Amoveo ♥🧿

Previous messages

Next messages

22 August 2020

MF

07:19

Mr Flintstone

Fork

ŽM

07:19

Živojin Mirić

But if majority supports it then its not false

07:20

Because that's the measure of truth

07:20

Truth is measured by the volume of money behind it?

Z

07:20

Zack

Sometimes the world at large believes false things.

ŽM

07:20

That's whats bothering me

Z

07:21

Zack

You can only bet on facts that have definition within some concrete narrative.

ŽM

07:21

Živojin Mirić

Ok whats not concrete with a result of a football match?

Z

07:21

Zack

We don't know almost anything directly.

We just believe what our tribe tells us to. We bet on that.

We just believe what our tribe tells us to. We bet on that.

ŽM

07:21

Živojin Mirić

That could not be simple enough

07:22

What will be the input to amoveo that my bet is the winning bet

Z

07:22

Zack

We can bet on what the tribe will tell us to believe.

That is the only reality available anyway.

That is the only reality available anyway.

ŽM

07:22

Živojin Mirić

If the opposing side has more money on the false result?

MF

07:23

Mr Flintstone

there will be a fork where you win

07:23

That is how the incentives are supposed to play out

ŽM

07:23

Živojin Mirić

And if im the only one that thinks that im correct

EA

07:23

Eric Arsenault

people will want to place bets on the truthful chain

ŽM

07:23

Živojin Mirić

I will be on my chain alone

07:23

Cursing god and the sky

07:23

Knowing the truth

07:24

But betrayed

MF

07:24

Mr Flintstone

sounds like you need to be good at knowing things that are correct in order to participate in amoveo

ŽM

07:24

Živojin Mirić

I know something is correct

MF

07:24

Mr Flintstone

a high bar

ŽM

07:24

Živojin Mirić

And most of people conspire

07:24

To bet against me

07:24

And I lose

07:24

They get the money

07:24

My fork is a lonely fork

07:25

And I kill myself because lies took my money

07:25

And that's ok

MF

07:25

Mr Flintstone

if your fork is a lonely fork sounds like you need to do a better job of understanding who won a football game

ŽM

07:25

Živojin Mirić

The result is clear

Z

07:25

Zack

The past is gone. We can't know what really happened.

Anyway, oracles arent about the past.

They are for the future.

We can use markets and oracles to reveal true facts about the future. To help us prepare for the future.

You can't control the narrative of the past.

Anyway, oracles arent about the past.

They are for the future.

We can use markets and oracles to reveal true facts about the future. To help us prepare for the future.

You can't control the narrative of the past.

ŽM

07:26

Živojin Mirić

In reply to this message

Ok I will skip a couple of arguments to get to the point

Z

07:26

Zack

But you can gain information to prepare for the future

ŽM

07:26

Živojin Mirić

If I bet on an universl truth

07:27

For example some pyhsics rule that works in our whole known universe

07:27

And someone bets that its not true

07:28

And puts a lot of money in that false claim

07:28

Amoveo will claim thats true

07:28

And I should make a fork and count on people to support me

07:28

???

MF

07:28

Mr Flintstone

you probably wouldnt need to

07:29

a very large bet on something false is an opportunity for someone to double their money, and more people would come bet on the truth

07:29

it takes 1 week to finalize so that should be enough time to spread the news

ŽM

07:29

Živojin Mirić

I dont care about probability, when Zack was talking about PoS corruption vulnerability it was in the same scope of possibilities as this

07:30

Who will know the truth?

07:30

Where is the exact border of truth and reality

07:31

It only matters on who has more money to spread their "truth"

MF

07:31

Mr Flintstone

when you are betting on amoveo, it is closer to betting on what a community believes is true versus what is actually true

ŽM

07:31

Živojin Mirić

So its not an Oracle

07:31

Its just a cult

07:31

You depend on a community of PEOPLE that are flawed by nature

EA

07:31

Eric Arsenault

all of the oracle solution are like that... did you follow the bet on Omen that got escalated?

ŽM

07:32

Živojin Mirić

I dont care, I care about amoveo

07:32

I though this is based on math not on feelings of a group of people

MF

07:33

Mr Flintstone

you dont have to believe the arguments

07:34

if there are market prices for things enforced by amoveo oracles, then the market is saying the amoveo oracles probably work

ŽM

07:34

Živojin Mirić

I would be persuaded by real arguments

07:34

You are talking about feelings and community

07:34

And those are flawed by definition

MF

07:35

Mr Flintstone

If that is true we wont be able to have things priced well, since at the end of the day things are priced based on what the oracle reports

EA

07:35

Eric Arsenault

oracles depend on some form of reporting. software couldn't tell us who won a game.

ŽM

07:35

Živojin Mirić

In that world Galileo would never be right

MF

07:35

Mr Flintstone

but we will find out shortly if we can have well priced subcurrencies

ŽM

07:35

Živojin Mirić

You are skipping ahead

JS

ŽM

07:35

Živojin Mirić

I dont care about that

MF

07:36

Mr Flintstone

you dont care if it works?

07:36

like that is evidence it works

ŽM

07:36

Živojin Mirić

What is evidence? Most people bet on something so it must be true?

07:36

Thats no evidence

MF

07:37

Mr Flintstone

evidence is building stablecoins off of the amoveo oracle

07:37

that it works

07:37

if they hold their value

ŽM

07:37

Živojin Mirić

Lets not advance this to stablecoins

07:38

We still did not pass fundamental stuff

07:38

And you skipped it

JS

07:38

Jon Snow

In reply to this message

Philosophically, truth is truth is people perceived it as truth. There will never be an ultimate god like judge yo tell you the absolute truth. Like if most people believe earth is flat, it is the “truth” at that moment.

EA

07:39

and more people will place bets on the chain that is committed to the truth, which will make that chain's VEO more valuable

07:40

If someone bets a ton of money on a falsehood, it's a huge incentive for everyone else to report truthfully, it's free money

ŽM

07:42

Živojin Mirić

In reply to this message

So whats the fucking point in this? You could cement the world in shit truths that most people believe, its not liberating humans its enabling domination of shit ideologies that have the ability to convince most of the resources to back their "truth'

Amoveo is then a backwards oriented tech that wants to throw humanity back to the darj ages?

Amoveo is then a backwards oriented tech that wants to throw humanity back to the darj ages?

07:42

Thats what im asking

07:43

If people had amoveo to decide whats truth in the old times then for example Galileo would never be considered as true

EA

07:44

Eric Arsenault

So don’t ask that kind of question

ŽM

07:44

Živojin Mirić

Its by default encouraging sheep to follow known "facts" and not real truth

07:44

Any question should be asked

MF

07:45

Mr Flintstone

No, amoveo is not good for any question

ŽM

EA

07:45

Eric Arsenault

It’s a protocol for derivatives

ŽM

07:45

Živojin Mirić

Lets get back to the first queation

07:45

Who won the match?

07:45

How can you know? How does amoveo know?

JS

07:45

Jon Snow

In reply to this message

It is not a “truth god”, but it is enough for financial derivatives

ŽM

07:46

Živojin Mirić

Then its succeptible to manipulation and corruption

07:46

As any

07:46

And especially if there is money to be made

07:46

You count on the honesty of the community to decide whats true?

JS

EA

07:47

Eric Arsenault

Not only honesty, there is money to be made to report the truth

ŽM

07:48

Živojin Mirić

Why do you think so? You presume that human beings care more about whats true than to make money?

JS

07:48

Jon Snow

In reply to this message

We are counting on people likes making money that losing money

07:48

Not count on their integrity

ŽM

07:49

Please elaborate

JS

07:51

Jon Snow

Which part is not comprehensible

ŽM

07:51

Živojin Mirić

I am a low hanging fruit waiting to be convinced but you all are not succeding, I am not an official measurment but it's a bit dissapointing

07:51

I though that I just am not understanding somethibg simple

07:51

But it seems not to be true

JS

07:51

Jon Snow

Let’s maybe start with your football match example

ŽM

07:51

Živojin Mirić

If only an Oracle could help us

07:52

Oh nooo

JS

07:52

Jon Snow

If the match has clear winner

07:52

Then people is incentivized to bet on the true result than the false one

ŽM

07:53

Živojin Mirić

Why are they incentivized? Because you say so?

07:53

Thats the missing link

JS

07:53

Jon Snow

In a scenario that you proposed that someone really wants to promote the false results

ŽM

07:53

Živojin Mirić

How do you know and predict what will people want to bet on?

07:54

They are people after all

07:54

Where is the math where is the fail safe where is 1= true

07:54

Oh a fork

07:54

Thx

07:54

Not good enough

JS

07:55

Jon Snow

But fork comes with cost

07:55

First you need to convince people that the forked false universe will be more valuable

ŽM

07:56

Živojin Mirić

I dont have to convince anyone i have the money

07:56

I win

07:56

If its 10$

07:56

Ok I still win

JS

07:56

Jon Snow

That’s betting on more people would like to use the wrong chain than the truth chain

EA

07:56

Eric Arsenault

Nobody will use your false chain

ŽM

EA

07:56

Eric Arsenault

You might have money, but you are one person, most people would use truthful one

ŽM

07:56

Živojin Mirić

Are you god?

JS

07:57

Jon Snow

In reply to this message

Exactly, if people knows the truth, you don’t need to convince anyone because people knows what is true

ŽM

07:57

Živojin Mirić

So amoveo is based on naivety of good hearted people that care about the "truth"?

EA

07:57

Eric Arsenault

If you are betting on derivatives, you want to use the truthful chain

JS

ŽM

07:57

Živojin Mirić

I see why Zack wanted this to be a cult now

EA

07:58

Eric Arsenault

its in everyones best interest to report the truth, and follow the chain that has the truth

07:58

Those are the incentives

ŽM

07:58

Živojin Mirić

So Oracle is not a real Oracle it just chooses to go with the option that hkas the most money on it? And the automatically claims that's the truth?

JS

07:58

Jon Snow

Here truth means security of your money, supporting false result means you want to bet your money that more people will think the “false” is true

ŽM

07:59

Živojin Mirić

So its a popularity contest....

EA

07:59

Eric Arsenault

sure

JS

ŽM

08:00

Živojin Mirić

We have numerous example in real life where marketing and apperances win or make a "truth out of no where '

JS

Z

08:00

Zack

Remember the ethereum dao incident?

Since the money was locked up so long, they could do a hard update to prevent it getting stolen.

Amoveo's oracle is slow on purpose. So we can do this if we need to.

So the defenders will always double their money, and the attacker will lose.

Since the money was locked up so long, they could do a hard update to prevent it getting stolen.

Amoveo's oracle is slow on purpose. So we can do this if we need to.

So the defenders will always double their money, and the attacker will lose.

ŽM

08:00

Živojin Mirić

So amoveo is just technically suporting then

08:00

Not really caring about the real teuth

08:01

Amoveo is a marketing tool

08:01

At its core

mx

08:01

mr x

Oracles arent that difficult. Just make them slow so that in worst case hard fork abusers money.

ŽM

08:01

Živojin Mirić

Good PR = truth = money

JS

08:01

Jon Snow

In reply to this message

I think the current marketing status of Amoveo can basically prove it is not a marketing tool lol

ŽM

08:02

Živojin Mirić

It is fundamentally

Z

08:02

Zack

In reply to this message

That is half of it.

You also need the escalation mechanism, to control the volume of hard forks we need to do.

You also need the escalation mechanism, to control the volume of hard forks we need to do.

JS

08:02

Jon Snow

In reply to this message

You cannot use good PR to convince people a different result of a football match

mx

08:02

mr x

yes

ŽM

MF

08:03

Mr Flintstone

Everyone knows who won a game

ŽM

08:03

You are naive

08:03

Thats not how the world works

08:03

People know shit

JS

08:03

Jon Snow

In reply to this message

Because if you believe that PR, you might lose you money if you just blindly believe it

Z

08:03

Zack

The entire institution depends on reliably agreeing on the results of games. They have many regulations in place for that reason.

JS

ŽM

08:04

Živojin Mirić

In reply to this message

Ok but whats the connection between a trusted institution and amoveo? Flawed human users?

08:04

There is a missing link

08:04

And thats no Oracle

Z

08:05

Zack

People are incentivized to hold the side that reports more honestly

ŽM

08:05

Živojin Mirić

Why di you think so?

Z

08:05

Zack

So it will have a higher value and more hashpower

ŽM

08:05

Živojin Mirić

What if an unhonest report brings more money?

Z

08:06

Zack

If it is too much money to respond to in less than a week, we can do a soft fork to prevent them from winning, and prevent them from increasing their bet, so we have enough time to gather the money to win.

ŽM

08:07

Živojin Mirić

Why would you do that? The system is flawd so a "supreme guardian" should manipulate it to it's will?

Z

08:08

Zack

I am incentivized to make nodes that follow the main chain

ŽM

08:08

Živojin Mirić

Ok you are incentivized with money but you are also a flawed human, money does not equal truth

JS

08:12

Jon Snow

In reply to this message

Yes, you can also incentivized by other stuff like your believes, but monetary incentives I guess for now is the only incentive that we can trust that will work on most people

ŽM

08:13

Živojin Mirić

In reply to this message

Ok so you are enabling people in a current finite world that have lots of existing money in certain ratios to strengthen their position and sponsor their "truths" merely because they have money

08:14

More money - > more true?

08:15

Amoveo is a monopoly enabler

08:15

Truth is irrelevant

08:15

??

08:16

I'm going to sleep now but looking forward to continue tonmorrow

08:16

I am eager to realize that I'm wrong

08:16

Honestly

MF

08:16

Mr Flintstone

Just because you have more money does not mean you can make one fork worth more than another without it being extremely expensive

08:17

the cost would be higher than any money you could expect to win from a bet

JS

08:18

Jon Snow

In reply to this message

They are not sponsoring “truth” without risk. If they have a lot of veo and sponsor an incorrect result, they are risking their money in a way such that their money could worth much less in the forked “untrue” universe.

D

09:55

Devender

In reply to this message

Okay. @zack_amoveo new future request after reading BS comments of this person

For every bet, the oracle will convert to a truthful human and will go and check the truth and report that truth. So mr oracle will save us from all false reporters. 😂

For every bet, the oracle will convert to a truthful human and will go and check the truth and report that truth. So mr oracle will save us from all false reporters. 😂

09:58

In reply to this message

I know a feature that can fix your pain.

Oracle will convert to a human (let's say Mr. Oracle) and will go and check the truth himself/herself and report it to the oracle (it's the coding version)

For example, it will go and watch a football match so that it knows the truth.

Oracle will convert to a human (let's say Mr. Oracle) and will go and check the truth himself/herself and report it to the oracle (it's the coding version)

For example, it will go and watch a football match so that it knows the truth.

09:58

😂

Deleted invited Deleted Account

ŽM

15:25

Živojin Mirić

In reply to this message

I don't know you and you better stop because I will bet that you do not exist

D

ŽM

15:26

Živojin Mirić

Dont know

15:26

The ORACLE will know

D

ŽM

15:27

Živojin Mirić

If I put a lot of money you must cease to exist!

D

15:28

Devender

Ah others can see my message and they can vote for my existence unless you buy them all 😟

ŽM

15:28

Živojin Mirić

Yes

15:29

Same as PoS

15:29

Depends on others and the fact if they are bribed or not

I

15:46

Instinct

People are always vulnerable to bribery. You cannot change that. Amoveo’s system makes it transparent - you can see if big money is trying to change a decision & therefore choose to bet against or exclude them by not using their side after the fork.

If a company buys up a lot of Veo to try to sway decisions, they end up risking all that capital in front of the whole community on a lie. They would have no users on that side of the fork unless they simultaneously bribed the majority of Amoveo holders. And even then it would only be a once off solution, people wouldn’t be incentivised to keep using a derivatives chain that is corrupt

If a company buys up a lot of Veo to try to sway decisions, they end up risking all that capital in front of the whole community on a lie. They would have no users on that side of the fork unless they simultaneously bribed the majority of Amoveo holders. And even then it would only be a once off solution, people wouldn’t be incentivised to keep using a derivatives chain that is corrupt

EA

16:13

Eric Arsenault

@ShakaRAMa maybe you can try to attack Amoveo once the update is live, if you are successful, I think you proved your point

16:13

Even in bitcoin, if someone has enough money, they can print money for themselves

16:14

In Amoveo, it will get increasingly expensive to do so as network grows

ŽM

16:14

Živojin Mirić

In reply to this message

Thats the exact thing I told Zack to do when he criticized other chains

16:15

So it has same fundamental flaws it relies on users and their feelings

I

16:18

Instinct

It doesn’t make economic sense to force decisions on Amoveo. Simple as that. No feelings involved

ŽM

16:31

Živojin Mirić

Ok, I want to believe you but am still not convinced so if we could go through an example, it may be flawed in some way because I'm writing it in a hurry but I think you'll understand what I'm asking

There's a bet that team A will win a football match, someone comes and puts a sum of money on team B and now people see that and double down on A because I don't know that team is really strong IRL

Now the amount of money on team A is worth enough for some wealthy malicious actor to put x100 of money on to team B winning just before the bet settles and he takes everything goes to the exchange sells for some other crypto and he bullied his way to take money from others and the only defense is that people will fork veo where team A won because that happened IRL but at that time the attacker already won and doesn't care about the "true" chain anymore

the thing bothering me is that it seems to me that the oracle is just really equal to "more money = true"

There's a bet that team A will win a football match, someone comes and puts a sum of money on team B and now people see that and double down on A because I don't know that team is really strong IRL

Now the amount of money on team A is worth enough for some wealthy malicious actor to put x100 of money on to team B winning just before the bet settles and he takes everything goes to the exchange sells for some other crypto and he bullied his way to take money from others and the only defense is that people will fork veo where team A won because that happened IRL but at that time the attacker already won and doesn't care about the "true" chain anymore

the thing bothering me is that it seems to me that the oracle is just really equal to "more money = true"

Z

16:33

Zack

In reply to this message

If someone puts a bunch of money in the Oracle to change it from being in one state to another, that resets the timer.

So we have another week to make counter-reports in the Oracle.

So we have another week to make counter-reports in the Oracle.

16:34

The betting mechanism is there to limit the rate at which we need to do fork-level oracle resolutions.

the betting mechanism doesn't determine the outcome, it is more like an anti-spam mechanism.

the betting mechanism doesn't determine the outcome, it is more like an anti-spam mechanism.

ŽM

16:36

Živojin Mirić

ok but for example you as the biggest veo whale could still bully it

Z

16:36

Zack

You wish.

16:37

Then you could double your Veo

ŽM

16:37

Živojin Mirić

how if you have more money?

Z

16:37

Zack

The community can follow the version with less money, if they do a fork level decision.

ŽM

16:38

Živojin Mirić

yeah but the bet settles in the meantime and the whale attacker takes the money and exchanges it to something else and he doesn't care about veo forks anymore

J

16:39

Josh

think of it as trying to manipulate a company's stock price by starting a whole new exchange and getting everybody to start using that one instead of NYSE.

Z

ŽM

16:53

Živojin Mirić

In reply to this message

the bet settles before community forks veo is still on exchanges he transfers his winnings and its game over

Z

16:54

Zack

In reply to this message

The Oracle is delayed till after the fork.

The bet contracts I wrote won't settle until the Oracle does, so they settle after the fork as well.

The bet contracts I wrote won't settle until the Oracle does, so they settle after the fork as well.

ŽM

16:54

Živojin Mirić

In reply to this message

same goes in your direction think of it there is a fraud detected in stock market you say the solution is to make a new stock market

Z

16:58

Zack

All blockchains need programmers maintaining it.

If both sides of a fork succeed, like the bitcoin cash fork, that means there are programmers on both sides.

If both sides of a fork succeed, like the bitcoin cash fork, that means there are programmers on both sides.

16:59

Software doesn't just exist. It is constantly rotting as the world around it changes

Z

17:26

Zack

https://github.com/zack-bitcoin/amoveo/pull/274

I set up the pull request for the subcurrency update.

So now it is easy to see exactly what lines are being changed for this update.

I set up the pull request for the subcurrency update.

So now it is easy to see exactly what lines are being changed for this update.

B

17:30

Ben

Zivojin has a valid point, i the current state veo is. basically the amount of people who could fork veo is less then a handfull so i would also say that currently the attacker is huge in favor. And since you could fork veo at any time or just bet against the Version you don't like with the biggest bag out there, that is an even bigger threat.

17:31

if veo attract a good spread community at some point, i guess "the Truth" has a better chance to win against a mailcious actor.

Z

17:32

Zack

In reply to this message

probably the most important part to review, if you want to review changes, is the records.hrl file.

This shows the format for the new datastructures.

This shows the format for the new datastructures.

D

17:42

What's the solution according to you?

ŽM

17:43

Živojin Mirić

I have no solution

17:44

Thats not the point

D

17:44

Devender

Great

I

17:45

Instinct

In reply to this message

It wouldn’t be hard to bring it to the community’s attention in here & people would then take the free money by betting on the truthful side

17:45

No need for the fork escalation

J

17:54

Josh

might be the best marketing we could get

17:56

we should put up a bunch of bets like "the earth is flat", "hillary clinton won the 2016 presidential elections"

D

17:57

Devender

And let earth flat gang bet of it 😅

Deleted invited Deleted Account

B

Z

18:40

Zack

you can't ask the oracle if the world is flat.

You can ask about some public body's official opinion on whether the earth is flat.

You could ask whether some particular scientist will announce that they believe the earth is flat.

You can ask about some public body's official opinion on whether the earth is flat.

You could ask whether some particular scientist will announce that they believe the earth is flat.

Z

20:14

Zack

I guess ill merge the hard update into the master branch for 2 weeks from now

20:14

it has a lot of testing now

20:15

As long as you don't put money into the new contracts, you will be safe if they break.

20:15

So updating sooner means we can start trying it out with real money sooner, and the risk is minimized.

20:17

I merged it

20:19

This is the announcement for hard update 32. The subcurrency hard update.

It activates at block 130300, in about 2 weeks.

even though it is #32, if you scan properly updated nodes they will say #34.

Nodes that need to be updated will say #33 or lower.

Here is the instructions related to updating https://github.com/zack-bitcoin/amoveo-docs/blob/master//getting-started/updating.md

It activates at block 130300, in about 2 weeks.

even though it is #32, if you scan properly updated nodes they will say #34.

Nodes that need to be updated will say #33 or lower.

Here is the instructions related to updating https://github.com/zack-bitcoin/amoveo-docs/blob/master//getting-started/updating.md

20:32

http://159.89.87.58:8080/peer_scan.html here you can see a list of which nodes updated.

MF

Z

20:41

Zack

there is nothing to try out for 2 weeks though

20:41

I guess researchers might be interested in looking at the new smart contract system now that it is stable

MF

20:42

Mr Flintstone

I think exchanges etc need to update

20:42

i.e. qtrade

Z

20:42

Zack

I maintain a list of who to contact for each update

MF

20:42

Mr Flintstone

Oh cool

Z

Rafi F invited Rafi F

Z

21:21

Zack

https://github.com/zack-bitcoin/amoveo/tree/amm I set up this other branch for making the AMM

21:21

I wrote the merkle tree to store the markets.

MF

21:35

You need to close it in order to settle contracts iirc

Z

22:33

Zack

I started writing the tx types in the AMM branch

22:48

should their be a fee for depositing coins to get liquidity shares? or for despoting the shares to get your coins back?

We would use this fee to pay the other liquidity shares holders.

We would use this fee to pay the other liquidity shares holders.

s

23:13

sanket

In reply to this message

I guess it should be the 2nd. That way people will provide liquidity first

23:13

and if you remove it, you pay a fee

MF

23:27

Mr Flintstone

maybe we can have no fee for LP?

23:28

would there be an issue with that?

Z

23:28

Zack

every tx still has a governance fee, and a miner fee.

The question we are talking about now is whether the market_liquidity_tx should have a fee that is used to pay holders of other liquidity shares.

The question we are talking about now is whether the market_liquidity_tx should have a fee that is used to pay holders of other liquidity shares.

S

23:48

Sebsebzen

Are there any open DAC’s at the moment?

23:49

From Exan for example

Z

23:49

Zack

I think there are none right now

23 August 2020

Deleted invited Deleted Account

CD

01:10

Crypt Dweller

Zivojin does have a valid point; as Zack pointed out, it's essentially the same concern that Paul had. And Paul is a very intelligent person. The oracle depends on game theory, as does Bitcoin. I don't really see how it's any more vulnerable to corruption than Bitcoin was in the early years. These are not some omniscient unbreakable technologies. They can definitely be exploited but the game theory and money incentives militate against it quite strongly. Some people seem to want a godlike Oracle that can divine absolute or objective truth, but that stems from a flawed understanding that such truth exists, and if it does, can be articulated in yes/no answers.

01:11

We want Amoveo to be a pragmatic technology for trustless derivatives, not some religious cult.

01:13

If wealthy malicious actors think they can compromise Amoveo and take people's money, then please by all means do so. It would be awesome to see how it responds to a real world test like that.

EA

Z

02:21

Zack

Their documentation is kind of long.

Constant multiple market makers seem pretty simple.

Constant multiple market makers seem pretty simple.

02:22

Paul sztorc has this idea that every market should be single threaded.

Like, every trade should say the exact state of the market before that trade gets executed.

Like, every trade should say the exact state of the market before that trade gets executed.

MF

Z

02:23

Zack

It solves a lot of front running issues, but isn't as scalable.

But we are pairing this system with the subcurrency swap mechanism and channels for 2nd layer markets, so maybe in this context it is a good tradeoff.

But we are pairing this system with the subcurrency swap mechanism and channels for 2nd layer markets, so maybe in this context it is a good tradeoff.

MF

02:24

Mr Flintstone

why not just specify a max slippage

Z

02:24

Zack

I'll review their docs again as I make the new txs

MF

Z

02:25

Zack

In reply to this message

There are weird attacks, like dropping a tx and purposefully processing others first, to force that user to re-make the tx at a higher price.

02:25

And it isn't so good letting miners take all the value between the market price and the limit price.

02:26

Each market can be a different thread in parallel.

MF

02:26

Mr Flintstone

they can still front run you, they just need to leave enough liquidity for your order to execute with max slippage

Z

02:26

Zack

It's just, it will get expensive to get a trade into a popular market.

MF

02:26

Mr Flintstone

they dont seem to have any issue with this strategy but i am not constantly using uniswap so maybe someone who does can chime in

02:28

if the drawbacks of using a max slippage model were significant we would see single threaded AMMs be popular on ethereum but there arent any

02:29

at least that i am aware of

02:29

idk, i wonder how frequently trades fail on uniswap in the current model

EA

03:13

Eric Arsenault

I don’t think it’s a big issue unless you set your gas really low

JS

Z

04:19

Zack

I think Pauls idea to have single threaded markets isn't good.

If different full nodes have contradictory trades in their mempools, it gets really complicated.

A trader would want to publish a different trade to each mining pool.

If different full nodes have contradictory trades in their mempools, it gets really complicated.

A trader would want to publish a different trade to each mining pool.

Z

04:37

Zack

Every time some other miner found a block, it would invalidate everything that they didn't include as well

Z

11:03

Zack

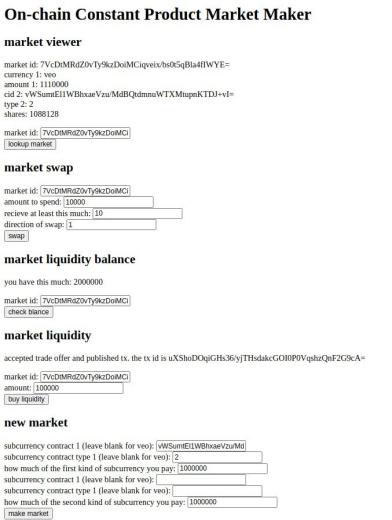

I wrote the first draft of the tx types for the AMM, the on-chain market maker.

MF

11:31

Mr Flintstone

nice, 500 lines of code

11:35

can you specify max slippage for a market order somewhere in here?

JS

Z

11:42

https://github.com/zack-bitcoin/amoveo/blob/amm/apps/amoveo_core/src/consensus/txs/market_swap_tx.erl#L14 this is the minimum amount you need to get for it to be a valid tx

11:42

https://github.com/zack-bitcoin/amoveo/blob/amm/apps/amoveo_core/src/consensus/txs/market_swap_tx.erl#L46 here we enforce it for one case

EA

11:45

Eric Arsenault

how does this AMM work in relation to the subcurrencies? Will people be able to provide liquidity for different subcurrency trading pairs?

11:47

Do people receive fees for providing liquidity?

MF

11:47

Mr Flintstone

yeah you can just provide liquidity for whatever subcurrency pair you want and the fees LP receive are a governance variable

11:49

so you could create some synthetic btc and usd and then make a btc/usd pool

11:50

you could also make a trump wins subcurrency and a biden wins subcurrency, and trade them against each other in a pool

11:51

you could create a 2x bitcoin token and put it in a pool with usd tokens

s

11:55

sanket

This sounds like Synthetix + Uniswap

11:55

Right?

MF

11:55

Mr Flintstone

yes

11:55

thats right

11:55

it is similar

s

MF

11:56

Mr Flintstone

Yeah

JS

11:59

Jon Snow

Now we just need a sick and intuitive UI to help meme people use it

MF

12:00

Mr Flintstone

probably can justin sun it tbh

JS

12:03

Jon Snow

copy the guy who is the master of copying

12:03

Sounds very fair to me

MF

12:04

Mr Flintstone

it would be a little different, like you wouldnt use something like metamask, but i feel like if they have already done a lot of work on making ux good and this product is similar then it makes sense to take inspiration

JS

12:05

Jon Snow

Yeah

Siddharth Jain invited Siddharth Jain

MF

12:12

Mr Flintstone

these have the potential to be the first truly censorship resistant stablecoins ever

Georgi Georgiev invited Georgi Georgiev

s

12:41

sanket

In reply to this message

I feel that UI isn't the important part. Look at curve.fi or yearn.finance

12:41

It's the functionally

I

13:09

Instinct

In reply to this message

I think it’s important, especially due to it not being in eth ecosystem

s

13:15

sanket

In reply to this message

True. But, there needs to be usability.

Maker did it beautifully with Dai.

Maker did it beautifully with Dai.

EA

13:30

Eric Arsenault

Do the trading pairs follow a x*y=k formula? Or something else?

13:31

Would be interesting to think about VEO rewards for LP providers. Feel like it would be good to incentivize stablecoins this way to bootstrap

EA

14:12

Eric Arsenault

In reply to this message

Will stablecoins expire? The expiry of all these contracts poses a usability challenge I think, people just aren't used to dealing with tokens that expire

MF

14:12

Mr Flintstone

you can sell them to the pool before they expire

14:13

i think you might be able to have them automatically roll as well

EA

14:15

Eric Arsenault

rolling over would be nice

MF

14:18

Mr Flintstone

In reply to this message

you would sign an offer trading the first stablecoin for an equivalent amount of the second

14:18

and it would be matchable after a certain block height

14:21

I think in theory, all of the future stablecoins can be moving around on amoveo, right now. so the first maturity stablecoin and second maturity stablecoin are on chain even though the first hasnt matured

14:22

meaning you can have a liquidity pool of the current stablecoin and the next one

14:26

im not 100% sure about that tho

Michael invited Michael

Z

s

18:04

I mean isn't there just one stablecoin per fiat currency

Z

18:06

Zack

in amoveo a stablecoin is a kind of financial derivative. a btc stablecoin would be a bet on the BTC/VEO price. You set up the bet to hedge yourself from veo price changes, so you are left holding something that stays the same value as BTC.

18:07

for the financial derivative to work, there needs to be an expiration when the contract can get executed based on the BTC/VEO price at that time.

So holders of the contract get paid based on the outcome of that contract.

So holders of the contract get paid based on the outcome of that contract.

18:07

each contract has an expiration date.

Z

19:50

Zack

I wrote passing tests for the AMM tx types.

19:56

I guess ill make a light node interface for it next

19:59

https://github.com/zack-bitcoin/amoveo/blob/amm/apps/amoveo_core/src/consensus/trees/markets.erl#L15 I needed a deterministic sqrt function that operates on integers.

it finds the nearest integer to the sqrt of it's input.

here is what I came up with.

it finds the nearest integer to the sqrt of it's input.

here is what I came up with.

20:00

hopefully this doesn't have an infinite loop embedded in it somehow.

that would make amoveo crash.

that would make amoveo crash.

Z

20:18

Zack

maybe instead of checking if it is near enough to the target, I should keep running the loop until it finds a fixed point?

That might be easier to prove it wont crash

That might be easier to prove it wont crash

20:18

or maybe I should have a hard limit of like 12 loops

20:21

https://en.wikipedia.org/wiki/Integer_square_root

looks like perfect squares don't have fixed points. they bounce between 2 outcomes.

So we could keep iterating until it either loops between 2 things or hits a fixed point.

looks like perfect squares don't have fixed points. they bounce between 2 outcomes.

So we could keep iterating until it either loops between 2 things or hits a fixed point.

I

23:13

Instinct

Voting messes still going on for governance https://twitter.com/andrecronjetech/status/1297536932063457281?s=21

MF

23:53

Mr Flintstone

In reply to this message

each stablecoin has its own maturity date, so you can have different stablecoins for the same fiat currency with different maturity dates

E

23:56

Emmanuel

Is this coin on only one exchange

24 August 2020

s

JS

00:20

Jon Snow

In reply to this message

I think hitBTC also has it, but qtrade.io is the main one so far

Z

00:32

Zack

In reply to this message

It is possible for the smart contract to redistribute the value between the subcurrencies while creating a new child contract.

So we could reset the margins occasionally by having the contract produce a child contract.

So we could reset the margins occasionally by having the contract produce a child contract.

00:33

If your stablecoin are from an old version, you can do a tx to transform into the newer version.

But some of the stablecoin might turn into Veo along the way.

But some of the stablecoin might turn into Veo along the way.

00:35

If a margin gets hit, then one side of the contract could become worth zero at that point so the other side wins all the Veo and the progress stops.

MF

00:40

Mr Flintstone

maybe a good strategy to do perpetual stablecoins is to recreate something like a decentralized ETF. like how an ETF on oil is made up of underlying futures with different maturities, but is itself perpetual

JS

00:42

Jon Snow

Spread out your contract rolling liquidity risk by diversifying your maturities

J

01:27

Josh

In reply to this message

that would be cool, can it be done completely in code with no managers?

MF

01:36

Mr Flintstone

i think it would be like this: instead of two assets in the liquidity pool like uniswap, you could have N assets. all these N assets are usd stablecoins, the only difference being maturity date. i think that the liquidity shares of this pool are kind of perpetual stablecoins?

01:37

if you rotate in more stablecoins once old ones hit expiration

01:40

i think a challenge there is that there may not be enough trading for the LP to this pool to make money

01:40

but i think we can figure out a way to do something like this without any managers

J

01:48

Josh

why wouldn't there be enough trading?

Z

01:49

Zack

I don't get how the rotation could work.

01:50

Constant product market with more than 2 kinds of currencies is easy.

K

02:00

K

The launch of a token system ontop of amoveo couldn't have came at a better time 👍

JS

02:01

Jon Snow

In reply to this message

It is sort of like a token system, but it is not like ETH token system I think?

Z

02:17

Zack

amoveo only has financial derivatives. the tokens are fungible divisible bearer-bonds for participating in a derivative.

02:18

so you can make a contract priced in another contract, or sell half your stake in a contract. stuff like that.

Deleted joined group by link from Group

K

02:40

K

Can I turn a financial derivative into a liquid asset

02:40

and trade it?

Z

02:40

Zack

Yes

K

Z

02:42

Zack

A basic javascript interface exists. We will iteratively improve it.

MF

02:55

Mr Flintstone

In reply to this message

you would schedule whitelisting future stablecoins for the pool

02:56

In reply to this message

i think you would need people to trade between the futures, but if people are just using the perpetual coin im not sure why would be trading stablecoin futures between themselves

J

03:05

Josh

there always has to be someone reading the other side though

MF

04:12

Mr Flintstone

if youre just trading the liquidity share against other things (btc, veo, etc), you dont need to go through the futures

Z

06:12

Zack

In reply to this message

https://github.com/zack-bitcoin/amoveo/blob/amm/apps/amoveo_core/src/consensus/trees/markets.erl#L15

I rewrote it based on the fixed point strategy.

I think it is good now.

I rewrote it based on the fixed point strategy.

I think it is good now.

MF

06:45

Mr Flintstone

cool

Z

08:28

Zack

I made and tested a javascript interface for creating new markets, and for looking up the state of an existing market.

I made interfaces for buying liquidity shares, and for swaping in markets, but I haven't tested them yet.

I made interfaces for buying liquidity shares, and for swaping in markets, but I haven't tested them yet.

08:28

I still need to make an interface for looking up your balance in liquidity shares.

MF

10:16

Mr Flintstone

lets say we add a provision to the oracle language of a stablecoin that if the price of collateral ever drops below X, then the stablecoin holder gets 100% of the VEO in the contract.

then, say someone else buys the stablecoin, they can simultaneously sign a swap offer offering to sell the contract for 99% of its value in VEO. this means you can hold a subcurrency that can be liquidated if the price drops too much. the liquidator will earn the 1% in veo minus fees.

instead of offering to sell the contract for 99% of its value in VEO, you can offer to sell it for 99% of its value in another, better collateralized stablecoin. meaning that even if the value of your collateral drops too much, you may be safe because it could be swapped for a different coin.

while this is an advantage for holders of the stablecoin, i think there is an even bigger advantage for liquidity providers because in an efficient market you might be able to have very very low collateralization ratios. like instead of backing stablecoins with 7x their value in veo, you could back them with only 2x or potentially less. because once the value of the collateral drops low enough, someone could come lock in the risk free veo return and your value in the stablecoin would be converted into a new one. so it could be very cheap to create subcurrenices on amoveo vs existing options

so if this works, amoveo might have very cheap leverage.

then, say someone else buys the stablecoin, they can simultaneously sign a swap offer offering to sell the contract for 99% of its value in VEO. this means you can hold a subcurrency that can be liquidated if the price drops too much. the liquidator will earn the 1% in veo minus fees.

instead of offering to sell the contract for 99% of its value in VEO, you can offer to sell it for 99% of its value in another, better collateralized stablecoin. meaning that even if the value of your collateral drops too much, you may be safe because it could be swapped for a different coin.

while this is an advantage for holders of the stablecoin, i think there is an even bigger advantage for liquidity providers because in an efficient market you might be able to have very very low collateralization ratios. like instead of backing stablecoins with 7x their value in veo, you could back them with only 2x or potentially less. because once the value of the collateral drops low enough, someone could come lock in the risk free veo return and your value in the stablecoin would be converted into a new one. so it could be very cheap to create subcurrenices on amoveo vs existing options

so if this works, amoveo might have very cheap leverage.

Z

16:31

Zack

In reply to this message

If this works it seems like it would be a big improvement.

I don't get how you estimate the 7x and 2x.

It is hard for me to imagine how much margin we would need in this case?

I feel like it relates to the cost of a tx fee relative to the size of your contract.

I don't get how you estimate the 7x and 2x.

It is hard for me to imagine how much margin we would need in this case?

I feel like it relates to the cost of a tx fee relative to the size of your contract.

Z

17:29

Zack

I made a javascript tool in the light node for looking up your balance in liquidity shares in a market.

Z

19:17

Zack

I got the basic javascript user interface working for the AMM

19:19

it can look up your balance in liquidity shares, make new markets. buy/sell liquidity shares, trade in the market, and look up the state of existing markets.

19:19

I guess we should do the hard update pretty soon.

19:19

oh, I should add these new txs to the multi-tx

Deleted invited Deleted Account

Deleted invited Deleted Account

Z

20:17

Zack

adding them to multi-tx is a little tricky, because I want flash loans to work correctly when combining market trades and swaps and liquidity withdraws etc.

20:17

ill have to make tests to be sure it is working right.

Z

20:42

Zack

I stored all the balances in the system using 48 bits. :(

So there can't be more than 2.8 million veo in any one place.

So there can't be more than 2.8 million veo in any one place.

20:42

I think we are going to need a big update to fix that. haha

20:44

well, we probably wont have that many veo for a long time anyway

20:50

I got a simple test working of flash loans for the different market tx types

20:51

so for example, if there are a lot of open swap offers, you could atomically match a bunch of those offers and create a market

20:52

or you could atomically make trades in markets and match swap offers.

B

20:58

Beer

🧿🧿🧿🧿🧿🧿🧿🧿🧿🧿🧿🧿🧿🧿🧿🧿🧿🧿🧿🧿

A

20:59

Alfie

👁

ŽM

21:00

Živojin Mirić

is Amoveo turkish coin?

Z

21:01

Zack

Amoveo is Earth's coin.

ŽM

21:02

Živojin Mirić

We should ask the ORACLE

Z

21:04

Zack

the market hard update seems ready to me.

Does anyone want to suggest more tests, or review it, or ask questions or something before we merge?

Does anyone want to suggest more tests, or review it, or ask questions or something before we merge?

ŽM

JS

21:15

Evil Eye emoji 🧿

I

21:18

Instinct

🧿🧿

21:33

here is the market interface so far

21:33

it all seems to work

21:34

im feeling pretty excited about the auto market maker update now

21:34

the subcurrency stuff too

MF

21:45

Mr Flintstone

nice

21:45

we can start abstracting this stuff now

M

23:28

Mike

Looks great

Deleted invited Deleted Account

25 August 2020

Z

00:38

Zack

If an amoveo market is built out of opposite sides of a binary contract, that gives us some extra abilities.

Like if the contract is stablecoin and long-veo.

Because you can use a multi-tx to simultaniously transform veo into the combination of stablecoin and long-veo.

So even though it is a market for only 2 assets, it is letting us move smoothly between 3 assets.

Like if the contract is stablecoin and long-veo.

Because you can use a multi-tx to simultaniously transform veo into the combination of stablecoin and long-veo.

So even though it is a market for only 2 assets, it is letting us move smoothly between 3 assets.

Rom invited Rom

MF

02:05

Mr Flintstone

an amoveo LP would currently make 0.5% versus uniswap LP at 0.3%

02:05

but amoveo on chain fees are very low right now

02:06

So for someone trading it may be cheaper

Z

02:20

Zack

We could start at 0.2%

02:21

Traders need to pay a flat governance fee.

What if the liquidity fee was 1/2 the governance fee, plus 0.1%?

What if the liquidity fee was 1/2 the governance fee, plus 0.1%?

EA

02:22

Eric Arsenault

I think fees should be low until we find PMF

Z

02:22

Zack

The liquidity shares are an interesting product

EA

02:23

I guess this is what rewards the LPs?

Z

02:23

Zack

Yes

MF

02:23

Mr Flintstone

yeah

02:23

we need LP to get compensated

EA

02:23

Eric Arsenault

Do you think we can add extra VEO mining incentives?

Z

02:23

Zack

We can increase the block reward

MF

02:24

Mr Flintstone

eric means to pay liquidity providers with

EA

02:25

Eric Arsenault

In reply to this message

maybe we wait until we have a product that is usable + we are happy with first

Z

02:25

Zack

I don't get what you are asking for

EA

02:26

Eric Arsenault

the idea is to reward liquidity providers with VEO

MF

02:26

Mr Flintstone

On ethereum people have been getting a lot of assets into defi applications by issuing tokens to people who provide these applications with liquidity

02:27

the problem is, they can issue a ton of tokens because that is the way they are initially distributing them. like the tokens didnt previously exist before this incentive program

02:27

and the tokens can be very valuable because they may have a claim to the fees generated by the application

02:28

so you are kind of leveraging your future potential cash flows to get liquidity into the application now

02:29

so just giving liquidity providers veo would be a different dynamic i think

EA

02:29

Eric Arsenault

with amoveo though, I don't think we would need to issue a ton of tokens this way. Could be like 10% of mining rewards. Maybe it would need to be for whitelisted pairs

02:29

but also, gets complicated since pairs expire

Z

02:29

Zack

Paying people to spam txs is a bad idea

MF

02:30

Mr Flintstone

it isnt spam

02:30

they have to keep their liquidity in the pool to get the rewards

02:31

For what its worth the most successful amm doesnt use this trick

02:31

but it had a first mover advantage

Z

02:31

Zack

Wouldn't everyone put their money into the extreme low risk pools. Like, a pool between 2 shares that split value 50-50

MF

02:32

Mr Flintstone

you specify which pools get the rewards

02:32

and your return is a function of the # of assets in the pool. since the reward is fixed per pool

02:32

so once the pool grows, the reward in a different pool may become more attractive

Z

02:33

Zack

Let's start with the simplest thing and try to get someone to use it and see what they say

EA

02:33

Eric Arsenault

I think for example: the stablecoin pool would benefit from this at the start

02:33

yeah, I would agree, start simple first

R

03:54

Rom

Hello, what’s the circulation supply of VEO pls ?

Z

R

03:58

Rom

And max supply

Z

03:59

Zack

We don't know.

Block reward is set by a governance mechanism.

Block reward is set by a governance mechanism.

MF

03:59

Mr Flintstone

annual inflation is something like 7% right now

R

04:01

Rom

Ok thx

04:03

Do you plan to list the VEO on new exchanges in the coming months?

Z

04:03

Zack

no

t

Z

Z

16:16

Zack

Looking at all the craziness people go through to keep their ethereum nodes synced, I think being able to sync blocks in reverse order is going to be a killer feature.

Full nodes that are immediately usable when you turn them on.

Full nodes that are immediately usable when you turn them on.

Z

17:13

Zack

We really want an interface in the light node so that if you know your veo pubkey, it can also tell your your balances in all the other subcurrencies that you own.

Repeatedly spamming a full node to get this data is not efficient.

What we need is an explorer that can organize the data from amoveo's blockchain into useful format, and then it should offer good api for the light node to have access to this data.

So I made a new github repository to build this.

I am starting to plan out which data to collect here: https://github.com/zack-bitcoin/amoveo-explorer/blob/master/todo.md

Repeatedly spamming a full node to get this data is not efficient.

What we need is an explorer that can organize the data from amoveo's blockchain into useful format, and then it should offer good api for the light node to have access to this data.

So I made a new github repository to build this.

I am starting to plan out which data to collect here: https://github.com/zack-bitcoin/amoveo-explorer/blob/master/todo.md

A G invited A G

Z

22:44

Zack

I set up the database to keep track of accounts, and one to track txs.

22:45

I made it an append-only database, so we can handle orphans really smoothly without having to roll-back anything.

22:46

kind of like how the blockchain works.

22:48

but in order to do that, I built a binary tree inside a dictionary. it is slower for writing and reading.

22:54

I think we need some garbage collection for this accounts database

22:57

eventually we want this explorer to work for lots of data. but for now I just want it to tell us which subcurrencies each account is involved with.

once that works well, we can do the rest.

once that works well, we can do the rest.

23:08

the AMM stuff, I basically stopped working on it. no one is suggesting any tests.

Can we merge it yet?

Can we merge it yet?

23:12

instead of garbage collection, I think for now I might just restart the thread every couple of weeks and let it rescan from the top blockchain state.

MF

Z

23:18

Zack

got it

MF

23:52

Mr Flintstone

In reply to this message

when your subcurrencies are displayed, it should highlight the ones that are not templated

26 August 2020

Z

00:02

Zack

Yes

D

00:03

Daniel

Hi, are questions about futarchy ok here or should I post it elsewhere?

In case it's OK, here is the question:

I read the 2014 post of Vitalik explaining futarchy in easy terms, if I translate it to the finance world - it's just buying/selling call/put options with underlying which is something else aside of market price. You can only lose what your premium if you bough, but you can loose unlimited value if you sold and the underlying moved in the wrong direction. Also in futarchy you are not limited by the yes/ no question - on opposite - the end result of the underlying can be open ended. (can also be binary)

Now, as I understood - your interpretation is a lot different. It rather like binary options - you either loose all you paid or you win the fixed ammount. (eg the underlying either reached the strike price or not) The binary nature of your algorithm seems to limit the potential use cases.

So the question is why do you think it's a better way to do it?

Apologies if it was asked before or you wrote some post on it. You can just answer with the link.

In case it's OK, here is the question:

I read the 2014 post of Vitalik explaining futarchy in easy terms, if I translate it to the finance world - it's just buying/selling call/put options with underlying which is something else aside of market price. You can only lose what your premium if you bough, but you can loose unlimited value if you sold and the underlying moved in the wrong direction. Also in futarchy you are not limited by the yes/ no question - on opposite - the end result of the underlying can be open ended. (can also be binary)

Now, as I understood - your interpretation is a lot different. It rather like binary options - you either loose all you paid or you win the fixed ammount. (eg the underlying either reached the strike price or not) The binary nature of your algorithm seems to limit the potential use cases.

So the question is why do you think it's a better way to do it?

Apologies if it was asked before or you wrote some post on it. You can just answer with the link.

MF

00:11

Mr Flintstone

definition of futarchy can kind of be simplified to: using market prices to make decisions for groups. the instrument you are measuring the price of isnt very consequential

00:13

but things like calls in the legacy financial world are actually credit instruments for the buyer. and puts are as well if the counterparty hasnt segregated enough cash to cover the underlying dropping to zero

Z

00:13

Zack

I think he just wants to know about derivatives and finance

MF

00:13

Mr Flintstone

i guess calls could be covered, but you dont know exactly what your counterparty’s exposures are

Z

00:14

Zack

"Futarchy" is just a buzz word

MF

00:14

Mr Flintstone

since u cant have credit on a blockchain you have to use fully funded derivatives

00:15

which are limited loss instruments

D

00:19

Daniel

In reply to this message

No Zack I know enough about derivatives and Finance. I know less about how Amoveo function.

It's not a nice tone to talk in the third person form about the person who is present in the conversation.

It's not a nice tone to talk in the third person form about the person who is present in the conversation.

00:24

In reply to this message

Thank you. You could lock the veo ammount received from the buyer on sellers account without possibility to withdraw until the result is known. Then the only credit risk would be the profit, which is acceptable, as the notional is secured and can be a risk for both buyer or seller. You still can have the uncertain p&l compared to your version where it's known in advance (more like binary options or sports betting)

MF

00:26

Mr Flintstone

the profit is taken from the counterparty’s collateral. if your profit exceeds their collateral, you cannot make more money

00:27

so for example, a CFD where we both put $100 in. if i am long and the underlying rips 1000%, i can only withdraw $200

00:27

but you can have it roll into another contract automatically with some tricks

D

MF

00:28

Mr Flintstone

if you are at 1x leverage to the underlying, i think in this case if notional is $100, you make $50 profit

00:29

you can also customize the notional

D

MF

00:31

Mr Flintstone

any kind of fully funded derivative can be programmed with any starting market value on either side and any notional value

N

00:46

NM$L

hi

JS

Harsh K invited Harsh K

Z

02:53

Zack

This is the announcement for amoveo update number 35, the automatic market maker update. It allows for uniswap style pools, and profiting from holding liquidity shares in these pools.

This update will activate on block 130700, in about 2 weeks.

Here is documentation related to updating, it is the same as always: https://github.com/zack-bitcoin/amoveo-docs/blob/master//getting-started/updating.md

This update will activate on block 130700, in about 2 weeks.

Here is documentation related to updating, it is the same as always: https://github.com/zack-bitcoin/amoveo-docs/blob/master//getting-started/updating.md

JS

03:05

Jon Snow

🧿

Deleted invited Deleted Account

M

03:49

Mike

🧿

D

04:15

Devender

🧿

Zzzzzz zzzzzzz invited Zzzzzz zzzzzzz

R

04:28

Rom

🧿

I

04:43

Iridescence

🧿

Deleted invited Deleted Account

D

06:17

Daniel

In reply to this message

Actually I have a filllowup question. To your statement that any derivative can be replicated.

So far I understand the oracle will only take yes/no questions in the end, correct?

So, in such case what question should you ask for this 50% from our previous example to materialise?

Simple forward:

Leverage 1:1

Nominal 100 veo

Goal: pay the proportional % profit to the side who won, so if the security lost 50% then buyer would pay 50 veo if the security gained 50%, then seller would pay 50 veo. Note in can be any % from - 100% to + 100%

Thanks again.

So far I understand the oracle will only take yes/no questions in the end, correct?

So, in such case what question should you ask for this 50% from our previous example to materialise?

Simple forward:

Leverage 1:1

Nominal 100 veo

Goal: pay the proportional % profit to the side who won, so if the security lost 50% then buyer would pay 50 veo if the security gained 50%, then seller would pay 50 veo. Note in can be any % from - 100% to + 100%

Thanks again.

MF

06:20

Mr Flintstone

the old way we used to do this, was to encode the scalar value in binary, and then have 10 oracles. then attach the smart contract to these 10 oracles, and use true = 1 and false = 0 to create our scalar price

D

MF

06:22

Mr Flintstone

you could agree to any number of oracles to add precision

06:22

3567 in binary is 110111101111

06:23

so more than 10 oracles

06:23

i think the new way is better anyhow

D

06:23

Daniel

In reply to this message

I see. Just read it. Doesn't matter how much if proceduraly generated. Thanks.

Z

06:25

Zack

The new way is to ask the Oracle a very specific question. Like, "is the price $11,845.34 at this time on this exchange?"

06:26

We can ask the Oracle question at the end, during enforcement. So at that point in time we know the price to ask about.

MF

06:29

Mr Flintstone

since you can agree than any 1 of X oracles can enforce the contract, you can agree to 100,000 oracles that are 1 cent different and get a 1,000 dollar price range

D

06:29

Daniel

In reply to this message

Not sure what you mean. You can't. Really ask this specific question for every cent of price change. I think that @mr_flintstone explanation works for me (of course only if I would only have to pay for creation of one oracle and not 10000 as well as there is a possibility to create those 10000 oracles using ui.

MF

06:29

Mr Flintstone

you can agree to some code that generates the oracles that you agree to be bound by

06:29

so you can procedurally generate the 100,000 different oracle questions that can enforce the outcome

06:30

but yeah, you only ask one at the end

06:30

if you need to enforce something on chain

D

MF

06:31

Mr Flintstone

no

06:31

the smart contracts are already written

D

06:32

Daniel

Ok thanks. Will dig deeper and come if anything pops up.

Z

06:45

Zack

It is already integrated into the light node too.

D

06:52

Daniel

In reply to this message

By the way, I understand how you can create derivatives with veo, but still don't see how veo can help to agree on any yes/no decision.

Eg if govt has to decide to forbid fossil fuel because of global warming and they ask the population the question "should we keep fossil fuel?" and choose the min(target temp-annualized average temp of the last 5 years; 0) as a measure.

Say target is average temp of 22c and population believes the temp can stay at 18 if we ban and 20 if we keep. So the No would win with the price of 4

Decision is made, the ban is enforced and At expiration the temperature is 19.

In such case the buyers of no get 3 units per contract and the sellers have to pay only 3 units. Buyer loss - 1 seller gain +1

So far I undestand, those are kinds of questions which are useful for futarchy. Don't see how you can ask anything close to that here.

Eg if govt has to decide to forbid fossil fuel because of global warming and they ask the population the question "should we keep fossil fuel?" and choose the min(target temp-annualized average temp of the last 5 years; 0) as a measure.

Say target is average temp of 22c and population believes the temp can stay at 18 if we ban and 20 if we keep. So the No would win with the price of 4

Decision is made, the ban is enforced and At expiration the temperature is 19.

In such case the buyers of no get 3 units per contract and the sellers have to pay only 3 units. Buyer loss - 1 seller gain +1

So far I undestand, those are kinds of questions which are useful for futarchy. Don't see how you can ask anything close to that here.

Z

06:58

Zack

You can type the Oracle question in English. It can be whatever you want.

06:58

You can also make contracts priced in other contracts

06:58

So you could first bet on the temperature, and use subcurrencies from that bet to bet in a market about government policy

06:58

Or the other order

MF

06:59

Mr Flintstone

subcurrency is basically contract you can send around. a shareable contract

Z

07:01

Zack

The smart contract language is turing complete. I can write one that takes N binary oracles, and let's us bet on the 2^N possible combinations

D

07:06

Daniel

In reply to this message

So then first there will be yes/no for voting on policy with the qustion like "should we keep the fossil fuel?" how will price finding work here Without any measure?

Then you will take this contract with some price and vote on the temperature with 100.000 oracles and be paid by the contract from the first oracle?

I the end you get some random price. What oracles would you make for such a policy voting with the temp as a measure?

Then you will take this contract with some price and vote on the temperature with 100.000 oracles and be paid by the contract from the first oracle?

I the end you get some random price. What oracles would you make for such a policy voting with the temp as a measure?

MF

07:07

Mr Flintstone

so you could create temperature coins

07:09

but you could make two separate kinds of temperature coins: one that turns into a temperature coin when the fossil fuels are banned (and both sides get their money back if it doesnt), and one that turns into a temperature coin if the fossil fuels are not banned (and both sides get their money back if it does)

Z

07:09

Zack

The goal is that the price of the contract should reflect how the policy will impact temperature.

We can make a market to guess the temperature. Let people bet on what it will be using a scalar contract.

So first make a binary contract asking whether the policy gets passed.

Then using each kind of currency from that binary contract, predict the temperature.

Now you have an estimate for how the policy will impact the temperature.

We can make a market to guess the temperature. Let people bet on what it will be using a scalar contract.

So first make a binary contract asking whether the policy gets passed.

Then using each kind of currency from that binary contract, predict the temperature.

Now you have an estimate for how the policy will impact the temperature.

MF

07:10

temperature coin is coin whose value increases when the temperature goes up ,and decreases when the temperature goes down

07:11

there are several approaches to get to a point where you can use market prices to inform your decisions on whether or not banning fossil fuels will impact the temperature

D

07:15

Daniel

Vice versa. Because we need to have a policy with lowest temperature increase, so the price should rise when the temp is lower. But the idea is clear.

07:16

Do you guys have a number of covid19 cases coin?

Z

07:16

Zack

Haha

Good one

Good one

MF

07:16

Mr Flintstone

haha not yet, we need subcurrencies for that which will go live in 2? Weeks

Z

07:17

Zack

Like 11 days I think

MF

07:17

Mr Flintstone

and then itll be easier to do this kind of decision analysis once we can put them in soemthing like uniswap

07:17

but that is a pretty cool suggestion

Z

07:17

Zack

That's in 2 weeks

D

MF

07:18

Mr Flintstone

where else could you trade covid19 cases but amoveo

D

07:21

Daniel

We should create some cool derivatives, which are just not possible in the regulated markets. Then people who want to use the veo to bet on those cases and not just people who want to speculate on veo price will come.

Z

07:22

Zack

Do these markets need to be priced in stablecoins to get volume?

MF

07:22

Mr Flintstone

you can have the case coin be stable in usd

D

07:22

Daniel

I dont know.

MF

07:22

Mr Flintstone

and then trade it against whatever base pair, veo, usd, btc w/e

07:22

yeah, it is definitely a good suggestion to do cool derivatives like cases count

07:22

you could even do specific states or countries

D

07:23

Daniel

How can you ensure its stable in usd? The collateral can't be in dollars you said it should be fully collateralized.

Z

07:23

Zack

I can see the headline "hackers using cryptocurrency to pay people to spread the coronavirus"

D

Z

07:24

Zack

We can use Veo to make a synthetic usd, and then have betting markets priced in the synthetic usd

D

07:24

Daniel

Bad publicity is still good.

MF

07:24

Mr Flintstone

you could also use VEO to create a synthetic case coin that is itself stable in USD

Z

07:24

Zack

So there are margins

MF

07:24

Mr Flintstone

the payout function is (1+case change)*(1+veousd price change) -1

07:24

soemthing along those lines

Z

07:25

Zack

Interesting

MF

07:25

Mr Flintstone

it is like how you create a stable btcusd with only VEO as collateral

07:26

so like, you want to put in $100 of veo. and if cases go up by 6% more than some threshold, you want to get $106 of veo

07:26

or, you can put in 100 usd tokens. and get 106 usd tokens.

D

07:26

Daniel

In reply to this message

I lost you here. Not very fluent with all the stable stuff. So far I read about dai it's really not that simple as just to pronounce the coin stable if you want it to be decentealised. You need a governance coin etc.

Z

07:27

Zack

All we have are synthetic assets

07:27

It has margins

MF

07:27

Mr Flintstone