Uniswap Mining - CoinList

archived 3 Apr 2021 10:03:29 UTC

archived 3 Apr 2021 10:03:29 UTC archived 3 Apr 2021 10:03:29 UTC

archived 3 Apr 2021 10:03:29 UTCarchive.today webpage capture | Saved from | ||

| Original | no other snapshots from this url | ||

| All snapshots | from host coinlist.co from host webcache.googleusercontent.com | ||

| WebpageScreenshot | |||

- Secure infrastructure. CoinList only works with best in class custodians like Bitgo, Gemini and Anchorage to secure your funds.

- DeFi leader. CoinList has been a leader in DeFi through our simple and easy to use wBTC minting service. Since launch, CoinList has minted or burned more than $350M wBTC/BTC.

- Trusted Network Participant. CoinList is an active network participant across new protocols. CoinList is one the largest validators on the Celo Network and our users have staked more than $50M ETH to the NuCypher Worklock.

| Pool | Allocation | Contribution Amount | Est. Pool Share | Est. Daily ETH Rewards (USD) | Est. Daily Uni Rewards (USD) | Est. Total ETH Rewards (USD) | Est. Total UNI Rewards (USD) | Value at End (USD) | Yield | APY |

|---|---|---|---|---|---|---|---|---|---|---|

| ETH/USDC | 25% | $250,000 | 0.07% | $93.17 | $284.62 | $4,291.23 | $13,109.47 | $267,400.70 | 6.96% | 54.05% |

| ETH/USDT | 25% | $250,000 | 0.06% | $133.04 | $267.64 | $6,127.69 | $12,327.65 | $268,455.34 | 7.38% | 57.33% |

| ETH/DAI | 25% | $250,000 | 0.08% | $74.88 | $343.12 | $3,448.86 | $15,804.12 | $269,252.97 | 7.70% | 59.81% |

| ETH/WBTC | 25% | $250,000 | 0.06% | $34.02 | $255.08 | $1,566.85 | $11,749.01 | $263,315.86 | 5.33% | 41.36% |

| Total | 100% | $1,000,000 | $335.10 | $1,150.46 | $15,434.63 | $52,990.25 | $1,068,424.88 | 6.84% | 53.14% |

| Mining Pool | Pool Size (USD) | Est. Average Daily Volume (ETH) | Est. Daily ETH Rewards (ETH) | Est. Daily ETH Rewards (USD) | Est. Daily Uni Rewards (UNI) | Est. Daily UNI Rewards (USD) | Est. Total Daily Rewards (USD) |

|---|---|---|---|---|---|---|---|

| ETH/USDC | $375,243,884 | 135,000.00 | 405 | $139,664 | 83,333 | $426,667 | $566,331 |

| ETH/USDT | $399,549,272 | 205,000.00 | 615 | $212,083 | 83,333 | $426,667 | $638,749 |

| ETH/DAI | $312,875,944 | 90,000.00 | 270 | $93,110 | 83,333 | $426,667 | $519,776 |

| ETH/wBTC | $419,833,337 | 55,000.00 | 165 | $56,900 | 83,333 | $426,667 | $483,567 |

| Total | $1,507,502,437 | 485,000.00 | 1,455 | 501,756.75 | 333,333 | $1,706,667 | $2,208,423 |

| Asset | UNI |

|---|---|

| Key Dates | September 29th – Registration for Uniswap Mining + deposits open October 2, 9:00 am PDT – Deposits for first deployment closes October 2, 5:00 pm PDT – First deployment to Uniswap October 9, 9:00 am PDT – Deposits for second deployment closes October 9, 5:00 pm PDT – Second deployment to Uniswap November 17 – Uniswap Mining ends November 24 – Tokens are distributed into CoinList wallets A third deployment may occur depending on demand |

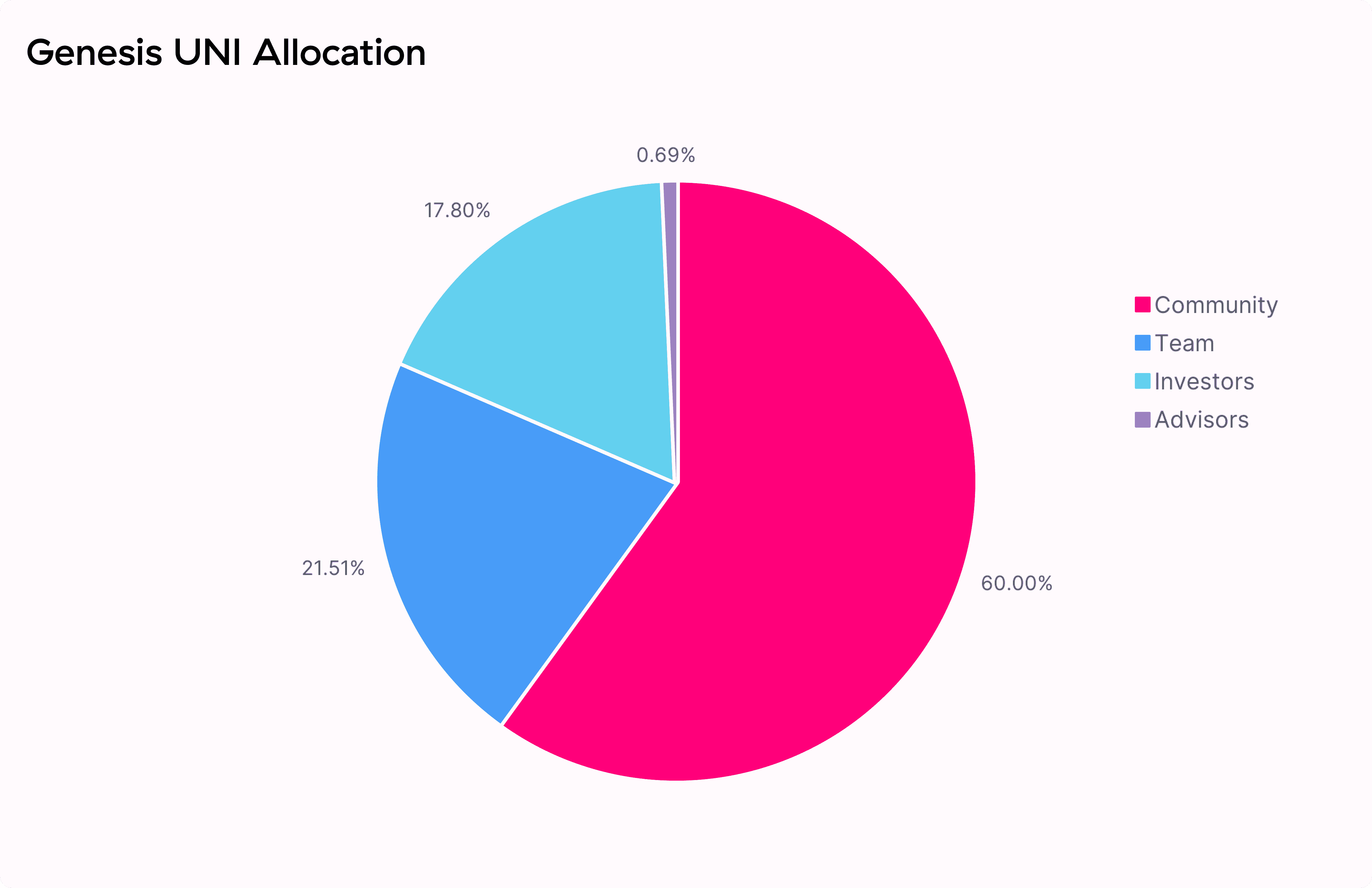

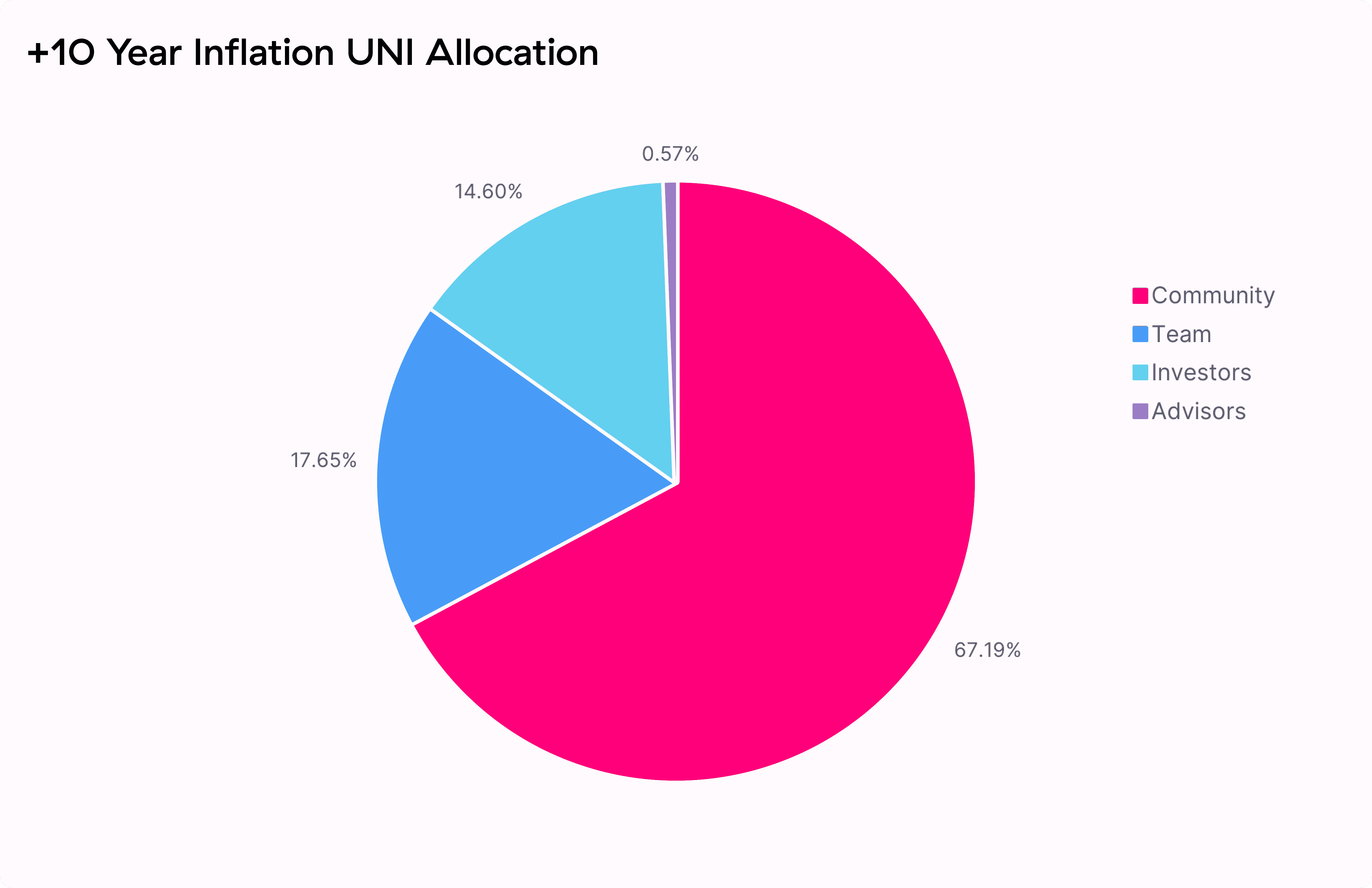

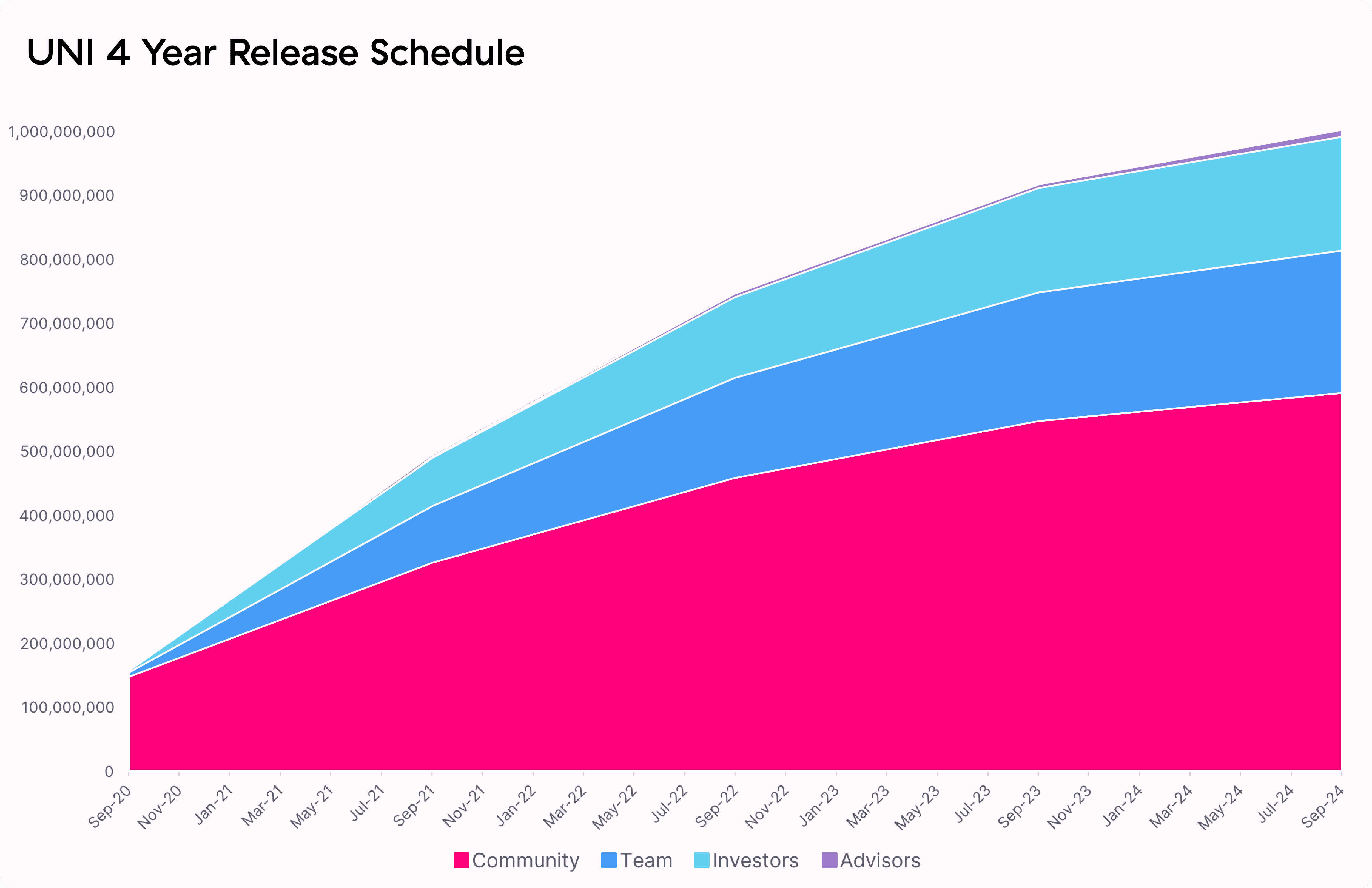

| Initial Supply | 1,000,000,000 UNI |

| Inflation Rate | A perpetual inflation rate of 2% per year will start after four years |

| Uniswap Mining on CoinList Period | 9/29 – 11/17 |

| Eligible Participants | Users in CoinList's supported jurisdictions, excluding the United States and Canada |

| Acceptable Assets to Deposit | Eligible participants can deposit one or more of the following assets to participate: - USD - USDC - USDT - DAI - wBTC - ETH |

| Rebalancing | Before we deploy funds to the Uniswap protocol, we will need to rebalance participant's tokens into the eligible Uniswap pools. Funds will be rebalanced into the following breakdown: - 12.5% USDC - 12.5% USDT - 12.5% DAI - 12.5% wBTC - 50% ETH Users will bear any trading costs for conversion. Final conversions and fees will depend on the distribution of assets deposited for use in Uniswap Mining. Not all assets will be converted. |

| Assets you’ll receive at the end of the liquidity mining program |

Eligible participants will receive each of the following assets at the end of the liquidity mining program: - USDC - USDT - DAI - wBTC - ETH - UNI Assets will be distributed pro-rata to all users who participated based on their original contribution amount, denominated in USD, at the time of conversion. |

| Fees | CoinList will take a 2% fee on accumulated liquidity rewards fees and UNI tokens |

| Token Distribution | Tokens will be distributed to CoinList wallets on 11/24 |

| CoinList Role | CoinList shall facilitate the conversion of assets into the pool assets, and will facilitate users' interfacing with the Uniswap Protocol, but has no ability to affect the functionality of the the Uniswap Protocol, and is not a service provider for, nor in any way affiliated with, either the Uniswap Protocol or Universal Navigation Inc. |

| Relevant Smart Contracts | Your funds will be sent to the following Uniswap pool smart contracts: ETH <> USDC ETH <> USDT ETH <> DAI ETH <> wBTC We have linked each of the pools above with their corresponding smart contract for you to review. Additionally, here is the four-month long security audit administered by six dapp.org engineers. |

| Interface Factors |

|

| Additional Resources | - Uniswap Website - Uniswap Whitepaper - Uniswap FAQ - Documentation on Pools - Uniswap: A Good Deal for Liquidity Providers? - Uniswap V2 Audit - Uniswap V2 Overview - Github - UNI Announcement - Uniswap Blog |

| Whitepaper | FAQ | UNI Announcement | Security Audit |

|---|