Amoveo ♥🧿

Previous messages

Next messages

31 December 2019

K

09:11

K

Am I able to create bets using payment channels?

09:12

Do you know if exante’s wallet does it via on chain transactions or LN?

Z

09:37

Zack

I'm not sure if exantech wallet supports this.

We have been updating the wallet I maintain, the process for making bets is simpler now.

We have been updating the wallet I maintain, the process for making bets is simpler now.

Peter invited Peter

1 January 2020

Z

02:43

Zack

I am thinking of writing an article about the airstrikes that the US military uses so frequently.

We should use futarchy to find out how effective these airstrikes are at protecting US citizens.

They cost like $1.4 million per missile, so it would be nice to know if this is money could be better used for something else.

We should use futarchy to find out how effective these airstrikes are at protecting US citizens.

They cost like $1.4 million per missile, so it would be nice to know if this is money could be better used for something else.

A

02:44

Aries

No 80,000

02:45

You mean Tomahawk or Hellfire?

Z

02:46

Zack

i don't know much about weapons.

A

02:46

Aries

Tomahawk around 1.8 million

02:47

Hellfire on predatory or reapers

02:47

70 to 80k

Z

02:47

Zack

I guess the drones that drop the bombs are pretty expensive as well

A

02:49

Aries

Predators are around 4.03 million

02:50

Cheap enough that the cia will crash them in order to have eyes on anyone who is high priority

02:50

Instead of going back to refuel

Z

02:56

Zack

I think it would be good to include a few facts in the article to give an idea of how much money is being spent on war

02:58

and also some facts to give an idea of how confident we are about how effective this money is at making US citizens safer.

03:06

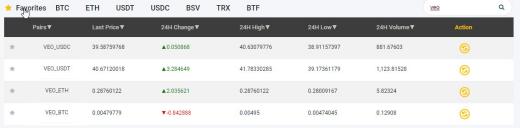

looks like there is an arbitrage opportunity between some exchanges.

Maybe this New Years will happen similar to last year.

Maybe this New Years will happen similar to last year.

I

MF

03:26

Mr Flintstone

ya I would say 195 vs 50 is a small arb opp

S

2 January 2020

S

01:32

Sy

Still wondering why nobody is trading there, registering that hard?

Z

01:33

Zack

Last I checked they wanted like $10k deposit to open an account

S

01:50

Sy

Not that much for some of the bigger holders tbh...

01:51

Can't find it on their page tho...

I

S

02:34

Sy

Ah k but you can spend it afterwards?

I

S

03:10

Sy

Gotta read up on that exchange...

TG

08:41

Toby Ganger

interesting that coin paprika removed gozo from the amoveo markets

Z

08:45

Zack

Oh yeah, it's gone now

Deleted invited Deleted Account

mx

12:52

mr x

Link to light node on github not working.

Z

3 January 2020

S

01:57

Sy

In reply to this message

They did? Maybe auto remove duo restricted access and stupid spread? It was listed when I last wrote

MF

02:18

Mr Flintstone

it’s disappeared and reappeared multiple times before

02:18

could be an api issue as well

02:21

one exciting thing that is being looked into is if it is possible and tractable to partially match channel offers. so you could put an offer out for 10 veo, and someone can match any amount of it instead of being required to match the full 10.

mx

13:37

mr x

could then have more orderbook like ui?

Ziad Mo invited Ziad Mo

S

20:38

Sy

im still unsure if gozo is real or fake...is there any intel on them?

I

22:43

Instinct

In reply to this message

They’re connected with exante, seems like the crypto trading branch of them

MF

23:37

Mr Flintstone

would be nice to understand the strange behavior lol

4 January 2020

Alex Tchandalito invited Alex Tchandalito

5 January 2020

Deleted invited Deleted Account

19:50

interesting orders at gozo 😅

19:51

but someone just bought everything up to 200

19:51

well "just" isnt exactly right, it was last day of 2019

M

20:26

Minieep21

How have they been open for so long yet there is still very little info?

I

6 January 2020

S

00:37

Sy

I mean 50 buy 185 sell...that's some serious spread 😁

00:39

In reply to this message

You have to fully verify to start trading, that's not so popular in crypto I guess

00:39

Plus 10k first deposit

Z

CD

02:32

Crypt Dweller

Zack, what are you working on these days?

Š

02:34

Šea

He's trying to make the best recipe to cook the eggs. Thats why he's less responsive here these days

02:34

I believe we could have updates soon

I

K

03:56

K

How important is privacy for Amoveo?

03:56

Do you think Amoveo can function just fine with a fully public chain as it has right now?

Z

04:22

Zack

In reply to this message

There is a lot of controversy about blockchain privacy. Here is my perspective. https://github.com/zack-bitcoin/amoveo/blob/master/docs/design/privacy.md

Privacy and scalability are the same thing. All that research we did in sortition chains isn't just the best known solution for scalability, it is also the best privacy solution.

Privacy and scalability are the same thing. All that research we did in sortition chains isn't just the best known solution for scalability, it is also the best privacy solution.

K

04:31

K

In reply to this message

So you believe that there is only such thing as delayed privacy on a blockchain?

04:36

If the best way to achieve privacy is by spending coins to yourself a bunch of times, likely using a mixer or some sort, then over time as tech increases and on-chain analysis techniques increases all transactions will be revealed

04:36

the more $ you spend, the longer you have until yours is broken

Z

04:37

Zack

In reply to this message

I don't work much around the winter solstice.

Today is my birthday.

I have been doing a little research into tradeoffs of different erlang data structures. I have been reviewing my family's finances.

This is a time when I try to step back, and make big picture strategy plans for the coming year.

Code should start getting written more quickly around January 15.

Today is my birthday.

I have been doing a little research into tradeoffs of different erlang data structures. I have been reviewing my family's finances.

This is a time when I try to step back, and make big picture strategy plans for the coming year.

Code should start getting written more quickly around January 15.

04:40

In reply to this message

Spending coins to yourself and using a mixer are 2 different privacy strategies.

The idea that on-chain analysis techniques will someday reveal everything is not the correct way to think about this.

If information is actually private, then it is provably impossible to uncover with any kind of analysis.

Paul sztorc has written some great stuff on this topic. He is a better writer than me.

The idea that on-chain analysis techniques will someday reveal everything is not the correct way to think about this.

If information is actually private, then it is provably impossible to uncover with any kind of analysis.

Paul sztorc has written some great stuff on this topic. He is a better writer than me.

04:43

https://twitter.com/Truthcoin/status/1202337024335843329?s=19 here is a twitter thread where you can see Paul sztorc and some zcash people debating about the nature of privacy on the blockchain.

EA

05:30

Eric Arsenault

Happy birthday Zack 🥳

B

07:10

Beer

Happy bd 👾

I

07:28

Instinct

🎉

T

08:21

Tromp

Feliz cumpleaños amigo!

S

08:54

Sy

In reply to this message

happy bday...damn itrs past midnight over here so i missed 😅

anyway, you are almost 10 years younger than me 😱

anyway, you are almost 10 years younger than me 😱

OK

09:21

O K

Happy birthday Zack!

ES

12:01

Ed Sonic

Happy Birthday Zack!

mx

12:18

mr x

HBD

B

15:37

Ben

HBD

EW

16:03

Eli W

Hbd

A

16:03

Aries

Happy Birthday Zack

w

16:11

wvvw

Happy Birthday Zack. I wish you much health and happiness ❤️🍀

N

16:27

NM$L

Happy Birthday Zack. I wish you much health and happiness ❤️🍀

7 January 2020

Z

01:36

Zack

Thanks for the well wishes.

This is going to be a good year.

This is going to be a good year.

АК

01:38

Алексей Колосов

С днюхой !! Zack

Deleted invited Deleted Account

Fabien invited Fabien

F

03:15

Fabien

Hi

Chris 🍞 invited Chris 🍞

C

04:31

I've been reminded by myself that i still need to close a DAC(?) for funding of someone

04:32

for myveowallet.com

04:32

if the dev can contact me i can transfer the funds that are still locked in the dac

CD

04:43

Crypt Dweller

Hey happy birthday Zack. You deserve some time off. Best wishes to you and your family.

C

14:13

Callum Wright

Happy birthday Zack!

14:14

On another note, I'm just thinking whether we can publish an article about Amoveo, its mission as well as sortion chain concepts on nakamoto.com

OK

8 January 2020

T

08:35

Topab

Reading this prediction makes me think that stable coins and derivatives are a real use case for crypto. It feels projects of such nature want to emerge but the underlying tech is not suitable. That seems to be the case for ethereum. This gives me hope for Amoveo. My worry is Amoveo adoption and development speeds are kind of slow.

Z

23:14

Zack

Someone from bitfare exchange says that they listed amoveo.

If anyone tries it out, tell us if it works.

If anyone tries it out, tell us if it works.

9 January 2020

00:09

looks like they really did

Z

00:10

Zack

Has anyone used this exchange? Are they reliable? Should I add them to the recommended list?

S

00:44

Sy

no idea

00:44

LOCATION: 32 Woburn Place London England WC1H 0JR

00:44

at least not the cayman islands or something like that ^^

Z

00:46

Zack

I think you don't need to be located in a country to set up a company there.

It could be a post office box where they are able to receive mail.

It could be a post office box where they are able to receive mail.

S

00:46

Sy

True but its still different laws, many companies in the EU formed as Ltd in UK since you dont need much capital...well not anymore, bb UK

J

00:47

Jed

they are also Located in Estonia

S

00:48

Sy

no veo trades on gozo since the new years 200$ run...odd

MF

01:29

Mr Flintstone

seems like someone was trying to make their 2019 performance look better

Z

01:38

Does this new years price spike happen to any other small cryptocurrency projects?

M

S

01:41

Sy

Yep

MF

01:44

Mr Flintstone

exact same thing happened 2018 to 2019 New Years on their charts for veo

S

02:11

Sy

Lol

02:11

It might actually work to fool some clients

MF

02:12

Mr Flintstone

yeah if they have horrific operational diligence wrt pricing best practices / or are just being lied to

M

S

02:58

Sy

Their portfolio is in veo, they want their annual balance and voila, veo is at 200

02:58

But maybe it's much simpler and just random, who knows 😁

02:58

But 8 days no trade is odd tbh

X

Z

05:56

Zack

Ok, I won't list them yet.

But if they do a good job, I will.

But if they do a good job, I will.

X

05:57

X | NPC

They have some isues with pegnet lately

Z

06:00

Zack

This doesn't seem like very strong evidence to me.

X

Z

06:02

Zack

Yes.

X

06:04

X | NPC

Another one from the pegnet discord:

Suspected Exchange Scam at BitFare.io @everyone

1 Million PEG taken, NOT 53 Million PEG.

Looking into the claims around an exchange scam <@!417824355385344052> did some good research and determined that BitFare.io is very likely to be a scam. You can see his detailed analysis on Twitter: https://twitter.com/niels_klomp/status/1211835230631452674?s=20

TLDR: Two community members have reported their deposits of PEG being taken when deposited at BitFare.io The PEG was immediately transferred and then sold via a different (legit) exchange, as can be seen on the pExplorer. These lost deposits total around 1 Million PEG.

Importantly the address people were tracing the PEG transfers to, is NOT involved in BitFare.io and belongs to a known exchange and therefore the 53 Million at that address are in that legit exchange's cold storage.

The 53 Million PEG is NOT being held by a scammer.

PLEASE BE CAREFUL WHEN USING ANY NEW EXCHANGE.

One good method is to quickly check the reputation of an exchange on Coin Gecko: https://www.coingecko.com/en/exchanges

Suspected Exchange Scam at BitFare.io @everyone

1 Million PEG taken, NOT 53 Million PEG.

Looking into the claims around an exchange scam <@!417824355385344052> did some good research and determined that BitFare.io is very likely to be a scam. You can see his detailed analysis on Twitter: https://twitter.com/niels_klomp/status/1211835230631452674?s=20

TLDR: Two community members have reported their deposits of PEG being taken when deposited at BitFare.io The PEG was immediately transferred and then sold via a different (legit) exchange, as can be seen on the pExplorer. These lost deposits total around 1 Million PEG.

Importantly the address people were tracing the PEG transfers to, is NOT involved in BitFare.io and belongs to a known exchange and therefore the 53 Million at that address are in that legit exchange's cold storage.

The 53 Million PEG is NOT being held by a scammer.

PLEASE BE CAREFUL WHEN USING ANY NEW EXCHANGE.

One good method is to quickly check the reputation of an exchange on Coin Gecko: https://www.coingecko.com/en/exchanges

Z

06:09

Zack

If you trade, then you should be careful.

X

06:11

X | NPC

Sure, just sharing info

10 January 2020

Z

14:09

Zack

In reply to this message

I looked into this idea more. I made a github issue for this topic. So we can continue the discussion there.

https://github.com/zack-bitcoin/amoveo/issues/269

I think that sortition chains would make this upgrade obsolete, so it seems like it would be better to just focus on sortition chains and not waste time on this upgrade.

https://github.com/zack-bitcoin/amoveo/issues/269

I think that sortition chains would make this upgrade obsolete, so it seems like it would be better to just focus on sortition chains and not waste time on this upgrade.

Z

14:55

Zack

https://github.com/zack-bitcoin/amoveo/blob/master/docs/use-cases-and-ideas/military_spending.md

I wrote about how we can use futarchy to find out what kinds of military spending are cost effective at making people safer.

I wrote about how we can use futarchy to find out what kinds of military spending are cost effective at making people safer.

Deleted invited Deleted Account

11 January 2020

Deleted invited Deleted Account

I

K

Z

03:50

Zack

There is a trading channel on discord. This place is not for trading.

13 January 2020

15:53

People from AVALabs talking about ur pos paper

Z

Z

19:41

Zack

Why did we want more than one validator per sortition chain? What is wrong with just having one?

19:44

Oh right. It is for availability attacks.

As long as 1 of n doesn't cheat, availability attacks are prevented.

Otherwise your money can get frozen and you don't get that one final chance to send it.

As long as 1 of n doesn't cheat, availability attacks are prevented.

Otherwise your money can get frozen and you don't get that one final chance to send it.

Deleted invited Deleted Account

14 January 2020

Z

22:33

Zack

we have so many branches on the amoveo github now. I am going to try to delete some.

22:39

im going to put the docs into a different github repository.

S

22:39

Sebsebzen

nice, remove the clutter

22:40

actually you could run a medium blog too

22:40

for these kinds of musings

Z

22:49

Zack

I think I might leave the current docs as-is for a while.

A lot of stuff links to them, and we might not want to break all those links yet.

A lot of stuff links to them, and we might not want to break all those links yet.

22:50

but I will update all the links we use to the new version.

22:50

and I can write "legacy docs, use the new version" on every page.

I

S

22:59

Sebsebzen

I actually enjoy Zacks oracle project comparison updates

22:59

Haha

Z

23:18

Zack

whats up with the branch called "legacy"?

No one is using that, right?

No one is using that, right?

23:18

I think that was when we updated to needing the new ubuntu version?

15 January 2020

K

00:13

K

Do you think amoveo governance will ever be binding?

Z

00:13

Zack

I gathered these notes about how to do hard updates that add an additional merkel tree to the blocks. https://github.com/zack-bitcoin/amoveo-docs/blob/master/checklists/new_merkel_tree_checklist.md

That way we didn't need to keep the sortition chain branch around.

That way we didn't need to keep the sortition chain branch around.

K

Z

10:01

Zack

Does anyone use non-default configuration options?

in particular, does anyone set db_version to 1?

I would like to drop support for the old version of storing blocks, because we could simplify the code.

in particular, does anyone set db_version to 1?

I would like to drop support for the old version of storing blocks, because we could simplify the code.

10:03

10:06

db_version 2 has the advantages:

* it uses far less space.

* you only write to disk once every few hundred blocks.

* you can read a contiguous range of blocks much faster.

db_version 1 has the advantages:

* you can look up any random individual older block faster.

* it uses far less space.

* you only write to disk once every few hundred blocks.

* you can read a contiguous range of blocks much faster.

db_version 1 has the advantages:

* you can look up any random individual older block faster.

11:35

Deleted Account

anyone else having troubles withdrawing from hitBTC? It's been weeks, tried support ticket and everything, still impossible to withdraw

Z

11:36

Zack

I heard hitbtc is having problems like that with a lot of currencies. I think we should not use their service.

11:38

Deleted Account

you are right but my VEO is there already, I'm sure many other people's veo as well

11:43

what's interesting is I think it's an easy issue to fix, but they won't do it. When I type in the withdraw address with the '=' at the end, the confirm email I receive has the address without the =. And then I click on the link, and it says error. Which makes sense in a way

Z

11:46

Zack

maybe they do errors like that on purpose so they don't have to give the veo back.

Deleted invited Deleted Account

Z

19:12

Zack

I want to make a checkpoint every 1000 blocks or so.

The checkpoint will keep a backup of the merkel trees from that point in time. This will allow us to sync blocks in reverse order.

But im running into an issue.

What if an attacker keeps re-mining block number 95000 for example?

would we need to save an additional checkpoint for every one?

until the block has enough confirmations, a full node is supposed to support history re-writes. So we need to be able to do checkpoint for any of the recent forks.

So I am thinking that instead of doing a checkpoint every 1000 blocks, we should check each block for whether

And if it is, that block should be a checkpoint.

So on average, there will be one block per 1000 blocks that is a checkpoint.

Does this strategy work?

What if miners refuse to publish any checkpoint blocks? It would only cost them 0.1% of their rewards.

I guess we would have to sync more blocks in the forwards instead of backwards direction, so it could take a few minutes longer to set up a new mining pool or anything that depends on a full node. But it would still be strictly better than syncing 100% of the blocks in the forwards direction.

The checkpoint will keep a backup of the merkel trees from that point in time. This will allow us to sync blocks in reverse order.

But im running into an issue.

What if an attacker keeps re-mining block number 95000 for example?

would we need to save an additional checkpoint for every one?

until the block has enough confirmations, a full node is supposed to support history re-writes. So we need to be able to do checkpoint for any of the recent forks.

So I am thinking that instead of doing a checkpoint every 1000 blocks, we should check each block for whether

(hash(header) % 1000) == 0 is true.And if it is, that block should be a checkpoint.

So on average, there will be one block per 1000 blocks that is a checkpoint.

Does this strategy work?

What if miners refuse to publish any checkpoint blocks? It would only cost them 0.1% of their rewards.

I guess we would have to sync more blocks in the forwards instead of backwards direction, so it could take a few minutes longer to set up a new mining pool or anything that depends on a full node. But it would still be strictly better than syncing 100% of the blocks in the forwards direction.

19:19

What if miners try to cause an excessive number of checkpoints to make it more expensive to run a full node?

If we store checkpoints that occurred in the most recent 2000 blocks, then on average we would expect to be storing 2 checkpoints.

If the miners throw out

But this means the miners are paying

So this attack isn't an issue.

If we store checkpoints that occurred in the most recent 2000 blocks, then on average we would expect to be storing 2 checkpoints.

If the miners throw out

(n-1) / n portion of their blocks, then they can increase the number of checkpoints we need to store to be 2*n.But this means the miners are paying

n times as much in order to find each block, which is cost prohibitive.So this attack isn't an issue.

19:23

What if at some point in the future, we have decided to make blocks at a much faster rate?

so instead of 1000 blocks per week, we have like 60000?

If we still want to store checkpoints for the last month, and if we are storing on average one checkpoint per 1000 blocks, then this means the total memory requirement of the checkpoints would be 60x higher.

So this makes me think that the rule for which blocks are checkpoints needs to be connected to the governance variable that controls the block time.

If the block time is reduced by a factor of 2, then we need to reduce the frequency of the checkpoints by a factor of 2.

so instead of 1000 blocks per week, we have like 60000?

If we still want to store checkpoints for the last month, and if we are storing on average one checkpoint per 1000 blocks, then this means the total memory requirement of the checkpoints would be 60x higher.

So this makes me think that the rule for which blocks are checkpoints needs to be connected to the governance variable that controls the block time.

If the block time is reduced by a factor of 2, then we need to reduce the frequency of the checkpoints by a factor of 2.

Z

19:56

Zack

I guess ill set it up so on average we have 2 checkpoints per month.

So on average, you only need to sync 2 weeks of blocks before the full node is usable, and on average a full node only needs to store less than 3 checkpoints at a time.

Currently each checkpoint will require 11 megabytes of data.

compare with 231 megabytes of blocks, and 24 megabytes of headers, and 11 megabytes of up-to-date merkel tree data.

So on average, you only need to sync 2 weeks of blocks before the full node is usable, and on average a full node only needs to store less than 3 checkpoints at a time.

Currently each checkpoint will require 11 megabytes of data.

compare with 231 megabytes of blocks, and 24 megabytes of headers, and 11 megabytes of up-to-date merkel tree data.

19:58

I think we can optimize this to the point that it takes less than 30 seconds for a new full node to be ready for mining or checking your balance or whatever you need.

20:00

we could set up a configuration variable so you don't have to sync all the historical blocks if you don't need them.

If you only sync the 1 month of blocks necessary for the checkpoints, then you would only download 4k blocks instead of 98k blocks.

If you only sync the 1 month of blocks necessary for the checkpoints, then you would only download 4k blocks instead of 98k blocks.

20:05

is 1 month ideal?

what attack exactly are we worried about?

What if we only stored checkpoints for the last week, or last day?

what attack exactly are we worried about?

What if we only stored checkpoints for the last week, or last day?

20:07

I guess the configuration value "fork_tolerance" would need to be set to less than the number of blocks until the checkpoint.

So if someone wanted a fork tolerance of 2000 blocks, then we would need some checkpoint from more than 2000 blocks ago.

So if someone wanted a fork tolerance of 2000 blocks, then we would need some checkpoint from more than 2000 blocks ago.

20:07

currently, the default fork tolerance is 50 blocks, which is like 8 hours.

20:09

if more than 50 blocks of history got rewritten, it would cause all the nodes with default configurations to crash.

20:16

if more than 1 days of blocks got undone, that seems like a pretty huge disaster. Some big double-spending could get done in 1 day.

So maybe 1 day's worth of blocks is the furthest back we need a checkpoint to be.

So maybe 1 day's worth of blocks is the furthest back we need a checkpoint to be.

20:17

needing to sync 144 blocks would be a lot faster than needing to sync 4000.

Z

21:00

Zack

One option is to maintain at least 2 checkpoints.

One that is 12 hours ago, and another that is 1 month ago.

So if there is a fork longer than 12 hours, you only need to sync 1 month of blocks.

One that is 12 hours ago, and another that is 1 month ago.

So if there is a fork longer than 12 hours, you only need to sync 1 month of blocks.

21:01

But that is a little complicated.

Maybe it is better to start with a simple solution, and upgrade it later if we need it.

Maybe it is better to start with a simple solution, and upgrade it later if we need it.

S

OK

21:30

O K

👍

Z

21:55

Zack

Ok, thanks guys

16 January 2020

Z

09:29

Zack

https://github.com/zack-bitcoin/amoveo/blob/master/apps/amoveo_core/src/checkpoint.erl

I made a module for checkpoints.

It stores on average one checkpoint per 1000 blocks, and on average it is storing 2 checkpoints at a time.

I haven't activated it yet.

I made a module for checkpoints.

It stores on average one checkpoint per 1000 blocks, and on average it is storing 2 checkpoints at a time.

I haven't activated it yet.

09:34

what if every node could choose different blocks to use as checkpoints?

09:36

it seems like it doesn't matter if the checkpoint you are syncing with is the same as one of the checkpoints that you store.

Deleted invited Deleted Account

20:28

Deleted Account

Any staff available to chat?

[

20:39

Deleted Account

So not really? Lol

[

20:40

[Riki]

Can check with chief of canteen if he is available too

ŽM

21:12

Živojin Mirić

hello, I am responding to the call of duty

21:12

how may I be of service to you kind sir?

21:13

please be quick, pork bellies will burn up in the oven

S

Z

21:58

Zack

In reply to this message

Are they still using dai? I wrote about why dai doesn't work.

It is good they are allowing for betting on "bad question".

That is an important feature.

They are still using a votecoin based oracle, so it is not scalable and it is cost prohibitive vs Amoveo's design.

It is good they are allowing for betting on "bad question".

That is an important feature.

They are still using a votecoin based oracle, so it is not scalable and it is cost prohibitive vs Amoveo's design.

S

22:54

Sebsebzen

Yes, DAI based. I guess we'll see when it's released.

22:54

The UI looks good tho, maybe something worth emulating

22:55

Would be nice to see Amoveo in the top50 at CMC someday 🙂

Deleted invited Deleted Account

Rafael B. invited Rafael B.

17 January 2020

Z

07:56

Zack

Amoveo has had some updates that made block syncing faster, but they were hard updates. So only the recent blocks are faster.

by syncing blocks in reverse order we can overcome the mistakes of our past, and feel the full effect of speed improvements immediately.

by syncing blocks in reverse order we can overcome the mistakes of our past, and feel the full effect of speed improvements immediately.

08:01

If we can sync blocks in reverse order, then a full node can be practically as light as a light node.

Just tell it not to sync the historical blocks.

Just tell it not to sync the historical blocks.

08:11

Looks like the 3.5 megabytes of trie databases can get compressed into a 0.6 megabyte checkpoint.

Z

08:27

Zack

Has any other blockchain enabled backwards syncing yet?

08:28

I set up this server to host checkpoints. 46.101.185.98

08:31

I think I heard about the backwards syncing idea in 2015 from Vlad Zamfir.

You would have thought that someone would have built it by now.

I guess a prerequisite is having a stateless full node, and Amoveo might be the only blockchain with stateless full nodes.

You would have thought that someone would have built it by now.

I guess a prerequisite is having a stateless full node, and Amoveo might be the only blockchain with stateless full nodes.

Z

12:08

Zack

I think once backwards syncing is working, an amoveo full node should be completely usable within 1 minute of turning it on.

and installing amoveo with dependencies on a new machine can probably be done in less than a minute.

and installing amoveo with dependencies on a new machine can probably be done in less than a minute.

Deleted joined group by link from Group

Z

18:15

Zack

a sortition chain will probably only last like 4000 or 8000 blocks.

So if you sync backwards, you only need to sync the most recent 4000 or 8000 blocks, and you can know everything about the sortition chains currently in use.

So if you sync backwards, you only need to sync the most recent 4000 or 8000 blocks, and you can know everything about the sortition chains currently in use.

ŽM

18:25

Živojin Mirić

this is great

Ntin Ang invited Ntin Ang

18 January 2020

Z

07:36

Zack

The checkpoint we were looking at before included merkel trees for the most recent 200-800 blocks, depending on the settings of who you got them from, and how many txs were in those blocks.

So I wrote an update for the merkel tree library. If you only care about a single merkel root, it can delete everything else from that checkpoint.

Syncing in reverse will completely remove any data leaks that accumulated while syncing the 100k blocks.

So I wrote an update for the merkel tree library. If you only care about a single merkel root, it can delete everything else from that checkpoint.

Syncing in reverse will completely remove any data leaks that accumulated while syncing the 100k blocks.

Z

07:56

Zack

I set it up so when you are doing a checkpoint, it verifies all the merkel proofs for all parts of the merkel tree in the checkpoint.

Pjmora28 invited Pjmora28

P

10:28

Pjmora28

Hello, what is the total suply?

Z

10:31

Zack

about 70 000 VEO.

P

10:33

Pjmora28

Max suply to?

Z

10:34

Zack

Amoveo has a governance system, we can't predict the max supply.

10:34

the governance system might raise or lower the block reward this month.

P

10:34

Pjmora28

👍

ŽM

19 January 2020

Z

01:01

Zack

I am running into issues with the prev_hashes part of each block.

01:03

originally we had a way to looking any block in a given version of history.

Starting with block N, to find block M, it look log2(N-M) lookups of blocks.

block N stores log2(N) many hashes of previous blocks.

This strategy was not good because as the number of blocks grew, and the size of blocks grew, it became very expensive to look up random blocks this way.

Starting with block N, to find block M, it look log2(N-M) lookups of blocks.

block N stores log2(N) many hashes of previous blocks.

This strategy was not good because as the number of blocks grew, and the size of blocks grew, it became very expensive to look up random blocks this way.

01:06

as long as we are only using db_version 2 from now on, then we only use a tree structure for the recent 200 or so blocks. As long as forks aren't longer than 100 blocks, this works.

older blocks get stored in compressed pages containing hundreds of blocks per page.

So we are barely useing the prev_hashes at all any more.

older blocks get stored in compressed pages containing hundreds of blocks per page.

So we are barely useing the prev_hashes at all any more.

01:07

I think it will be even faster if we scan through the recent 100 headers, since they are all in ram. that way we don't have to do any unnecessary reads from the hard drive.

01:08

then we can get rid of prev_hashes entirely, which will make checkpointing a lot simpler as well.

Z

05:56

Zack

should store this prev-hashes data with the headers?

Do we ever want to query by height?

Do we ever want to query by height?

06:00

I think if we did want to query by height, it should be a new dedicated data structure. And not a hack on top of the headers process.

Z

14:28

Zack

I am able to sync the recent blocks between the checkpoint and the top, and then the node stays in sync like a normal node.

So the next step is to verify the rest of the blocks in reverse order back to the genesis, and give some command to look up how far backwards has been verified.

So the next step is to verify the rest of the blocks in reverse order back to the genesis, and give some command to look up how far backwards has been verified.

14:29

im probably going to come up with some better plan for syncing headers.

and we will need to run tests to make sure a full node can sync either forwards or backwards with an existing full node that was synced either forwards or backwards.

and we will need to run tests to make sure a full node can sync either forwards or backwards with an existing full node that was synced either forwards or backwards.

Z

14:46

Zack

the headers are pretty repetitive. maybe we can compress them before sending.

Z

20:14

Zack

It looks like syncing backwards will be a lot faster than forwards.

Going forwards there was one step that was synchronous. Maintaining the merkel trees had to be done one block at a time.

Writing the new batch of data to the RAM tree after processing each block.

But when we verify the blocks in reverse, we don't need to maintain any merkel trees, so everything is parallelizable.

Going forwards there was one step that was synchronous. Maintaining the merkel trees had to be done one block at a time.

Writing the new batch of data to the RAM tree after processing each block.

But when we verify the blocks in reverse, we don't need to maintain any merkel trees, so everything is parallelizable.

20 January 2020

Z

06:00

Zack

Im still working on syncing backwards.

I ran into an issue.

We need to calculate the merkel root of the consensus state after running all the txs.

But currently, the only way of doing that is by maintaining the long term merkel data structure that has everything in it.

so we need a way to gather up all the merkel proofs from a single block, and make them into a small merkel data structure that can be updated, and we can get the new root from it.

I ran into an issue.

We need to calculate the merkel root of the consensus state after running all the txs.

But currently, the only way of doing that is by maintaining the long term merkel data structure that has everything in it.

so we need a way to gather up all the merkel proofs from a single block, and make them into a small merkel data structure that can be updated, and we can get the new root from it.

Z

07:54

Zack

so, the way I am thinking of dealing with this.

The txs have a bunch of merkel proofs, and instead of making a tree, I am going to update these merkel proofs directly.

This is something we need to do anyway, if we want to have sharded mining pools that can include txs from other shards.

Once the merkel proofs are updated, each one will say the new merkel root on it, which is what we need.

The txs have a bunch of merkel proofs, and instead of making a tree, I am going to update these merkel proofs directly.

This is something we need to do anyway, if we want to have sharded mining pools that can include txs from other shards.

Once the merkel proofs are updated, each one will say the new merkel root on it, which is what we need.

07:55

maybe we need to upgrade the full node to allow a less repetitive format for the merkel proofs.

If they were gathered up into trees, we could operate over them more efficiently, and it would waste less space.

If they were gathered up into trees, we could operate over them more efficiently, and it would waste less space.

Z

08:40

Zack

https://github.com/zack-bitcoin/MerkleTrie/blob/master/src/verify.erl#L6

I made a tool for updating a merkel proof.

I made a tool for updating a merkel proof.

ŽM

C

17:56

Chris 🍞

In reply to this message

cuz he's been in blockchain longer then you have been out of diapers

Z

18:08

Zack

An advantage of syncing backwards is that it will make testing so much faster.

If we can spin up a fresh full node in only 2 minutes instead of 25+ minutes, then we can test new code out on the full node that much faster.

If we can spin up a fresh full node in only 2 minutes instead of 25+ minutes, then we can test new code out on the full node that much faster.

b

19:13

I have been reading about Erlang, Zack you are way ahead of many blockchains doing it with it.

One of many smart decisions you have taken.

One of many smart decisions you have taken.

Z

19:18

Zack

Erlang is a great language. Here is a recent video about it from a channel on YouTube that I enjoy https://youtu.be/SOqQVoVai6s

b

19:24

bitcoinsfacil - pedro

I am reading this free book recommendation you said > https://learnyousomeerlang.com/

Z

19:26

Zack

If we had to choose between a modern popular language built for highly scalable infrastructure protocols and massive development teams, vs an obscure language from the 80s built for connecting phone calls, guess which is better?

A

19:27

Advanced

Hei guys, hey zack! Just checking in after more than a year, I was mining and buying VEO ... what's current average price for 1 VEO?

Z

19:28

Zack

Qtrade seems to have the most honest price.

I think it was around $40 last I checked.

I think it was around $40 last I checked.

A

19:29

Advanced

thanks

JS

22:28

Jon Snow

In reply to this message

Which are the two languages? I guess Erlang is the one from 80’s built for connecting phone calls?

Z

22:31

Zack

In reply to this message

many languages fit that description: golang, rust, c#, swift, java

22:35

yes, erlang was designed and optimized for connecting analogue telephone calls.

21 January 2020

JS

00:17

Jon Snow

In reply to this message

Why didn’t Amoveo use a modern popular language built for highly scalable infrastructure protocols and massive development teams, but an obscure language from the 80s built for connecting phone calls?

B

00:29

Ben

good question ;)

b

00:49

bitcoinsfacil - pedro

Check Erlang please and then rephrase, it is really a great language for development on exactly this type of projects

Z

02:38

Zack

In reply to this message

Erlang is much better than modern popular languages.

Erlang is not the fastest. C/rust/golang/swift/java are faster. even javascript is faster now that there is asm.js

But in the context of blockchain, a faster language doesn't really matter. If we implement scaling correctly, then we can support trillions of users in parallel, even with a slow language.

Where erlang does win is in:

* a person can implement new features in erlang much faster than the popular languages. It is about as fast as Lisp for adding new features. Probably less than 1/10th as much work as popular languages.

* erlang has the best system for error handling I have seen, and it is the only system I have seen than still works well when doing parallel computation. This is a critical feature for catching unexpected bugs, and reducing the DOS attack surface area.

* every other language has parallelism thrown on top as a bonus feature after the language is already built. in Erlang parallelism was the primary goal. It is the only language I have used with sane tools for parallel computation. This is a critical feature for any protocol that has many simultaneous peers. It makes it easy for us to maintain large number of simultaneous channel relationships. It makes it easy to process blocks in parallel.

Erlang is not the fastest. C/rust/golang/swift/java are faster. even javascript is faster now that there is asm.js

But in the context of blockchain, a faster language doesn't really matter. If we implement scaling correctly, then we can support trillions of users in parallel, even with a slow language.

Where erlang does win is in:

* a person can implement new features in erlang much faster than the popular languages. It is about as fast as Lisp for adding new features. Probably less than 1/10th as much work as popular languages.

* erlang has the best system for error handling I have seen, and it is the only system I have seen than still works well when doing parallel computation. This is a critical feature for catching unexpected bugs, and reducing the DOS attack surface area.

* every other language has parallelism thrown on top as a bonus feature after the language is already built. in Erlang parallelism was the primary goal. It is the only language I have used with sane tools for parallel computation. This is a critical feature for any protocol that has many simultaneous peers. It makes it easy for us to maintain large number of simultaneous channel relationships. It makes it easy to process blocks in parallel.

Z

08:03

Zack

In reply to this message

I made a version that takes a list of merkel proofs, and updates, and returns all the new merkel proofs as they will look after all the updates are applied.

Cactus invited Cactus

C

21:56

Cactus

Hi everyone is anyone available from the team to take a message? Thanks in advance

22 January 2020

Deleted invited Deleted Account

Z

09:57

Zack

In reply to this message

im starting to think that updating merkel proofs in place is not a good strategy.

Most of the time it works fine, but the edge case of making a new stem 1/16th of the time makes it kind of complicated.

Most of the time it works fine, but the edge case of making a new stem 1/16th of the time makes it kind of complicated.

10:01

one option is to launch a new set of merkel tree processes for every block we are processing in parallel. That way garbage collection is trivial, we just drop the entire process.

And there is no race condition issues because each block being verified can have its own tree processes to store its own merkel trees.

Another option is to re-write the merkel tree operations for these small merkel trees, but instead of using ETS which requires a process to own it, we can use tuples and lists to build the trees.

garbage collection would be trivial, we can just drop the variable that is storing the merkel tree.

and there is no race condition issues, because each block can have its own variable to store its own merkel tree.

And there is no race condition issues because each block being verified can have its own tree processes to store its own merkel trees.

Another option is to re-write the merkel tree operations for these small merkel trees, but instead of using ETS which requires a process to own it, we can use tuples and lists to build the trees.

garbage collection would be trivial, we can just drop the variable that is storing the merkel tree.

and there is no race condition issues, because each block can have its own variable to store its own merkel tree.

10:03

I kind of like the idea of re-writing the merkel tree application so it doesn't have any processes, and it works like an erlang dictionary that you can just pass around to the process that needs it.

Z

10:56

Zack

Now that we are using the sortition chain scaling plan, that means we can keep the merkel trees in ram forever. they will never need to go on the hard drive.

So this means we don't need a separate process for managing our merkel trees.

It turns out you can use ETS in "public" mode, and then it can act like a dictionary, you can pass it between processes.

So I think I will make a new branch of the merkel tree. I will only support ram version, not hd.

I will stop using the dump dependency.

I will start by making tools for merkel trees, and then afterwards I will use those merkel tree tools to build the long-term database for the up to date consensus. So it will work in both ways.

So this means we don't need a separate process for managing our merkel trees.

It turns out you can use ETS in "public" mode, and then it can act like a dictionary, you can pass it between processes.

So I think I will make a new branch of the merkel tree. I will only support ram version, not hd.

I will stop using the dump dependency.

I will start by making tools for merkel trees, and then afterwards I will use those merkel tree tools to build the long-term database for the up to date consensus. So it will work in both ways.

23 January 2020

Alex invited Alex

A

02:58

Alex

Hi there

03:03

Have been quite impressed with this project - and Zach, to be honest.

03:04

Still working through some of the finer details regarding the technical logic and game theory that enables centralized trustless services

03:04

But impressed and engaged

A

05:14

Alex

Zack I havent been able to find a link to Amoveo's tokenomics. Is there one I am missing?

Z

05:23

Zack

hi Alex. thanks for your interest in Amoveo.

I am not sure what "tokenomics" means.

Amoveo has a governance system called "futarchy".

Futarchy is able to update aspects of Amoveo, like the block time and the block reward.

We can't predict what futarchy will set the block reward to in the future.

I am not sure what "tokenomics" means.

Amoveo has a governance system called "futarchy".

Futarchy is able to update aspects of Amoveo, like the block time and the block reward.

We can't predict what futarchy will set the block reward to in the future.

A

05:39

Alex

Understood, thank you. I mean the total supply on CMC is just under 70mm, but it would seem to me that there is no supply cap if PoW is ongoing

05:42

I suppose the term "token metrics" might be more appropriate here

Z

05:43

Zack

there might be a supply cap. there might not be.

We cannot predict what the governance system will set the block reward and block time to.

We cannot predict what the governance system will set the block reward and block time to.

A

05:44

Alex

Fair point, understood

C

J

16:42

JOHNwick3's dog

so, what are derivatives? its a bet right?

Could you use Amoveos oracles to make a bet in another coin? What potential does Amoveo bring to be interoperable with other coins? i'm brainstorming/tinkering with ideas that I don't fully understand yet.. trying to think about how to build dapps

Could you use Amoveos oracles to make a bet in another coin? What potential does Amoveo bring to be interoperable with other coins? i'm brainstorming/tinkering with ideas that I don't fully understand yet.. trying to think about how to build dapps

16:43

The best coin.. would be a fusion between successful coins..

Z

17:05

Zack

In reply to this message

>what are derivatives?

A financial derivative is the most basic financial instrument.

Primary colors are to colors what financial derivatives are to finance.

The same way you can combine the primary colors to produce all possible colors, you can combine financial derivatives to create any financial portfolio.

the chemical elements are to chemistry what financial derivatives are to finance.

The same way you can combine the chemical elements to produce all possible chemicals, you can combine financial derivatives to create any financial portfolio.

If you are a farmer who is growing orange fruit trees, there is a lot of risk for you if the price of orange fruits should drop before you are ready to harvest.

You could use a financial derivative to hedge this risk. That way you can lock in the current price of oranges, so when your oranges are ready you can sell them at the price you locked in.

Financial derivatives are older than written language. Financial derivatives are the most popular use-case of currency.

> could you use amoveo to bet on another coin?

you can use Amoveo to bet on the price of BTC. We can have BTC stablecoins on top of Amoveo.

>brainstorming

here are a bunch of use-cases of Amoveo to give you an idea of what is possible https://github.com/zack-bitcoin/amoveo/tree/master/docs/use-cases-and-ideas

>the best coin would be a fusion between successful coins.

When it comes to software tools, it seems like simple tools that do their job well end up more successful in comparison to tools that try to do too many different things.

I can't see any reason that a platform for financial derivatives could be improved by adding crypto-kitties, or subcurrencies, or DAO-voting-pools, or any of the other crazy finance experiments people have been doing lately.

Financial derivatives are popular today for the same reason they have been popular since prehistory, which is the same reason that they will be popular in the future. Financial derivatives are a scalable way to hedge risks.

They are scalable because their enforcement doesn't require any shared mutable state.

A financial derivative is the most basic financial instrument.

Primary colors are to colors what financial derivatives are to finance.

The same way you can combine the primary colors to produce all possible colors, you can combine financial derivatives to create any financial portfolio.

the chemical elements are to chemistry what financial derivatives are to finance.

The same way you can combine the chemical elements to produce all possible chemicals, you can combine financial derivatives to create any financial portfolio.

If you are a farmer who is growing orange fruit trees, there is a lot of risk for you if the price of orange fruits should drop before you are ready to harvest.

You could use a financial derivative to hedge this risk. That way you can lock in the current price of oranges, so when your oranges are ready you can sell them at the price you locked in.

Financial derivatives are older than written language. Financial derivatives are the most popular use-case of currency.

> could you use amoveo to bet on another coin?

you can use Amoveo to bet on the price of BTC. We can have BTC stablecoins on top of Amoveo.

>brainstorming

here are a bunch of use-cases of Amoveo to give you an idea of what is possible https://github.com/zack-bitcoin/amoveo/tree/master/docs/use-cases-and-ideas

>the best coin would be a fusion between successful coins.

When it comes to software tools, it seems like simple tools that do their job well end up more successful in comparison to tools that try to do too many different things.

I can't see any reason that a platform for financial derivatives could be improved by adding crypto-kitties, or subcurrencies, or DAO-voting-pools, or any of the other crazy finance experiments people have been doing lately.

Financial derivatives are popular today for the same reason they have been popular since prehistory, which is the same reason that they will be popular in the future. Financial derivatives are a scalable way to hedge risks.

They are scalable because their enforcement doesn't require any shared mutable state.

17:12

Computer programmers don't know enough about finance to know what a derivative is.

Finance people don't know enough about programming to realize why the lack of shared state is so important in the success of derivatives.

Finance people don't know enough about programming to realize why the lack of shared state is so important in the success of derivatives.

I

17:32

Instinct

Could a centralised exchange like qtrade list a Veo btc stablecoin?

B

17:35

Ben

no

17:36

at least it is not an easy thing

Z

17:37

Zack

In reply to this message

yes, and you have a lot of freedom to decide which parts to make trust-free.

there are already exchanges that allow you to buy leverage on bitcoin. That is a kind of financial derivative that is very trustful.

Amoveo markets for derivative contracts have a centralized untrusted hub to facilitate trading at the current market price. So a centralized exchange like qtrade could offer completely trust-free stablecoin contracts.

there are already exchanges that allow you to buy leverage on bitcoin. That is a kind of financial derivative that is very trustful.

Amoveo markets for derivative contracts have a centralized untrusted hub to facilitate trading at the current market price. So a centralized exchange like qtrade could offer completely trust-free stablecoin contracts.

B

17:37

Ben

contracts != stablecoin

Z

17:38

Zack

a stablecoin is one kind of derivative contract.

B

17:38

Ben

true, more a naming thing

17:39

but still i guess if the implementation would be easy, qtrade would have done it.

Z

17:39

Zack

there are also stablecoins built out of subcurrencies, like ERC-20 subcurrencies on Ethereum.

They are not derivatives because they involve shared mutable state.

They are not derivatives because they involve shared mutable state.

J

17:40

JOHNwick3's dog

Thanks for the response Zack!

well, what i'm curious about is why you need Amoveo to host Derivatives. Why can't you use any other crypto?

Doesn't this have something to do with Oracles?

But why can't someone just create some type of universal Oracle that can use any currency for a derivative?

Say you wanted to use Bitcoin as the bet, could you?

or USD?

So lets say some other coin comes up with a demand for derivatives with their coin, but wants to use Amoveos Oracles without risk in VEO.

I'm obviously asking because I don't fully understand this lol

well, what i'm curious about is why you need Amoveo to host Derivatives. Why can't you use any other crypto?

Doesn't this have something to do with Oracles?

But why can't someone just create some type of universal Oracle that can use any currency for a derivative?

Say you wanted to use Bitcoin as the bet, could you?

or USD?

So lets say some other coin comes up with a demand for derivatives with their coin, but wants to use Amoveos Oracles without risk in VEO.

I'm obviously asking because I don't fully understand this lol

Z

17:40

Zack

In reply to this message

it will get easier with time. We are building up tooling to make stuff like this easy on Amoveo.

Sortition chains will be a key feature moving us in this direction because they will allow a central hub to match up customer contracts without needing to maintain to much locked up capital.

Sortition chains will be a key feature moving us in this direction because they will allow a central hub to match up customer contracts without needing to maintain to much locked up capital.

B

17:41

Ben

perfect, usability is one key aspect that stops amoveo

Z

17:46

Zack

In reply to this message

Amoveo's goal is to be a very cost effective platform for derivatives.

People have been using derivatives longer than recorded history, at least 10k years. Amoveo is less than 2 years old. Cryptocurrency is barely 10 years old.

You don't need Amoveo or any cryptocurrency to use financial derivatives.

>doesn't this have something to do with oracles?

Amoveo's design for oracles is very cost effective. you can read about it here https://github.com/zack-bitcoin/amoveo/blob/master/docs/design/oracle.md

> why not create a universal oracle that can use any currency for a derivative? can you use Bitcoin to bet? or USD?

You can use the result of Amoveo's oracle to resolve contracts on other blockchains. Amoveo has a cheap light node. If you embed the light node into another blockchain, then it can know the results of oracles on Amoveo.

You can make BTC stablecoins on Amoveo, and then make a derivative contract on Amoveo that is priced in the BTC stablecoins.

Similarly you can bet on Amoveo using USD stablecoins.

People have been using derivatives longer than recorded history, at least 10k years. Amoveo is less than 2 years old. Cryptocurrency is barely 10 years old.

You don't need Amoveo or any cryptocurrency to use financial derivatives.

>doesn't this have something to do with oracles?

Amoveo's design for oracles is very cost effective. you can read about it here https://github.com/zack-bitcoin/amoveo/blob/master/docs/design/oracle.md

> why not create a universal oracle that can use any currency for a derivative? can you use Bitcoin to bet? or USD?

You can use the result of Amoveo's oracle to resolve contracts on other blockchains. Amoveo has a cheap light node. If you embed the light node into another blockchain, then it can know the results of oracles on Amoveo.

You can make BTC stablecoins on Amoveo, and then make a derivative contract on Amoveo that is priced in the BTC stablecoins.

Similarly you can bet on Amoveo using USD stablecoins.

WL

17:47

Wilson Lau

In reply to this message

If sortition chain works, what will the flow of setting up and closing a derivative looks like?

J

17:51

John

Do we have a example platform for derivatives running on amoveo?

Z

17:56

Zack

In reply to this message

the p2p derivatives tool in the light node will still work basically the same way once sortition chains exist. the "smart contract" section of the light node http://159.89.87.58:8080/home.html

How the derivatives work behind the scenes doesn't really make a difference for how the user interface looks or acts.

Eventually we will get to the point where the user experience of making an Amoveo derivative contract will be about the same as how it feels to make a derivative contract on a centralized platform like CME today.

How the derivatives work behind the scenes doesn't really make a difference for how the user interface looks or acts.

Eventually we will get to the point where the user experience of making an Amoveo derivative contract will be about the same as how it feels to make a derivative contract on a centralized platform like CME today.

J

17:57

JOHNwick3's dog

so if a lot of derivatives were made on a btc stablecoin or other coin, would that benefit the price of Amoveo a lot? So basically, If you have a BTC stablecoin that it uses, it mirrors the price of BTC but you hold VEO to do it with right?

Z

17:57

Zack

In reply to this message

we have the p2p derivatives tool in the light node. and there is that website where you can post offers of derivatives contracts.

J

17:59

JOHNwick3's dog

Also, you mentioned a while back that there was a method of using Amoveo for derivatives without getting exposure to the price fluxuations? How does that work again? I guess that would be just another derivative basically?

Z

17:59

Zack

In reply to this message

if there was a lot of VEO locked up in contracts, and there was demand for more VEO to be locked up in more contracts, that demand would result in the price of VEO increasing.

If you hold a BTC stablecoin on Amoveo it would stay the same price as BTC, but the contract is priced completely in VEO. When it expires, you get paid a quantity of VEO that is worth as much as how many BTC the contract specifies for you.

If you hold a BTC stablecoin on Amoveo it would stay the same price as BTC, but the contract is priced completely in VEO. When it expires, you get paid a quantity of VEO that is worth as much as how many BTC the contract specifies for you.

WL

18:00

Wilson Lau

In reply to this message

What about the matching both sides? It enable user to match within the chain? Or require thrid party platform?

Z

18:00

Zack

In reply to this message

you can combine derivatives to create whatever risk profile you are interested in.

For example, if you bet that the price of BTC/VEO will increase, and you bet that the price of GOLD/BTC will increase, the combination is like betting that GOLD/VEO will increase.

For example, if you bet that the price of BTC/VEO will increase, and you bet that the price of GOLD/BTC will increase, the combination is like betting that GOLD/VEO will increase.

J

18:03

JOHNwick3's dog

alright, thanks for the feedback Zack. I took some notes. I'm not 100% sure where I was going with this. I'm mainly trying to brainstorm how to build a business/dapp to become financially indepenedent. haha. Makes my head hurt I have to think!

J

18:03

John

In reply to this message

Anything holding back for people to build a large scale derivative tool on amoveo based on the lightnode? Afterall, amoveo is quite a dream tool for them and it sounds like a good way make a lot of money

Z

18:06

Zack

In reply to this message

>what about matching both sides

we previously had a market mechanism where people could make bets on both sides.

But before the existence of sortition chains, it was too expensive. the operator had to lock up too much veo to operate it.

Also, we found some bugs in the smart contract for it.

So we turned that feature off for now, until we are ready to try again.

You can read about how it will work here: https://github.com/zack-bitcoin/amoveo/blob/master/docs/design/limit_order_in_channel.md

> it enable user to match within the chain? or require third party platform?

markets necessarily involve some shared mutable state. The order book where trades are matched.

Amoveo doesn't support this kind of state on-chain.

But you can use Amoveo to host this kind of state on a central server in a trust-free way.

I feel that making the market secure and trust-free is more important than making the market decentralized.

if one central trust-free market gets shut down, we can make another.

we previously had a market mechanism where people could make bets on both sides.

But before the existence of sortition chains, it was too expensive. the operator had to lock up too much veo to operate it.

Also, we found some bugs in the smart contract for it.

So we turned that feature off for now, until we are ready to try again.

You can read about how it will work here: https://github.com/zack-bitcoin/amoveo/blob/master/docs/design/limit_order_in_channel.md

> it enable user to match within the chain? or require third party platform?

markets necessarily involve some shared mutable state. The order book where trades are matched.

Amoveo doesn't support this kind of state on-chain.

But you can use Amoveo to host this kind of state on a central server in a trust-free way.

I feel that making the market secure and trust-free is more important than making the market decentralized.

if one central trust-free market gets shut down, we can make another.

18:08

In reply to this message

>anything holding back people who want to build large scale derivatives tools on amoveo based on the light node?

The light node is an open source tool for making derivatives. If you have idea on how to improve it, I am willing to accept pull requests.

Or you can make suggestions, and if they are good I will program it, or we will make contracts to incentivize someone else to program it.

The light node is an open source tool for making derivatives. If you have idea on how to improve it, I am willing to accept pull requests.

Or you can make suggestions, and if they are good I will program it, or we will make contracts to incentivize someone else to program it.

J

18:09

John

Thanks for your response Zack

Z

18:10

Zack

Feel free to ask questions about Amoveo here any time.

J

18:13

JOHNwick3's dog

What makes Amoveo blockchain unique?

The Oracle right?

Why can't Bitcoin take the code and have Derivatives done with that?

or any ERC20 coin?

Why can't we just take the code and use it on a different coin so that derivatives can be done on any coin that has liquidity?

The Oracle right?

Why can't Bitcoin take the code and have Derivatives done with that?

or any ERC20 coin?

Why can't we just take the code and use it on a different coin so that derivatives can be done on any coin that has liquidity?

18:14

Can't this just be done by copying amoveos code and making a sidechain on other coins?

18:14

obviously I don't understand the details of how this works, thats why i'm asking

Z

18:24

Zack

In reply to this message

Amoveo is 100% open source.

Any part of Amoveo's software can be easily copied into other blockchains.

This is a very serious risk to the success of Amoveo, it is a big part of the reason that VEO is such a high risk investment.

What can't be copied is the community that has built up around Amoveo. We have a culture, with values that we share.

If Amoveo's culture is correct, then other blockchains wont realize that we were right until we are already popular. And if we are already popular, then there will be network effects making Amoveo the better platform for doing the things that makes Amoveo popular.

> can amoveo be cloned to an erc20 on ethereum?

It is hard to put a competitive oracle on top of Ethereum.

Part of what makes Amoveo's oracle design work is that it is the only oracle on Amoveo. So the success of veo and the success of the oracle are tied together closely. So we can use the price of veo as a signal to know about the oracle's accuracy on a fork.

With ethereum there can be many oracles, so the success of any one oracle isn't very connected to the price of ETH.

The kinds of oracles that people have been able to build on Ethereum are all less cost effective than Amoveo's oracle design.

> can amoveo be cloned to a bitcoin?

yes, that is the goal of the drivechain project. I highly recommend their website and forums http://bitcoinhivemind.com/ they are a major inspiration for Amoveo.

Adding these features to bitcoin is a political battle.

Bitcoin is so big that it is very hard to make changes to it now.

Also, I think the current strategy being explored by drivechain will not work https://github.com/zack-bitcoin/amoveo/blob/master/docs/other_blockchains/drivechain.md

Any part of Amoveo's software can be easily copied into other blockchains.

This is a very serious risk to the success of Amoveo, it is a big part of the reason that VEO is such a high risk investment.

What can't be copied is the community that has built up around Amoveo. We have a culture, with values that we share.

If Amoveo's culture is correct, then other blockchains wont realize that we were right until we are already popular. And if we are already popular, then there will be network effects making Amoveo the better platform for doing the things that makes Amoveo popular.

> can amoveo be cloned to an erc20 on ethereum?

It is hard to put a competitive oracle on top of Ethereum.

Part of what makes Amoveo's oracle design work is that it is the only oracle on Amoveo. So the success of veo and the success of the oracle are tied together closely. So we can use the price of veo as a signal to know about the oracle's accuracy on a fork.

With ethereum there can be many oracles, so the success of any one oracle isn't very connected to the price of ETH.

The kinds of oracles that people have been able to build on Ethereum are all less cost effective than Amoveo's oracle design.

> can amoveo be cloned to a bitcoin?

yes, that is the goal of the drivechain project. I highly recommend their website and forums http://bitcoinhivemind.com/ they are a major inspiration for Amoveo.

Adding these features to bitcoin is a political battle.

Bitcoin is so big that it is very hard to make changes to it now.

Also, I think the current strategy being explored by drivechain will not work https://github.com/zack-bitcoin/amoveo/blob/master/docs/other_blockchains/drivechain.md

J

18:32

JOHNwick3's dog

Couldn't you build an oracle on an erc20 token so that its price is tied to that? and that would be independent of Ethereum price?

I'd bet Amoveo has a chance of success even if this happens, but i'm curious.

I'd bet Amoveo has a chance of success even if this happens, but i'm curious.

18:33

Amount of money in derivatives is huge, so it makes sense to have redundancy of where to store the derivatives and competition.

18:34

Amoveo on its own blockchain is a security risk.. Bitcoin has apparently had two inflation bugs.

Z

18:35

Zack

In reply to this message

That is an idea we talked about before.

For example, if Augur only allowed betting in Rep.

I asked Augur why they don't only do betting in Rep. Let me try and remember what they said.

For example, if Augur only allowed betting in Rep.

I asked Augur why they don't only do betting in Rep. Let me try and remember what they said.

18:42

oh, I remember.

The reason an ERC-20 can't be as effective is because the rest of the Ethereum community might not care to hard fork their entire blockchain just to rescue one ERC-20 derivatives contract.

So even if Ethereum did hard fork as part of the recovery process, and the ERC-20 was much more valuable on side A so we could know which side has an honest oracle, side B with the dishonest oracle could still win if the price of Eth is higher on side B.

And the reason Augur didn't use that strategy is because Rep is too volatile, and the market cap of Rep is too low. It would have been an inferior product with more volatility.

The reason an ERC-20 can't be as effective is because the rest of the Ethereum community might not care to hard fork their entire blockchain just to rescue one ERC-20 derivatives contract.

So even if Ethereum did hard fork as part of the recovery process, and the ERC-20 was much more valuable on side A so we could know which side has an honest oracle, side B with the dishonest oracle could still win if the price of Eth is higher on side B.

And the reason Augur didn't use that strategy is because Rep is too volatile, and the market cap of Rep is too low. It would have been an inferior product with more volatility.

18:45

In reply to this message

yes, if Amoveo was popular, there would inevitably be altcoins ready to take our place if we ever mess up.

J

19:02

JOHNwick3's dog

In reply to this message

I don't undestand this part. why would you need to hardfork to rescue a derivatives contract?

19:03

What does the side a and side b stuff mean?

Z

19:03

Zack

In reply to this message

This is the design we are using in Amoveo to allow for such an extremely affordable oracle.

If Amoveo's oracle works, then every other design currently being explored will become cost-prohibitive in comparison to Amoveo's design.

If Amoveo's oracle works, then every other design currently being explored will become cost-prohibitive in comparison to Amoveo's design.

19:04

We were studying oracles a lot.

It turns out that coming to agreement on the state of the oracle is a kind of consensus protocol, like how PoW is a blockchain consensus protocol to come to agreement about who has which money.

It turns out that coming to agreement on the state of the oracle is a kind of consensus protocol, like how PoW is a blockchain consensus protocol to come to agreement about who has which money.

19:04

Consensus protocols are very expensive.

19:05

Amoveo's oracle is cheap because we found a way to re-use the blockchain consensus protocol to also be an oracle consensus protocol.

All other designs involve sustaining 2 consensus mechanisms at the same time, which is far more expensive than just having 1.

All other designs involve sustaining 2 consensus mechanisms at the same time, which is far more expensive than just having 1.

19:07

this is the documentation for Amoveo's oracle https://github.com/zack-bitcoin/amoveo/blob/master/docs/design/oracle.md

J

19:07

JOHNwick3's dog

So this is the "why" of Amoveo. This is all fine and well, but if I struggle to understand this than other people probably do too. I get the basic idea of what your saying...

Why can't all this be copied onto an erc20 token?

Why can't all this be copied onto an erc20 token?

19:08

all other designs suck why aren't they copying your design? lol

Z

19:17

Zack

In reply to this message

> why can't this be copied into an erc20 token?

ethereum erc20 tokens are inside a VM sandbox.