answers my question I guess:)

i suggest you spend 5-10 min googling about it, will be much more efficient than me trying to explain it here.

i suggest you spend 5-10 min googling about it, will be much more efficient than me trying to explain it here.

x

KL

00:03

Karlis L

it is basically the reason why Curve operates only with stablecoins

Z

00:06

Zack

In reply to this message

oh. you mean how if the price moves a lot in one direction, and stays there, that liquidity providers lose value.

being a liquidity provider is a kind of bet. You are betting that the price will move up and down a lot, but stay in about the same location.

liquidity providers have a dampening effect on the price.

Like any bet, you can lose. If you bet wrong, you lose money.

For this current example, my plan is to withdraw all my liquidity before block 131000, that way I will suffer no impermanent loss.

being a liquidity provider is a kind of bet. You are betting that the price will move up and down a lot, but stay in about the same location.

liquidity providers have a dampening effect on the price.

Like any bet, you can lose. If you bet wrong, you lose money.

For this current example, my plan is to withdraw all my liquidity before block 131000, that way I will suffer no impermanent loss.

I

00:08

Instinct

Zack pulling the rug

mx

00:09

mr x

lol

Z

00:10

Zack

market id: 1mNy85YLtBcKDEKNz3Tu0rvC7sw8nZkrv4JaiXcEL2o=

contract 1: 3if2H3uJBuie4qxP4R6HacQgqYEds7MOIklU1+ojgC0=

type 1: 1

amount 1: 2000237347

cid 2: 3if2H3uJBuie4qxP4R6HacQgqYEds7MOIklU1+ojgC0=

type 2: 2

amount 2: 1999842841

shares: 2000000000