Amoveo ♥🧿

Previous messages

Next messages

1 July 2020

DB

02:46

Darragh Brady

iOS

Z

CD

02:47

Crypt Dweller

"Bitcoin runs into its scaling limit. If scaling not fixed, Bitcoin will crash. If the Lightning Network fixes scaling, Bitcoin will rise a lot further, and all other crypto currencies fade. If the Lightning Network fails, a crypto currency that can scale will replace Bitcoin."

Z

02:48

In reply to this message

lightning network isn't for scaling. it is for contracts that can mutate more rapidly.

DB

02:48

Darragh Brady

In reply to this message

The one for iPhone that can be downloaded from the amoveo site

Z

02:48

what is your address?

DB

Z

02:49

Zack

right.

02:49

your amoveo address.

DB

02:49

Darragh Brady

BNitWy0VKzw3edyaqKL3ejBXShHqAQnA/Xc2+e8WVtw0kWaLMHsof8iavDpLxosOypA3xfCGxWlpDFKJw9TWoh8=

CD

02:49

Crypt Dweller

You would know better than me, but the layperson's idea of Lightning is that it's a workaround to Bitcoin's small block size limit

Z

02:49

Zack

In reply to this message

it is a workaround for slow finality. you have to wait so many confirmations.

DB

02:50

Darragh Brady

In reply to this message

Only the first transaction went through though (and it’s the smaller test one)

Z

02:50

Zack

it says you have 0.06 veo

02:50

is that the first one?

DB

02:50

Darragh Brady

Yes

Z

02:51

Zack

there aren't any txs in the mempool. so waiting longer wont change anything.

02:51

do you have the txid from the tx you tried to make?

02:51

how long ago did you attempt to make it?

DB

02:52

Sent you a screenshot of my qtrade withdrawals for amoveo privately

Z

02:54

Zack

I think you should contact qtrade.

They have a channel on our discord for problems like this.

They have a channel on our discord for problems like this.

02:54

in the #qtrade-exchange channel

DB

03:00

Darragh Brady

Thanks for your help!

Deleted invited Deleted Account

C

09:38

but step by step first I guess

MF

09:43

Mr Flintstone

the same process you use to create veo-backed usd, you can do the same for an arbitrary index

09:44

then send it around, trade it etc

Deleted invited Deleted Account

Deleted invited Deleted Account

J

16:23

Jeans

Hi, do you think it’s possible that the haven protocol project will one day use the oracle Amoveo, instead of chainlink oracle?

Z

18:59

Zack

In reply to this message

Anyone can use Amoveo's oracle.

The amoveo light node is small and easy to embed in other protocols.

It is possible.

Keep in mind that an oracle is only one ingredient to make a stable asset.

Even if haven protocol had a secure oracle, their product is still not secure.

The amoveo light node is small and easy to embed in other protocols.

It is possible.

Keep in mind that an oracle is only one ingredient to make a stable asset.

Even if haven protocol had a secure oracle, their product is still not secure.

J

19:59

Jeans

Thanks Zack! You have certainly several moves ahead and I would like to suppose that haven is not currently the most secure. That said, it could be interesting to encourage projects like Haven to use the Amoveo oracle, even if the rest of the project is not completely secure. This would make the whole project more secure, and probably less expensive. And that can allow Amoveo to prove itself. I submit this idea to the Haven team on their discord channel, we’ll see.. Have a nice day!

Z

22:33

Zack

https://github.com/zack-bitcoin/amoveo/blob/subcurrency/apps/amoveo_core/src/consensus/txs/resolve_contract_tx.erl#L51

I wrote this code to handle contract resolution where the result of a contract is another contract.

I wrote this code to handle contract resolution where the result of a contract is another contract.

2 July 2020

Z

01:10

Zack

Here is an interesting math question.

Lets say we have contracts A, B, and C.

Contract A resolved into contract B according to matrix ab.

Contract B resolved into contract C according to matrix bc.

given ab and bc, how do we calculate ac, where ac is a matrix that brings us directly from contract A to contract C.

Lets say we have contracts A, B, and C.

Contract A resolved into contract B according to matrix ab.

Contract B resolved into contract C according to matrix bc.

given ab and bc, how do we calculate ac, where ac is a matrix that brings us directly from contract A to contract C.

01:11

A solution to this can potentially let us prune stuff.

Like, if you hold some subcurrency in contract A, ideally you would only need one merkle proof for ac, rather than needing 2 merkle proofs, one for ab and one for bc.

Like, if you hold some subcurrency in contract A, ideally you would only need one merkle proof for ac, rather than needing 2 merkle proofs, one for ab and one for bc.

01:18

The identity and inverse matrices seem to be the same as in normal matrix multiplication.

T

01:51

Topab

Can you do options in Amoveo? This article name some options platforms in Ethereum. Perhaps interesting to read https://medium.com/coinmonks/a-comparison-of-decentralized-options-platforms-140b1421c71c

MF

01:54

Mr Flintstone

yeah binary options

01:56

they have been live for a while but the ux is rough

Z

02:18

Zack

We have scalar derivatives too.

Options are popular for centralized tools. Because options are the kind of derivative where only one of the participants needs to be trusted.

So with options there can be one single trusted node that everyone connects with to trade, and that central hub doesn't need to trust any of the customers.

This makes enforcement cheaper, because only that one central node can possibly cheat.

With trustless tech, it is usually better to use forward contracts instead of options, because forwards contracts are the kind of derivative that is symmetric. This makes it simpler for the kinds of p2p stuff we want in a decentralized network.

Options are popular for centralized tools. Because options are the kind of derivative where only one of the participants needs to be trusted.

So with options there can be one single trusted node that everyone connects with to trade, and that central hub doesn't need to trust any of the customers.

This makes enforcement cheaper, because only that one central node can possibly cheat.

With trustless tech, it is usually better to use forward contracts instead of options, because forwards contracts are the kind of derivative that is symmetric. This makes it simpler for the kinds of p2p stuff we want in a decentralized network.

s

02:35

sanket

In reply to this message

I guess amoveo has a lot of features but not a good ui/ux for someone to use it. Or is there?

T

02:42

Topab

Thanks for the explanation

Z

02:46

Zack

In reply to this message

The light node is ok.

You can ask questions here if anything is confusing.

You can ask questions here if anything is confusing.

02:49

In reply to this message

the more I look at this, the more I think it is normal matrix multiplication.

RAPOSTLE Sam invited RAPOSTLE Sam

B

13:28

Ben

Amoveo has no usable UX at all, i mean for the average joe. I guess as soon as Zack is comfortable with the base Technology the next step would be to get a UI/UX that average Joe can use.

Chris B invited Chris B

Z

19:04

Zack

In reply to this message

The light node works ok. It is beautiful, but most people seem able to use it, especially if they can ask questions here.

B

19:12

Ben

that is your perception, i spoke to a some people and no one like your light node.

19:13

for a POC totally ok

19:13

but for Production, this is not sufficent

Z

19:13

Zack

Were any of them able to offer constructive criticism?

What do they want to see changed in the light node?

What do they want to see changed in the light node?

s

19:18

sanket

if I may, he means from a UI PoV it's very basic.

Compare it to other things like Veil or Flux or Augur V2. it's not easy to understand and navigate

Compare it to other things like Veil or Flux or Augur V2. it's not easy to understand and navigate

19:18

Deleted Account

Kinda sad that while literally dozens of defi projects are flying in terms of volume and engagement, Amoveo is nowhere to be seen. With all these well organized teams gaining ground and recognition, it's going to be increasingly harder for a one man team to grab a piece of the pie.

s

19:19

sanket

correct me if that's not what you meant

19:19

I should able to

1. Deposit veo

2. Create or trade a contract with ease, or no help

3. withdraw veo.

it should be this simple.

1. Deposit veo

2. Create or trade a contract with ease, or no help

3. withdraw veo.

it should be this simple.

Z

19:21

Zack

In reply to this message

what does "deposit veo" mean? what does "withdraw veo" mean?

Creating a contract is a simple one step process in the light node.

making a trade is 2 steps: 1) fill out the form. 2) publish your trade somewhere public.

Creating a contract is a simple one step process in the light node.

making a trade is 2 steps: 1) fill out the form. 2) publish your trade somewhere public.

19:22

In reply to this message

is there something specific you would like changed?

"not easy to navigate" isn't helpful for me to know what to change.

"not easy to navigate" isn't helpful for me to know what to change.

s

19:22

sanket

In reply to this message

I was assuming that you need to deposit veo first to trade.

My bad.

My bad.

Z

19:22

Zack

what does "deposit veo" even mean though?

s

Z

19:23

Zack

like, deposit where/

s

19:23

sanket

In reply to this message

generally the other platforms I mentioned require you to first deposit "tokens" for trade.

19:23

Anyways, chuck it.

Z

19:23

Zack

usually "deposit" means when you send your coins to an exchange

19:24

amoveo is trustless. you don't give your coins to any server.

s

19:25

sanket

yeah. I know. that's why I said my bad in terms of confusing other platforms with veo

Z

19:28

Zack

If I have 2 matrices where the columns sum to 1, and I do matrix multiplication, the result is always another matrix where the columns sum to 1, right?

19:32

https://en.wikipedia.org/wiki/Stochastic_matrix

I think these matrices we use for resolving contracts into other contracts, if they are square then they are stochastic matrix.

I think these matrices we use for resolving contracts into other contracts, if they are square then they are stochastic matrix.

19:33

left-stochastic. since the columns sum to 1.

J

19:49

Josh

@zack_amoveo Do you know about the statebox channel? They have a lot of mathematicians, especially category theory, and they're interested in blockchain stuff.

Z

19:50

Zack

I don't know about statebox

J

Z

19:54

Zack

so, they use category theory to try and write smart contracts without bugs? it doesn't seem related to amoveo.

J

19:57

Josh

or program in general with less bugs. but their telegram channel could be useful for asking math questions.

Z

20:03

Zack

formal methods are nice for making and verifying large mathematical proofs that are too big for humans to read. Like when they did they proved the 4-color theorem.

I am not a fan of using formal methods for writing safety-critical software.

Formal methods can be used to prove that 2 different pieces of software are equivalent, but there could still be a bug hidden in both sides.

I think these tools are popular with mathematicians who haven't actually written much software.

When I worked at NASA, they had a whole protocol for writing mission critical software. There were lots of rules about how to write code so that it is easy to verify that there are no bugs, and it does what you expect.

They don't use formal verification.

Personally, my favourite tools for safety critical software are classic CS strategies.

Make every function as pure as it can be.

Reduce the number of possible states of the system as much as possible.

keep the namespace small.

For every loop, make a proof to show that it will exit in a reasonable amount of time.

I am not a fan of using formal methods for writing safety-critical software.

Formal methods can be used to prove that 2 different pieces of software are equivalent, but there could still be a bug hidden in both sides.

I think these tools are popular with mathematicians who haven't actually written much software.

When I worked at NASA, they had a whole protocol for writing mission critical software. There were lots of rules about how to write code so that it is easy to verify that there are no bugs, and it does what you expect.

They don't use formal verification.

Personally, my favourite tools for safety critical software are classic CS strategies.

Make every function as pure as it can be.

Reduce the number of possible states of the system as much as possible.

keep the namespace small.

For every loop, make a proof to show that it will exit in a reasonable amount of time.

20:06

I like the erlang strategies too.

Separating resources into small independent threads that do not share mutable state.

Fail-fast, let it crash.

Separating resources into small independent threads that do not share mutable state.

Fail-fast, let it crash.

J

20:06

Josh

a lot of category theory is about composing small state machines into bigger state machines

20:07

with different kinds of petri nets you can prove stuff about liveness, boundedness, etc

20:07

and petri nets can be modeled in category theory

Z

20:08

Zack

"category theory" is incredibly broad.

looks like statebox is about formal verification.

looks like statebox is about formal verification.

J

20:08

Josh

they started off with category theory, they seem to be branching off into formal verification and type theory

Z

20:09

Zack

In reply to this message

I don't see any telegram channel of theirs.

there is a way to contact an individual from their team on telegram.

there is a way to contact an individual from their team on telegram.

J

20:09

Josh

"If I have 2 matrices where the columns sum to 1, and I do matrix multiplication, the result is always another matrix where the columns sum to 1, right?" I'm not sure why this would be true.

20:09

do you mean the rows of the first matrix and the columns of the 2nd matrix sum to 1?

Z

20:10

Zack

In reply to this message

these kinds of matrices form a closed group under matrix multiplication. they are stochiastic matrices.

20:12

you can think of one of these matrices as a function that takes a probability vector to another probability vector.

So for example, 3 independent events. [0.5, 0.2, 0.3]

there is 50% odds of first, 20% of second, 30% of third.

a matrix could take this vector, and output some other probability vector like [0.1, 0.1, 0.8]

Each probability vector, the probabilities need to sum to 1, because the different possible outcomes are independent.

So for example, 3 independent events. [0.5, 0.2, 0.3]

there is 50% odds of first, 20% of second, 30% of third.

a matrix could take this vector, and output some other probability vector like [0.1, 0.1, 0.8]

Each probability vector, the probabilities need to sum to 1, because the different possible outcomes are independent.

20:13

the way to make sure that the input and output probability vectors both sum to 1 is if the matrix that transforms them, it needs columns that each sum to 1.

20:14

If one matrix preserves the property that the probability vector sums to 1, then using 2 of these matrices one after the other should also result in a probability vector that sums to 1.

20:14

so, if we multiply the 2 matrices together, we must result in another matrix with the same property. that it preserves the fact that the probability vector sums to 1.

20:15

so matrix multiplication between pairs of stochastic matrices must result in another stochastic matrix.

J

20:16

Josh

what if the first row of the first matrix is all 0s?

Z

20:16

Zack

but in the case of Amoveo, we aren't doing probability vectors. Instead the vector is for who has how much VEO. We want to conserve the total quantity of veo.

20:16

In reply to this message

it can still be left-stochastic.

left-stochastic means the columns sum to 1.

left-stochastic means the columns sum to 1.

20:18

This is pretty basic linear algebra, not very difficult or exciting.

but it is cool to see it appear in the wild.

but it is cool to see it appear in the wild.

J

20:19

Josh

it's been a while since i did this stuff, not immediately clear to me why it preserves that but i'd have to work through it

Z

20:20

Zack

since we are using left-stochastic matrix, the probability vector needs to be a column vector, not a row vector.

20:22

left-stochastic is preferable for us because we want to build a merkel tree based on the rows.

When you convert subcurrency from the resolved contract into subcurrencies in the new contract, you only need to use one row of the matrix.

So we want it to be convenient to build proofs based on the rows.

When you convert subcurrency from the resolved contract into subcurrencies in the new contract, you only need to use one row of the matrix.

So we want it to be convenient to build proofs based on the rows.

J

20:23

Josh

sounds like a cool application of these stochastic matrixes

Z

20:29

Zack

normally, if you have some subcurrency in contract A, and contract A resolved to B, and contract B resolved to C, and contract C resolved to veo so you can withdraw, it could take a lot of txs to withdraw your veo.

first you need to convert your subcurrency in A into one or more subcurrencies in B. (one Tx)

For each subcurrency you have in B, you convert it into one or more subcurrencies in C. (as many txs as there are subcurrencies in B)

For each subcurrency in C, you withdraw to veo. (as many txs as there are subcurrencies in C).

But if we do matrix multiplication, we can create a direct path from contract A to contract C.

so the process is shorter:

first you convert subcurrency A into one or more subcurrencies in C (one Tx)

then for each subcurrency you have in C, you withdraw to veo (as many txs as there are subcurrencies in C)

So maybe we should have a tx type to update resolved contract A to point to C instead of pointing to B.

first you need to convert your subcurrency in A into one or more subcurrencies in B. (one Tx)

For each subcurrency you have in B, you convert it into one or more subcurrencies in C. (as many txs as there are subcurrencies in B)

For each subcurrency in C, you withdraw to veo. (as many txs as there are subcurrencies in C).

But if we do matrix multiplication, we can create a direct path from contract A to contract C.

so the process is shorter:

first you convert subcurrency A into one or more subcurrencies in C (one Tx)

then for each subcurrency you have in C, you withdraw to veo (as many txs as there are subcurrencies in C)

So maybe we should have a tx type to update resolved contract A to point to C instead of pointing to B.

20:30

It is especially useful if A and C have few subcurrency types, and B has many subcurrency types.

or if the path has many more than three steps.

contract A could resolve to B could resolve to C, then D, E, F .... for dozens of steps.

or if the path has many more than three steps.

contract A could resolve to B could resolve to C, then D, E, F .... for dozens of steps.

20:34

Keeping the on-chain contracts immutable makes it a lot easier to build amoveo, to achieve scalability, to verify security.

but it means every time we do want to change a contract, we are creating a new contract on-chain, and the old one resolves to the new one.

So we want this process to be efficient.

but it means every time we do want to change a contract, we are creating a new contract on-chain, and the old one resolves to the new one.

So we want this process to be efficient.

B

21:12

Ben

in regards to the Usability, take any modern interface and compare it to amoveo, you will notice that amoveo is not easy to understand/navigate and use. If you doubt it, take a non Crypto user from your Family and ask them for feedback about the lightnode, you will see that they have no idea what it is all about.

Z

21:14

Zack

lets try to keep the criticism constructive.

If you have no idea on how to improve something, then complaining about it is not helpful.

If you have no idea on how to improve something, then complaining about it is not helpful.

B

21:15

Ben

as somone above mentioned, user expect something as frontend like the other oracle Implementations are offering.

Z

21:17

Zack

This is still not constructive.

You need to point to some specific change that you would like to see, and give reasoning for why you think that change would make the interface better.

You need to point to some specific change that you would like to see, and give reasoning for why you think that change would make the interface better.

B

21:19

Ben

could you give me the URL to the latest Version? will give you an example

Z

21:19

Zack

As far as I know, Amoveo is the only blockchain offering P2P derivative bets based on custom question text where you don't need to build the oracle on-chain, unless there is a disagreement about the outcome.

B

21:20

Ben

you don't get the point. it is not about the underlying Technology it is about the presentation Layer to the User.

21:21

i don't question Amoveo is superior in regards to oracle Technology

21:21

thats a given.

Z

21:21

Zack

it is an entirely different service than anyone else offers.

Not just the tech differs.

It is a different product.

Not just the tech differs.

It is a different product.

21:22

making a bet in an existing on-chain oracle-powered market is very different from a P2P bet on custom private text.

B

21:23

Ben

for example, the wallet part of the light node is pretty common in all blockchains, could you agree on that point?

21:23

if you compare modern wallets/webwallets to the lightnode you will recognize that is far harder for the user to understand what he is doing in your lightnode.

Z

21:24

Zack

Maybe I should take some time and look at other blockchain light nodes. haha

B

21:24

Ben

and since he is dealing with money, it should be cristal clear.

Z

B

21:26

Ben

take a look to other projects, maybe you will recognize something.

21:26

maybe also a question what your targeted usergroup is.

Z

B

21:27

Ben

if you only target "Blockchain Nerds" then you are all set.

Z

21:29

Zack

choosing a target demographic before you know the product you are selling is a recipe for failure.

MF

21:30

Mr Flintstone

something constructive: right now, the light node is like handing someone a blank ethereum blockchain and telling them they can do anythjng they want, they just need to build the smart contract themselves. Which is technically challenging. instead, people should be using applications built on top of the light wallet with preset smart contracts coded rather than create the contracts themselves

Z

21:31

Zack

In reply to this message

yes, that makes sense.

We need pages that have more pre-set defaults so there are fewer choices when doing popular things.

We need pages that have more pre-set defaults so there are fewer choices when doing popular things.

MF

21:31

Mr Flintstone

but i think this is the goal for this next update, as we discussed we would want to have USD stablecoins built in, which is like an application. and the user doesnt worry about the tricks underneath the UI that make 1 stablecoin = 1 dollar

B

21:31

Ben

btw. the amoveo wallet is pretty good in shaping your technology into a form that an average user can interact with it. maybe you should team up with the exantech guys.

Z

21:33

Zack

In reply to this message

yes, that seems like the right order.

* subcurrency update

* good stablecoin tools

* simple light node interface to use the stablecoin for contracts.

* subcurrency update

* good stablecoin tools

* simple light node interface to use the stablecoin for contracts.

B

21:36

Ben

👍 agree

J

3 July 2020

Z

02:36

Zack

One thing we can do is have contracts denominated in subcurrencies from other contracts.

Another thing we can do is to have a contract resolve into another contract.

Are these two things identical, as far as use-cases enabled, or do we need both?

Another thing we can do is to have a contract resolve into another contract.

Are these two things identical, as far as use-cases enabled, or do we need both?

Marcus Kain invited Marcus Kain

Z

02:41

Zack

I think we need (1) to make betting denominated in stablecoins convenient.

Otherwise we would need to bundle the bet denominated in stablecoins along with someone buying long-veo all in the same moment.

Otherwise we would need to bundle the bet denominated in stablecoins along with someone buying long-veo all in the same moment.

02:53

The advantage of (2) is that we can get rid of repetition in smart contract execution.

If 2 smart contracts share some code, that can be extracted into a 3rd smart contract that they both reference.

And we can have persistent contracts with permissions about who can make a new version. Which could be useful for domain name registries, or other non-finance use cases of blockchain.

And the smart contract can be updated in ways that had not been anticipated when it was first written.

And we can split up contract execution into multiple blocks, for very big contracts that don't fit into one tx.

And we can potentially keep more code off-chain.

If all the participants in a contract sell their subcurrency to one person, he can extract all the source currency from that contract, without actually having to execute it.

For example, the first contract might have 4 kinds of shares, but 2 kinds end up worthless, and the last 2 kinds are converted to a new contract.

If everyone with positive value subcurrency sells it to the same person, then the second contract never needs to be executed.

If 2 smart contracts share some code, that can be extracted into a 3rd smart contract that they both reference.

And we can have persistent contracts with permissions about who can make a new version. Which could be useful for domain name registries, or other non-finance use cases of blockchain.

And the smart contract can be updated in ways that had not been anticipated when it was first written.

And we can split up contract execution into multiple blocks, for very big contracts that don't fit into one tx.

And we can potentially keep more code off-chain.

If all the participants in a contract sell their subcurrency to one person, he can extract all the source currency from that contract, without actually having to execute it.

For example, the first contract might have 4 kinds of shares, but 2 kinds end up worthless, and the last 2 kinds are converted to a new contract.

If everyone with positive value subcurrency sells it to the same person, then the second contract never needs to be executed.

02:54

I think maybe this combination allows for everything you can do with ethereum, but with a couple benefits.

It is a stateless full node.

The contracts are immutable, which makes for an easier development environment with less bugs.

It is a stateless full node.

The contracts are immutable, which makes for an easier development environment with less bugs.

Deleted joined group by link from Group

Z

03:41

Zack

I found a big simplification for these matrices.

Lets say contract A resolves to contract B, and B resolves to veo, and lets say that both A and B have resolved.

When B resolves, there is a vector of how many veo each of the subcurrency types is awarded.

matrix AB converts a vector of ownership of veo in contract A into a vector of ownership of veo in contract B.

So if we calculate the inverse of AB -> (AB)^-1,

We can use this to go backwards.

We can convert the payout vector from contract B into a payout vector for contract A.

So now the users who own value in A, they can withdraw directly to veo without having to deal with contract B at all.

Lets say contract A resolves to contract B, and B resolves to veo, and lets say that both A and B have resolved.

When B resolves, there is a vector of how many veo each of the subcurrency types is awarded.

matrix AB converts a vector of ownership of veo in contract A into a vector of ownership of veo in contract B.

So if we calculate the inverse of AB -> (AB)^-1,

We can use this to go backwards.

We can convert the payout vector from contract B into a payout vector for contract A.

So now the users who own value in A, they can withdraw directly to veo without having to deal with contract B at all.

03:46

In reply to this message

if we use either strategy (1) or (2) for the same contract, lets compare how many txs we need on-chain.

A simple example with 2 steps: We start with veo, and we want to make a bet priced in stablecoins.

So with strategy (1), we first make a tx to convert the veo into stablecoins. then we make a tx to buy your side of the bet. a tx to sell your side of the bet, then we make a tx to convert the stablecoins back to veo. 4 txs total.

With strategy (2), you can use one tx to use your veo to participate in a bet where you can get paid stablecoins.

And as long as someone else does the tx that calculates the inverse of AB, you are able to withdraw directly to veo with a single tx. 2 txs total.

So this can reduce the number of txs on-chain, and it can reduce how many merkle proofs we need for our txs.

I think we should allow contracts to resolve to contracts.

A simple example with 2 steps: We start with veo, and we want to make a bet priced in stablecoins.

So with strategy (1), we first make a tx to convert the veo into stablecoins. then we make a tx to buy your side of the bet. a tx to sell your side of the bet, then we make a tx to convert the stablecoins back to veo. 4 txs total.

With strategy (2), you can use one tx to use your veo to participate in a bet where you can get paid stablecoins.

And as long as someone else does the tx that calculates the inverse of AB, you are able to withdraw directly to veo with a single tx. 2 txs total.

So this can reduce the number of txs on-chain, and it can reduce how many merkle proofs we need for our txs.

I think we should allow contracts to resolve to contracts.

03:50

oh, I think it isn't the inverse.

MF

03:51

if bitcoin drops to below 8200 at the end of the next 28 hours or so you get 50 veo, if not you lose 3.25 veo

03:52

the trade offer expires in 5 veo block which is about an hour

CD

03:55

Crypt Dweller

Nice, not gonna take it tho

Z

03:56

Zack

If you can make the Oracle lie, this is your chance to win 50 Veo.

MF

03:57

Mr Flintstone

whatever shitcoin your heart desires, i can do the same thing for

CD

03:57

Crypt Dweller

"it is an entirely different service than anyone else offers.

Not just the tech differs.

It is a different product."

Indeed. It's good that Amoveo is not lumped into the current DeFi bonanza, which is not going to end well. Amoveo stands apart from everything else. It either supersedes everything else on the market (unlikely) or dies a slow, quiet death (likely). Despite these odds, there are still very good reasons to stay interested in Amoveo and root for its success. What it is trying to accomplish is fundamentally different than DeFi, much grander.

Not just the tech differs.

It is a different product."

Indeed. It's good that Amoveo is not lumped into the current DeFi bonanza, which is not going to end well. Amoveo stands apart from everything else. It either supersedes everything else on the market (unlikely) or dies a slow, quiet death (likely). Despite these odds, there are still very good reasons to stay interested in Amoveo and root for its success. What it is trying to accomplish is fundamentally different than DeFi, much grander.

03:58

Amoveo is the only crypto project that I believe has actual value in it.

03:58

Aside from Bitcoin of course.

Z

03:59

50 Veo

MF

04:00

Mr Flintstone

in veo terms probably, maybe if we put 1000 veo on 2+2 =4 that one will be bigger

Deleted invited Deleted Account

Z

04:48

Zack

I figured it out.

Let S be the column vector of the subcurrencies you own in contract A.

Contract A uses matrix A to convert your subcurrencies into subcurrencies for contract B.

B goes to C, and C results in a payout row vector = C which converts subcurrencies into an integer value of how many Veo you own = V.

So the formula is

SABC = V.

Matrix multiplication is associative.

So the payout row vector for contract A is (ABC).

The payout row vector for contract B is (BC).

The matrix that takes subcurrencies from contract A to contract C is (AB).

Let S be the column vector of the subcurrencies you own in contract A.

Contract A uses matrix A to convert your subcurrencies into subcurrencies for contract B.

B goes to C, and C results in a payout row vector = C which converts subcurrencies into an integer value of how many Veo you own = V.

So the formula is

SABC = V.

Matrix multiplication is associative.

So the payout row vector for contract A is (ABC).

The payout row vector for contract B is (BC).

The matrix that takes subcurrencies from contract A to contract C is (AB).

MF

05:22

Mr Flintstone

In reply to this message

i refreshed this trade with the same terms. expires in 6 veo blocks

C

16:00

:P

s

16:20

I didn't see this before

Altpl invited Altpl

B

20:01

Ben

if you do so please give feedback if you think that the Lightnode Interface is sufficent.

Z

MF

23:10

the premium will be higher though

23:10

i got tired of making these trades manually so i wrote a bot to automatically generate these trade offers every so often, the last step is to push them to the website

s

23:19

sanket

awesome. is there a way someone can be notified of this trades?

MF

23:19

Mr Flintstone

hopefully in a day or so you'll just always be able to see btc -10% insurance available on the website

23:22

anyways

23:22

this ends on Jul 4 2020 as reported by coinmarketcap historical data. so it's about 32 hours or so

23:23

you win 50 veo if you're right, premium paid is 3.25 veo

23:23

also whenever i add a new underlying coin to the bot to buy insurance on i'll let this chat know

4 July 2020

B

00:14

Ben

the page is emtpy

MF

00:15

Mr Flintstone

yeah someone took the trade

00:15

i think

00:15

or it expired

B

00:19

Ben

so there is no history on that?

MF

00:19

it expired

Z

B

00:20

Ben

ok

MF

00:20

Mr Flintstone

these are all off chain offers until someone accepts

B

00:20

Ben

right

00:21

btw. usability enhancment: would be nice to say when this trade approx. would expire and maybe give a current block height as Indication.

MF

00:21

Mr Flintstone

yeah that makes sense

B

00:22

Ben

and to give it a bit more format and color, to avoid me getting goosbumps.

Z

B

00:22

Ben

perfect zack.

00:25

and maybe to visualize with some nice graphics what side you can take in this bet. that is all very cryptic.

Deleted invited Deleted Account

Z

05:24

Zack

Mr flintstone made the first trading bot.

This is a new era of amoveo.

AI algorithmic traders.

This is a new era of amoveo.

AI algorithmic traders.

Tauredunum invited Tauredunum

EA

11:50

Eric Arsenault

Zach have you looked at realit.io? Looks like Gnosis is using them as their oracle

Z

12:31

Zack

Looks like they tried to rebuild Amoveo's oracle in ethereum.

I think that doesn't work.

Amoveo is willing to fork over a bad question in a way that ethereum is not willing to.

They also support a bunch of other broken designs.

I think that doesn't work.

Amoveo is willing to fork over a bad question in a way that ethereum is not willing to.

They also support a bunch of other broken designs.

MF

12:34

Mr Flintstone

another issue is the ether will be valuable even if it comes from a dishonest report

12:35

i think this game degenerates into something like poker

12:35

but we will see

MF

13:10

Mr Flintstone

there should always be an offer for a bitcoin put option expiring between 24 and 48hrs from now with a strike of -10% on this page now:

http://159.89.87.58:8090/main.html

http://159.89.87.58:8090/main.html

13:11

it will pay out 10 veo

13:13

if you can figure out how to game the bot, you can win up to 50 veo

C

14:23

In reply to this message

just an opinion, I think make it lower like -5% (obv with lower rewards) would encourage participation more

MF

14:24

Mr Flintstone

sure, ill do a -5% one

14:26

strike is 8630

14:26

there will always be a -5% put option here

14:28

i think probably what makes sense in the future is to run the above page locally and load keys then just accept a trade with one click instead of the copy paste stuff you have to do now

C

14:41

Callum Wright

In reply to this message

is the reward decrease as time come closer or price get closer to strike?

MF

14:41

Mr Flintstone

how much you have to pay changes based on the time

14:42

since they would be anywhere between 24 and 48 hours, you have to pay more for one that lasts 48 hours vs one that lasts 24 hours. it will always keep the strike price about 5% below spot

C

14:43

Callum Wright

In reply to this message

yeah I mean like, instead of paying now for example, if I wait until price get below 8.9k in next 4 hours, let's say, is the reward gonna be less?

MF

14:43

Mr Flintstone

sorry

14:44

no the strike will go down, the reward will stay the same

14:44

so if bitcoin's at 8.9k youd still win 10 veo but the strike price would be 8455

14:45

these trade offers are constantly expiring and i am replacing them with fresh ones, so i can update the strike price

C

14:45

Callum Wright

I see

14:45

dumb question but the expiry time 121685 is in miliseconds?

MF

14:46

Mr Flintstone

block height

C

14:47

Callum Wright

oh yeah obvious, dumb question haha

14:47

ok understood how it works now, thanks

MF

14:49

Mr Flintstone

np it isnt very intuitive yet

C

16:11

Callum Wright

In reply to this message

How much does it cost your bot to keep generating channels like this?

Z

18:58

Zack

In reply to this message

Channel offers are off-chain. If no one accepts, then it costs him nothing.

He just leaves his browser open.

He just leaves his browser open.

Z

23:10

Zack

It seems like certain computations get exponentially more expensive if we increase the number of subcurrencies in a shareable contract.

So I guess we need some upper limit.

I guess ill make a governance variable for that.

So I guess we need some upper limit.

I guess ill make a governance variable for that.

5 July 2020

Z

01:03

Zack

I'm thinking when you withdraw winnings from a contract, if you own more than one subcurrency in that contract, maybe it should do them all in a single tx.

MF

01:57

Mr Flintstone

In reply to this message

also when you accept the trade, you should also simultaneously sign a channel close offer which gives you 99+% of the value in the channel. nobody would agree to this unless they were going to lose 100%, so as soon as the event happens and you win,the other party will close the channel to get some veo instead of losing it all, and your winnings will just show up in your pubkey balance without needing to do anything

01:57

i think this would mean you could get the user experience down to a 1 click on accept trade offer, and a fast settlement

mx

02:01

mr x

good thinking

mx

02:25

mr x

just copy every betting site by scraping the odds :P

MF

02:26

Mr Flintstone

you can offer better odds in theory

mx

02:26

mr x

yeah...

MF

02:26

Mr Flintstone

costs are way less

mx

02:30

mr x

binary events better for ui

02:30

because presigning

MF

02:33

Mr Flintstone

for stuff like cfd, you can do kind of take profits/ maybe stop loss too by integrating binary conditions and presigning with the scalar

Z

02:35

Zack

It is turing complete.

You could reference a different oracle that checks if the price ever crosses a limit.

You could reference a different oracle that checks if the price ever crosses a limit.

Deleted joined group by link from Group

MF

02:39

Mr Flintstone

In reply to this message

actually if you presign 99% for a scalar, you get your money out before the other side runs out of margin

02:39

that seems like a nice feature

02:42

maybe in the same block, you can make another transaction to get your exposure back, and make these atomic somehow?

Z

02:43

Zack

In reply to this message

Atomically connecting trades in single price batches is what we made that market tool for.

Deleted invited Deleted Account

6 July 2020

MF

04:05

Mr Flintstone

In reply to this message

now additional logic to the light wallet has been coded where when you accept a trade, it concurrently signs a channel close offer giving you 99% of the possible winnings and pushes this close offer to the trade explorer so it is public. next steps are to program the trade explorer to display these close channel offers for people who want to see them, and then after that, make the trade explorer local so you can with one click, enter a trade & sign a channel close so you don't have do anything in the case of winning or losing

mx

06:58

where code? 😇

MF

07:33

Mr Flintstone

i'm testing the part where the trade explorer hosts the sent channel close real quick, then ill put it on github

MF

09:26

Mr Flintstone

ok

09:27

so if you go into src/js/ folder, you can open up otc_listener2.html

09:29

when you load keys and then accept a trade, it pushes it the trade offer on-chain, then also signs and pushes a channel close offer so it is hosted by the trade explorer. if you hit go with a valid trade offer, if you wait a few seconds then click check balance you can see an unconfirmed negative balance.

09:30

the trade explorer UI doesnt show the channel close offer. but it is accessible by API pull, where you can put in your pubkey and find all the channel close offers addressed to you. but this step is only for specialists so regular users wont need to know about it

Z

MF

09:31

Mr Flintstone

you can see the lines where the channel close offer is pushed to the trade explorer here:

https://github.com/mr-pookenstein/light-node-amoveo-2/blob/master/src/js/otc_finisher2.js#L374

https://github.com/mr-pookenstein/light-node-amoveo-2/blob/master/src/js/otc_finisher2.js#L374

09:32

and you can see where an example API pull is done to pull any channel close offers hosted by the server:

https://github.com/mr-pookenstein/light-node-amoveo-2/blob/master/src/js/otc_finisher2.js#L382

https://github.com/mr-pookenstein/light-node-amoveo-2/blob/master/src/js/otc_finisher2.js#L382

09:33

now we are at the point where we can make the trade explorer run locally, then we have enough to just add a button to the trades to accept and everything happens automatically after that

MF

09:52

Mr Flintstone

there are some small offers up here

09:52

cost ~0.014 veo

mx

11:19

mr x

Ok accepted. My work is now done... :P

11:23

now bet explorer on same page...

11:24

autosync and balance update xD

11:25

and you start sucking the blood out of all internet betting sites

MF

11:45

Mr Flintstone

i think we can also create like a network of these explorers since the full nodes host them on startup. so as soon as you send your trade to one it is passed to all of them

11:46

then it would be funny if you put like an "undercut" button on the trades that copied it but at a better price and rebroadcast it to the network

11:50

you could also, when you broadcast a trade, pay someone else on-chain contingent on that trade getting matched into a block. so you are basically paying them for the service of getting your trade matched

11:50

trust free

MF

20:17

Mr Flintstone

sometime later today, i am going to work on making the explorer local

20:17

im thinking at first, something simple. like just copy and paste the code, and maybe do some kind of API pull?

20:18

i think it has all the stuff already to check if the trades are valid, and will remove expired trades with existing logi

20:18

logic

Z

20:18

Zack

you want the p2p explorer page to be a part of the light node?

MF

20:18

Mr Flintstone

yeah

20:18

oh wrong chat lol

20:18

but yeah

Z

20:18

Zack

sounds good

20:20

1) copy paste the javascript and html

2) add a link in the light node to the new page

3) teach the amoveo node to serve these new pages of js and html by adding them to the whitelist

4) update some api requests of the p2p server to use our new

2) add a link in the light node to the new page

3) teach the amoveo node to serve these new pages of js and html by adding them to the whitelist

4) update some api requests of the p2p server to use our new

request function instead of the old variable_get function.

MF

20:25

Mr Flintstone

yeah

7 July 2020

Deleted joined group by link from Group

MF

01:04

Mr Flintstone

im thinking, potentially we want some kind of update to the channel creation transaction that lets you make a channel offer, but the person accepting it can choose to only take some proportion of it instead of all of it.

MF

02:01

Mr Flintstone

In reply to this message

we can maybe consider this if the tools we’re building to simplify the ux get popular

mx

03:00

mr x

things starting to look like an order book :P

Z

MF

05:30

Mr Flintstone

yeah

MF

09:31

Mr Flintstone

maybe a “request for quote” button could be made on the trade explorer

09:32

where you just describe some kind of trade you want in simple english, and then it is broadcast to the network, and maybe a specialist will craft it for you and broadcast it back out.

Deleted invited Deleted Account

Z

22:03

Zack

im having a little trouble with these shareable contracts.

We have this tool to keep track of the total amount of veo going in and out of every block, to verify that no new veo comes from no-where.

I want this tool to be compatible with the shareable contracts.

So that means it needs to be able to scan these contracts and know how much veo is in them.

The difficulty is that we can have contracts priced in other contracts, and we can have contracts resolve into other contracts.

So given a handful of contract objects being used in a block, it isn't clear how much veo we should be assigning to each one.

We have this tool to keep track of the total amount of veo going in and out of every block, to verify that no new veo comes from no-where.

I want this tool to be compatible with the shareable contracts.

So that means it needs to be able to scan these contracts and know how much veo is in them.

The difficulty is that we can have contracts priced in other contracts, and we can have contracts resolve into other contracts.

So given a handful of contract objects being used in a block, it isn't clear how much veo we should be assigning to each one.

22:05

I guess any contract that can resolve into veo should have the total quantity of veo written on it, and it isn't complicated.

But what if that contract resolves into another un-resolved contract?

If I convert some type 1 subcurrency from the first contract into a few different kinds of subcurency in the second contract, what numbers should be written on the 2 contracts to keep track of how much total veo is being used?

But what if that contract resolves into another un-resolved contract?

If I convert some type 1 subcurrency from the first contract into a few different kinds of subcurency in the second contract, what numbers should be written on the 2 contracts to keep track of how much total veo is being used?

22:06

Seems like the solution is that as soon as the first contract resolves, we should change the volume_of_veo number on it to 0, and add all those veo to the volume_of_veo number on the second contract.

22:07

So what if we have a contract priced in a subcurrency? what number should we write for the volume?

I guess in this case, volume should indicate the total amount of subcurrency in that contract, and we should teach the checksum tool to count this kind of contract as if it owns zero veo.

I guess in this case, volume should indicate the total amount of subcurrency in that contract, and we should teach the checksum tool to count this kind of contract as if it owns zero veo.

MF

22:25

Mr Flintstone

couldnt you have all the child shareable contracts point to the on chain parent which just has the initial veo locked amount written

22:26

or like, contracts that are generated by other contracts point to the original one

Z

22:26

Zack

yeah, that is part of it

22:26

we need to handle all the cases

MF

22:27

Mr Flintstone

or i guess, since you can get veo out of one of the children without going all the way back to the parent, you need to manage that case

Z

22:27

Zack

a contract can either pay out the source currency it was made with, or it can payout in subcurrencies for another contract that has the same source currency.

22:28

if the source currency isn't veo, it can't pay out veo

Deleted invited Deleted Account

8 July 2020

Deleted invited Deleted Account

11:40

Deleted Account

Are there any write-ups available on the subcurrencies update?

MF

11:41

Mr Flintstone

In reply to this message

i finished doing this, so the trade explorer is local, and then you just accept the trade with one click after loading keys

11:41

and then it broadcasts the 99% channel close offer to the server and also puts the trade on chain

11:42

once you accept, you can see it show up in your unconfirmed balance

11:43

it sync automatically as well and refreshes the sync every 10 seconds i think

11:44

things to consider: if you dont have a pubkey, generate one and throw the private key in localstorage immediately so you dont have to sign in and you already have an account

11:45

probably also need some kind of verification that you actually want to accept the trade cuz its literally one click and its out at the moment

12:08

Deleted Account

Thanks

MF

12:10

Mr Flintstone

imagine you lock veo up in a special account for a month, and by locking it up you get to create 2 different transferable tokens. each token gets to claim the locked up veo at the end of the month in a proportion determined by some smart contract logic. so if you wanted to do like, a us dollar stablecoin, you would say in the smart contract language this token has a claim to $1 of value in the special account. and then the other token has claim to the lower of either total veo in the special account minus 1 dollar of veo, or 0. so then arbitrageurs should be willing to buy the token that has claim to $1 for very close to $1 provided appropriate collateralization. and if the token goes over $1, you can create more and sell them

12:11

i would imagine that if you were to collateralize these kinds of monthly maturity us dollar stablecoins with 7 to 8 times their value in veo, they would be pretty high quality

12:11

then since they are transferable, you can use them to create contracts and participate in betting, and they could be plugged directly into the trade explorer or amoveobook or w/e

12:13

you would need to use fungible tokens, so we would need to come up with some kind of standard to use, but probably weekly or monthly would be fine

12:14

what i described isnt the exact process but it is more or less a high level summary of my understanding of how subcurrencies will work

12:25

In reply to this message

localstorage could also be used to manage all of your position data when you accept a trade. so we could generate a list of your current positions on the page too.

12:26

and we can add a way to download it and re upload for backup

Z

9 July 2020

Deleted invited Deleted Account

G

04:02

Gregory

veoscan dead?

Z

04:02

Zack

yeah, it has been down for a while

G

04:03

Gregory

zack, do you have resources to buy food?

Z

04:05

Zack

my survival needs are secure.

G

04:06

Gregory

till the end?

aqua invited aqua

a

04:29

aqua

Hey

MF

07:20

Mr Flintstone

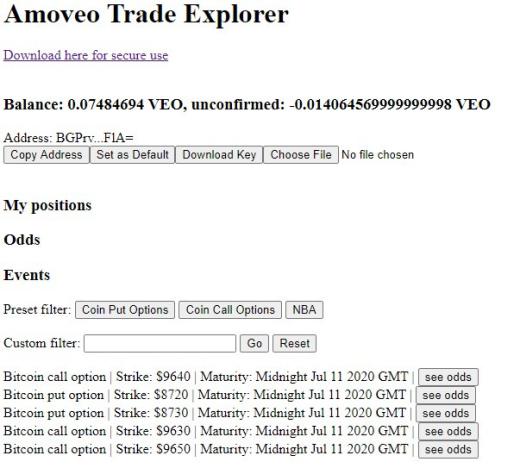

i pushed some updates to github, looks like this now. if bitcoin call or put options are formatted correctly in the oracle langauge, they show up like this now

Z

07:21

Zack

This is great

MF

07:21

Mr Flintstone

once you hit see odds, it tells you the odds, then you can accept in one click and it shows up in your unconfirmed balance by querying the node for the mempool

07:22

we still have some work to do on having the page automatically refresh the trades, and make sure you dont see trades that have already been taken

07:22

but it's geting there

07:23

also need to code some channel management stuff in localstorage but that isnt too hard

07:26

once that stuff is done, we can add in a "your current positions" section, then throw some css on it

mx

07:41

mr x

awesome

mx

08:22

mr x

might as well make it a wallet :P

Z

08:27

Zack

It's in his fork of the light node wallet

MF

08:29

Mr Flintstone

he means like add spends to it

Z

08:29

Zack

Oh right.

MF

10:03

Mr Flintstone

20 veo put option at strike of $8930 that matures in ~ 2 days is on the explorer

T

11:26

Topab

Very short and interesting. At the end, at all ends in Amoveo https://tonysheng.substack.com/p/unblocking-creative-output-with-technology

MF

11:56

Mr Flintstone

someone mentioned if there was a way to be notified of new trades

11:57

so maybe we can make a twitter bot

11:57

then if you want, you can turn notifications on

12:03

one interesting thing about this design is that since the offers are off chain, you aren't really capital constrained. you could for example take 50 veo and make 500 veo worth of offers in different bets. or more

Deleted invited Deleted Account

Z

Adept Proposal invited Adept Proposal

10 July 2020

CD

00:14

Crypt Dweller

Mr Flintstone is a god

00:26

This is like watching the birth of a new universe.. You guys are gonna make history

Deleted invited Deleted Account

K

04:48

K

Realistically speaking, a soft fork bribery attack could never work on a pos network as coin are distributed as stated in the Power Law theory

04:49

There will always be whales on the platform who will be extremely hard to bribe. It wont be cheaper than a centralized entity

04:50

Especially hard if people who are large holders are involved in dapps on the network

Z

04:50

Zack

In reply to this message

It is cheaper to bribe the validators who have the least stake.

So a power law distribution is less secure than if the validators each had the same amount of stake.

So a power law distribution is less secure than if the validators each had the same amount of stake.

04:50

You don't have to bribe the whales. Bribe all the guppies.

K

Z

04:51

Zack

Bribe the 51%who own less.

K

04:54

K

When pos networks grow, does the stake become more decentralized? Or is it always the same

Z

04:55

Zack

In reply to this message

I guess it depends on the network. I think some are hard coded to have a fixed number of validators, and others let anyone with more than some minimum balance participate as a validator

04:55

Also, not clear what "decentralized" means in this context.

K

Z

04:56

Zack

Better to talk about the relative level of trust.

K

04:56

K

So it will be easier to bribe relative to its size

Z

04:57

Zack

In reply to this message

That sounds reasonable. If more people are involved, then the typical person probably has less total control.

mx

05:54

mr x

system is centralized to the extent it is ruled by "voting" xD??

Z

06:10

Zack

It is not useful to think in terms of centralized/decentralized. Everyone has a different definition for what that means, and none of the definitions are useful for evaluating whether a cryptocurrency is likely to succeed.

It is much better to think in terms of trustful/secure, which has a formal definition based in mathematics, and is useful for assessing how likely a cryptocurrency is to be attacked. https://github.com/zack-bitcoin/amoveo-docs/blob/master/basics/trust_theory.md

It is much better to think in terms of trustful/secure, which has a formal definition based in mathematics, and is useful for assessing how likely a cryptocurrency is to be attacked. https://github.com/zack-bitcoin/amoveo-docs/blob/master/basics/trust_theory.md

Deleted joined group by link from Group

22:38

so there is a filter section now, so we can manage a high volume of Events very easily

22:39

next steps are to modify the backend logic so it can support options on any cryptocurrency

22:40

then ill have my bot basically create the entire vol surface for these coins (maybe top 100 on cmc?) i.e. all the strikes and maturities you can think of for the options, since we can easily filter

22:41

and then when thats ready, ill make the section that displays Odds and lets you accept trades more user friendly (sort, filter etc)

22:41

then build out the My positions section, to show you what you've already bet on

22:45

In reply to this message

though maybe will need to be more targeted cuz of bandwidth considerations. we will find out

mx

23:32

mr x

woah... when ui for bet operators :P

11 July 2020

MF

00:26

Mr Flintstone

In reply to this message

im trying to think what a good way to implement this is

00:27

the subcurrency update will make getting your winnings much simpler, since anyone can do it for you instead of just the person you signed a channel with currently

00:29

In reply to this message

probably at first some bet offer presets, and a way to aggregate your positions, and a way to manually report the outcome in the UI and it will settle any positions you have open

00:31

In reply to this message

once we are able to do this, we can also make it really easy to offer bets in the UI, and you dont need to worry about managing the settlement of positions if you dont want to

00:32

since you are also signing a trade offer for 99% of your stake in the bet, when you offer a bet. and whoever accepts, they are doing the same thing when they accept. and anyone can take these trade offers

00:36

shareable contracts are nice

00:37

i think itll be rly easy to update this UI as well once we have them

00:42

we could also have it be betting in USD instead of betting in VEO which is 10x better imo

Z

00:44

Zack

it might make more sense to swap USD for a contract who's resolution is priced in USD.

That way if the 2 USD's have different expirations, it still works.

That way if the 2 USD's have different expirations, it still works.

MF

01:20

Mr Flintstone

what kind of scheme could we use to pay the tx fees in usd

01:20

so an account doesnt need veo

01:20

i assume you would need to sell some in the same block to someone else for veo

01:20

economic abstraction would work except there are small amounts of veo burned per tx

Z

01:21

Zack

You can set the fee to zero, and have some agreement with the mining pool

01:22

Like, you pay the pool in stable USD for credits, and they reduce your credits when they include a tx.

MF

01:23

Mr Flintstone

i think maybe you can do it trust free, like a contract to pay the coinbase address of your block some usd?

Z

01:30

Zack

If you have a channel with the mining pool, it is possible.

MF

13:27

Mr Flintstone

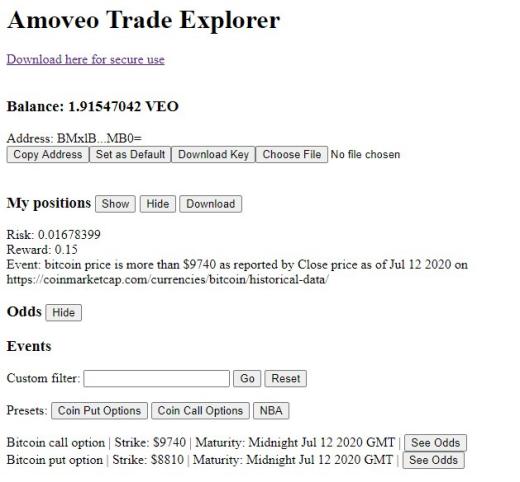

i pushed some updates to github.

https://github.com/mr-pookenstein/light-node-amoveo-2

now we have a My positions section which shows you what positions you have on-chain. it also doubles as a channel management feature, since you can download all the channel data associated with these positions.

https://github.com/mr-pookenstein/light-node-amoveo-2

now we have a My positions section which shows you what positions you have on-chain. it also doubles as a channel management feature, since you can download all the channel data associated with these positions.

13:27

it looks like this^^

13:29

next, a way to filter positions the same way as Events, and then a filter toggle on Odds to show only the best odds/minimum veo offered etc. as well as improving the presentation of the odds. and also add some expiration info for non-whitelisted oracles

Z

12 July 2020

MF

00:54

Mr Flintstone

i think it makes sense to add a button to My positions that shows all the channel close offers that have been addressed to you, with a button to accept next to each individual close offer. so it is easy for the bet operator to settle trades they have lost, and make a small amount of money back

01:01

probably, we can just add a button to the existing list of positions only if there is a channel close in the database addressed to your pubkey. it would let you settle the trade early if you lost, and in exchange pay you some veo. and then there can be a button to send another channel close offer as well

Z

01:02

Zack

that sounds good

Z

01:23

Zack

https://github.com/zack-bitcoin/amoveo-docs/blob/master/basics/trust_theory.md

This is the mathematical definition of security we are using to assess the oracle.

This is the mathematical definition of security we are using to assess the oracle.

MF

01:23

Mr Flintstone

In reply to this message

the amount of money riding on an oracle decision doesnt impact the accuracy of the oracle in amoveo. in many other oracle systems if enough money is at stake, incentives to provide accurate data by the oracle start falling apart

Z

01:24

Zack

if you use this method, you can calculate a number for how secure a tool is.

It gives a better number for the Amoveo oracle than any other I have reviewed.

It gives a better number for the Amoveo oracle than any other I have reviewed.

MF

01:24

Mr Flintstone

In reply to this message

an example is what happened with makerdao, when they froze their oracle to protect whales from being liquidated for pennies on the march 12 -50% day

01:25

but these kinds of oracle failures could lead to much more loss of money in the future

01:29

im not sure how much money is riding on link oracles at the moment

01:29

but yeah, there is a lot of money in maker

Z

01:31

Zack

Security and cost are different perspectives on one number.

If an Oracle is less secure, it is also more expensive to use.

https://github.com/zack-bitcoin/amoveo-docs/blob/master/design/consensus_efficiency.md

If an Oracle is less secure, it is also more expensive to use.

https://github.com/zack-bitcoin/amoveo-docs/blob/master/design/consensus_efficiency.md

MF

02:09

Mr Flintstone

lol someone took a 5 veo trade

Z

02:10

Zack

great

MF

02:11

Mr Flintstone

whoever that is plz tell me if the UI is bugging

02:13

it matures in ~30 hours

JS

Z

04:34

Zack

wasn't there a site, veomarkets?

They were trying this with an older version of channels.

They were trying this with an older version of channels.

MF

JS

04:45

Jon Snow

Were they also making the market? Or just created the order book to display others order?

04:45

I don’t remember now

Z

04:46

Zack

I think they wanted to do both.

but with the old channels we ran into serious liquidity issues. you had to lock up a ton of money to make the market work correctly.

but with the old channels we ran into serious liquidity issues. you had to lock up a ton of money to make the market work correctly.

04:46

maybe once the subcurrency update happens, then their website will be able to work

JS

04:47

Jon Snow

I see

Z

04:51

Zack

the channel offers stuff Mr Flinstone is working with is a partial solution.

but it is on-chain, so it has front running issues.

once the subcurrency update happens, we can have channels priced in shares of a smart contract, so we don't need to lock up anything extra in our contracts.

but it is on-chain, so it has front running issues.

once the subcurrency update happens, we can have channels priced in shares of a smart contract, so we don't need to lock up anything extra in our contracts.

JS

04:54

Jon Snow

When should we expect this update happens?

Z

04:55

Zack

its hard to know

K

05:17

K

Hypothetically, what happens if by chance blocks go a little too fast and a bet expires before anyone knows the true outcome?

MF

05:18

Mr Flintstone

we did this math earlier today haha

Z

05:18

Zack

I think for a length of time greater than like 30 blocks, it starts to look like a bell curve. and the standard deviation of that bell curve is sqrt(expected number of blocks).

MF

05:21

Mr Flintstone

so like, if there is an event in a week

05:22

making some assumptions (if a normal week is 1000 blocks, and hash rate is constant, etc) there is a 99.85% chance there will be fewer than ~1100 blocks

05:22

1000 + 3*sqrt(1000)

05:22

3 being # of st dev

05:23

i want to build this kind of oracle start time safety tolerance into the UI, so it tells you the 99.9% confidence for oracle start time

K

05:25

is there a way to extend the bet?

MF

05:26

Mr Flintstone

i suppose in the smart contract language you could say if oracle 1 returned bad question then use oracle 2 which is at a later date, and then in oracle 1's language you can be like "if some crazy shit happens with the blocks then return bad question"

05:27

but i think we can just add like 2 standard deviations and make it >99.99% or w/e instead

05:29

i wouldnt expect the oracle to be needed very frequently

05:29

anyhow

05:29

most trades should settle without the need for the oracle enforcement

Z

05:41

Zack

The Oracle process takes at least a week.

For only a small bet, you can extend this to two weeks.

The Oracle mechanism is a kind of betting mechanism.

For only a small bet, you can extend this to two weeks.

The Oracle mechanism is a kind of betting mechanism.

mx

05:50

mr x

stupid question: oracles must reference block height not real time?

Z

05:50

Zack

it is hard for the blockchain to enforce things about real time.

05:51

we can't trust the timestamps to be exactly right

mx

05:51

mr x

difficulty adjustment though?

MF

05:51

Mr Flintstone

currently you have to put a block height for the oracle start time

05:51

you can use the difficulty adjustment to have some level of certainty about the time x blocks in the future

mx

07:10

mr x

Isn't the settle early option only for cases where you lost?

MF

07:21

Mr Flintstone

yeah, its more like offer to settle early

07:21

if you didnt already sign a ctc

07:23

im not sure you should need that button tbh

mx

07:31

mr x

right

MF

13:55

Mr Flintstone

i think in order to build the settle early stuff into the UI, we should first have something to create new bets. so we could ensure there is always a channel close for either side, so they could both settle early.

MF

15:03

Mr Flintstone

i think it would be easier to have whitelisted oracle language across all kinds of assets with an oracle language scheme like this. "W = coinmarketcap.com; X = $10,000; Y = Bitcoin; Z = Jul 13 2020; return (price of Y is less than X as of Z as reported by W)"

15:04

so then, the language inside of the return statement could uniquely define a put

15:04

so we can have 1 standard per instrument type

15:09

"W = coinmarketcap.com; X1 = $10,000; X2 = $9000; Y = Bitcoin; Z = Jul 13 2020; return (price of Y is less than X1 and greater than X2 of Z as reported by W)"

15:09

this would be a strangle

15:10

it isnt really 1:1 since they arent technically options in the vanilla sense but you can get similar kinds of exposures using these "binary options"

15:12

"team X defeated team Y on date Z" is even easier

15:21

it would mean for the UX of creating bets, that you just select the instrument type, (coin option, sports bet etc), then fields to put in the the variables XYZ etc show up, and you hit go and the backend handles the rest

13 July 2020

mx

10:48

mr x

settle early not working?

MF

10:48

Mr Flintstone

i didnt put the code in yet

10:48

on github

10:48

like the backend

mx

10:49

mr x

ok

MF

10:49

Mr Flintstone

i built a Create tab already and then am now doing the ctc stuff on my positions, will push to github when thats ready. also changed the formatting of the coin options so you can do any coin you want

mx

10:51

mr x

ok cool

MF

11:50

Mr Flintstone

k

11:54

its in there

11:56

since we generalized the crypto options i also need to make it show what direction youre buying lol (true or false)

12:08

keep in mind, if you create a bet, you won't be able to automatically broadcast a 99% close until it's in a block, until we have the subcurrency update at least. since now you need the other person's pubkey in the ctc transaction. so i will put a button to send another 99% close if there isnt one on the server(s) youre connected to

MF

14:12

Mr Flintstone

added competitions to the trade creator

CD

15:13

Crypt Dweller

This is exciting. Don't forget to do your pullups and pushups today, Zack.

14 July 2020

mx

00:22

mr x

Lol I didn't realize i won xD

00:22

but yeah...

MF

00:22

Mr Flintstone

in amoveo everyone wins

mx

00:23

mr x

😅👍

00:24

your address?

MF

01:00

Mr Flintstone

dw

01:00

i think we should have a spend tab

01:00

like create, explore, send

01:01

then its basically a wallet

mx

01:06

mr x

yes

01:06

thats the mvp

01:07

and the whole publish oracle onchain and get your money out manually :P

MF

01:08

Mr Flintstone

yeah, in the worst case

01:08

at least for this iteration

mx

01:08

mr x

right

MF

01:09

Mr Flintstone

once we can share the contracts, it only takes one person to specialize in settling trades and the entire ecosystem can be supported

mx

01:09

mr x

really??

MF

01:09

Mr Flintstone

yeah

01:10

i basically buy the contract from you for 99%. and it gets transferred to me

mx

01:10

mr x

ohh

MF

01:10

Mr Flintstone

relatively risk free profit provided that you dont get hustled by a bad oracle question. but we can have tools to recognize the question is in a certain format i.e. you are safe

01:11

i still wouldnt expect many on chain oracles to be needed since the specialists can settle amongst each other as well. it would only be in the case where some risk owner truly disappeared

01:11

or there is an oracle dispute

mx

01:12

mr x

yea court system

01:13

like lightning except also oracles

01:13

or something

Z

01:23

Zack