Amoveo ♥🧿

Previous messages

Next messages

6 August 2018

OK

22:52

O K

not USD

22:52

They try to get more BTC at the end of their trades

22:52

not USD

Z

22:52

Zack

I don't see how that matters.

We could measure the price in grams of copper and the math is still all the same.

We could measure the price in grams of copper and the math is still all the same.

OK

22:52

O K

Because you want to make changes that impact the price positively, but you are pricing in the wrong currency

22:53

Take the other side, why don't we price in Bolivars?

22:53

Bolivar fuerte

22:53

Saying the price will go up 100% in bolivar fuerte would not tell us very much, would it?

S

22:54

Sebsebzen

Maybe Zack is right but as a math noob I guess I’d misunderstand the bet and it would affect my vote

Z

22:54

Zack

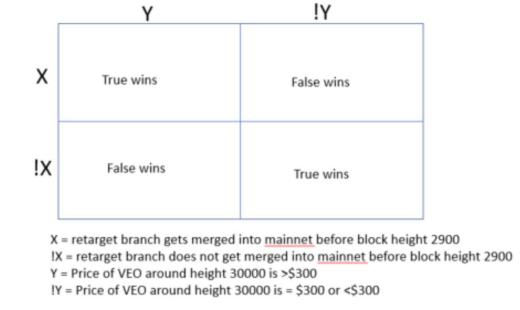

[P(VEO > $300 | we update) - P(VEO > $300 | do not update) ]

[P(VEO > 0.5 Eth | we update) - P(VEO > 0.5 Eth | we do not update ]

There are either both above 0.5 or they are both below 0.5

There is no way one is above and the other below.

[P(VEO > 0.5 Eth | we update) - P(VEO > 0.5 Eth | we do not update ]

There are either both above 0.5 or they are both below 0.5

There is no way one is above and the other below.

22:54

Unless the Eth-USD exchange rate somehow depends on whether we do a hard update.

Which is impossible, since VEO isn't popular enough among either ETH users or USD users.

Which is impossible, since VEO isn't popular enough among either ETH users or USD users.

OK

S

22:55

Sebsebzen

ELI5 proof bets please

22:55

Haha

OK

22:57

O K

In reply to this message

I think I get it. It only matters in cases where the price is exactly 50

22:57

Thanks for the nuanced explanation

Z

22:57

Zack

In reply to this message

http://bitcoinhivemind.com/papers/3_PM_Applications.pdf

Paul Sztorc probably explains better than me.

Paul Sztorc probably explains better than me.

22:58

In reply to this message

if the price is exactly 50, then it is a failed market that isn't giving us useful info in either direction.

OK

22:58

Like if we priced 10% higher in Bolivar Fuerte but everyone knows the inflation rate is in the thousands

22:58

It would not be useful

22:59

How many decimals will the current markets let you input for price?

Z

22:59

Zack

Does it accept decimals? it might only do integers

23:00

Deleted Account

I still don't get why you want to set price as a condition for updates. Any random event can influence price levels

23:00

Deleted Account

Its pretty easy: once the fork happened, the bets are only on the $300 part. Id say more likely to not happen. This is why the bets were matched

Z

23:01

Zack

In reply to this message

We only want updates that positively influence the price.

The price isn't a condition for updates. Our expectation of the change in price due to the update is the condition.

The price isn't a condition for updates. Our expectation of the change in price due to the update is the condition.

23:01

Deleted Account

Perhaps the bets should have been closed before you announced the intention to fork?

23:01

I think most people agree that the fork is positive for Amoveo

Z

23:01

Zack

In reply to this message

Good point!

This is a limitation of our current design we should think about more.

This is a limitation of our current design we should think about more.

23:02

Deleted Account

I tried to grab 5 veo for myself yesterday, but couldnt figure out the interface

23:02

I was late for work as a result :)

Z

23:02

Zack

In reply to this message

Announcements of intention are cheap.

Until an update is buried under POW, the community hasn't made a decisionn.

Until an update is buried under POW, the community hasn't made a decisionn.

23:03

Deleted Account

Perhaps a different wording could alleviate the issue. Ill think about it

Z

23:05

Deleted Account

There is also inflation, which is related to emission rates. Demand would have to equal the emission rate for the price to be stable. And only growing adoption will offset inflation. It's also difficult to predict which feature addition will generate more adoption. What am I missing here?

23:06

Deleted Account

I think perhaps any decisions that affect VEO price should not be in markets, or else outside considerations may become more important than the actual question being bet on

23:07

Futarky might not work unfortunately. (Just a thought right now)

Z

23:07

Zack

In reply to this message

yes the price does depend on emission rate and community adoption.

That doesn't make any difference to the accuracy of our futarchy markets because the futarchy markets are only measuring the correlation between the price and whether we do an update.

That doesn't make any difference to the accuracy of our futarchy markets because the futarchy markets are only measuring the correlation between the price and whether we do an update.

23:08

Deleted Account

@zack i think I got it now. Ill try to get aquainted with betting at a more leisurely pace. Im not a big better though :-/

Z

23:08

Zack

How would an "outside consideration" have any effect on the price of our futarchy markets?

23:08

Deleted Account

Sorry, i know Im borderline trolling here. Give me time to think more...

MF

23:11

Deleted Account

In reply to this message

Your approach is different from mine, but you have an idea for an experiment. All experiments are useful. This I agree with.

23:14

I'm here because I want to see how a prediction market ecosystem is born. So far it's fascinating 👍

Z

23:24

Zack

In reply to this message

I can use math to show how this isn't a problem.

First review this tautological fact:

P(A) = P(A | X) + P(A | !X)

X = is adoption rate fast.

A = price goes up

B = we do a hard update

Our formula for correlation:

P(A|B) - P(A|!B)

Add in the X factor:

P((P(A|B) - P(A|!B)) | X) + P((P(A|B) - P(A|!B)) | !X)

distributive property of multiplication

= P(P(A|B) | X) - P(P(A|!B)|X) + P(P(A|B)|!X) - P(P(A|!B)|!X)

switch order of the 4 values.

= P(P(A|B)|X) + P(P(A|B)|!X) - ( P(P(A|!B)|X) + P(P(A|!B)|!X))

Now we apply the tautological fact twice. once the the first 2 values, and once to the second 2 values.

= P(A|B) - P(A|!B)

As you can see, the X completely cancels out.

So the rate of adoption does not make any difference to the result of the futarchy market.

First review this tautological fact:

P(A) = P(A | X) + P(A | !X)

X = is adoption rate fast.

A = price goes up

B = we do a hard update

Our formula for correlation:

P(A|B) - P(A|!B)

Add in the X factor:

P((P(A|B) - P(A|!B)) | X) + P((P(A|B) - P(A|!B)) | !X)

distributive property of multiplication

= P(P(A|B) | X) - P(P(A|!B)|X) + P(P(A|B)|!X) - P(P(A|!B)|!X)

switch order of the 4 values.

= P(P(A|B)|X) + P(P(A|B)|!X) - ( P(P(A|!B)|X) + P(P(A|!B)|!X))

Now we apply the tautological fact twice. once the the first 2 values, and once to the second 2 values.

= P(A|B) - P(A|!B)

As you can see, the X completely cancels out.

So the rate of adoption does not make any difference to the result of the futarchy market.

[

23:25

[Riki]

Animation

Not included, change data exporting settings to download.

242.2 KB

23:26

Nice

Z

23:28

Zack

Conditional probability algebra is one of my favorite parts of math. I got so much better at texas holdem after learning it.

It is great for making decisions. You can estimate how much a decision will impact your income, you can use data from actuary tables to accurate calculate the risk of your behaviors.

It is great for making decisions. You can estimate how much a decision will impact your income, you can use data from actuary tables to accurate calculate the risk of your behaviors.

23:30

Deleted Account

The problem is we cant easily state that «price goes up» relative to forking or not?

23:31

I think its natural that the standings in a market of bets change as outside facts evolve and become more certain

23:32

Eg. At the beginning, i would rate the probability of a fork happening as 70%, and price above $300 as 30%. Now i rate them 99% and 10%, based on recent observations

Z

23:33

Zack

In reply to this message

Sure we can. one way is to estimate is to measure the correlation like this:

P(VEO > $300 | we do the upgrade) - P(VEO > $300 | we do not do the upgrade.)

We could combine it with a CFD to precisely measure the change in price depending on whether we upgrade.

Mr Flinstone came up with a clever way to do this where we only modify the oracle question, and don't have to make any new smart contracts.

P(VEO > $300 | we do the upgrade) - P(VEO > $300 | we do not do the upgrade.)

We could combine it with a CFD to precisely measure the change in price depending on whether we upgrade.

Mr Flinstone came up with a clever way to do this where we only modify the oracle question, and don't have to make any new smart contracts.

OK

23:34

O K

In reply to this message

Now that I understand this a little better, maybe it would be good to in the beginning days to have full ELI5 explanations on market pages explaining the math behind different bets

Z

23:34

Zack

P(VEO > ($300 * RAND) | we do the upgrade) - P(VEO > ($300 * RAND) | we do not do the upgrade)

Where RAND is a random value to be decided based on a block's hash after the betting is closed.

Where RAND is a random value to be decided based on a block's hash after the betting is closed.

23:36

if RAND sets the price uniformly between $200 - $400, then the contract acts like a CFD, so we can use the price in the market to determine the expected change in value of VEO if we do the upgrade.

23:37

I watched some lectures about financial derivatives from some masters degree program. They are on youtube.

The math for financial derivatives can get intense.

The math for financial derivatives can get intense.

23:38

Deleted Account

I believe the rand scheme does not change much, as the distribution will be around some value. Also the users of the market will be more confused. If many people are confused, the accuracy of the prediction is bound to deteriorate

Z

23:40

Zack

In reply to this message

We can build a simple interface on top.

The resulting mechanism is simple for users to understand.

Users don't have to understand the complicated math tricks we use for building simple mechanisms.

The resulting mechanism is simple for users to understand.

Users don't have to understand the complicated math tricks we use for building simple mechanisms.

23:46

Deleted Account

But is there a big difference between $300 and rand($200..$400)? The mean expected value is still $300

23:49

Once the people in the market consider that someone will probably take some action based on the results of the bet, they will consider how outside conditions change based on the bets, which may be more valuable than the bets/rewards thenselves

23:49

Kind if recursive problem there

23:53

If you stored the $x in a text file, and used the hash in the market question. Then later reveal the text before the oracle resolves, but after the betting ends

Z

23:54

Zack

It is the difference between trading an over/under binary derivative vs trading a CFD.

A market for CFD's has a price that can be used to estimate the price of the underlying asset.

A market for over/under only tells us the odds that the price will cross a threshold.

So CFD's can be used for synthetic assets.

And in the case of futarchy, a CFD can be used to measure exactly how much the value of VEO will change if we do an update.

A market for CFD's has a price that can be used to estimate the price of the underlying asset.

A market for over/under only tells us the odds that the price will cross a threshold.

So CFD's can be used for synthetic assets.

And in the case of futarchy, a CFD can be used to measure exactly how much the value of VEO will change if we do an update.

23:54

Deleted Account

Then you are betting on some unknown value.

Z

23:55

Zack

using randomness is not necessary for CFDs. that is just a cool trick that Mr Flintstone invented so we can use a single oracle question to make CFDs, so we can immediately start using CFDs without having to write a new smart contraact.

23:55

it is much easier to make an oracle than it is to write a smart contract.

23:55

Deleted Account

Also you dont know anything about the range of the value

Z

23:55

Zack

I don't know anything about the range of what value?

23:56

A more precise way of making CFDs is to express a scalar value in binary, and have every bit of the binary be a different oracle question.

Then the smart contract can piece the bits back together to calculate the scalar value.

Then the smart contract can piece the bits back together to calculate the scalar value.

7 August 2018

MF

00:05

In reply to this message

the way to think about how this would work is that in a traditional CFD, you may pay x% of the notional each day, where x is the percent change of the asset

00:06

if we want to use a binary outcome to act like a cfd, you would pay the entire notional x% of the time, where x is the percent change of the asset

00:06

this way, since you either send the entire notional or you don’t, we can constrain this cfd to one bit of oracle output

M

00:09

Mike

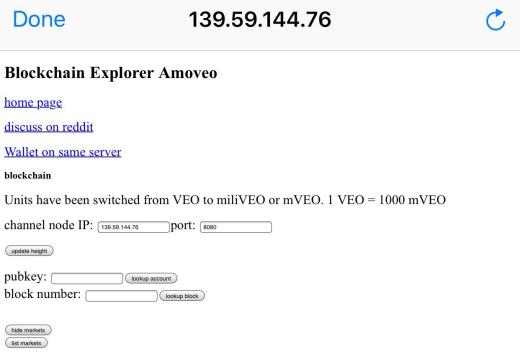

Is there an option on VEOscan to switch between mVEO and VEO

MF

00:18

Deleted Account

No. Let's get used to mVEO.

00:20

I think keep using both units is confusing. Let's switch.

00:26

Deleted Account

@zack if you set the price at $9999 the winners in the markets would be the losers in the market. Because when you decide to fork based on the result. So it only makes sense to place any bets to match other orders, but not change the result of the market. And then hope some random person does not change the outcome...

00:27

To explain: the betters in minority will cash in

00:28

The situation might be alleviated if there was only a single batch in the market

S

Z

00:36

Zack

In reply to this message

The price of the market does not determine the outcome. Nakamoto consensus is the ultimate decider.

So it isn't exactly a minority-wins game.

So it isn't exactly a minority-wins game.

S

00:43

Sebsebzen

This is definitely something for UX designer to ponder upon

00:43

How to make it as simple as possible

00:43

Deleted Account

Well you being the creator of Amoveo have considerable social power over the community. Given the good mood in the group in general, i would not expect a fork or non fork against your recommendation

00:45

Now with the assumption that few people believed that VEO would reach $300, with the statement above, I believe I have proven that people behaved 5 VEO worth of irrational. Either they did not understand the implications of the market question, or they were more concerned with outside effects

00:46

I think the takeaway is that the community showed strong support for the fork

00:46

The oracle/market is some of the most interesting thing Ive seen in a while. Some crypto or even general publication should cover it...

00:52

That would in identally probably cause the price to pass the $300 mark and make the oracle true

Z

00:53

Zack

In the futarchy market, irrational actors will continue to lose money to accurate actors. The market will get more accurate as time goes on.

00:59

Deleted Account

Thats true

01:04

Proposal/brainstorm: what if you made two market questions: 1) Amoveo forks and price is > $300 and 2) Amoveo doesnt fork and price is > $300. — now you could just compare the two markets to see which is more positive. They would be kind of balanced and less of a paradox. If outside forces wanted to push a fork by betting irrationally, others will bet against to get the free money

01:04

Im not sure if it adds up though

01:04

I think it does tho

01:06

And make sure you dont publish the fork code until after the markets are closed

Z

01:07

Zack

In reply to this message

That measures something non-useful.

We want to measure how much the update will change the price of VEO.

The markets you describe are measuring (probability that we fork) * (probability that price is above $300)

We want to measure how much the update will change the price of VEO.

The markets you describe are measuring (probability that we fork) * (probability that price is above $300)

Ray R invited Ray R

OK

01:14

O K

In reply to this message

Actually, isn't it the opposite? The market is a chance for a code audit

01:15

Deleted Account

Revised: 1) Amoveo forks and price is > $300 (This Q is only good if A forks) and 2) Amoveo doesnt fork and price is > $300. (This Q is only good if A doent fork)

01:16

By holding back the sw, someone else would have to write the fork and that would be unlikely

Z

01:16

Zack

In reply to this message

If the software is unwritten, then we probably shouldn't make a market. since it the futarchy is like a audit, yes.

01:17

Deleted Account

I dont agree that we are not measuring anything: we are predicting which of the two scenarios are most likely, reflected in the market price

01:17

With bad question, those betting on a nonexistent future get a refund, no?

01:18

With this structure it doesnt matter if you guess if we fork. You are betting only on the chance of either side crossing a price

01:19

If more people think that possible with a fork, that would be reflected in the order book

01:19

Yes, its probably better to let people look at the code. My mistake

OK

01:20

O K

I think the market in its current form actually accomplishes this already though

01:20

The question is a fancy way of asking "does making this change make it more or less likely that the price will go up?"

01:20

It actually gives us the answer to that question

01:21

I didn't understand that a few hours ago, but I think it's starting to click

01:22

Even if it's not at all likely that the price will hit $300, as long as it's *more* likely that the price will hit that with the change than without it, the market should reflect that. Right?

Z

01:24

Zack

In reply to this message

yes, it sounds like you understand my intentions now.

I may have an error in my math somewhere.

I may have an error in my math somewhere.

MF

01:39

Mr Flintstone

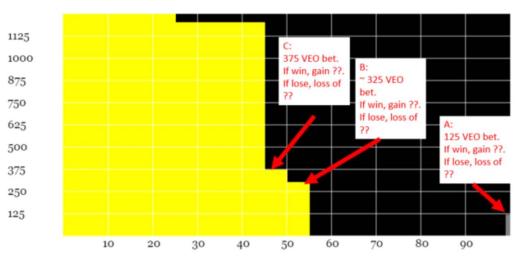

20 more blocks until we update.

01:40

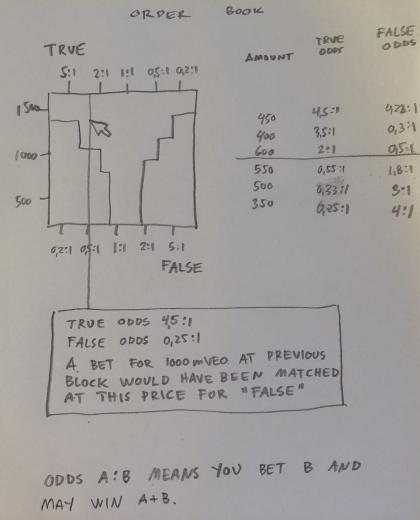

for anyone who thinks the price will not be over 300 usd in 2 weeks or so, there is 1100 mVEO in free money available

01:41

In reply to this message

nobody took the other side of the bet, so we would need to think that not only the bettors of that 5 veo are irrational, but that the entire universe of veo paying attention to this market is irrational too

Z

01:47

In reply to this message

We need more than 1 confirmation before we are sure the update will happen. Currently we have 0 confirmations.

MF

01:48

but you could wait until the update, then bet

Z

01:49

Zack

would you accept a 0th confirmation payment?

Currently there are 0 blocks using the updated code. 0 confirmations if we will update.

Currently there are 0 blocks using the updated code. 0 confirmations if we will update.

01:51

Deleted Account

The point is you should not be rewarded for guessing if there is a fork.

01:56

Even more revised: Q1: Price of Veo > $300, only valid if Amoveo forked Q2: Price of veo > $300, only valid if Amoveo didnt fork

+

01:59

Deleted Account

The recursion that comes with guessing the fork leads to majority wins market if price is too low, and minority wins if the price is too high. The former will make it difficult to change initial sentiment, all bids must be matched. The latter leads to markets as close as possible to tie

01:59

Both we want to avoid

Z

02:03

Zack

In reply to this message

you are confused because you think that the futarchy market is controlling the fork.

Nakamoto consensus controls the fork, not the market.

Nakamoto consensus controls the fork, not the market.

02:03

futarchy is just for gathering information.

02:05

Deleted Account

The market is effectively controlling the fork, otherwise there would be no use for it. If what you say is true people would have forked earlier, I believe on the quite strong sentiment that a fork would be a good thing

02:06

But everyone waited for you to write the fork and pull it into main branch. Everyone was expecting you to listen to the outcome of the prediction market

02:07

The nakamoto fork would only happen if many people were displeased with how things are going

02:08

To say the fork is independent of the market would be very strange imho

02:09

Recursion exists here.

02:13

Admit there is a dependency, but make the bets about everything except wether the fork will happen, then you wont have issues

MF

02:38

Mr Flintstone

In reply to this message

can’t be finalized before two weeks because on of the oracle conditions is related to price around block height 32000

02:38

at least I think it’s 32000

02:39

but if veo starts pumping or dumping you could sell your true or false shares for closer to full value respectively provided the chain updated

+

02:39

++

Thx.

MF

02:41

Mr Flintstone

I feel like there are a ton of things we can use this kind of oracle question for...

OK

02:43

O K

In reply to this message

Someone who understands how to do this should do a writeup on how to buy and sell shares

+

02:44

++

In reply to this message

Confused. In Zack’s oracle design description, it says that that the bets finalizes after a certain number of blocks pass without a change in output type. Couldn’t someone create market with a bet that finalized prior to an actual outcome being known?

“If the output type doesn’t change for a certain number of blocks, the oracle is finalized in this state.”

“If the output type doesn’t change for a certain number of blocks, the oracle is finalized in this state.”

OK

02:44

O K

How could it possibly finalize before the block where there is a variable check

+

02:47

++

In reply to this message

I had a similar thought but just reading the oracle design, seems possible, non?

https://github.com/zack-bitcoin/amoveo/blob/master/docs/blog_posts/oracles_overview.md

https://github.com/zack-bitcoin/amoveo/blob/master/docs/blog_posts/oracles_overview.md

02:48

Here is relevant section from paper.

Bets of different types will get matched on a 1:1 basis. The type with the highest unmatched balance determines the output type of the oracle. If the output type of an oracle has not been changed for a certain number of blocks, the oracle can be finalized with that output type and betting ends. Placed bets are locked up until the oracle is finalized, at which point you are paid out according to the final output type.

Bets of different types will get matched on a 1:1 basis. The type with the highest unmatched balance determines the output type of the oracle. If the output type of an oracle has not been changed for a certain number of blocks, the oracle can be finalized with that output type and betting ends. Placed bets are locked up until the oracle is finalized, at which point you are paid out according to the final output type.

OK

02:51

O K

But the oracle will be deciding after that block

02:53

Deleted Account

(This is what I believe to be true now, tho i am not sure) There is a difference between market bets and oracle bets. Market bets are done buying shares at a certain price based on the current situation. Trades are done in batches to prevent frontrunning (?) as the odds change with every new bet

02:53

Oracle bets are strictly odds 1:1

+

02:56

++

In reply to this message

From Zack’s description, I’m not sure how to actually make sure the oracle is decided after a certain block. I think you might be able to specify the number of blocks with no change required for finality and make sure that number pushes you past a certain point in the worst case scenario, but oracle finality is tied to inactivity not to a date or specific block as far as I can tell...

03:00

In reply to this message

The downside of requiring too many blocks of inactivity in order for there to be finality is maybe you never get finality ... perhaps someone could game it by creating periodic activity so there is not resolution ?

Z

03:01

Zack

In reply to this message

the oracle market is different from the channel markets.

Oracle market is on-chain and only matches bets at 50-50 odds.

channels are off-chain smart contracts in the lightning network. you can bet at any price.

Oracle market is on-chain and only matches bets at 50-50 odds.

channels are off-chain smart contracts in the lightning network. you can bet at any price.

03:01

In reply to this message

obviously you can't close an oracle before we had a chance to bet on it.

03:03

In reply to this message

https://github.com/zack-bitcoin/amoveo/blob/master/docs/api/commands_oracle.md

that is what "Start" is for when you make a new oracle. it decides when we can start reporting on the outcome.

that is what "Start" is for when you make a new oracle. it decides when we can start reporting on the outcome.

03:09

I did a bunch of math.

It seems like the correlation (which we are using in the current futarchy oracle) is not the same thing as P(high price|update) - P(low_price|no_update).

These are both metrics which may be useful for futarchy type oracles.

I wonder what the ideal metric would be.

I found some other interesting results, like

P(high_price|update) - P(high_price|no_update) = P(low_price|no_update) - P(low_price|update) = how much more likely we are to achieve our goal if we update.

It seems like the correlation (which we are using in the current futarchy oracle) is not the same thing as P(high price|update) - P(low_price|no_update).

These are both metrics which may be useful for futarchy type oracles.

I wonder what the ideal metric would be.

I found some other interesting results, like

P(high_price|update) - P(high_price|no_update) = P(low_price|no_update) - P(low_price|update) = how much more likely we are to achieve our goal if we update.

+

03:10

++

Thx. I read the link you attached. Didn’t see the section on “Start”.

Does start initiate the beginning of betting?

Does start initiate the beginning of betting?

Z

03:10

Zack

start is when you can start betting in the oracle mechanism.

+

03:12

++

In reply to this message

Right. So you would begin betting before the outcome is known and betting ends and oracle state is determined once there have been a certain number of blocks of inactivity?

MF

03:12

markets can start betting whenever

Z

03:14

Zack

In reply to this message

lightning network betting in the channels happens before the outcome is known.

oracle betting, also called "reporting", happens after the result is known.

oracle betting, also called "reporting", happens after the result is known.

+

03:17

Didn’t realize there are actually two markets, prediction market and reporting market.

03:31

Deleted Account

@Afterwit me neither. I though the oracle transitioned from prediction to truth over time

T

03:41

Topab

In reply to this message

Bringing this back from yesterday. Perhaps we should have done it this way?

TG

03:41

Toby Ganger

market seems to be responding bearishly to the impending fork...unless it's just bearish overall crypto market in general causing the bleeding

Z

03:48

Zack

In reply to this message

Almost every aspect of a blockchain needs to be designed as a market in order for it to be secure.

There is a market for miners. A market for getting txs into a blocks. A market between channel hubs for getting users to make channels.

There is a market for miners. A market for getting txs into a blocks. A market between channel hubs for getting users to make channels.

TG

03:49

Toby Ganger

seems like either all the buyers dropped off...or all the sellers ate up the buy orders without them being replaced

03:49

should be interesting to see how this plays out with the fork

+

03:52

++

In reply to this message

This sounds right and is very thought provoking. Kinda back to the cryptoeconomic alignment point...

03:53

Deleted Account

Expect a small currency like Amoveo to be volatile

TG

03:56

Toby Ganger

In reply to this message

I expect volatility to be an understatement on a 4 million market cap coin

03:56

anyone see this? https://info.binance.com/en/currencies/amoveo

03:56

does that mean it will be listed on Binance? or am I missing something

Z

03:57

Zack

https://veoscan.io/account/BATman9wDh0c8K45%252BMUvXATNROMEtjPQMHXHBHjthmLcCMwF2ESAkh3i3ga5WwhICMjzWfExfQwig7WruIvqtG0%253D

Do you think BATman lost his keys?

Do you think BATman lost his keys?

TG

03:59

Toby Ganger

that's quite a nice stash

Z

03:59

Zack

In reply to this message

I wish binance didn't make our white paper into a PDF. it is supposed to be a page on github.

TG

Z

04:01

Zack

the links are all broken. When I update the white paper on github, their version will not update.

The Binance version is slower to load.

The Binance version is slower to load.

04:10

"Naval & Nick Szabo follows him on twitter"

04:16

We’re building an exchange for Amoveo, one of the most undervalued coins that we know which is currently being traded by OTC. You may register at amoveo.exchange to learn when it is launched.

MF

04:51

Info.binance looks like a cmc clone kind of?

04:58

Deleted Account

That sight just gives info on coins. You can find most coins in it. It doesn't mean they'll be listed on Binance.

MF

05:47

Mr Flintstone

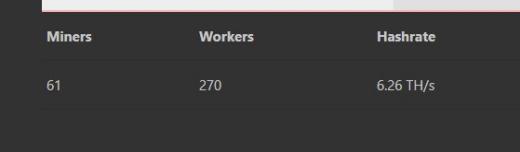

net hash around 25 th/ second right now

05:48

Which is around 25 min blocks ?

05:49

so miner revenue should roughly double some time after the update provided no new hash comes online

I

05:53

Iridescence

Amoveo on binance 😱

05:56

Deleted Account

Binance claims the high ground of exchanges. All they do is extort projects for listing. The only benefit of getting listed there is for a price pump. Other than that, pursuing them for honest listing is not worth it. Better chances are Bittrex and likely have the same price action.

Z

[

S

06:19

Sy

In reply to this message

fun fact, if the ap miner would turn on again current diff would actually be pretty close to normal

OK

06:19

O K

He told me he will be back eventually

06:19

🤷♀️

S

06:20

Sy

xD

06:20

that would put us on roughly 120 blocks

I

06:28

Iridescence

Eventually

DY

06:42

Demi Yilmaz

In reply to this message

Lol, there was an add coin button and I just filled the form.

TG

Z

06:45

Zack

In reply to this message

That isn't how I want to win.

Paying people to advertise us is a short-term solution for pump and dumpers.

I want to build a useful product that will create value for decades.

Paying people to advertise us is a short-term solution for pump and dumpers.

I want to build a useful product that will create value for decades.

TG

06:48

Toby Ganger

In reply to this message

I didn’t say that you should pay extortions. I just said that those exchanges are the path to getting out of the minor leagues. There is a symbiotic relationship between value and development/use.

06:50

can value come to the coin with just one self made exchange? sure it's possible...but MUCH less likely..

06:50

people have to onboard somewhere new....trust somewhere new...you have a vastly smaller liquidity pool because there aren't other coins drawing liquidity to the platform..etc..

Z

06:58

Zack

There are 3 exchanges, I only made one.

DY

07:02

Demi Yilmaz

In reply to this message

I agree with zack. Getting on bigger exchanges doesn’t help out the coin as a matter of fact it may even cripple the coin. Check out sky & nas listings on binance. Most coins which get listed there lose a lot of momentum afterward.

TG

07:03

Toby Ganger

depends on when the listings happen...premature listings can kill a coin

MF

07:03

Mr Flintstone

I do think Toby has a point in that liquidity is better for a coin, regardless of price pumping

07:03

we want to make it easy for people to get veo

TG

07:03

Toby Ganger

liquidity is everything

MF

07:04

Mr Flintstone

if we focus on tapping into the vast potential amoveo has, everything else will follow

[

07:04

[Riki]

Sky is quite advanced yet it ended up as a binancd listing pnd

DY

07:04

Demi Yilmaz

In reply to this message

True we want everyone to easily get access to veo & its platform. Getting only veo doesnt work. Accessing the oracles & markets is the key here. The bottle neck is not getting the coins but using them in the markets.

TG

07:04

Toby Ganger

from an economic perspective saleability is one of the main factors that makes something a monetary instrument...it's much harder to build your own liquidity pool than to piggy back on a larger one....not saying it's impossible..it's just MUCH harder because liquidity begets liquidity

Z

07:05

Zack

Adding more exchanges doesn't help liquidity.

It increases the number of arbitrage opportunities, which decreases liquidity.

It increases the number of arbitrage opportunities, which decreases liquidity.

TG

07:06

Toby Ganger

In reply to this message

increasing arbitrage opportunities decreases liquidity? wtf?

DY

MF

07:06

Mr Flintstone

before we go down this path let’s make sure we are on the same page with definitions lmao

07:06

what zack just said may seem outrageous on the surface but maybe he means something else

TG

07:06

Toby Ganger

yeah that was a baffling statement unless he's using a totally different definition

Z

07:07

Zack

"liquidity" means how many veo you can buy without moving the price very much.

If you break up the market into many small exchanges, then an individual trade on one of those exchanges moves the price further.

If you break up the market into many small exchanges, then an individual trade on one of those exchanges moves the price further.

07:08

There is nothing outrageous here. liquidity and arbitrage both have precise definitions that I am using correctly.

MF

07:08

Mr Flintstone

liquidity can refer to money that is not currently in veo, but in bitcoin

07:08

by adding an exchange, you can increase access to this liquidity

07:09

liquidity is not defined by an order book, but this may be one definition

TG

07:09

Toby Ganger

The more an asset is saleable the more useful it becomes and thus it tends to be used more...so the liquidity depth increases across all exchanges...

07:09

because people feel comfortable holding and buying something they know they can sell

Z

07:09

Zack

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset's price.

https://www.investopedia.com/terms/l/liquidity.asp

https://www.investopedia.com/terms/l/liquidity.asp

[

07:10

[Riki]

In reply to this message

More useful or more valuable? Value should follow usefullness.

TG

07:10

Toby Ganger

more useful and thus more valuable

MF

07:10

Mr Flintstone

sometimes people use “liquidity” interchangeably with “money”

07:11

this is the case in professional finance

07:11

I guess the precise investopedia definition would preclude this, but I know this is the case

TG

07:11

Toby Ganger

we're operating under the same definition...just seems like Zack has a different "theory" in regards to how money becomes money that isn't rooted in any school of economic thought

Z

07:12

Zack

Toby is a troll, right?

TG

OK

07:12

O K

😂

07:13

You're not the first person Toby who has studied econ and been confused by Zack's strange econ

07:13

Try to read Zack's words tongue-in-cheek

07:13

He has a subtle sense of humour

07:13

🙂

MF

07:13

Mr Flintstone

I guess zack’s order book logic is technically correct

TG

07:14

Toby Ganger

I used to teach econ...the things he says don't seem to make any sense...and I WANT to understand where he's coming from

MF

07:14

Mr Flintstone

but not in the beginning when order books on binance and bittrex would definitely be deeper than qtrade and amoveo.exhanfe

07:14

Deleted Account

money = liquidity makes perfect sense IMHO

07:15

Nice metric to measure tokens - by aggregated orderbooks

MF

07:15

Mr Flintstone

it looks like this (along with most disagreements) is driven by semantics

07:16

in this case colloquial vs textbook

TG

07:16

Toby Ganger

In reply to this message

it's only technically correct if you operate from a starting point of abundant liquidity....but the key to attracting liquidity is increasing saleability....when people have multiple, trusted, liquid markets into which they can sell an asset then they feel more comfortable buying it.....the saleability is the useability which brings value....it's a feedback loop

[

07:16

[Riki]

Coin velocity makes them valuable too

TG

07:17

Toby Ganger

In reply to this message

I disagree...velocity is a symptom of saleability not a cause

Z

07:18

Zack

Ideally we would have one big exchange with 80-90% of trade volume, and have many other exchanges that technically support us, but are almost always empty.

TG

07:20

Toby Ganger

In reply to this message

oy...velocity is created because of the saleability of the token...it does not come the other way around....of course there's a correlation...but the causation you're proposing is backwards

Z

07:21

Zack

You guys really think he isn't a troll?

TG

07:21

Toby Ganger

ooops...can't dump anything because they're no liquidity

MF

07:21

Mr Flintstone

that’s what all the cool kids are doing

[

07:21

[Riki]

😂

MF

07:21

Mr Flintstone

pretty sure he’s not a troll

TG

07:22

Toby Ganger

why would I be around for months in this chat with almost no comments if I was a troll...it's because I hold a lot of VEO and I believe in the tech and want to see it succeed

MF

07:22

Mr Flintstone

yeah, I remember Toby from a few months ago

07:22

I seem to recall you were pushing the mveo agenda? lol

OK

07:23

You're stuck here now

TG

07:23

Toby Ganger

yes I was the first gnat at the mveo picnic

MF

07:23

Mr Flintstone

lol

OK

TG

S Z joined group by link from Group

I

08:24

Iridescence

Liquidity across multiple exchanges assumes that arbitrage between exchanges is easy

08:24

In crypto that is often not the case

08:25

In crypto the less people / institutions you trust, the better. And institutions that have a good track record gain more trust

08:26

Hence trading and liquidity tends to centralize on exchanges that they can reach.

I

08:27

Iridescence

If you are willing to sell VEO at an attractive enough price I'm sure you will find enough liquidity to sell into 😬

08:27

Deleted Account

Agree

I

08:29

Iridescence

You could argue that crypto is so volatile precisely because there isn't as much liquidity as, say, the foreign exchange markets

Z

08:43

Zack

I am thinking of making a tool where we can pay VEO to post to a feed.

I will use the block retargeting algorithm to determine the price of posting, that will regulate the speed at which posts are made.

I will use the block retargeting algorithm to determine the price of posting, that will regulate the speed at which posts are made.

08:44

kind of like reddit or steemit, but extremely simplified, and using fees to regulate posting rate.

S

08:49

Subby

In reply to this message

I don't know what the rules are here but that's not exactly right. There's a project from Japan by Quoine (called Qash, soon to be rebranded to Liquid) they have an MMO that connects multiple exchanges (the WorldBook) it basically removes arbitrage. I can grab a video of it tightening JPY/BTC to SGD/BTC from $45 SGD to 10cents

08:54

Not sure if this knowledge is of any value but figured I'd share

MF

08:54

like an amoveo node

Z

08:54

Zack

yes.

08:55

Eventually we could integrate channel payments, so you don't trust the server with any money.

JL

10:06

Josh L

Lower diff yet?

+

10:08

++

In reply to this message

You both are right given a different set of assumptions.

I think Zack assumes a world where there are a fixed number, eg 10, of people that want to trade a coin. For market depth, you would be better off having these 10 people on 1 exchange, than each person on different exchanges. If there is minimal friction to arbitrage, arbitrageurs might help to re-aggregate demand across multiple exchanges by doing the work of moving supply from where it is plentiful to where it is scarce. Reality, though, is you need some friction to make the arb worth it so arb isn’t the best aggregator of liquidity and if there is truth to Zack’s assumption that nearly anyone that would be Interested in trading VEO is already trading it across the existing exchanges, then siphoning some of this demand onto another exchange would indeed decrease average market depth.

I think Toby assumes that listing on a new exchange brings potential new investors into the fold that wouldn’t have otherwise been willing to invest in VEO. This would be a source of new demand and eventually new supply and all else equal would increase average market depth.

I think Zack assumes a world where there are a fixed number, eg 10, of people that want to trade a coin. For market depth, you would be better off having these 10 people on 1 exchange, than each person on different exchanges. If there is minimal friction to arbitrage, arbitrageurs might help to re-aggregate demand across multiple exchanges by doing the work of moving supply from where it is plentiful to where it is scarce. Reality, though, is you need some friction to make the arb worth it so arb isn’t the best aggregator of liquidity and if there is truth to Zack’s assumption that nearly anyone that would be Interested in trading VEO is already trading it across the existing exchanges, then siphoning some of this demand onto another exchange would indeed decrease average market depth.

I think Toby assumes that listing on a new exchange brings potential new investors into the fold that wouldn’t have otherwise been willing to invest in VEO. This would be a source of new demand and eventually new supply and all else equal would increase average market depth.

MF

10:17

Mr Flintstone

In reply to this message

In 2 blocks I think diff will start dropping every block

B

10:18

Ben

It's a proven fact that listings on markets with different demographics brings awareness to new potential investors. In classical markets, the exchanges were consolidated, and the broker-dealers began building internal orderbooks and Alternative Trading Systems to enhance liquidity, primarily cater to big block trading (eg. 10,000 shares min). In crypto, OTC infrastructure is similar to the old days of stockroom floor trading with people running around with paper slips yelling across the room to find a counterparty. Hence, the public markets remain more efficient mechanisms for many investors to gain awareness and access to new asset liquidity.

TG

10:27

Toby Ganger

In reply to this message

I agree that each respective view is rational within the frameworks you described however only the latter is an accurate representation of anything that can be considered a monetary instrument...especially in crypto due to the unique market dynamics

S

10:37

Sebsebzen

++ is right, for example Bithumb, or Korea in general is quite isolated as a market and trades are in Korean Won. Getting listed there gives you access to many new potential investors that maybe don’t trust other exchanges’ security.

10:37

In an ideal theoretical situation Zack is right

10:38

But there will never be complete frictionless markets

MF

10:54

Mr Flintstone

ok

10:54

28102

10:54

34129 th per block

Z

10:56

Zack

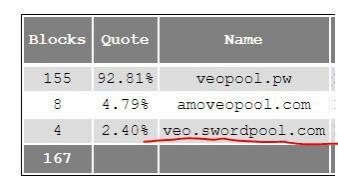

We found the recent blocks so quickly that the exponential weighted average hashrate says the difficulty is currently within the target range.

So it didn't update the difficulty either way.

So it didn't update the difficulty either way.

MF

10:56

Mr Flintstone

ahh

10:56

yeah, those were 3 quick blocks

10:56

within 6 minutes

10:58

about 30 th/s net hash

10:59

so diff should decrease eventually

Z

11:00

Zack

yes it will probably decrease some soon. I am guessing by about a factor of 2.

MF

11:00

Mr Flintstone

yeah around there

Z

11:00

Zack

within 40 blocks

11:01

The light node is still syncing correctly

Deleted invited Deleted Account

MF

12:00

Mr Flintstone

28103 is apparently quite the block

Z

12:04

Zack

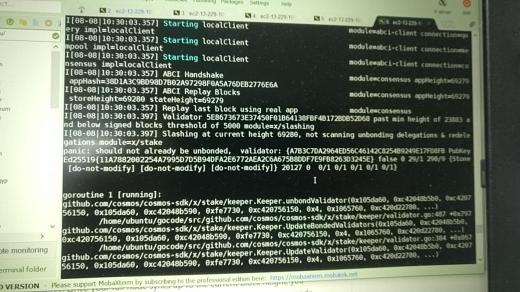

I made a mistake.

The exponential weighted average is calculating 10 minute blocks all through our recent history.

At low difficulties, all the tests were passing fine.

I will find out why it is not estimating the block time accurately on the main net.

Luckily this failure mode isn't dangerous, we are trapped at the current difficulty until we do a hard update to fix it.

The exponential weighted average is calculating 10 minute blocks all through our recent history.

At low difficulties, all the tests were passing fine.

I will find out why it is not estimating the block time accurately on the main net.

Luckily this failure mode isn't dangerous, we are trapped at the current difficulty until we do a hard update to fix it.

AK

12:48

A K

Can you elaborate? The way I read it, it's exponential, so whole long tail shouldn't matter much

Z

13:01

Zack

the update failed. it didn't have any change.

so we are turning it off until we can fix it.

so we are turning it off until we can fix it.

ŽM

15:23

Živojin Mirić

Is this good old Batman again?

J

16:31

Jurko | Bermuda capital 📈

good ol' batman saviour

A

20:38

Angelos | Coinomi Wallet (I will never PM you first)

In reply to this message

Another victim of FUD

MF

20:38

Mr Flintstone

rip

20:39

did amoveo push you over the edge? lol

IP

A

OK

IP

OK

IP

21:35

I P

Sticker

Not included, change data exporting settings to download.

😁, 36.6 KB

21:35

Deleted Account

Sticker

Not included, change data exporting settings to download.

💪, 38.5 KB

21:35

😭

Z

22:09

Zack

It seems like my original instinct was correct.

We shouldn't average hashrate, we should average inverse-hashrate.

At low difficulty I could not get this to work correctly, but now that I am testing on mainnet blocks, it seems to be very accurate. I will share some test data here.

We shouldn't average hashrate, we should average inverse-hashrate.

At low difficulty I could not get this to work correctly, but now that I am testing on mainnet blocks, it seems to be very accurate. I will share some test data here.

22:10

28100 EWAH estimate: 18267 time: 32506

28101 EWAH estimate: 17495 time: 2824

28102 EWAH estimate: 16665 time: 902

28103 EWAH estimate: 18171 time: 46791

28104 EWAH estimate: 17332 time: 1385

28105 EWAH estimate: 19131 time: 53316

28106 EWAH estimate: 21345 time: 63400

28107 EWAH estimate: 21047 time: 15392

28108 EWAH estimate: 20634 time: 12797

28109 EWAH estimate: 19713 time: 2204

28110 EWAH estimate: 18857 time: 2603

28111 EWAH estimate: 18356 time: 8826

28112 EWAH estimate: 18936 time: 29963

28113 EWAH estimate: 18330 time: 6806

28114 EWAH estimate: 17988 time: 11495

28115 EWAH estimate: 18264 time: 23507

28116 EWAH estimate: 17477 time: 2530

28117 EWAH estimate: 17358 time: 15091

28118 EWAH estimate: 16786 time: 5923

28119 EWAH estimate: 16278 time: 6624

28120 EWAH estimate: 17091 time: 32538

28121 EWAH estimate: 17902 time: 33321

28122 EWAH estimate: 17775 time: 15347

28123 EWAH estimate: 17203 time: 6354

estimate is the average blocktime lately. time is the exact block time for one block.

they are both measured in 1/10ths of a second.

6000 = 10 minutes.

28101 EWAH estimate: 17495 time: 2824

28102 EWAH estimate: 16665 time: 902

28103 EWAH estimate: 18171 time: 46791

28104 EWAH estimate: 17332 time: 1385

28105 EWAH estimate: 19131 time: 53316

28106 EWAH estimate: 21345 time: 63400

28107 EWAH estimate: 21047 time: 15392

28108 EWAH estimate: 20634 time: 12797

28109 EWAH estimate: 19713 time: 2204

28110 EWAH estimate: 18857 time: 2603

28111 EWAH estimate: 18356 time: 8826

28112 EWAH estimate: 18936 time: 29963

28113 EWAH estimate: 18330 time: 6806

28114 EWAH estimate: 17988 time: 11495

28115 EWAH estimate: 18264 time: 23507

28116 EWAH estimate: 17477 time: 2530

28117 EWAH estimate: 17358 time: 15091

28118 EWAH estimate: 16786 time: 5923

28119 EWAH estimate: 16278 time: 6624

28120 EWAH estimate: 17091 time: 32538

28121 EWAH estimate: 17902 time: 33321

28122 EWAH estimate: 17775 time: 15347

28123 EWAH estimate: 17203 time: 6354

estimate is the average blocktime lately. time is the exact block time for one block.

they are both measured in 1/10ths of a second.

6000 = 10 minutes.

MF

22:52

Mr Flintstone

how do we know what to adjust the next block’s difficulty by?

Z

22:54

Zack

we use the EWAH = "exponentially weighted average hashrate" to estimate the current block time. We compare this estimate of the current block time with our target block time to know how much to adjust.

22:54

6000 = 10 minutes is our target block period.

MF

22:57

Mr Flintstone

how do you use EWAH to estimate current block time? what is the reference difficulty used

Z

22:59

Zack

I use the difficulty from the previous block.

It isn't precise as it could be, but it seems to work ok.

It isn't precise as it could be, but it seems to work ok.

22:59

it would be more accurate if we estimated the next blocks difficulty and used that to estimate EWAH.

23:01

The EWAH estimates I posted above are the calculated average blocktime in 1/10ths of seconds.

Not the hashrate.

Not the hashrate.

S

23:41

Sy

So we are 3-4 times too high?

Z

23:49

Zack

20k / 6k = about 3x too high yes.

23:53

The new difficulty retargeting seems to be working well.

I guess we should do this soon, before we lose too much hashrate.

I guess we should do this soon, before we lose too much hashrate.

OK

23:55

O K

That would be ideal

Z

23:55

Zack

each block is 30 minutes.

so lets give ourselves about 5 hours to upgrade.

How does 28135 sound for the update? @potat_o @Simon3456

so lets give ourselves about 5 hours to upgrade.

How does 28135 sound for the update? @potat_o @Simon3456

OK

23:56

O K

I'm okay with that, Sy?

S

23:57

Sy

Np

23:57

Im Up for the next 4-5h

Z

23:57

Zack

great

S

23:58

Sy

No resync this time?

8 August 2018

Z

00:00

Zack

it will require a resync.

I was just running final checks, and I found one more thing I need to test. It will be another 30-60 minutes.

I was just running final checks, and I found one more thing I need to test. It will be another 30-60 minutes.

Z

00:18

Zack

http://139.59.144.76:8080/explorer.html

I am resyncing this node with the new code. It if works, then we should resync everything else.

I am resyncing this node with the new code. It if works, then we should resync everything else.

00:32

it synced well.

We are ready to update the network.

We are ready to update the network.

00:36

@Simon3456 @potat_o time to update and resync

MF

00:50

Mr Flintstone

🤞

Protovist invited Protovist

S

00:58

Sy

syncing...

Z

00:59

Zack

great

01:00

when you say you will be awake 4-5 hours, does that mean you think we should do the fork even faster?

Blocks are so slow, I think we can handle doing an update by 28130

Blocks are so slow, I think we can handle doing an update by 28130

S

01:00

Sy

btw do you zip the data or is it send plain text when we sync?

Z

01:00

Zack

It is sent worse than plain text. it is JSON formatted.

So binaries get expanded out into base64 format, etc

So binaries get expanded out into base64 format, etc

S

01:01

Sy

cant you zip it? should compress really well since its text

01:01

stuck at block 5143

Z

01:01

Zack

I compress blocks before storing to the hard drive,

S

01:01

Sy

which in return might make it slower

Z

01:01

Zack

I fully synced. probably the node you are talking to broke contact

01:02

sync:start(). does this fix it?

S

01:02

Sy

disk space is easy to get, bandwith might be a bottleneck tho

Z

01:02

Zack

currently sending blocks has an extra step of decompression we could skip.

01:03

I will add a new endpoint to the api, that way javascript can use the old api.

S

01:03

Sy

yeah something like that, might increase syncing speed and we should be able to get more than 10 per thread

Z

01:04

Zack

We could also make a version of the api that sends the blocks without proofs.

Full nodes already store the proofs locally, so they don't need to re-download them.

This would significantly slow down block verification, and it would prevent us from verifying in parallel.

Full nodes already store the proofs locally, so they don't need to re-download them.

This would significantly slow down block verification, and it would prevent us from verifying in parallel.

S

01:05

Sy

2nd try, went past 5143

Z

01:05

Zack

it might be preferable on some systems

01:12

I used a $20 per month vps to sync the blocks in about 10 minutes.

01:13

you should be able to use different ports to run 2 instances of amoveo on the same machine. so you can resync without turning off your mining pool.

or you can sync on a different machine, and copy the files over to the mining pool machine.

or you can sync on a different machine, and copy the files over to the mining pool machine.

01:14

they can sync in parallel

01:14

we could make a script to work with scp to tell all of them to update at once

OK

01:16

O K

What is the size of the blockchain now?

Z

01:17

Zack

159 mb of blocks.

OK

01:17

O K

Pretty impressive

01:17

I wonder what was the size of bitcoin's blockchain at the same blockheight

MF

01:17

Mr Flintstone

I wonder how big btc was at 30k

01:18

lol

OK

01:18

O K

😄

Z

01:18

Zack

51 mb to keep track of recent merkle trees to be able to process blocks

OK

Z

01:21

Zack

220 mb for the erlang release that gets packaged to make a standalone.

70 mb for the dependencies and source code

70 mb for the dependencies and source code

01:21

cool calculator

OK

MF

01:22

Mr Flintstone

I think the bottleneck for sync speed is still verification time? Zack I think you may have said something about this when you were working on the parallelizafion

Z

01:22

Zack

the 159 mb of blocks are compressed. so this is what it would be like once we add compression for the api

01:23

In reply to this message

all machines are different.

I think for the important machines, the bottleneck is now in bandwidth.

I think for the important machines, the bottleneck is now in bandwidth.

S

Z

S

01:25

Sy

i told you about a month ago when i started doing *.db backups

01:25

it resumes at height but cant build on top

Z

01:25

Zack

I will write it down this time

OK

01:38

O K

Do you use orgmode zack?

01:38

I have been using Zim Wiki lately for notes, I've found it quite nice

S

01:42

Sy

i could create a github issue aswell 😅

01:42

okay main node is synced for a while now

01:43

syncing backup and balance node...

Z

01:46

I like to use emacs for typing when possible. It has so many nice tools.

AK

02:16

A K

when mainnet ^W, diff update?

02:16

28130 ?

MF

02:19

Mr Flintstone

28135

02:53

Deleted Account

OK

02:59

O K

:'D

03:00

In reply to this message

That's why I thought you might use OrgMode, it's an emacs thing. You should check it out

03:00

If you like geeky videos, there is a nice youtube video lecture from some conference about it

Z

03:00

Zack

cool! I haven't heard of it.

md files are nice because they look good on github

md files are nice because they look good on github

OK

03:00

O K

In reply to this message

True, I was just talking about personal notes. Most people don't put personal notes on github

03:01

But you're weird 🤷♀️ that's cool

03:12

Deleted Account

I have lots of personal notes in github and also gists

OK

03:13

O K

Maybe I'm the weird one then

03:14

For me, I don't think Microsoft needs to know me that intimately

H W invited H W

S S invited S S

S

03:35

S S

How is this different frm augur

J

03:39

Jurko | Bermuda capital 📈

two more blocks 💪🏻

F

03:45

Fića

Animation

Not included, change data exporting settings to download.

95.1 KB

S

03:45

Sy

Deadpool 2 is disturbingly funny

F

03:46

Fića

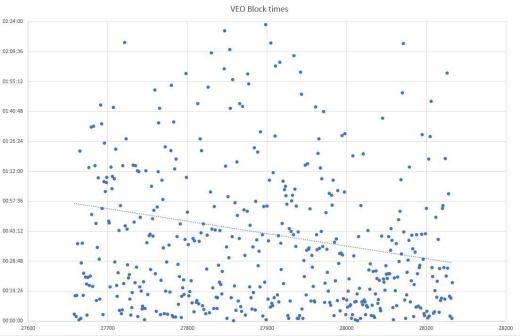

why are block times so random?

03:46

there are 2 min blocks, then 1h blocks then some 30 min blocks

MF

03:54

Mr Flintstone

In reply to this message

markets are in channels rather than on-chain is one difference. another is that veo doesn’t have subcurrencies

03:55

also, parasitic interest is not an input into amoveo’s security model, but it is for augur

03:55

there are lots more differences that are outlined on zacks GitHub

Deleted invited Deleted Account

Z

04:02

Zack

I havent yet finished updating the light wallet.

I might not finish in the next 2 blocks.

I might not finish in the next 2 blocks.

Deleted invited Deleted Account

F

MF

04:41

Mr Flintstone

Isn’t block time a Poisson distribution?

04:41

that’s why it has so much variance

F

04:41

Fića

i also excluded 26999 > 27000 that took 7 hours...

S

04:47

Sy

Thats why its an avg

OK

04:48

O K

In reply to this message

I wondered this too and thought, why doesn't this happen with bitcoin?

04:48

Then I looked at something similar for bitcoin, it kind of does

F

04:50

Fića

So that means we could have a 20 hour block if we simply wait long enough?

S

04:53

Sy

Unlikely

04:53

You can calculate the chance for that

F

04:58

Fića

Interesting

J

04:58

Jurko | Bermuda capital 📈

28135

MF

04:58

Mr Flintstone

nice

04:59

second times the charm hopefully

J

Z

05:02

Zack

the light node will be unable to sync until we fix it.

MF

05:02

Mr Flintstone

other than that, I guess next block we will find out if the update worked

S

05:03

Sy

Yep

05:03

Obviously a 2h+ Block 😂

MF

Z

05:37

Zack

looks like the next block will have 1/2 the difficulty of the current block

05:37

I think I fixed the light node. I pushed the fix to my servers. we will see once the next block comes.

P

05:37

Protovist

(amoveo_core_prod@amoveo-node)22> block:get_by_height(28136).

{block,28136,

<<135,115,2,148,228,56,15,53,83,206,2,229,25,237,52,82,

200,97,40,245,54,104,117,142,97,73,...>>,

<<132,83,24,146,45,38,116,162,122,29,95,22,80,22,41,201,

87,115,122,134,170,63,188,74,141,...>>,

143825405,14053,5982,3,

{block,28136,

<<135,115,2,148,228,56,15,53,83,206,2,229,25,237,52,82,

200,97,40,245,54,104,117,142,97,73,...>>,

<<132,83,24,146,45,38,116,162,122,29,95,22,80,22,41,201,

87,115,122,134,170,63,188,74,141,...>>,

143825405,14053,5982,3,

MF

05:37

Mr Flintstone

yayyy we found a block

P

05:37

Protovist

same diff?

MF

05:38

Mr Flintstone

yeah, diff is the same?

P

05:38

Protovist

14053

MF

05:38

Mr Flintstone

on veoscan

Z

05:38

Zack

use

potential_block:check(). to see the next block being worked on. it has a much lower diff.

MF

05:38

Mr Flintstone

oh, it’ll be next block

Z

05:39

Zack

potential_block:check().

{block,28137,

<<63,170,126,254,105,24,48,239,162,34,176,50,229,87,115,

82,10,99,165,6,35,52,119,16,22,6,...>>,

<<13,88,122,94,164,35,87,167,240,179,153,192,57,88,240,67,

112,245,13,121,156,82,58,225,27,...>>,

143825671,13796,5982,3,0,

13796 is about 1/2 as difficult.

{block,28137,

<<63,170,126,254,105,24,48,239,162,34,176,50,229,87,115,

82,10,99,165,6,35,52,119,16,22,6,...>>,

<<13,88,122,94,164,35,87,167,240,179,153,192,57,88,240,67,

112,245,13,121,156,82,58,225,27,...>>,

143825671,13796,5982,3,0,

13796 is about 1/2 as difficult.

OK

MF

05:39

Mr Flintstone

so this should be like a 15 minute block?

P

05:40

Protovist

(amoveo_core_prod@amoveo-node)29> potential_block:check().

[]

OK

05:40

O K

Damn proto

05:40

that looks real easy

P

05:40

Protovist

lol

OK

05:40

O K

almost too easy

Z

05:41

Zack

In reply to this message

your node isn't being used as a mining pool, so there is nothing being worked on.

You can do

You can do

potential_block:new(). to generate a block to work on, then you can look at it with potential_block:check().

P

05:41

Protovist

ok, thanks

OK

Z

05:41

Zack

I added checkpoints to the light node, so it syncs very fast now

P

05:42

Protovist

(amoveo_core_prod@amoveo-node)31> potential_block:check().

{block,28137,

<<63,170,126,254,105,24,48,239,162,34,176,50,229,87,115,

82,10,99,165,6,35,52,119,16,22,6,...>>,

<<114,158,19,24,16,204,5,59,191,72,17,152,252,222,100,184,

40,198,28,21,150,92,33,73,31,...>>,

143829185,13931,5982,3,0,

Z

05:42

Zack

his is 13931. that is a little worrysome.

that is a lot more difficult from what I calculated.

that is a lot more difficult from what I calculated.

05:43

about 50% more difficult

P

05:43

Protovist

should they not be the same?

Z

05:43

Zack

you calculated your after mine, so it could be a little lower.

05:44

143830652,13789,5982,3,0

now I get 13789

now I get 13789

05:45

@Protovist are you using the newest version of the software?

P

05:45

Protovist

commit 8dd1175a8462590f37d5a9705ea5e4037c6cd127

Z

05:46

Zack

now I get 13788

P

05:48

Protovist

I get 13925

Z

05:51

Zack

I checked on a second node, it is identical with my first node. they are both on 13784.

P

05:51

Protovist

143835094,13922,5982,3,0,

OK

05:51

O K

13783 looks like here...

Z

05:52

Zack

yes, it is decreasing. now my nodes are on 13783 as well

S

05:52

Sy

ofc since blocktime is increasing

05:53

13788 now

OK

05:53

O K

Why would it go up

05:53

do you mean 78

Z

05:54

Zack

Sy's is only 5 off.

256 off is a factor of 2x higher difficulty.

5 off is about 2% higher difficulty.

I guess Sy's clock in his computer is slightly off-sync with ours

256 off is a factor of 2x higher difficulty.

5 off is about 2% higher difficulty.

I guess Sy's clock in his computer is slightly off-sync with ours

05:54

Maybe Protovist's computer is very far off

05:56

If you mine blocks from the future, the rest of us will ignore the block until it was made in the past.

If you mine a block from the past, it has higher difficulty.

It is most profitable to have your clock be nearly accurate.

If you mine a block from the past, it has higher difficulty.

It is most profitable to have your clock be nearly accurate.

P

05:56

Protovist

$ ntptrace

localhost: stratum 3, offset -0.000023, synch distance 0.027690

localhost: stratum 3, offset -0.000023, synch distance 0.027690

05:57

my clock is synced

Z

05:57

Zack

I guess we should wait to see which nodes will sync the next block

S

05:57

Sy

mine is probably older

Z

05:58

Zack

Sy refreshes his potential_block work very rarely I think

OK

06:01

O K

It went up a bit after it went down

06:01

So, no not in the sense that you're thinking, I think

06:04

🙃

S

06:05

Sy

na its going down

06:05

its just like zack said, i dont refresh that often

Z

06:07

Zack

if you refresh the work more frequently, then the workers are spending more time working on stale problems.

S

06:11

Sy

i found 2 more

OK

06:11

O K

What's tophegiht

06:11

28138

06:11

?

S

06:11

Sy

yes

OK

06:11

O K

👍

S

06:12

Sy

i have to refresh the block more often now because the one after the block find has ofc the highest diff which is decreasing over time

OK

06:12

O K

Got one!

06:13

Form a handshake agreement, take down ethereum first

06:13

then come back for amoveo

S

06:13

Sy

there they are

06:13

block data reports the same diff tho

06:14

hmm

Z

06:14

Zack

28140

S

06:14

Sy

not on veoscan

06:14

am i parsing the wrong field? ^^

OK

06:14

O K

28141

Z

06:15

Zack

difficulty is at 13773. light nodes are able to sync. looks like a successful hard update.

S

06:15

Sy

yeah my parser is wrong

J

06:16

Jurko | Bermuda capital 📈 via @gif

In reply to this message

Animation

Not included, change data exporting settings to download.

407.1 KB

Z

06:16

Zack

5 blocks in 5 minutes was a little frightening, but it seems to have the right difficulty

OK

Z

06:18

Zack

oh, the light node is not working.

S

06:20

Sy

hmm but the diff only changed once?

06:20

ah yeah, blocks too fast -> ignored

Z

06:20

Zack

In reply to this message

correct. when the estimate is inside of the tolerance range, then the difficulty does not change.

S

06:21

Sy

the tolerance is?

06:22

im off to bed

as long as it doesnt ignore 100 fast blocks and doesnt increase diff we are good for now, cya tomorrow :)

as long as it doesnt ignore 100 fast blocks and doesnt increase diff we are good for now, cya tomorrow :)

Z

06:24

Zack

it is a factor of 2

06:25

from 3*target/4 -> 3*target/2

EP

06:30

Evans Pan

5 blocks in 5 mins, it's just lucky?

Z

06:31

Zack

it was just from randomness

IP

06:33

I P

sorry guys missed the action. do all full nodes need to update and resync?

Z

06:39

Zack

I fixed the light nodes.

MF

06:46

Mr Flintstone

great stuff!

OK

06:48

No 2nd clean for the 2nd fork light node fix

06:48

?

Z

06:49

it is only changing javascript stuff

06:54

well, you need to restart it after you git pull.

no resync.

no resync.

06:58

last 5 blocks took 45 minutes.

Looks like it works.

Looks like it works.

AS

M

08:17

Mike

Good work Zack, looks great

[

08:18

[Riki]

Animation

Not included, change data exporting settings to download.

236.3 KB

08:30

Deleted Account

👍👍

09:12

Deleted Account

Lol.

09:14

Vitalik definitely needs to pack on some extra pounds.

[

OK

09:18

O K

😂

Z

09:40

Zack

How about we make markets for bribing famous people to write about Amoveo?

09:41

"Vitalik uses the word 'Amoveo' in a tweet before the end of August."

MF

09:45

Mr Flintstone

would this be thru a dac?

TG

09:51

Toby Ganger

In reply to this message

this is actually wise marketing...it's similar in a sense to paying social media influencers to mention your product...except it's like a decentralized crowdfund

Z

09:53

Zack

In reply to this message

If the famous person sets up a server, or works with me, then we can make a dominant assurance contract. This would be the more profitable way to do it.

If we are trying to get their attention, we can make a normal market and see if the rumor of it gets to them.

If we are trying to get their attention, we can make a normal market and see if the rumor of it gets to them.

MF

MF

10:55

Mr Flintstone

though it seems like this list doesn’t include such luminaries as Justin sun for some reason

Z

10:55

Zack

I should make a list and let people pay to be on it.

Z

11:41

Zack

It seems like the blocks are staying near to 10 minutes each.

S

12:13

Sy

Diff didnt change again?

MF

12:38

Mr Flintstone

has it needed to?

S

12:49

Sy

its a "retarget every block" algo now, it should

12:49

and yes, we are still too high

12:50

lets wait and see, its still better than before ^^

Deleted invited Deleted Account

AK

TG

14:33

Toby Ganger

just a heads up that qtrade withdrawals for VEO aren't working

14:34

never had an issue with it before..but alas here we are...any ideas on the technical side what it could be?

14:37

could they be separated from the network due to the fork/update?

Deleted joined group by link from Group

ŽM

16:01

Živojin Mirić

Almost 1000 users yaaay

B

16:04

Ben

maybe the Node they use is not updated yet

S

18:31

I update cosmos, but can't start it

AK

19:05

A K

1000 mveo )

MF

AK

19:11

A K

and retarget %% is unlimited now, no steps?

19:12

range is 0.75 - 1.5 ?

S

19:18

which means, since its not changing, we will do above 200 per day

19:19

we are at 100 blocks 13h in the new diff

T

19:27

Topab

Thanks Zack and all the rest of contributors for the nice work. I got excited with Amoveo as soon as I read about but got my miners late, just when the difficulty skyrocketed so mined very little. Now it looks much better :) I persisted on mining on veo despite the difficulty. Really like the project and see the potential. To the point that I am thinking of start building something using Amoveo. I am not developer myself but I could get those resources if I present a decent proposal. I would welcome any ideas from you.

19:27

A stable coin has been always in my mind as one of the thingsI think Amoveo could do well, efficient and using a truly decentralized oracle

AK

19:42

A K